How much is the Gold Storage Limit without income proof? Are there any restrictions or limitations for keeping the gold without any income proof?

Gold is one of the most precious assets for all of us. However, many of us are unaware of the restrictions imposed by the income tax department for keeping gold without any income proof.

How Much Is The Gold Storage Limit Without Income Proof?

Just imagine a case where the income tax department raided your house and they unearthed the gold you are keeping. Then in such a situation, how much gold as per the law is permissible to keep without any income proof? Let us try to answer these questions in detail.

Whenever you buy gold, it is always better to keep the receipts safely with you. This will resolve the many issues. According to the CBDT press release (1st Dec 2016), there is no limit on holding gold jewellery provided that the source of investment or inheritance can be explained. However, it is essential that the income of the taxpayer should be in line with the quantity of gold held. Providing necessary proof for such possession will help in avoiding scrutiny from the income tax department. If you fail to provide the proper answer, then the assessing officer may confiscate such unaccounted gold.

Either you must have proof of purchase or proof related to gold you have inherited or received as a gift. If you have gold due to inheritance or gift, you have to provide a receipt in the name of the initial owner of the item. Otherwise, you can also submit a family settlement deed, will, or a gift deed stating the transfer of such an asset to you. However, in some cases, if there is no such document available, the assessing officer may analyse your family’s social status, customs, and traditions to come to a conclusion on whether your statement is valid or not.

Hence, having proper bills and also the source of buying such gold will resolve the unnecessary headache of asking questions like “How much GOLD can we hold without proof?”

However, in some cases, you may not keep the receipts of your gold purchase or you don’t have proof to show that the gold you are holding now is due to inheritance or gift. In that case, what is the permissible gold you can hold without any income proof?

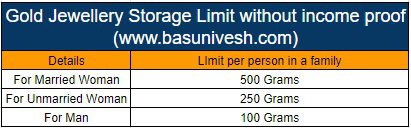

According to the CBDT, the limit is different for married women, unmarried women, and men. If you are holding the above-prescribed limit of gold, then you are not obliged to produce proof of receipt, inheritance, or gift.

Do remember that the above limits are per person for a family. Hence, take for example, if you are a family of 5 persons where two are married women, two are married men, and one is an unmarried woman. In that case, the total permissible gold storage limit without income proof is = 1,000 Grams for married women + 200 grams for married men + 250 Grams for unmarried woman = 1,450 grams.

As I mentioned above, if you hold the gold beyond this limit, then the assessing officer has the right to seize such unaccounted gold. Also, if you are holding the gold that does not belong to your family, then that can also be sized.

Do remember that sometimes the assessing officer may not seize the gold which is beyond the above permissible limit considering the family customs and traditions (for this there are no such standard rules stated).

Some important court judgments –

# Married ladies receiving jewellery in the form of ‘stree dhan’ during their long married life on various occasions like the birth of a child, birthdays, marriage anniversaries, etc., and accumulated over a period of years are to be excluded.

# Diamond Jewellery (not diamond studded gold jewellery), Gold Bar, or Gold Coins will not form part of the above limit. Mainly because the prescribed limit is only for gold jewellery and ornaments.

Note – Refer to our all Gold related articles at “Gold Articles“