Public Provident Fund or PPF is one of the best and most popular debt instruments available to us. However, it does not mean it is risk-free. What are the risks of investing in a Public Provident Fund or PPF?

No asset class on this earth is completely risk-free. In one way or another way, they carry a certain amount of risks. Only nature or colour may change. Hence, understanding the risks of investing in a Public Provident Fund is most important.

Before proceeding further, let us recap the features of the Public Provident Fund.

Features of Public Provident Fund or PPF

Who can open it?

(i) a single adult by a resident Indian.

(ii) a guardian on behalf of a minor/ person of unsound mind. ?

Note:- Only one account can be opened all across the country either in the Post Office or any Bank.

How much to deposit?

(i) Minimum deposit of Rs. 500 in a Financial Year and Maximum deposit is Rs. 1.50 lakh in an FY

(ii) Maximum limit of Rs. 1.50 lakh shall be inclusive of the deposits made in his/her own account and in the account opened on behalf of a minor.

(iii) Amount can be deposited in any number of installments in an FY in multiple of Rs. 50 and a maximum up to Rs. 1.50 lakh.

(iv) The Account can be opened by cash/cheque and in the case of the cheque the date of realization of the cheque in Govt. the account shall be the date of opening of account/subsequent deposit in the account.

(v) Deposits qualify for deduction under section 80C of the Income Tax Act.

What if you discontinue the account?

(i) If in any financial year, a minimum deposit of Rs.500/- is not made, the said PPF account shall become discontinued.

(ii) Loan/withdrawal facility is not available on discontinued accounts.

(iii) Discontinued account can be revived by the depositor before maturity of the account by deposit minimum subscription (i.e. Rs. 500) + Rs. 50 default fee for each defaulted year.

(iv) The total deposit in a year, shall be inclusive of deposits made in respect of years of default of previous financial years.

What is the interest rate?

(i) Interest shall be applicable as notified by the Ministry of Finance on a quarterly basis. The current interest rate is 7.1%.

(ii) The interest shall be calculated for the calendar month on the lowest balance in the account between the close of the fifth day and the end of the month.

(iii) Interest shall be credited to the account at the end of each Financial year.

(iv) Interest shall be credited to the account at the end of each FY where the account stands at the end of FY. (i.e. in case of transfer of account from Bank to PO or vice versa)

(v) Interest earned is tax-free under the Income Tax Act.

Can we avail a loan?

(i) Loan can be taken after the expiry of one year from the end of the FY in which the initial subscription was made. (i.e. A/c open during 2010-11, loan can be taken in 2012-13).

(ii) Loan can be taken before the expiry of five years from the end of the year in which the initial subscription was made.

(iii) Loan can be taken up to 25% of the balance to his credit at the end of the second year immediately preceding the year in which the loan is applied. (i.e. if the loan was taken during 2012-13, 25% of the balance credit on 31.03.2011)

(iv) Only one loan can be taken in a Financial Year.

(v) A Second loan shall not be provided till the first loan was not repaid.

(vi) If the loan is repaid within 36 months of the loan taken, a loan interest rate @ 1% per annum shall be applicable.

(vii) If the loan is repaid after 36 months of the loan taken loan interest rate @ 6% per annum shall be applicable from the date of loan disbursement.

How much withdrawal is allowed? ?

(i) A subscriber can take 1 withdrawal during a financial after five years excluding the year of account opening. (if the account was opened during 2010-11 the withdrawal can be taken during or after 2016-17)

(ii) Amount of withdrawal can be taken up to 50% of the balance at the credit at the end of the 4th preceding year or at the end of the preceding year, whichever is lower. (i.e. withdrawal can be taken in 2016-17, up to 50% of balance as on 31.03.2013 or 31.03.2016 whichever is lower).

When it will mature?

(i) Account will be maturity after 15 F.Y. years excluding FY of account opening.

(ii) On maturity depositor has the following options:-

# Can take maturity payment by submitting account closure form along with passbook at concerned Post Office.

# Can retain maturity value in his/her account further without deposit, the PPF interest rate will be applicable and payment can be taken any time or can take 1 withdrawal in each FY.

# Can extend his/her account for a further block of 5 years and so on (within one year of maturity) by submitting a prescribed extension form at the concerned Post Office. (Discontinued account cannot be extended).

# In an extended account with deposits, 1 withdrawal can be taken in each FY subject to a maximum limit of 60% of balance credit at the time of maturity in the block of 5 years.

Whether premature closure allowed?

(i) Premature closure shall be allowed after 5 years from the end of the year in which the account was opened subject to the following conditions.-> In case of life-threatening disease of account holder, spouse, or dependent children.-> In case of higher education of account holders or dependent children.-> In case of a change of resident status of the account holder ( i.e. became NRI).?(ii) At the time of premature closure 1% interest shall be deducted from the date of account opening/date of extension as the case may be.

