Which are the Top 10 Best SIP Mutual Funds To Invest In India In 2024? How to select them and how to create a portfolio? Do we need to change funds yearly? Let us try to answer all these questions in this post.

If you are familiar with my blog, then you noticed that every year I publish my list of funds. Last year I did not publish the data for certain reasons. Many of of blog readers asked and I was unable to publish. Saying sorry to all my blog readers for this delay from my side. It is all due to my Fee-Only Financial Planning Service work. If you are interested in availing of this Fixed Fee-Only Financial Planning Service, then you can refer to the Service page of this blog (Fixed Fee-Only Financial Planning Service).

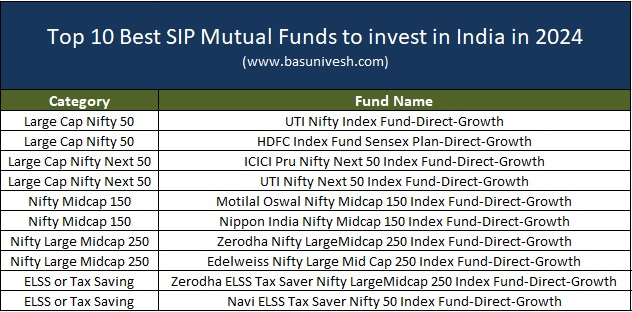

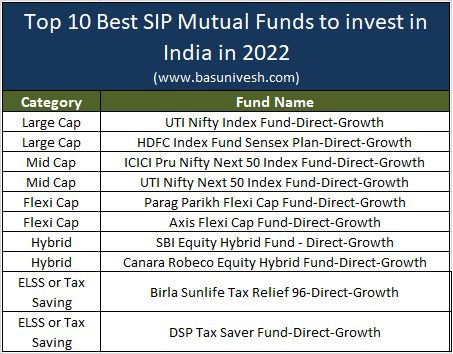

For this reason, I thought to publish this routine post well in advance for 2024. Let us first recap what I have recommended in 2022.

Many things changed in between like the taxation of debt mutual funds or the launch of tax-saver index funds. If you remember, since the SEBI’s Recategorization Of Mutual Funds, I started to recommend Index Funds majorly.

By adopting the Index Funds, you are actually running away from searching for the BEST fund and also avoiding the risk of a fund manager’s underperformance risk. Investing in an Index Fund and expecting the returns of the Index is the simplest way of investment. The only risk you can’t avoid is market risk, which you have to manage by proper asset allocation between debt and equity (I mean at the portfolio level).

BY adopting index funds you are sure of index returns. However, when you choose the active funds, the risk of underperformance is always there. Look at the history, you noticed that no fund manager on this earth can generate CONSISTENT superior returns to index. Few years of outperformance may vanish if there is a prolonged underperformance of the fund. Above that due to the high cost, active funds are more vulnerable to generate low returns than index. This can be validated from the history also.

“If you are incredibly talented and extremely lucky, you will beat the market most of the time. Everybody else will be better off investing in low-cost broad-market index funds.” – Naved Abdali

Show me one fund manager in the history of investment who accepted the underperformance openly or accepted that outperformance is because of LUCK. Even if it is because of luck, they always show us as if the result of their SKILL.

It remembers me of my favorite Daniel Kahneman’s quote from the book “Thinking, Fast and Slow” –

“Mutual funds are run by highly experienced and hardworking professionals who buy and sell stocks to achieve the best possible results for their clients. Nevertheless, the evidence from more than fifty years of research is conclusive: for a large majority of fund managers, the selection of stocks is more like rolling dice than playing poker. More importantly, the year-to-year correlation between the outcomes of mutual funds is very small, barely higher than zero. The successful funds in any given year are mostly lucky; they have a good roll of dice. There is general agreement among researchers that nearly all stock pickers, whether they know it or not – and few of them do – are playing a game of chance.”

