The cost of housing can take up a significant amount of anyone’s budget. The general rule of thumb is to keep housing costs around 30%. But what about the cost of filling your home with the items you need?

Aside from the cost of your housing payment, it’s can also be expensive to fill your home with furniture, appliances and other things that you may need or want for comfort.

We’ve recently been in the market for a new couch and a stainless steel stove. Both some pretty expensive purchases. These weren’t really emergency items. So, I felt no need to dig into the emergency fund and tried to cash flow them instead.

The idea of quoting prices from our local Rent a Center did sound like an option as well. We all know I’m not a fan of financing furniture, but I knew Rent a Center has a ‘6 months same as cash’ program. BIG mistake.

After doing some research on this company and its offers, I realized Rent a Center was doing some serious scamming and more people needed to understand how this place operates. In this post, I’m going to explain why Rent a Center is a rip off to the average person.

Pay as You Go?

What attracts people most about Rent a Center is the option to purchase that big-ticket item like a furniture set or an appliance without really paying for it in full.

Can’t afford a new couch? Come to Rent a Center and get on a plan so you can take it home today with little money down and pay as you go to settle your balance.

Rent a Center sells everything from TVs, living room furniture, and bedroom sets to kitchen appliances, computers and smartphones. They carry big brands and don’t have credit check requirements for their payment plans.

This means, as long as you have an income and make a down payment, you can likely get on a plan to pay your item off in weekly, bi-weekly and monthly payments. Of course, you’ll pay more overall if you use their long-term payment plans because you’ll get charged interest.

However, Rent a Center has a 6-month ‘same as cash’ program. This program ensures that you won’t pay extra so long as you pay off your purchase in 6 months. If you’re looking to save money on interest, this 6 months same as cash option may sound promising, but don’t fall for it!

You’re Not Building Credit

When I financed my first couch back in college (something I’d never ever do again BTW), I did it under Ashley Furniture’s credit building program. This means my payments were reported to all three credit bureaus. Paying off the couch helped me build some positive credit history.

Rent a Center doesn’t check credit when you apply. This means they have no intention of reporting your payment to the credit bureaus – and they don’t. Still, you’re getting charged interest and a general up-charge on your purchases anyway. There are much better ways to build your credit aside from financing furniture, but I’m just trying to make a point.

Related: I Raised My Credit Score By 150 Points, Here’s How

Your payments are simply lining the pockets of Rent a Center. Meanwhile you’re stuck making overpriced weekly and monthly payments. The items Rent a Center sells don’t appreciate in value so it makes more sense to just buy them in cash on your own.

Overpriced…Everything

I mentioned earlier how I did some browsing on their site as I was considering the 6-month same as cash offer. I looked up a stove along with some furniture since I was also in search of a leather couch. Having a dog really summed up why we need to switch to leather furniture from now on.

I was really shocked to see Rent a Center’s prices for a single piece of furniture. Then it hit me. The prices are severely marked up regardless of how soon you pay the item off.

If anyone would do a quick Google search to compare prices, they’d see that Rent a Center is overcharging customers. Sure, they carry good brands but you can honestly find a better deal by going straight to that brand and buying the furniture or appliance you need.

