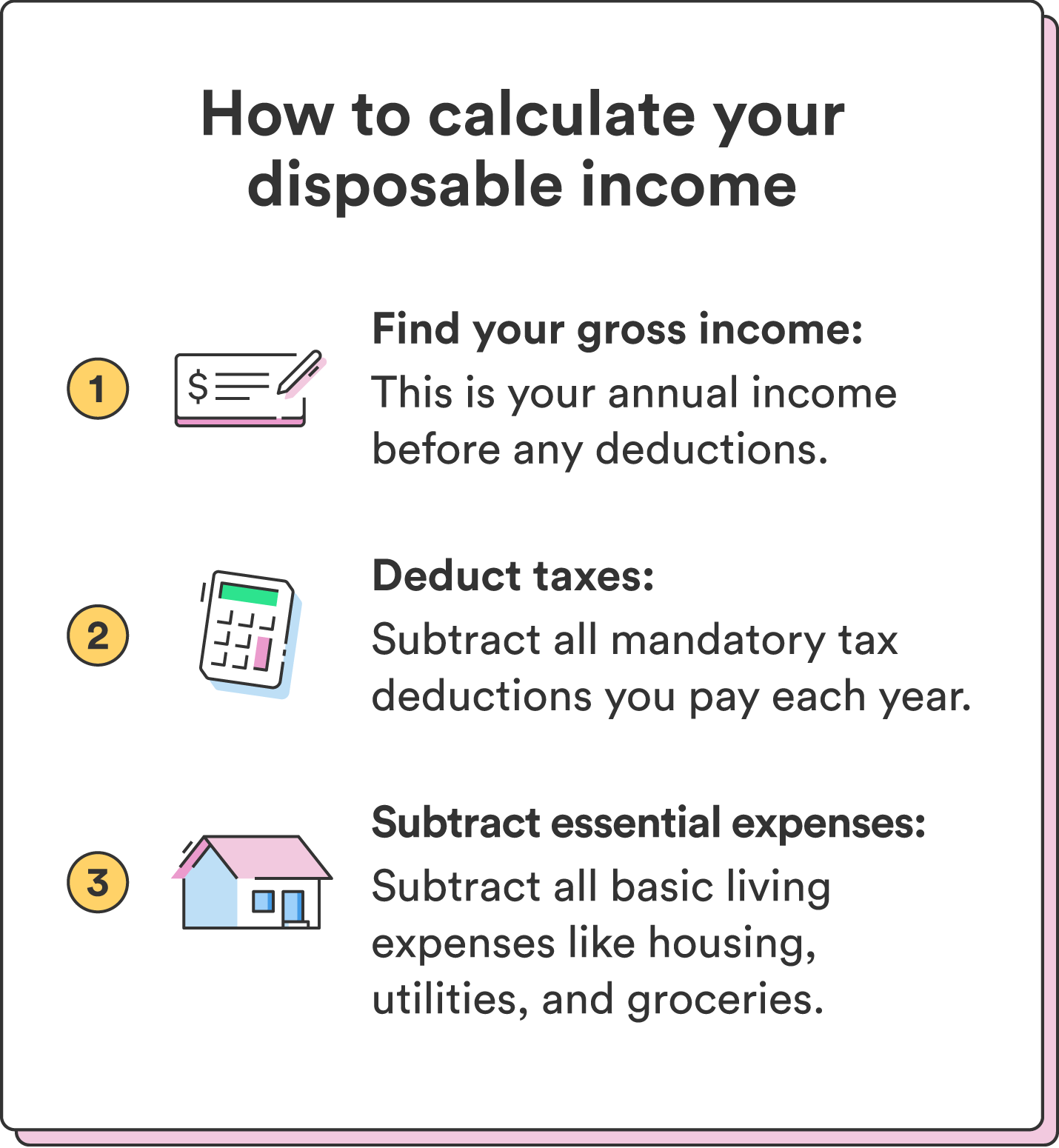

The information you’ll need to calculate discretionary will vary if you’re using discretionary income for student loan purposes. But for general budgeting purposes, here’s what you’ll need:

- Gross income: This is your annual income before any deductions, including your salary, bonuses, and any other sources of earnings.