Therefore, should we blindly jump into Index Funds? The answer is NO. As you may be aware, many AMCs are now launching a lot of Index Funds. Because they are trying to follow the trend. Few launched with an idea of low cost and few brought complications by launching smart-beta funds. However, in my view, owning the whole market (especially Nifty 100) is far better than these various smart-beta index funds. I know that they may reduce the volatility. However, it comes with compensation for returns. Hence, for simplicity, owning the Nifty 100 is far better. Beware…You don’t need all Index Funds. You need 1-2 funds among the jungle of Index Funds. It reminds me of the quote from John Bogle.

“The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course.”

– John C. Bogle, The Little Book of Common Sense Investing.

For 99.99% of the investors, the primary reason to choose the fund is past returns. John Bogle once said, “Buying funds based purely on their past performance is one of the stupidest things an investor can do.“. They never look for even consistent returns or the risk involved in the fund. Hence, end up in having an exposure to the category of funds that are not suitable for them.

Why do we have to invest?

For many investors this basic first question is unanswerable. They invest randomly because they have a surplus to invest. They invest mainly because to generate higher returns than the Bank FDs. They invest mainly because few of their friends or colleagues are investing in mutual funds.

You must INVEST to reach your financial goals but not to generate higher returns. When you chase the returns, you end up making more mistakes. Never invest based on your friend’s recommendation. Your financial life is entirely different than your friends. Your risk profile is entirely different than your friends.

Sharing once again the quote of Morgan Housel.

“If I had to summarize my views on investing, it’s this: Every investor should pick a strategy that has the highest odds of successfully meeting their goals. And I think for most investors, dollar-cost averaging into a low-cost index fund will provide the highest odds of long-term success.” – Morgan Housel, The Psychology of Money (Timeless Lessons on Wealth, Greed and Happiness).

I am not saying that all the funds will underperform the index. There are ALWAYS few funds that will outperform the Index. However, the question mark for you and me is which is CONSISTENTLY outperforming funds during OUR investment journey.

The cost you pay to them is fixed. However, the returns are not fixed. If a fund manager is claiming that his fund is beating the index, then you have to check what is the actual returns after cost and how consistently he can deliver returns.

How To Choose The Best Index Funds?

When you decide to invest in Index Funds, you have to just concentrate on three aspects of the funds and they are as below.

# Expense Ratio:-Lower the Expense ratio is better for me.

# Tracking Error:-It is nothing but how much the fund deviated in terms of returns with respect to the Index it is benchmarked. Lower the tracking error means better fund performance. Few fund houses do not publish this data on a regular basis. Hence, you have to be cautious with this data. Refer to my post in this regard “Tracking Difference Vs Tracking Error Of ETF And Index Funds“.

# AUM:- Higher AUM means a better advantage for the fund manager to manage the liquidity issues.

If you go by these criteria, then Index NFOs are also not considered. Once they have decent AUM with historical tracking errors, then you can consider them.

Basics of Investing Mantras

Now before jumping to investing, you must have an idea of what are the basics of investing. I repeat this exercise on a yearly basis in my blog post. But still, find the same type of questions from the readers. Hence, to give you the clarity, I am writing once again.

As per me, before jumping into an investment, one must be aware of how well they are prepared for facing financial emergencies. Financial emergencies may include loss of life, meeting with an accident, hospitalization, sudden income loss, or job loss.

Hence, the first step is to cover yourself with proper Life Insurance (Term Life Insurance where the coverage should be at least 15-20 times your yearly income). You must have your own health insurance (rather than relying on employer-provided health insurance). Create better coverage with a family floater plan and Super Top Up Health Insurance. Ideally around 3-5 Lakh of family floater plan and around Rs.10-25 Lakh of Super Top Up is a must nowadays. Buy around 15 to 20 times of your monthly salary corpus as accidental insurance. Then finally create an emergency fund of at least 6-24 months of your monthly commitment. This will be handy whenever your income will stop or if you face any unplanned expenses.

Once these basics are done, then think of investing. If your basics are not done properly, then whatever investment building you are creating may tumble at any point in time. Let us move on and understand the basics of investing.