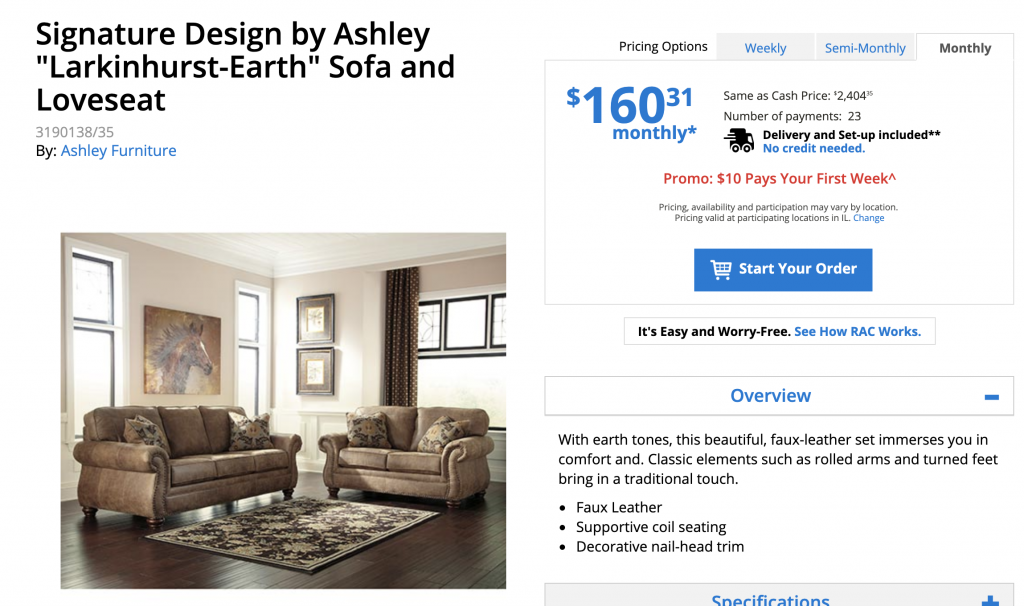

As you can see, this sofa and loveseat set is $160.31 per month at Rent a Center. You’re required to make payments for almost 2 years….in other words, $3,687.13!!!

If you decide to pay the set off in 6 months, you’d still pay $2,404.35. Ouch.

You may find it interesting that Amazon is selling the exact same loveseat for $476 and the sofa for $509. If you avoid those marked-up prices, you could score this set for under $1,000.

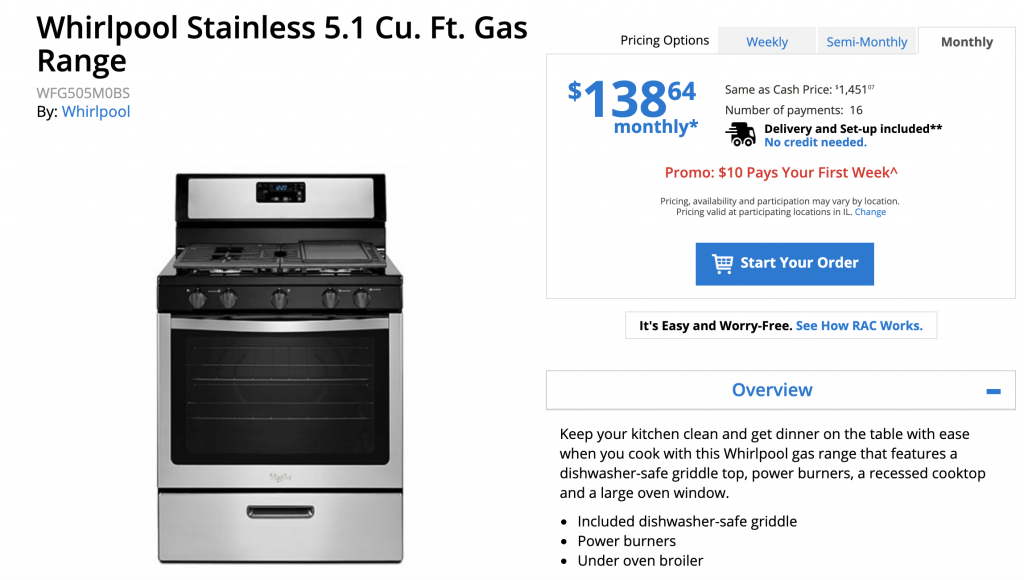

This Whirlpool 5-burner gas range stove is $138.64 per month at Rent a Center. It takes 16 months of payments to own it and you’d end up spending $2,218.24. The 6-month ‘same as cash’ price is $1,596.46.

