Freshly motivated by Rob Vinall’s kind reference, let’s kiss more frogs in the Norwegian share market to see if we find a princess or two.. I expanded the amount of randomly selected companies to 20 per post as this allows me to finish the serieswith 4 posts overall. This time only two stocks made it on the preliminary watch list. Enjoy.

196. Reach Subsea

Reach Subsea is a 95 mn EUR market cap marine service company that seems to concentrate on “subsea services”, such as pipeline expections, reservoir monitoring etc. As far as I undestand, these services are mostly geared towards the oil and gas industry.

The stock has performed very well since a near death experience early 2020 and has made 5x since then:

The company seems to offer a couple of specialist vesssels and the largest shareholder is Wilhelmsen. 2023 so far looks vey strong and as net income also went up a lto, the stock looks still cheap. Main negaitve point is that the business seems to be very short term and the order book only covers one quarter of sales. Navertheless, onte to potentially “watch”.

197. Capsol Technologies

Capsol is a 60 mn EUR market cap company that seems to have developed a technology for “end of pipe” carbon capture, where CO2 is captured directly from the exhaust pipes of a Biomass thermal power plant.

They seem to use a technology that is different from competitors but already have at least a plant running and some sales. The stock has been IPOed into the hypi in October 2021 but only lost -50% since then and sales have been growing (from a low level) recently:

They do have a very comprehensive quarterly report. Despite making losses, this is soemthing I want to have a closer lok at. “Watch”.

198. Aker Biomarine

Aker Biomarine is a 330 mn EUR market cap member of the Aker Group (78% owned by Aker) that accoring to Euornext is ” a biotech innovator and Antarctic krill-harvesting company, developing krill-based ingredients for nutraceutical, aquaculture, and animal feed applications. The company’s fully transparent value chain stretches from sustainable krill harvesting in pristine Antarctic waters through its Montevideo logistics hub, Houston production plant, and all the way to customers around the world. The company is dedicated to improving human and planetary Health.”

The company was IPOed in 2020 and has lost more than -50% since then. The company in 2023 so far is loss making.

I have to say that the business model assuch is so exotic that I actually like it, on the other hand it doesn’t sound like such a great business model as such. Therefore, I’ll “Pass”.

199. Norwegian Air Shuttle

Norwegian Air shuttle is a 780 mn EUR market cap short haul budget airline that is the successor of bankrupt Norwegian Airlines. It seems to be teh Nr. 4 budgest airline in Europe behin Ryanair, Easyjet and Wizzair. I don’t like airlines as such and I am not sure if being the No 4 in a crowded market will ever be a value proposition, therefore I’ll “pass”.

200, Hofseth Biocare

Hofseth is a 87 mn EUR market company that “operates as a consumer and pet health ingredient supplier in Norway and internationally”. From waht I understand they sell fish/salmon based products and have been loss making for many years. “Pass”.

201. Sparebank 1 Ostlandet

Sparebanken 1 Ostlandet is a 1,3 bn EUR market cap local savings bank, that similarily to other Norwegian savings banks is quite cheap and has done quite well over the past few years. It is majority owned by another Sparebanken Organisation. Nothing for me, “pass”.

202. Lokotech

Lokotech is a 15 mn EUR market cap stock, that just changed its name from “Harmonychain” and seems to be a disruptive microchip company that intends to disrupt each and everyone with the help of AI. “Pass”.

203. Polaris Media

Polaris is a 216 mn EU market cap media company that owns traditional and digital media assets. Schibsted seems to be a large shareholder, however in 2023 the company was loss making, is quite indebted and the share price looks uninspiring. No angle here for me, “Pass”.

204. Baltic Sea Properties

As the name indicates, this 27 mn EUR market cap company is aciv in Commercial real estate in the Baltics. Not exactly my area of expertise, therefore I’ll “pass”.