You Must Have A Proper Financial Goal

I noticed that many investors simply invest in mutual funds just because they have some surplus money. The second reason may be someone guided that mutual funds are best in the long run compared to Bank FDs, PPF, RDs, or even LIC endowment products.

If you have clarity like why you are investing, when you need the money, and how much you need money at that time, then you will get better clarity in selecting the product. Hence, first, identify your financial goals.

You must know the current cost of that goal. Along with that, you must also know the inflation rate associated with that particular goal. Remember that each financial goal has its own inflation rate. For example, the education or marriage cost of your kid’s inflation is different than the inflation rate of household expenses.

By identifying the current cost, time horizon, and inflation rate of that particular goal, you can easily find out the future cost of that goal. This future cost of the goal is your target amount.

I have written a separate post on how to set your financial goals. Read the same at “Financial Goals – How to set before jumping into investing?”

Asset Allocation Is a MUST

The next step is to identify the asset allocation. Whether it is a short-term goal or a long-term goal, the proper asset allocation between debt and equity is a must. I personally suggest the below-shared asset allocation strategy. Remember that it may differ from individual to individual. However, the basic idea of asset allocation is to protect your money and smoothly sail to reach your financial goals.

If the goal is below 5 years-Don’t touch equity product. Use the debt products of your choice like FDs, RDs, Liquid Funds, Money Market Funds, or Ultra Short Term Funds.

If the goal is 5 years to 10 years-Allocate debt: equity in the ratio of 60:40.

If the goal is more than 10 years-Allocate debt: equity in the ratio of 40:60.

While choosing a debt product, make sure that the maturity period of the product must match your financial goals. For example, PPF is the best debt product. However, it must match your financial goals. If the PPF maturity period is 13 years and your goal is 10 years, then you will fall short of meeting your financial goals.

First fill the debt allocation with EPF, PPF, or SSY (based on the maturity and goal type). If you still have room to invest in debt, then choose the debt funds. Personally, my choice always is to fill these wonderful debt products like EPF, PPF, and SSY.

Return Expectation

Next and the biggest step is the return expectation from each asset class. For equity, you can expect around 10% to 12% return. For debt, you can expect around 6% to 7% returns.

When your expectations are defined, then there is less probability of deviating or taking knee-jerk reactions to the volatility.

Portfolio Return Expectation

Once you understand how much is your return expectation from each asset class, then the next step is to identify the return expectation from the portfolio.

Let us say you defined the asset allocation of debt: equity as 40:60. Return expectation from debt is 6% and equity is 10%, then the overall portfolio return expectation is as below.

(60% x 10%) + (40% x 6%)=8.4%.

How Much To Invest?

Once the goals are defined with the target amount, asset allocations are done, and return expectation from each asset class is defined, then the final step is to identify the amount to invest each month.

There are two ways to do it. One is a constant monthly investment throughout the goal period. The second way is increasing some fixed % each year up to the goal period. Decide which suits you.

I hope the above information will give you clarity before jumping into equity mutual fund products.

How Many Mutual Funds Are Enough?

How many mutual funds do we have? Is it 1, 3, 5, or more than 5? The answer is simple…you don’t need more than 3-4 funds to invest in mutual funds. Whether your investment is Rs.1,000 a month or Rs.1 lakh a month. With a maximum of 3-4 funds, you can easily create a diversified equity portfolio.

Having more funds does not give you enough diversification. Instead, in many cases, it may create your portfolio overlapping and lead to underperformance.

Few choose new funds for each goal. That creates a lot of clutter and confusion. Because, starting is easy and after few years, it looks like a hilarious task to manage. Hence, my suggestion is to have the same set of funds for all goals. Either you create a unified portfolio or create a separate folio for each goal and invest.

