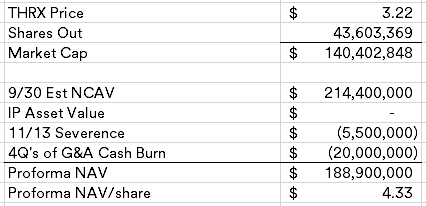

Theseus Pharmaceuticals (THRX) (~$140MM market cap), a cancer therapy researcher, is the latest addition to the broken biotech basket trade. This week, Theseus announced a 72% reduction in workforce and the exploration of strategic alternatives “to consider a wide range of options with a focus on maximizing shareholder value, including potential sale of assets of the Company, a sale of the Company, a merger or other strategic action.” The company hasn’t reported for Q3 as of this writing, but did disclose an estimated cash and securities balance of $225.4MM in the same press release.

The 6/30 cash and securities balance was $234.2MM, so the company only burned a bit under $9MM during the quarter despite attempting to push forward a few early stage programs (which may have some value?) after shutting down their Phase 1/2 trial for their lead candidate in mid-July, pointing to some expense discipline here. Otherwise the balance sheet is fairly straight forward, there’s a small lease obligation (already backed out in my NCAV number) and no debt. Despite jumping 50% on the strategic alternatives news, I still think this one is attractively priced.

Disclosure: I own shares of THRX