- Taxes: List all mandatory tax deductions you pay each year, including federal and state income taxes, Social Security, and Medicare contributions. Your employer may automatically deduct these from your paycheck – read your pay stubs to see what deductions are taken from your paycheck.

- Essential expenses: List all of your basic living expenses, like housing costs (rent or mortgage), utilities (electricity, water, gas), groceries, transportation expenses (gas, public transportation, parking), and essential insurance (health, auto, etc).

If you’re calculating your discretionary income just for budgeting purposes, subtract your total tax deductions and essential expenses from your gross income. The remaining amount is your discretionary income.

To calculate discretionary income for student loans, the U.S. Department of Education uses your Adjusted Gross Income (AGI), which already accounts for your tax deductions and exemptions.

You can find your AGI on your most recent federal income tax return. For the 2023 tax year, your AGI is on Line 11 on IRS form 1040, 1040-SR, or 1040-NR from your 2022 IRS tax return.¹ Follow the steps below to calculate your discretionary income for student loans.

Chime tip: If you need help finding your previous tax returns, you can find them through your tax preparation software, tax preparer, or the IRS website if you filed online. If you filed a paper return, you can find your AGI on the physical return.

1. Determine the Federal Poverty Guideline for your household

Once you know your AGI, you must find the federal poverty guideline for your state and family size. The “poverty guideline” is a threshold amount based on your where you live and how many people are in your household.

You can find the Poverty Guidelines on the Department of Health and Human Services (HHS) website and below.²

| Number of people in household² | 2023 poverty guidelines (48 contiguous U.S. states and the District of Columbia)² |

| 1 | $14,580 |

| 2 | $19,720 |

| 3 | $24,860 |

| 4 | $30,000 |

| 5 | $35,140 |

| 6 | $40,280 |

| 7 | $45,420 |

| 8 | $50,560 |

If you have more than eight people in your household, add $5,140 per additional person.

| Number of people in household² | 2023 poverty guidelines for Alaska² |

| 1 | $18,210 |

| 2 | $24,640 |

| 3 | $31,070 |

| 4 | $37,500 |

| 5 | $43,930 |

| 6 | $50,360 |

| 7 | $56,790 |

| 8 | $63,220 |

If you have more than eight people in your household, add $6,430 per additional person.

| Number of people in household² | 2023 poverty guidelines for Hawaii² |

| 1 | $16,770 |

| 2 | $22,680 |

| 3 | $28,590 |

| 4 | $34,500 |

| 5 | $40,410 |

| 6 | $46,320 |

| 7 | $52,230 |

| 8 | $58,140 |

If you have more than eight people in your household, add $5,910 per additional person.

2. Multiply the amount by 1.5 (150%)

Once you have your poverty guideline, multiply that number by 1.5 (150%). Then, subtract this number from your AGI found in step two.

If you’re using an income-contingent repayment plan, you don’t need to multiply your poverty guideline amount by 1.5. (That’s because this type of repayment plan uses 100% of the federal poverty guideline amount instead of 150%, so the multiplier isn’t necessary).²

3. Subtract the result from your adjusted gross income

After finding your poverty guideline and multiplying that number by 1.5 (150%), subtract this number from your AGI.

