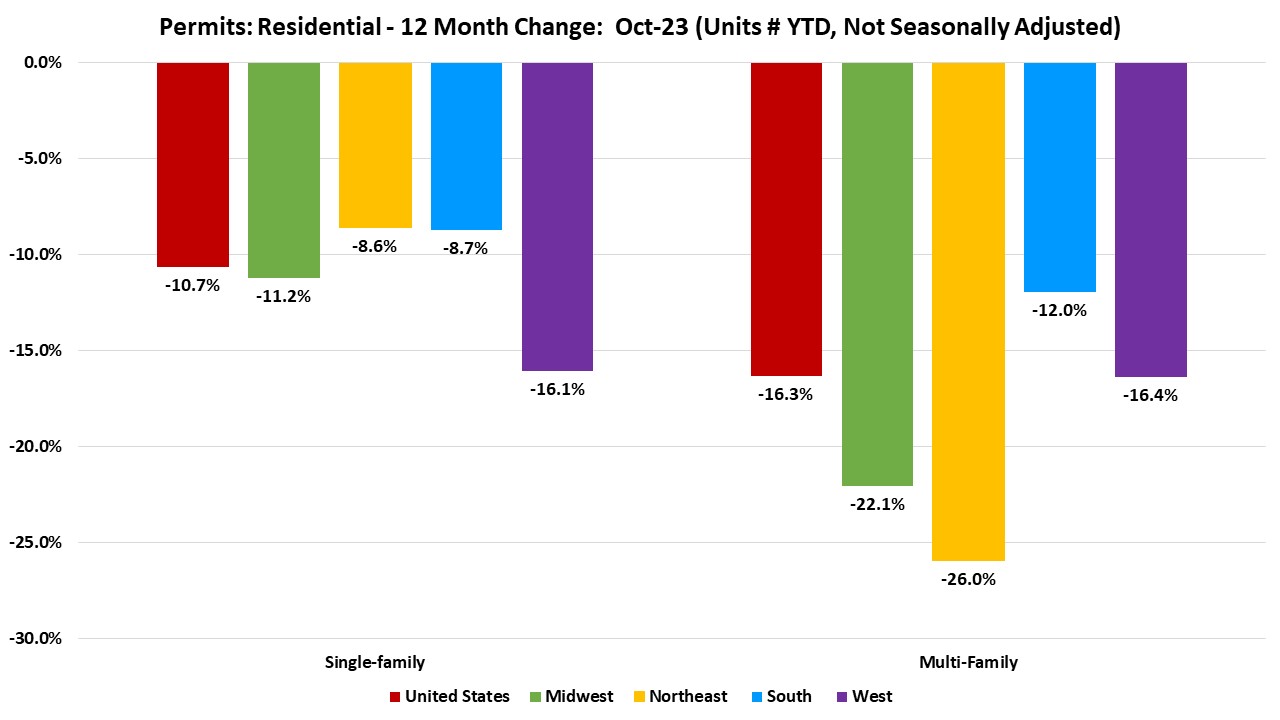

Over the first ten months of 2023, the total number of single-family permits issued year-to-date (YTD) nationwide reached 773,526. On a year-over-year (YoY) basis, this is 10.7% below the October 2022 level of 865,815.

Year-to-date ending in October, single-family permits declined in all four regions. The range of permit decline spanned 8.6% in the Northeast to 16.1% in the West. The South declined by 8.7% and the Midwest declined by 11.2% in single-family permits during this time. For multifamily permits, the percentage decline spanned 12.0% in the South region to 26.0% in the Northeast. The West declined by 16.4% and the Midwest declined by 22.1% in multifamily permits during this time.

Between October 2022 YTD and October 2023 YTD, except for Hawaii (+18.6%) and Maryland (+7.9%), all the other states and the District of Columbia reported declines in single-family permits. The range of declines spanned 1.6% in New Hampshire to 47.8% in the District of Columbia. The ten states issuing the highest number of single-family permits combined accounted for 63.8% of the total single-family permits issued. Texas, the state with the highest number of single-family permits issued, declined 11.0% in the past 12 months while the next two highest states, Florida and North Carolina declined by 10.2% and 2.9% respectively.

Year-to-date, ending in October, the total number of multifamily permits issued nationwide reached 481,612. This is 16.3% below the October 2022 level of 575,671.

Between October 2022 YTD and October 2023 YTD, 12 states recorded growth, while 38 states and the District of Columbia recorded a decline in multifamily permits. Delaware (+64.9%) led the way with a sharp rise in multifamily permits from 373 to 615 while Wyoming had the largest decline of 80.9% from 1,016 to 194. The ten states issuing the highest number of multifamily permits combined accounted for 63.7% of the multifamily permits issued. Texas, the state with the highest number of multifamily permits issued, declined 21.4% in the past 12 months while the next two highest states, Florida and California declined by 9.0% and 1.5% respectively.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

| Top 10 Largest SF Markets | Oct-23 (# of units YTD, NSA) | YTD % Change (compared to Oct-22) |

| Houston-The Woodlands-Sugar Land, TX | 43,270 | 1% |

| Dallas-Fort Worth-Arlington, TX | 35,826 | -8% |

| Atlanta-Sandy Springs-Roswell, GA | 20,519 | -14% |

| Phoenix-Mesa-Scottsdale, AZ | 20,436 | -16% |

| Charlotte-Concord-Gastonia, NC-SC | 16,241 | -3% |

| Orlando-Kissimmee-Sanford, FL | 14,748 | 5% |

| Austin-Round Rock, TX | 14,390 | -27% |

| Tampa-St. Petersburg-Clearwater, FL | 12,226 | -11% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 12,083 | -11% |

| Jacksonville, FL | 10,822 | -14% |

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

| Top 10 Largest MF Markets | Oct-23 (# of units YTD, NSA) | YTD % Change (compared to Oct-22) |

| New York-Newark-Jersey City, NY-NJ-PA | 24,551 | -39% |

| Dallas-Fort Worth-Arlington, TX | 21,484 | -26% |

| Austin-Round Rock, TX | 18,753 | -9% |

| Phoenix-Mesa-Scottsdale, AZ | 16,746 | 2% |

| Houston-The Woodlands-Sugar Land, TX | 16,727 | -31% |

| Los Angeles-Long Beach-Anaheim, CA | 15,950 | -14% |

| Miami-Fort Lauderdale-West Palm Beach, FL | 15,530 | 37% |

| Atlanta-Sandy Springs-Roswell, GA | 13,796 | -19% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 10,494 | -38% |

| Seattle-Tacoma-Bellevue, WA | 9,577 | -44% |