Existing home sales in October fell to the lowest level since August 2010, as limited inventory and higher mortgage rates continued to weigh on homebuyers, according to the National Association of Realtors (NAR). Low resale inventory and strong demand continued to drive up existing home prices, marking the fourth consecutive month of year-over-year median sales price increase. However, recent declines in mortgage rates and a continued improvement in inventory are expected to fuel more demand in the coming months.

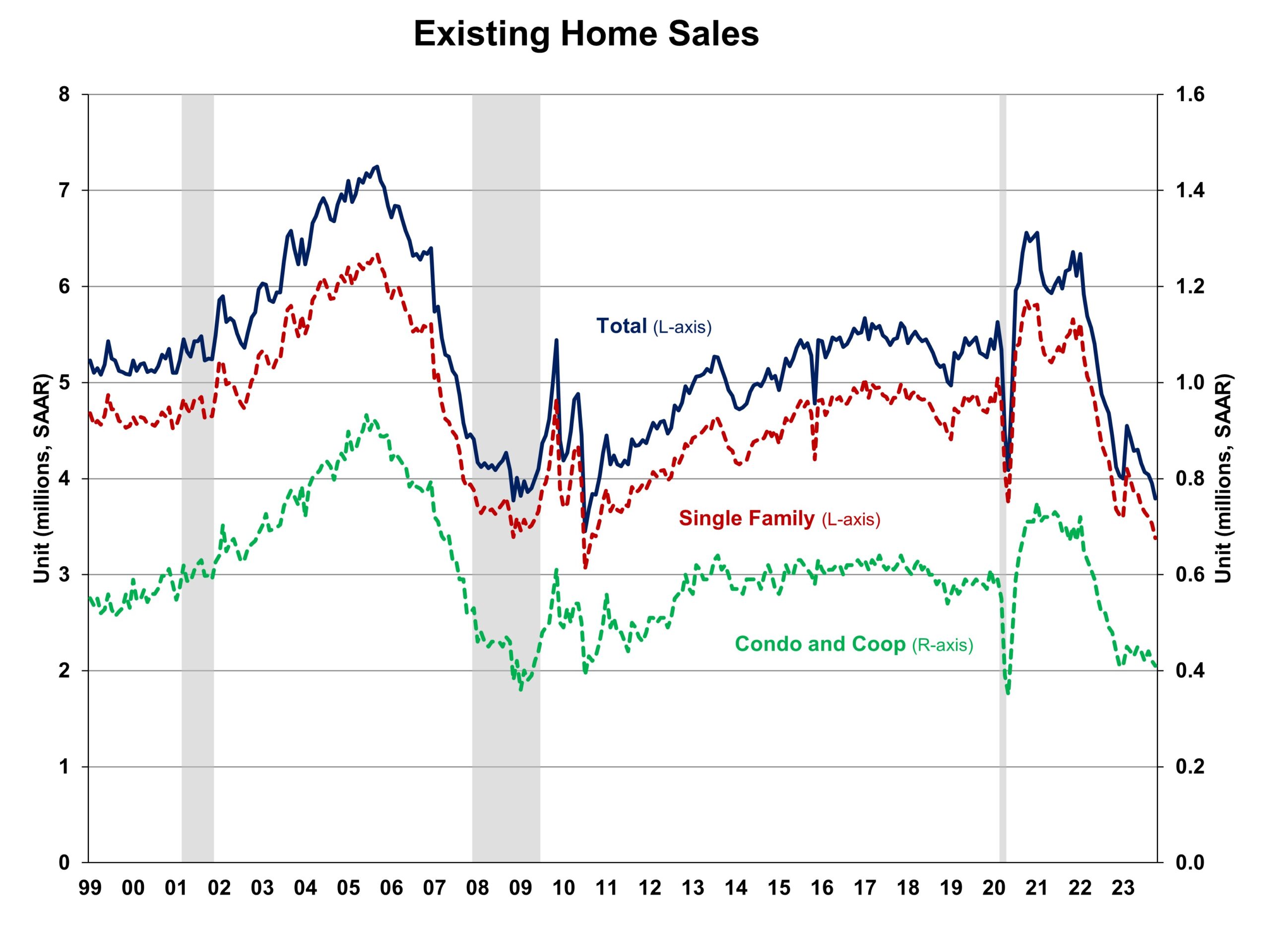

Total existing home sales, including single-family homes, townhomes, condominiums and co-ops, fell 4.1% to a seasonally adjusted annual rate of 3.79 million in October. On a year-over-year basis, sales were 14.6% lower than a year ago.

The first-time buyer share rose to 28% in October, up from 27% in September 2023 and identical to October 2022. The October inventory level measure increased slightly to 1.15 million units but was down 5.7% from a year ago.

At the current sales rate, October unsold inventory sits at a 3.6-months’ supply, up from 3.4-months last month and 3.3-months reading a year ago. This inventory level remains very low, compared to balanced market conditions (4.5 to 6 months’ supply), and illustrates the long-run need for more home construction.

