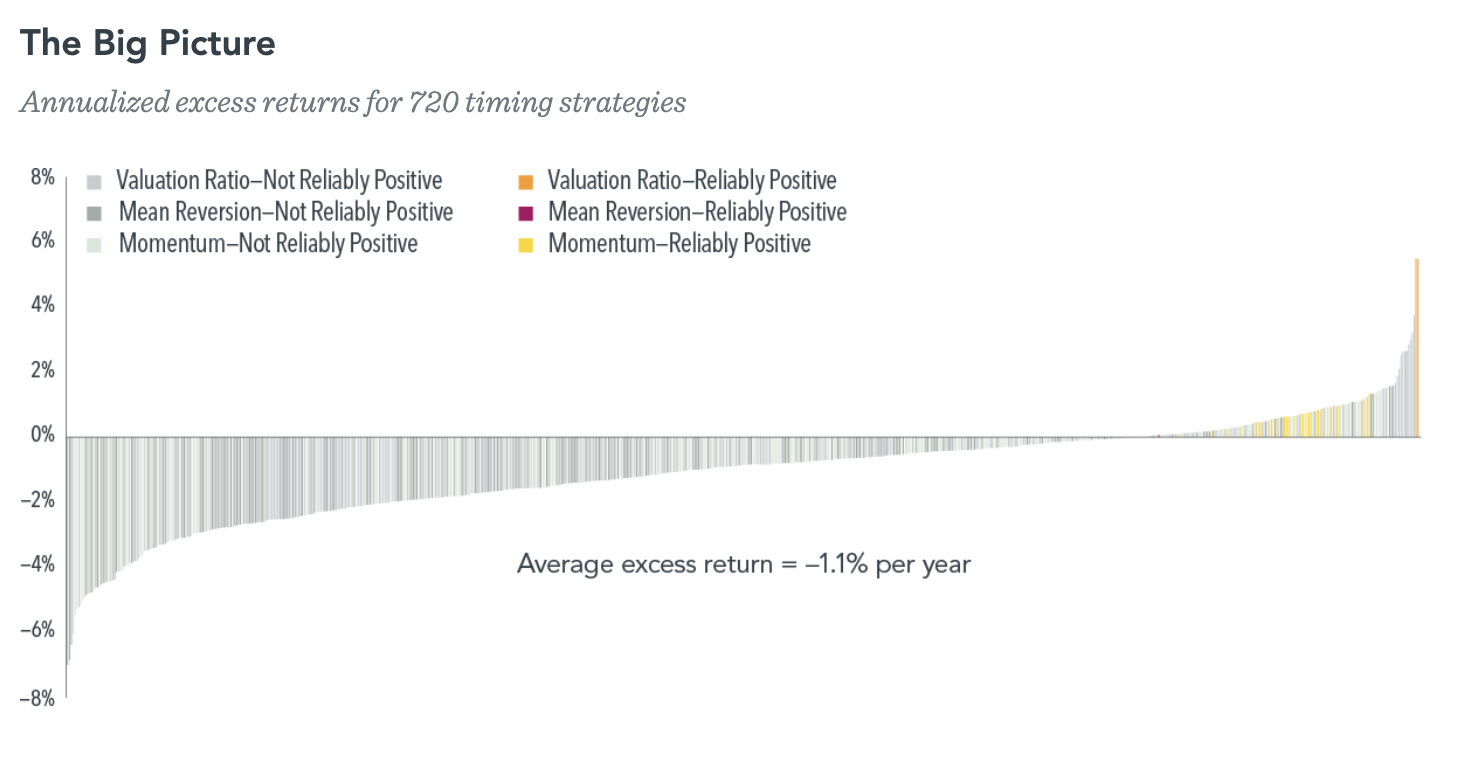

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read.