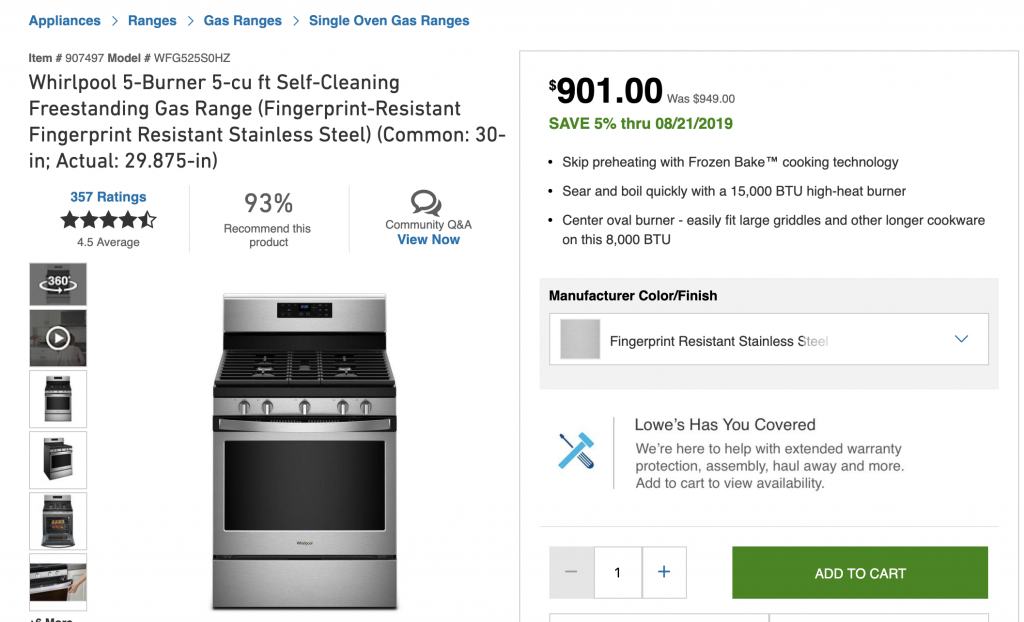

A similar stainless steel gas oven from Lowes costs around $900. Other brands like General Electric only cost around $600 to $700 depending on the type.

Sketchy Contract Terms

Rent a Center’s contract is a legally binding agreement stating the terms of the transaction including payments, taxes, fees, the number of payments, cost to acquire ownership, late fees, and more. If customers don’t follow the terms of the agreement, they could get their items revoked.

After making all those overpriced payments, imagine falling on hard times and getting your furniture repossessed so you now have nothing to show for it.

One of the most interesting things about Rent a Center’s contract is how it states that you do not build any equity toward the merchandise as it remains the property of Rent a Center until you pay the agreed amount to own it. This company’s contracts are super sketchy. Many people have shared that they really didn’t understand the nature of the terms and how much the fees were initially involved.

There are thousands of people who have complained about being trapped in a contract with Rent a Center and got scammed out of a ton of money. It sucks to hear about how some people have been harassed over the phone and in person by payment collectors. Nerd Wallet published an article to lend some tips to frustrated customers longing to get out of their Rent a Center contracts.

In it, they suggested that you avoid the biggest markup and added fees by paying off your merchandise within 90 days of the lease agreement. If you really want out of the contract, you may need to return your stuff altogether.

Fees on Top of Fees

I searched high and low for a breakdown of Rent a Center’s fees but that information seems locked and sealed for some reason. Luckily, Nerd Wallet completed an in-depth study in 2017 about their fees and outrageous interest rates.

