LIC Jeevan Utsav (Plan No. 871) is available from 29th Nov 2023. Few are misselling it as a 10% GUARANTEED return product. What is 10% and what is GUARANTEED here?

Why is LIC launching this plan now?

Before we move on to understand the LIC Jeevan Utsav (Plan No.871) in detail, let us first understand the reasons or logic behind the launching of this product in the month of November.

TAX SAVING, GUARANTEED, and SAFETY are the few words to which we Indians are attracted to a lot. To exploit such a mindset, the financial world always plays certain games.

As you all are aware (especially salaried class), employees have to submit investment proof to their employers to avoid the tax deduction. Hence, employees who are unplanned about tax saving from the beginning will obviously be in a desperate mode looking for certain options to invest and save.

To target such individuals, if you noticed the history of LIC, they launch new products in the month of November end or in the beginning of December.

Hence, don’t rush to invest in this product with the sole intention of saving the tax and this is a new product. Instead, try to understand the features and eligibility, and if it suits your requirements then go ahead.

LIC Jeevan Utsav (Plan No. 871) – Eligibility

LIC’s Jeevan Utsav is a Non-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan. It is a Limited Premium plan with Guaranteed Additions throughout Premium Paying Term.

Below is the table to explain the LIC Jeevan Utsav (Plan No. 871) Eligibility.

Additional riders available in this plan are – Accidental Death and Disability Benefit Rider, Accident Benefit Rider, New Term Assurance Rider, New Critical Illness Benefit Rider, and Premium Waiver Benefit Rider.

The modes of premium payment allowable are Yearly, Half Yearly, Quarterly, and Monthly (through NACH only) or through salary deductions (SSS).

LIC Jeevan Utsav (Plan No. 871) – Benefits

The benefits are LIC Jeevan Utsav (Plan No. 871) can be categorized as below.

# LIC Jeevan Utsav (Plan No. 871) Death Benefits

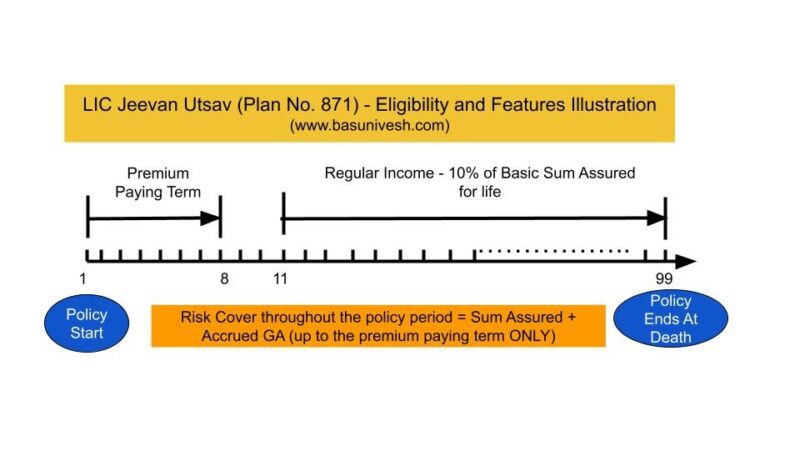

On the death of the policyholder and after the date of commencement of risk, Death Benefit equal to “Sum Assured on Death” along with accrued Guaranteed Additions shall be payable, provided the policy is in force.

GUARANTEED ADDITION – Guaranteed Additions will accrue at the rate of Rs.40 per R.1,000 Basic Sum Assured at the end of each policy year during the Premium Paying Term. There will be no further accrual of Guaranteed Additions after the Premium Paying Term. This means, that if your premium paying term is 8 years and assume that the sum assured is Rs.5,00,000, then each year GA accumulation will be 20,000. Let us say the policyholder dies after 3 years from the date of commencement of policy (risk), then LIC will pay Rs.5,00,000 (Sum Assured) + Rs.60,000 GA (Rs.20,000 per year GA *3) = Rs.5,60,000.

Let us say the policyholder dies after 10 years from the date of commencement of policy (risk), then LIC will pay Rs.5,00,000 (Sum Assured) + Rs.1,60,000 GA (Rs.20,000 per year GA *8) = Rs.6,60,000.

Note that even though the policyholder survived beyond the premium paying term, the GA as mentioned above, will be calculated only for the premium paying terms (Only for 8 years but not for 10 years).