Homes stayed on the market for an average of 23 days in October, up from 21 days in September and October 2022. In October, 66% of homes sold were on the market for less than a month.

The October all-cash sales share was 29% of transactions, unchanged from September but up from 26% a year ago. All-cash buyers are less affected by changes in interest rates.

The October median sales price of all existing homes was $391,800, up 3.4% from a year ago. The median existing condominium/co-op price of $356,000 in October, up 7.6% from a year ago.

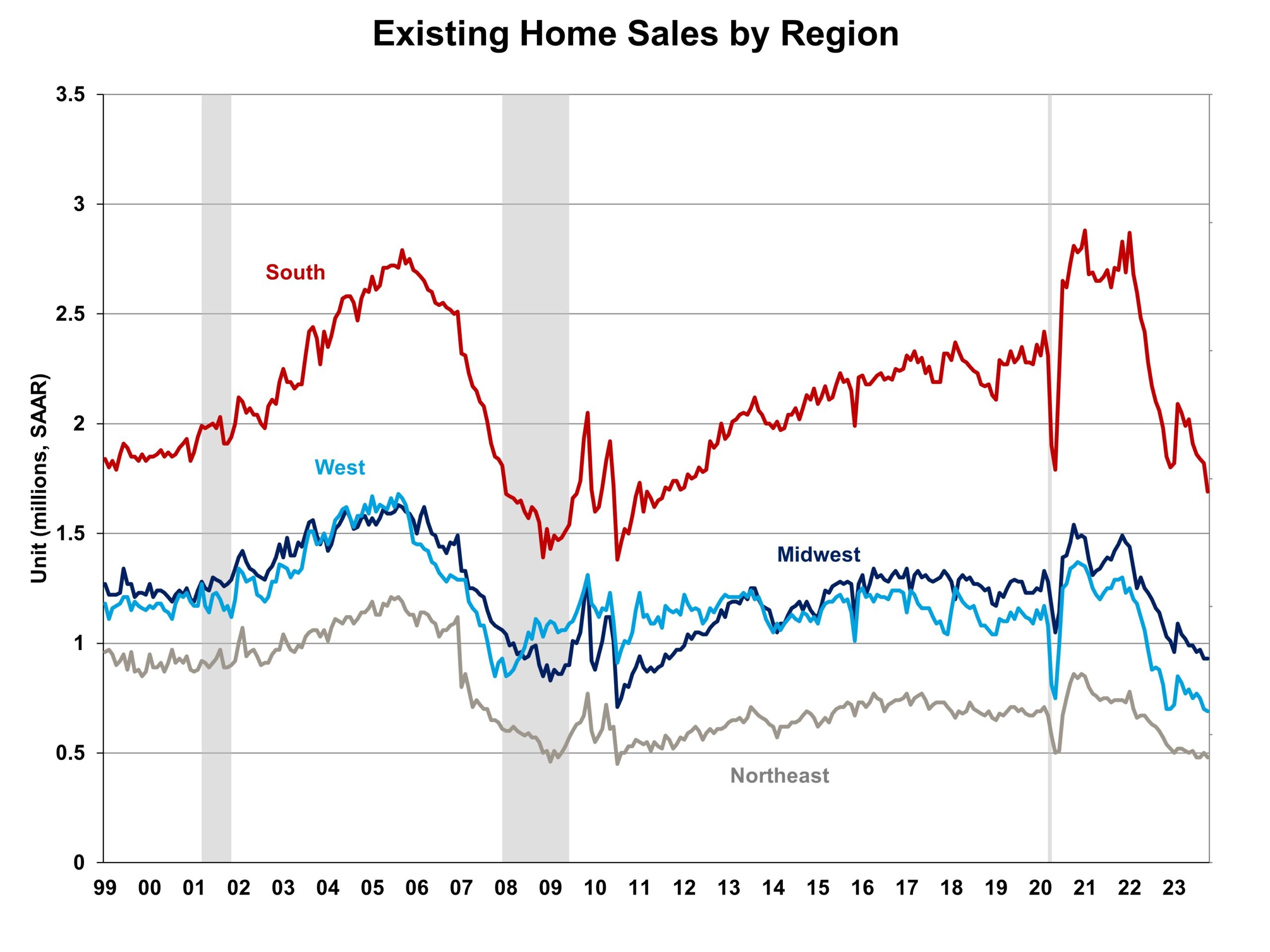

Existing home sales in October were mixed across the four major regions. Sales in the Northeast, South and West decreased 4.0%, 7.1% and 1.4% in October, while sales in the Midwest remained unchanged. On a year-over-year basis, all four regions continued to see a double-digit decline in sales, ranging from 13.9% in the Midwest to 15.8% in the Northeast.

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI rose 1.1% from 71.8 to 72.6 in September. On a year-over-year basis, pending sales were 11.0% lower than a year ago per the NAR data.