Taxation of Equity Mutual Funds for FY 2023-24

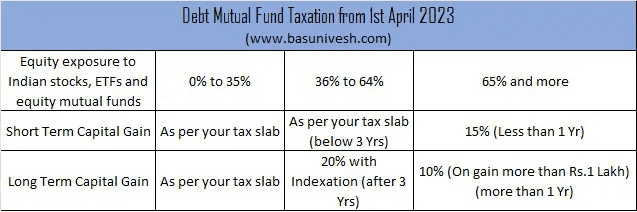

As I mentioned above, there are certain changes happened with respect to debt mutual funds taxation. This amendment to the Finance Bill 2023 created three categories of mutual funds for TAXATION.

# Mutual Funds Holding More Than 65% Or More In Indian Equity, Indian Equity ETFs, Or Equity Funds

In this category, there is no change in taxation. They are taxed like equity funds. If your holding period is less than a year, then STCG is applicable and taxed at 15%. However, if your holding period is more than 1 year, then LTCG is applicable and taxed at 10% (over and above the aggregated long-term capital gain of Rs.1 Lakh). As there is no change in this category, I hope it is clear for you.

You noticed that the taxation rules for equity are unchanged. The old rules will continue as usual.

# Mutual Funds Holding Less Than 65% Or More Than 35% In Indian Equity, Indian Equity ETFs, Or Equity Funds

Here also there is no change. They are taxed like debt funds (as per the old rule). If your holding period is less than three years, then the gain is taxed as STCG and the rate is as per your tax slab. However, if the holding period is more than three years, then taxed at 20% with an indexation benefit.

# Mutual Funds Holding Less Than Or Equal To 35% Of Indian Equity, Indian Equity ETFs, Or Equity Funds

Here is a big change (if the amendment passed in parliament). The taxation is as per your tax slab. No question of LTCG or STCG. This taxation rule will be applicable from 1st April 2023.

Investments done before 31st March 2013 are eligible as per the old tax rules (with indexation for long-term capital gain).

Because of this, many are very angry with the government (I can understand investors’ anger but I hate the anger of the finance industry. Because it is mainly because they lose the business).

The same can be tabulated as below.

Top 10 Best SIP Mutual Funds To Invest In India In 2024

I have written few posts which as per me are best to add value to your investment journey. Hence, suggest you read them first (sharing the list below).

I have created a separate set of articles to educate the investors with respect to debt mutual funds. Trying to write as many as possible in this category. Because what I have noticed is that many are lagging in understanding the debt funds. You can refer to the same here “Debt Mutual Funds Basics“.

Let us move on to my sharing of the Top 10 Best SIP Mutual Funds To Invest In India In 2024.

Best SIP Mutual Funds To Invest In India In 2024 -Large-Cap

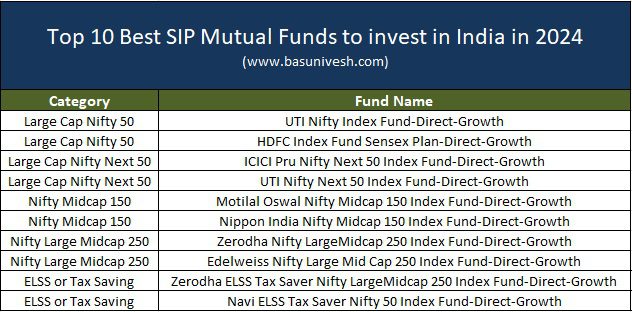

Last time I recommended two Large Cap Index Funds. I am retaining the same funds for this year too.

# UTI Nifty Index Fund-Direct-Growth

# HDFC Index Fund Sensex Plan-Direct-Growth

Best SIP Mutual Funds To Invest In India In 2024 -Mid-Cap

Last time, I recommended two Nifty Next 50 Index Funds. This year also, I am retaining the same funds for my recommendations in Mid Cap Funds. In my article Nifty Next 50 Vs Nifty Midcap 150 – Which is best?, I have given the reasons why the Nifty Next 50 should be your better alternative than the Nifty Mid Cap.