205. Scatec

Scatec is a 850 mn EUR market cap that develops and operates Renewable Energy power plants globally. The stock chart looks like if thery had on the side developed a Covid Vaccine(which they of course didn’t):

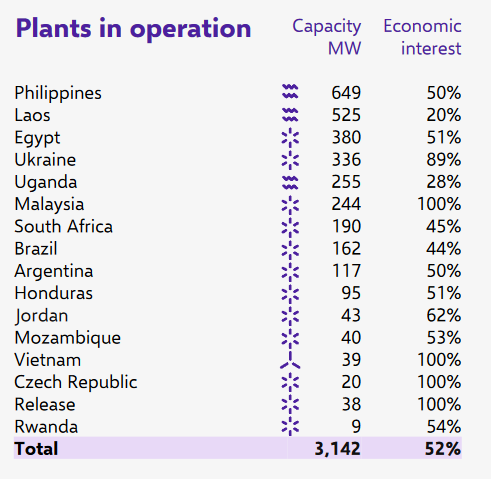

At first sight, Scatec looks quite cheap, with a forward EV/EBITDA of 9x. On the other hand, Scatec has a lot of debt (20 bn NOKs or ~7x EBITDA. In addtion, the operating assets are in exotic locations like Uganda, Philipies; Pakistan etc. This is the list of operating assets:

As to e expected, operations in these countries can be very volatile, this year the Philipine assets perform worse than expected. Although I do like Renewable Energy developers, Scatec seems a little bit too “spicy” for me, therefore I’ll “pass”.

206. Western Bulk Chartering

Western Bulk is a 68 mn EUR dry bulk perator that only seems to charter ships, not owning them. Trailing KPIs seem to be very cheap, but according to their last quarterly release, results seem to be more or less random. “Pass”.

207. Nordic Unmanned

Nordic Unmanned is a 9 mn EUR market cap drone company that actually has some sales but seems to urgently need capital. Since it’s IPO in Decmeber 2020, the stock lost .95% of its value. “Pass”.

208. Univid

Univid is a 4 mn EUR nanocap that has just changed its name from DLTX and according to Euronext “want to project a sense of unity, commitment, and shared dedication to a common goal”. That’s very funny but still, “pass”.

209. Interoil Exploration and Production

Interoil, with a market cap of 15 mn EUR is, surprise an oil company and “engaged in acquisition, exploration, development and operation of oil and gas properties, and serves as operator and active license partner in several production and exploration areas in Argentina and Colombia”. Thank you, “pass”.

210. BW Ideol

BW Ideol is a 32 mn EUR market cap company that is somehow active in floating offshore wind. It seems that cash is running out but lcukily a partner made an offer at 12 NOK per share which it seems will close soon. Sharehodler who bought this in the 2021 IPO lost -75%. “Pass”.

211. Var Energy

Var Energy is a 8 bn EUR market cap oil upstream company that is majority owned by ENI and was spun-off/Ipoed in 2022. The stock looks quite cheap. For people interested in Skandinavian oil companies, this could be interesting, for me it’s a “pass”.

212. Elkem

Elkem is a 970 mn EUR company that “develops silicones, silicon products and carbon solutions, helping its customers create and improve electric mobility, digital communications, health and personal care as well as smarter and more sustainable cities.”.

That sounds great but the stock has lost -50% in the last 8 months or so:

Elkem had 2 very good years in 2021 and 2022 but 2023 looks less good. In general the business seems to be very cyclical and energy intensive. The company is majority owned by a HoldCo. “Pass”.

213. GC Rieber Shipping

As the name says, this 67 mn EUR market cap company is active in shipping. At the time of writing, the 92% majority holder just made a voluntary offer for the remainder of the shares. “Pass”.

214. Totens Sparebank

Totens is a 100 mn EUR market cap “independent local bank established in 1854, and has its primary marked in the region around Mjøsa”. As it’s Norwegian peers, it looks cheap and pays a high dividend. Nevertheless, I’ll “pass”.

215. Biofish Holding

Biofish is a 8 mn EUR microcap that specializes in “small fish” or “smolt – juvenile fish destined for aquaculture facilities”. The company has been IPOed in 2021 and as many of its vinatage peers, lost around -95% since then. “Pass”.