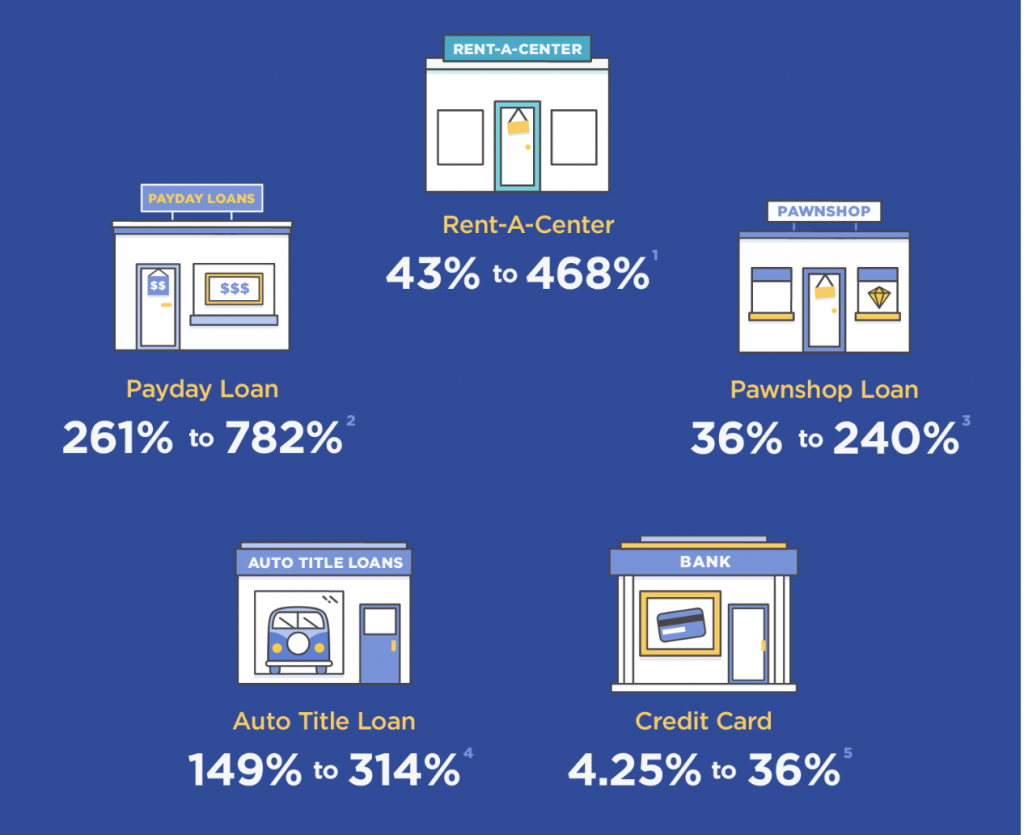

Their APR rates can be comparable to payday loans and in the triple digits on average.

Source – Nerd Wallet

The company also offers options fees that can add on to what you’d have to pay.

Their loss-damage wavier can be up to 10% of the total cost of the lease in some states. If you enroll in RAC Benefits Plus, this can provide you with some coupons and discounts. However, you may not use them and it adds around $13 per month to your lease agreement.

Don’t forget about state and local taxes. It’s no secret that you will have to pay them for lease the item but Rent a Center customers also pay additional for the extra ‘services’ as well.

The Trouble With Instant Gratification

Truth be told, stores like Rent a Center and their other counterparts wouldn’t exist if people weren’t so tempted to give in to instant gratification. This company seeks to benefit from the fact that our society is praising unhealthy convenience factors and fast transactions.

Why wait to pay for furniture in cash when you could put $10 down and get a week free of payments – only to be stuck overpaying for your item by thousands of dollars over the next year or two…

When you look at it this way, the math certainly doesn’t add up. We paid about $460 for our leather couch in cash which was much cheaper than what Rent a Center was charging.

We paid $644 for our new stainless steel gas range oven when Rent a Center would charge us $1,400+ for something similar. The main difference? You have to be willing to be patient, weigh other options, and practice delayed gratification.

My husband and I waited to get a new oven and used an electric skillet (that was a wedding gift) to cook our meals for a few weeks. In the meantime, we both hustled hard to come up with half of the cost. He drove some extra hours for Uber and I picked up additional client work. We both came to the table with $322 each to put down to buy the oven in cash.

Delaying your gratification can save you so much money in the long run and also allow you to truly appreciate and cherish the things you have. I’m grateful for that fact that no one can come knock on my door and take my furniture or appliances away because I own them outright.

Related: 80+ Extra Income Ideas That Don’t Suck

20 Ways to Make Extra Money Today

Side Hustles Explored: How to Get Started With Freelance Writing

5 Reasons Why You Should Start Driving for Uber

Some Alternatives to Leasing Furniture and Other Stuff

Although it’s clear that Rent a Center is a rip-off, they’re not the only store scamming people out of their hard-earned cash. Other similar furniture leasing stores are basically doing the same thing.