The broad strokes are: Market timing is extremely difficult, very few people (if any) do it consistently well. Not only are the odds stacked against you, but very often systems that have successfully timed the market have been simply lucky, and do not succeed in out-of-sample tests. This is before we get to the issue of capital gains taxes, which create a hurdle of (minimum) 20% on those pesky profits just to get to breakeven.

Let’s add some color to the discussion on timing itself and add a little nuance.1

I’ve had some pretty good market timing calls in my career, and I attribute my success in that space to three factors: 1) Instinct; 2) Low Stakes; 3) Luck. Let’s delve into these to see if they apply to your own investing and trading:

Instinct: Malcolm Gladwell’s Blink: The Power of Thinking Without Thinking, discusses the strengths and capabilities of the “adaptive unconscious.” Gladwell credits success in many fields to rapid, automatic judgments that come from years of practice. After enough reps, it becomes second nature for the brain to quickly recognize patterns and regularities to make good snap judgments.2

Color me skeptical.

There are many problems with instinct, but two stand out in particular: First, markets evolve over time; that “market sense” traders develop can be rendered fallible as the financial world changes. Second, being a “Contrarian” requires you to fight the crowd — and you as a social primate desperately want to stay with your tribe or social group. Catching the exact right moment when the crowd is mostly wrong goes against all of your instincts as a social primate.3

Imagine a private placement memorandum seeking to raise money based on “decades of honed instincts” as an investment model. It’s utterly laughable.

Low Stakes: The most successful market timers are often those people who do not have actual assets at risk. The less it matters, the easier it is to be bold and outside of the mainstream.4

Newsletter writers are notorious for making big calls. But when they get market timing wrong, they lose subscribers. When you get it wrong, it crushes your retirement plans. Hence, the less it matters, the less actual capital is on the line, the easier it is to make those bold calls.

My own track record at making big calls is pretty damned good, but none of our clients wants me slinging around their retirement monies based on my gut instinct. I sure as hell don’t want to either.

Luck: I put luck last because it’s so often overlooked.

Consider what you would have had to do over the past 2 decades to be a successful timer. The dotcom top, the double bottom in Oct 02-March 03; the highs in 2007, the lows 2009. Staying long through the 60-day 34% drop during the 2020 pandemic; getting out of the market ahead of the 2022 rate hiking cycle; and getting back in October 2022 for the next bull leg.

I have dozens of examples of traders who made the right call for some of the above for all the wrong reasons. It is little wonder these folks are inconsistent.

~~~

If you want to have a small percentage of your portfolio in a cowboy account where you can swing in and out without affecting your real money, sure, why not¡ But with your core portfolio — the capital that really matters — the best thing you can do is leave it alone to compound over time.

Previously:

The Timing Mistake: Thoughts & Pushback (August 26, 2020)

Market Timing for Fun & Profit (August 28, 2020)

The Art of Calling a Market Top (October 4, 2017)

DOs and DONTs of Market Crashes (January 16, 2016)

The Truth About Market Timing (March 13, 2013)

Timing the Market? (October 22, 2012)

Investing via Media Market Timing (February 8, 2009)

Forecasting & Prediction Discussions

Sources:

We Found 30 Timing Strategies that “Worked”—and 690 that Didn’t

By Wei Dai, PhD, Audrey Dong,

DFA, Oct 31, 2023

In the Stock Market, Don’t Buy and Sell. Just Hold.

By Jeff Sommer

New York Times, Nov. 24, 2023

__________

1: In particular, why average outperforms over the long run; Sommers credits not making errors (via Charlie Ellis’ “Winning the Loser’s Game”) but the nuance and math are fascinating. More on this later.

2: Blink’s premise has been criticized as overstated, lacking rigorous evidence, anecdotal, and unscientific.

3: Remember, the crowd is right most of the time — indeed, markets ARE crowds.

4: This is a big advantage of a Cowboy account – you can swing for the fences and if you strike out, its irrelevant. And, it has the advantage of leaving your actual investments alone.