(iii) The Account can be closed on the above conditions by submitting the prescribed form along with the book at the concerned Post Office.

What will happen if the account holder dies?

(i) In case of the death of the account holder, the account shall be closed and the nominee or legal heir(s) shall not be allowed to continue deposits in the account.

(ii) At the time of closure due to death PPF rate of interest shall be paid till the end of the preceding month in which the account is closed.

Risks Of Investing in Public Provident Fund (PPF)

Let us now try to understand the risks of investing in public provident fund (PPF).

# Liquidity Risk

One of the biggest risk associated with Public Provident Fund (PPF) is the liquidity risk. Even though loan and withdrawal facility is available, but they come with their own set of rules and regulations. You can’t withdraw as per your own requirements. Hence, understanding this risk before blind investment is a must for all investors.

This risk will ease after a year (to avail loan) and especially after fiver years (to avail withdrawal). However, the real liquidity risk will vanish to certain extent post 15 years completion. Because after 15 years completion, 1 withdrawal can be taken in each FY subject to maximum limit 60% of balance credit at the time of maturity in the block of 5 years.

Refer my earlier post in this regard – “PPF-Loan And Withdrawal” and “PPF Withdrawal Rules & Options After 15 Years Maturity“.

# Interest Rate Risk

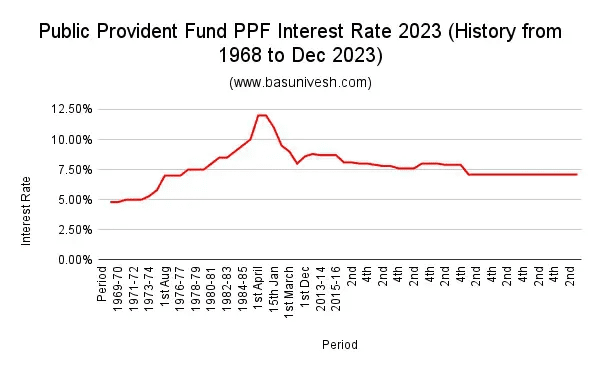

As I mentioned above, PPF interest rate will change once in a quarter. Look at below chart to understand the history of the PPF interest rate.

You notice that during initial years, it was around 5%, then touched the peak of around 12% in around 2000 and now at 7.1%. Hence, if you are investing and assuming the same current 7.1% interest you will get throughout your investment cycle is a complete MYTH. Refer my post in this regard “Public Provident Fund PPF Interest Rate 2023 (History From 1968 To Present)“.

# Goal Mismatch Risk

Many people blindly invest in PPF without understanding their actual need. If you need the money within 15 years, then obiviously PPF is not a suitable product for you. Make sure that your financial goal should match your PPF maturity date. Otherwise, even though you invested in PPF, due to its liquidity risk, you may not fund towards your goal fully.

Hence, never invest blindly. Instead understand your requirement and then invest.

# Policy Risk

The major motive for PPF investors is safety and tax free nature of interest and maturity. However, when the policymakers change the rules is unknown to us. If you invested today with an assumption that it will remain tax free but later on if the rules changed, then you have to suffer in a big way. The classic example is of EPF. Earlier whatever you earn as interest on your contribution (employee contribution) and your employer contribution was tax free. However, now the limit set for your contribution (Rs.2,50,000) a year. If you contribute beyond this, then whatever the interest earned by such additional contribution will be taxable income for the employee on yearly basis. Refer my earlier post “Taxation Of EPF Contribution Above Rs.2.5 Lakh – CBDT Clarification“.

Hence, never be in a wrong belief that the tax rules or the benefits of PPF will continue forever like how they are today.

# Inflation Risk

PPF is the best debt instrument. No doubt in that. However, PPF alone is not sufficeint to fullfill your future long term financial goals. Hence, never invest full amount in PPF. Instead, you need the equity part also to generate inflation adjusted return.

Sadly many people not understand this. Instead, blindly they fill the Rs.1.5 lakh gap without fail. Instead, based on your goals, you must do the asset allocation and part of your debt should be invested in PPF. In fact if you are following the goal based investing, and PPF is a debt part of your portfoio, then never invest all debt part in PPF. Mainly because in case of rebalancing, you can’t partially withdraw (as per your terms) to balance the portfolio. In such a situation, debt funds will be handy for you.

Conclusion – The idea behind this post is not to bring the negativity of a product. However, the idea is to suggest that DON’T INVEST BLIDNLY just because PPF offers tax benefits and safety of money. Instead, think beyond this and if you understood the above mentioned risks of investing in public provident fund (PPF), then go ahead. BLIND EMPTIONAL INVESTMENT IS ALWAYS RISKY.