So what’s an alternative if you want to buy some furniture, expensive electronics, or big household items?

Be Patient

This is our top option. When we bought our house, of course I wanted to furnish and decorate it. I also didn’t want to finance a bunch of stuff and be buried in monthly payments. So I waited.

We bought one small sectional practically new off the Facebook Marketplace and I used my old couch (from our apartment) for our family room. Slowly, we saved up money and came across deals to add furnishings and other decor to our home. Sure, it wasn’t the quickest solution, but I’m glad that I own everything in my home and don’t have to be bogged down by all the payments.

Holiday Sales

We actually bought our stove for a steal thanks to a 4th of July sale. Whether you’re looking to buy furniture or household appliances, you can count on holiday sales to help you save anywhere from $100 – $200 on the item.

I took advantage of an online Black Friday deal at Best Buy to get my Macbook Pro for several hundred dollars less than it was normally listed for.

Shop Online

There are tons of discount sites you can use to buy your furniture and other items for less. I like sites likes Wayfair, Brad’s Deals, and Overstock can be great places to score deals on quality furniture.

Don’t forget to use Rakuten (Ebates) when shopping online to earn cash back.

You can also bid for items on eBay and see what Amazon has to offer.

Related: Rakuten (Ebates ) Review: Earn Cashback For Everyday Shopping

Shop Used

The small sectional I bought when we first moved into our house was gently used and from the Facebook marketplace. I also got our kitchen table from the marketplace as well and saved hundreds of dollars on both purchases combined.

Our glass table sits 6 and the chairs were recently upholstered so it looked just like new. You can check out resale shops and other sites for gently used options if it helps you avoid getting scammed by Rent a Center.

Related: How to Start Saving Money on Furniture (New and Used)

0% APR Credit Card

I present this option with caution because I’m not really a fan of people racking up debt on a credit card, even if there’s no interest. However, if you need to make an urgent purchase, this is a much better option than doing rent-to-own with Rent a Center.

You’ll need good credit in the first place to qualify for a 0% interest credit card but this is how I paid for my Macbook Pro. I really needed a reliable computer for my business – it couldn’t wait because how else would I be able to make money since this is my full-time job?

These laptops are so expensive and even with the sale price, I didn’t want to drain my savings so I used Best Buy’s 0% APR option. So I put $200 down and paid $100 per month until the end of the year.

With this option, the key is to avoid going overboard with the purchase price of the item to ensure you can actually pay it off during the o% APR promotional period. Avoid making other purchases on the card while you’re paying back the balance to make it easier.

Related: 6 Healthy Habits That Lead To a Better Credit Score

Summary – Is Rent a Center a Rip Off?

I hope this didn’t come off as an ‘I hate Rent a Center’ article, but I just really don’t like when I see companies take advantage of other people who are looking for a solution that provides some financial relief.

A scam is defined as a dishonest scheme. A rip off is defined as cheating someone out of money financially. I believe Rent-a-Center is doing both.

Just because people sign an agreement doesn’t mean they fully understand the terms and can’t see past the marketing and claims to “buy now and pay $10 a week later”. Rent-a-Center should do a better job at explaining their contract because from the looks of all their complaints online, people did not fully understand or support the terms of the agreement.

The truth is, if you can’t afford to buy furniture, household appliances and other items, you shouldn’t even consider going to a store like Rent a Center in the first place. They prey on people who need certain items but can’t afford them. They entice customers with the idea of flexible, low-cost payments but this ends up locking you into a long-term contract with ridiculous fees and interest.

Instead, play the waiting game and really ask yourself if you need to purchase the item at this time. Can you put it off and save up instead or wait for a good deal? If so, you probably won’t regret it waiting a few weeks or even a few months to potentially save over a thousand dollars.

What are your thoughts on leasing furniture?

When I got my first apartment in college and looked at my empty living room, I felt bad. I caved and financed furniture but looking back, I wasn’t going to die or be scarred for life had I went a few months without that stuff and saved up. Have you ever done business with Rent a Center or a similar store?

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.