It’s Wednesday, and today I discuss the latest US inflation data, which shows a significant annual decline in the inflation rate with housing still prominent. But for reasons I discuss, we can expect the housing inflation to fall in the coming months. I also discuss how on-going fiscal ignorance allows the Australian government to avoid investing in much-needed fast rail infrastructure which would solve many problems that are now reducing societal well-being. And then some of the best guitar playing you will ever hear.

The US inflation situation – summary

The BLS published their latest monthly CPI yesterday which showed for July 2023 (seasonally adjusted):

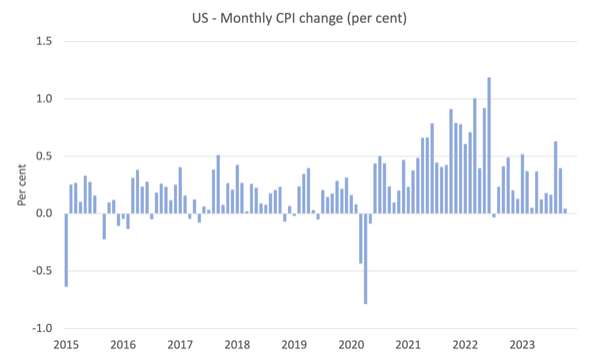

- All Items CPI increased by 0.4 per cent over the month and 3.2 per cent over the year – stable in other words.

- The peak monthly rise was 1.2 per cent in July 2022.

- The largest contributor was shelter (by some margin) which rose as petrol prices fell significantly.

The BLS note that:

The index for shelter continued to rise in October, offsetting a decline in the gasoline index and resulting in the seasonally adjusted index being unchanged over the month. The energy index fell 2.5 percent over the month as a 5.0-percent decline in the gasoline index more than offset increases in other energy component indexes. The food index increased 0.3 percent in October, after rising 0.2 percent in September. The index for food at home increased 0.3 percent over the month while the index

for food away from home rose 0.4 percent …The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7-percent increase for the 12 months ending September.

Summary: So inflation has declined to just 3.2 per cent although now the poor housing policy in the US has become the issue.

However, the housing inflation is also declining.

The annual rate of inflation thus fell significantly.

Remember in June 2022, the inflation rate was 9.1 per cent as the supply constraints really were biting.

One cannot attribute this decline to the policies of the Federal Reserve because there has not been a significant rise in unemployment.

The logic of the interest rate rises was to push up unemployment to reach some unspecified NAIRU (stable inflation unemployment rate).

The fact that inflation has fallen dramatically since June 2022 without a recession or a large increase in the unemployment rate tells me that the major inflationary pressures were supply side and arising from the disruptions from the pandemic.

Quite clearly, when the pressures are being driven by supply factors or international factors, interest rate hikes are not an effective anti-inflation tool.

All the talk about fighting inflation by pushing unemployment rates up to the ‘mysterious’ NAIRU (which is core New Keynesian orthodoxy) is just a scam.

The central bankers have little idea of where the NAIRU is and have less idea about the ultimate net distributional impacts of the interest rate hikes.

They just hope and pray.

The first graph shows the evolution of the monthly inflation rate since the beginning of 2015.

Even with the housing situation, the overall situation is now contained largely because energy prices have fallen so much.

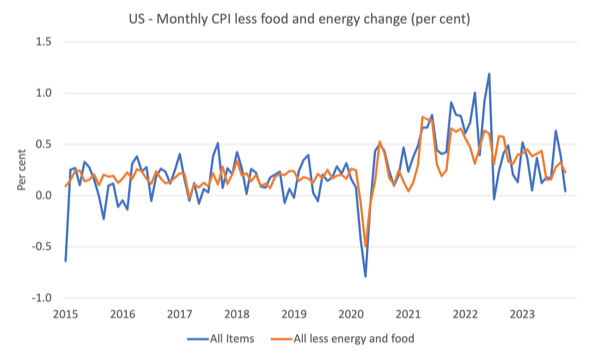

The next graph shows the evolution of annual price rises for the goods sector and for the services sector since 2000 – up to October 2023.

The contention always has been that the inflation has been largely driven and instigated by the supply factors that constrained the ability of the economy to meet demand for goods – the Covid factory and shipping disruptions and the like.

The graph shows clearly that those factors have been in retreat since the second-half of 2022 as the supply chain constraints ease.

The services sector, which is derivative of the supply drivers, lagged behind the goods sector and while still recording higher inflation that the goods sector, now has peaked and is also on the way down.

The goods time series has now recorded monthly deflation for the last two consecutive months.

The other point to note (which is referred to above) is that rental inflation has been an important component of the overall inflation story.

There are two aspects that are relevant.

First, this is one component that is being driven by Federal Reserve Bank interest rate hikes.

In a fairly tight rental market, the landlords who face higher mortgage costs can easily pass the rate hikes on as increases in rents.

And that is the one conduit through which the central bank actually causes inflation in its efforts to quell it.

But, second, there is an interesting part of the way the BLS measure the rental component, which tells me that the inflation rate in the US is going to fall fairly quickly.

The rental vacancy rate, which measures the proportion of the rental inventory that is vacant for rent has risen since the end of 2021 from 5.6 to 6.6 per cent in the September-quarter 2023 (Source).

The other point to note is that the BLS measures the price changes in rental leases in such a way that a ‘vintage’ of price effects is captured by the monthly measure – that is, the monthly posted result includes new rental leases plus past leases

As a result, there is a lagged effect operating and as new rental leases decline in $ amounts, the overall series declines more slowly.

This BLS Spotlight on Statistics information page – Housing Leases in the U.S. Rental Market – provides more detailed explanations of all this.

It takes about 12 months for the series to reflect what is happening now with respect to new rental leases in the current CPI result.