Nifty Next 50 is actually an essence of both large-cap and mid-cap. Because of this, it acts with the same volatility as mid-cap. Hence, I am suggesting Nifty Next 50 as my mid-cap fund than particular Mid Cap Active or Index Funds.

I am continuing last year’s choices:-

# ICICI Pru Nifty Next 50 Index Fund-Direct-Growth

# UTI Nifty Next 50 Index Fund-Direct-Growth

However, if you are fond of mid-cap, then you can choose the below Midcap Index Funds.

# Motilal Oswal Nifty Midcap 150 Index Fund-Direct-Growth

# Nippon India Nifty Midcap 150 Index Fund-Direct-Growth

Best SIP Mutual Funds To Invest In India In 2024 -Large and Midcap Fund

Two years back when I wrote a post, I was unable to find this category. However, currently, two funds are available in this category. While reviewing the product Zerodha, I aired my view in this category. You can refer to the same “Zerodha Nifty LargeMidcap 250 Index Fund – Should You Invest?“.

As this is the blend of the Nifty 100 and Nifty Midcap 150 Index in the ratio of 50:50. I suggest this should be for those who wish to hold in the same ratio and with a single fund rather than two to three funds. My recommendations are as below.

# Zerodha Nifty LargeMidcap 250 Index Fund-Direct-Growth

# Edelweiss Nifty Large Mid Cap 250 Index Fund-Direct-Growth

Best SIP Mutual Funds To Invest In India In 2024 – ELSS Or Tax Saver Funds

As I have mentioned above, now we have Index Funds available in this category also. Hence, rather than having active funds, I am suggesting passive funds here too.

# Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund-Direct-Growth

The above fund is for those who want the blend of the Nifty 100 + Nifty Midcap 150 in the ratio of 50:50. However, if they don’t want exposure to mid-cap, then they can consider the below fund.

# Navi ELSS Tax Saver Nifty 50 Index Fund-Direct-Growth

What about Small-Cap Funds?

Refer to my earlier post “Who CAN Invest In Small Cap Funds?“, where it is evident from the past 20 years of data that by taking higher risk through small cap, you may end up with less than Midcap return. Hence, I feel it is an unnecessary headache.

Personally, I never invested in small-cap funds, and also for all my fee-only financial planning clients, I never suggest small-cap funds. I may be conservative. However, in the end, what I want is a decent return with sound sleep at night. Hence, staying away from Small Cap Funds (even though the whole of India is currently behind Small Cap

So you noticed that this year, I stayed away from Flexi Cap Funds, and Hybrid Funds, and in the case of ELSS, I suggested the index funds only. But it does not mean those who invested in Flexi Cap Funds or Hybrid Funds must come out. Instead, have a constant monitor).

Finally, a list of my Top 10 Best SIP Mutual Funds to invest in India in 2024 is below.

What is my style of construction Equity Portfolio?

I have listed all the funds above. However, I suggest constructing the portfolio as below within your equity portfolio.

50% Large Cap Index+30% Nifty Next 50+20% Midcap

50% Large Cap Index+30% Nifty Next 50+20% Flexi Cap Funds (You can use my earlier recommendation of Parag Parikh Flexi Cap Fund). This I have mentioned earlier as my favorite approach.

Otherwise, a single NIfty Large Midcap 250 Index Fund is enough for the equity. May be it look concentrated due to single fund holding. However, indirectly you have an exposure equally to large cap and mid cap.

Conclusion:- These are my selections but it does not mean they must be universal selections. Hence, if you have a different opinion, then you can adopt so. You also noticed that I hardly change my stance until and unless there is a valid reason. In the end, investing is a BORING and LONG-TERM journey, right? Best of LUCK!!

Disclaimer: The Views Expressed Above Should Not Be Considered Professional Investment Advice, Advertisement, Or Otherwise. The Article Is Only For General Educational Purposes. The Readers Are Requested To Consider All The Risk Factors, Including Their Financial Condition, Suitability To Risk-Return Profile, And The Like, And Take Professional Investment Advice Before Investing.