In the case of minors where the commencement of risk has not started and death happened between the start of the policy and before the commencement of risk, then the nominee will receive the premiums paid as of death (excluding the tax, rider premiums, and extra premium).

This Death Benefit will not be less than 105% of total premiums paid (excluding tax, extra premium, and rider premium) up to the date of death.

“Sum Assured on Death” is defined as higher than ‘Basic Sum Assured’ or ‘7 times of Annualized Premium (excluding tax, extra premium, and rider premium)’.

Commencement of RISK – In case the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement of policy or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately from the date of issuance of the policy.

# LIC Jeevan Utsav (Plan No. 871) Survival Benefits

Here, there are two options provided.

1) Regular Income Benefit – On survival of the policyholder, a Regular Income Benefit equal to 10% of the Basic Sum Assured will be payable at the end of each policy year starting from the year as specified below, provided all due premiums have been paid.

For Premium Paying Terms 5 Yrs to 8 Yrs – Regular Income Benefit starts from 11th Year.

For Premium Paying Terms 9 Yrs, 10 Yrs, 11 Yrs, 12 Yrs, 13 Yrs, 14 Yrs, 15 Yrs, and 16 Yrs – Regular Income Benefit starts from 12th Year, 13th Year, 14th Year, 15th Year, 16th Year, 17th Year, 18th Year and 19 Years respectively.

2) Flexi Income Benefit – On survival of the policyholder, a Flexi Income Benefit equal to 10% of the Basic Sum Assured will be payable at the end of each policy year starting from the year as specified below, provided all due premiums have been paid.

For Premium Paying Terms 5 Yrs to 8 Yrs – Regular Income Benefit starts from 11th Year.

For Premium Paying Terms 9 Yrs, 10 Yrs, 11 Yrs, 12 Yrs, 13 Yrs, 14 Yrs, 15 Yrs, and 16 Yrs – Regular Income Benefit starts from 12th Year, 13th Year, 14th Year, 15th Year, 16th Year, 17th Year, 18th Year and 19 Years respectively.

However, in this option policyholder can defer and accumulate such yearly benefits. LIC will pay interest on the deferred and accumulated Flexi Income Benefits at the rate of 5.5% p.a. compounding yearly for completed months from its due date till the date of withdrawal, surrender, or death, whichever is earlier. The fraction of months will be ignored for the purpose of calculation of interest.

You are allowed to withdraw 75% of (Benefit + Interest) such balance once in a policy year. The remaining amount will continue to earn the 5.5% interest compounding yearly.

# LIC Jeevan Utsav (Plan No. 871) Maturity Benefits

As it is a whole-life plan, there is no maturity benefit under this plan.

The whole benefits of this plan can be explained in the below image.

LIC Jeevan Utsav (Plan No. 871) – Should you invest?

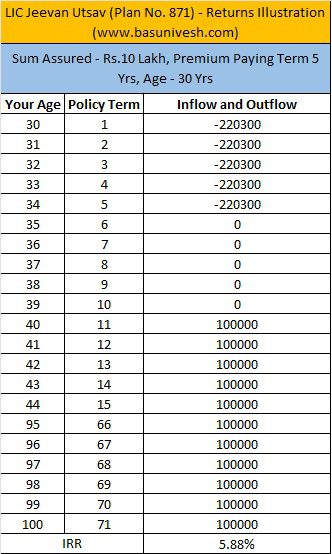

Before we judge based on the features of this product, let us try to understand the calculation with the below example.

You noticed that even if you assume a 30-year policyholder lives up to 100 years, the return on investment will be less than 6%. If the death happens before that, then returns will further reduce.

Hence, even though in whatever way you calculate, the returns are not more than 6%. This is the typical one-more LIC plan but with an eyewash of 10% benefit returns and GUARANTEED ADDITION keywords.

In this product, a 10% benefit is 10% of the basic sum assured what you get throughout your life. But not 10% RETURNS!! Also, GUARANTEED here is a guaranteed addition of Rs.40 per Rs.1,000 sum assured what you get up to your premium paying term (also they do not add a single penny to this accrued GA). Because of these two factors, assuming this product as 10% GUARANTEED returns is a complete myth. Don’t be in this trap. Instead, understand fully the product feature.

However, if you feel LIC is the best (not the product) and the less than 6% returns are BEST for your long-term investment, then you can go ahead and invest.