And we know that rents on new leases are declining.

So we can expect the housing component of the US CPI to fall in the coming months and the overall inflation rate to drop sharply.

The US inflation is burning out now.

My conclusion is that this transitory inflationary episode is about over.

Fiscal fictions that retard progress

On Friday, I am catching the Shinkansen to Tokyo for our book launch, which is now a sold out event.

Whenever I am on the fast train to and from Tokyo I reflect on how misguided Australian policy makers are.

I live some of the time in Newcastle, which is about 168 kms away from Sydney.

It takes around 3 hours by train from the Newcastle station to Central Station in Sydney, a ridiculously slow, grinding trip.

It means that if one has a meeting in Sydney one has to get up very early and get home rather late.

The wi-fi is also rather mixed in reliability on the journey, cutting out in many places, which makes it hard to work.

One can certainly not schedule Zoom meetings during those 6 hours of travel.

There was an article on the ABC (national broadcaster) site today (November 15, 2023) – Newcastle to Sydney fast rail proponents say project must start for future of Hunter – which reflected on this appalling lack of fast rail infrastructure.

In terms of context, the Newcastle labour market is very thin, which means that there is a poor occupational spread, particularly in the professional occupations, which means that many young people, including new graduates, are forced to leave their home town in order to find work.

They gravitate to Sydney because the commute from Newcastle is nigh on impossible, even though some hardy folks do commute some days.

But commuting for 6 hours a day is not a sustainable long-term proposition.

The upshot is that Sydney is hopelessly overcrowded with unaffordable housing and gridlocked roads and failing public transport systems.

The distance between Kyoto and Tokyo is around 450 kms – station to station – and the fast train takes around 2 hours and 15 minutes.

If there was a fast train between Newcastle and Sydney, the journey would be between 45 and 50 minutes only, instead of the current time of between 2hr50 and 3hr.

Ever since I was an adult there have been talk of establishing fast-train infrastructure in Australia.

Various governments have conducted feasibility studies and promised in their election campaigns to solve this problem.

The ABC article quotes one train expert as saying:

Australia is probably a world leader for studies into fast rail without any construction.

It is estimated that over the last several decades, governments have spent $A150 million on such studies.

But still our train system grinds along and causing regional imbalances, real estate bubbles and a hollowing out of regional areas as people crowd into the capital cities.

The most recent study of the Newcastle-Sydney option has established that technically there is no constraint on the construction.

The resources to accomplish that feat are available.

And the need is great, as the ABC Report notes:

The Sydney to Newcastle corridor has the largest regional passenger volume in Australia …

The corridor is already at capacity, so there’s got to be some kind of solution to that.

The solution is simple – build the f*&!@$# train.

Such a train would revitalise Newcastle, which has been in industrial decline since the steel works shut down.

And Newcastle, as the world’s largest coal export port, will have to transition from coal in the coming period as a response to climate change.

One rail expert said that:

Newcastle has more potential than any place I’ve visited around the world of a similar size to become a centre of advanced manufacturing and high skills …

But there will be no investment until the rail infrastructure problem is solved.

So what is stopping the development?

You can guess!

One expert said:

High-speed rail has been investigated in Australia since the 1980s, but funding and successive governments have remained key obstacles to the concept … Fast rail will be expensive …

And there’s the rub.

Governments believing they are financially constrained have baulked at committing the necessary funding to make this a reality.

The longer they delay the larger the costs of not doing it are.

And so we get to today, where the trains are grindingly slow, and the urban landscape is distorted to the detriment of everyone, because governments believe the fiscal fiction that they do not have enough money.

The Federal government could transfer the necessary billions to the procurement process with the tap of a keyboard any time it wanted to.

The lack of a fast train system in Australia is a testament to our collective ignorance and the dominance of lying economists.

Meanwhile, on Friday, I will enjoy my rapid transit to Tokyo.

The Smith Family head to Kyoto for holidays

Episode 5 of the Smith Family Manga – is out on Friday.

This episode introduces Mariko and Hiroshi Fujii who are hosts to the Smith Family while they are on holidays in Kyoto.

Elizabeth discusses her frustration with Ryan’s closed mind with her best mate Mariko.

Hiroshi, who works at the Bank of Japan, clarifies some economic matters but Ryan isn’t listening.

Music – Peter Green

This is what I have been listening to while working this morning.

This is – Peter Green – playing the – B.B. King – song – I’ve Got a Good Mind To Give Up Living.

When I was young and was doing a paper round I bought all the early Fleetwood Mac albums.

I loved Jimi Hendrix and Peter Green.

This song was never on those albums and it wasn’t until I heard the – Boston Tea Party – and read more about the band that I understood this song was one of their live favourites.

If I was to engage in simplistic rating of instances of electric blues guitar playing then this would be one at the top.

It was never included on an original Fleetwood Mac album but it was a regular part of their repertoire in the late 60’s. There is one version from a Boston Tea Party set of recordings (recorded in February 1970).

This version is recorded live at that Warehouse in New Orleans on February 1, 1970.

I first heard the song on the – East-West – album that was released by – Paul Butterfield – in 1966, although I didn’t hear it until 1969.

But nothing compares to the early Fleetwood Mac version where Peter Green goes beyond anything reasonable to play like an angel.

We knew earlier that Peter Green was struggling – just listen to the 1969 recording – Man of the World.

In March 1970, the infamous acid party in Munich really destroyed his mental health.

He quit the band later in May 1970 after an appearance at a festival in Bath and in 1971 answered the call from the band to fill in during a US tour after Jeremy Spencer ran away with a religious cult.

But that was really the end of him.

Martin Celmins biography of Peter Green (Castle books, 1995) is a must read for Peter Green fans – it is a very sympathetic and detailed account of a troubled genius.

Perfect.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.