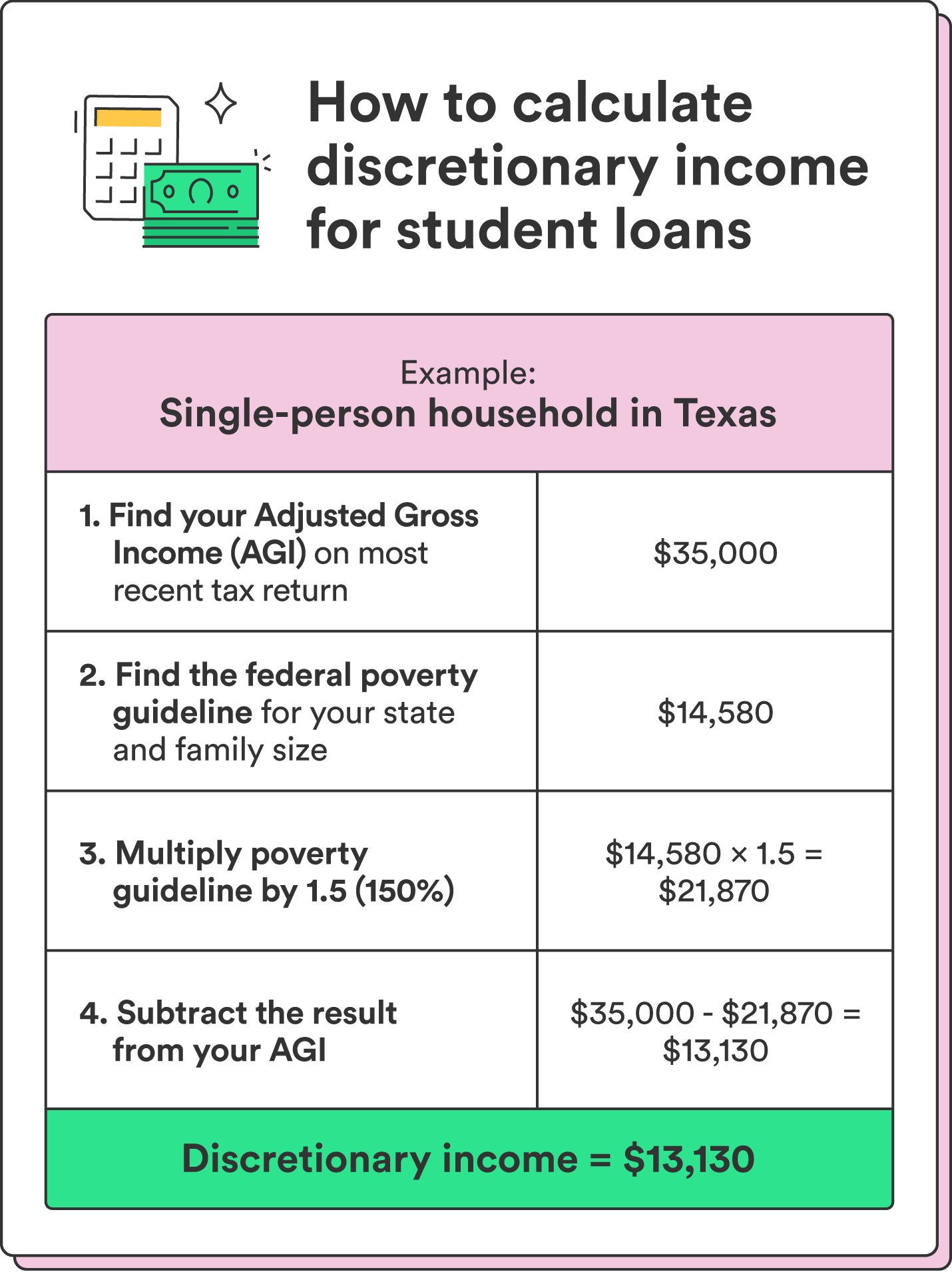

Example discretionary income calculation

Let’s break down a hypothetical calculation to figure out discretionary income for student loans. For this example, let’s say you’re single, live in Texas, and your AGI is $35,000 per year.

Here’s an overview of the calculation:

- 2023 federal poverty guideline (for a single-person household in Texas): $14,580

- Multiply your poverty guideline by 1.5 (150%): 1.5 x $14,580 = $21,870

- Subtract that number from your AGI: $35,000 – $21,870 = $13,130

In this example, your discretionary income is $13,130. Use this amount to determine your monthly student loan payments under income-driven repayment plans. See a full breakdown below: