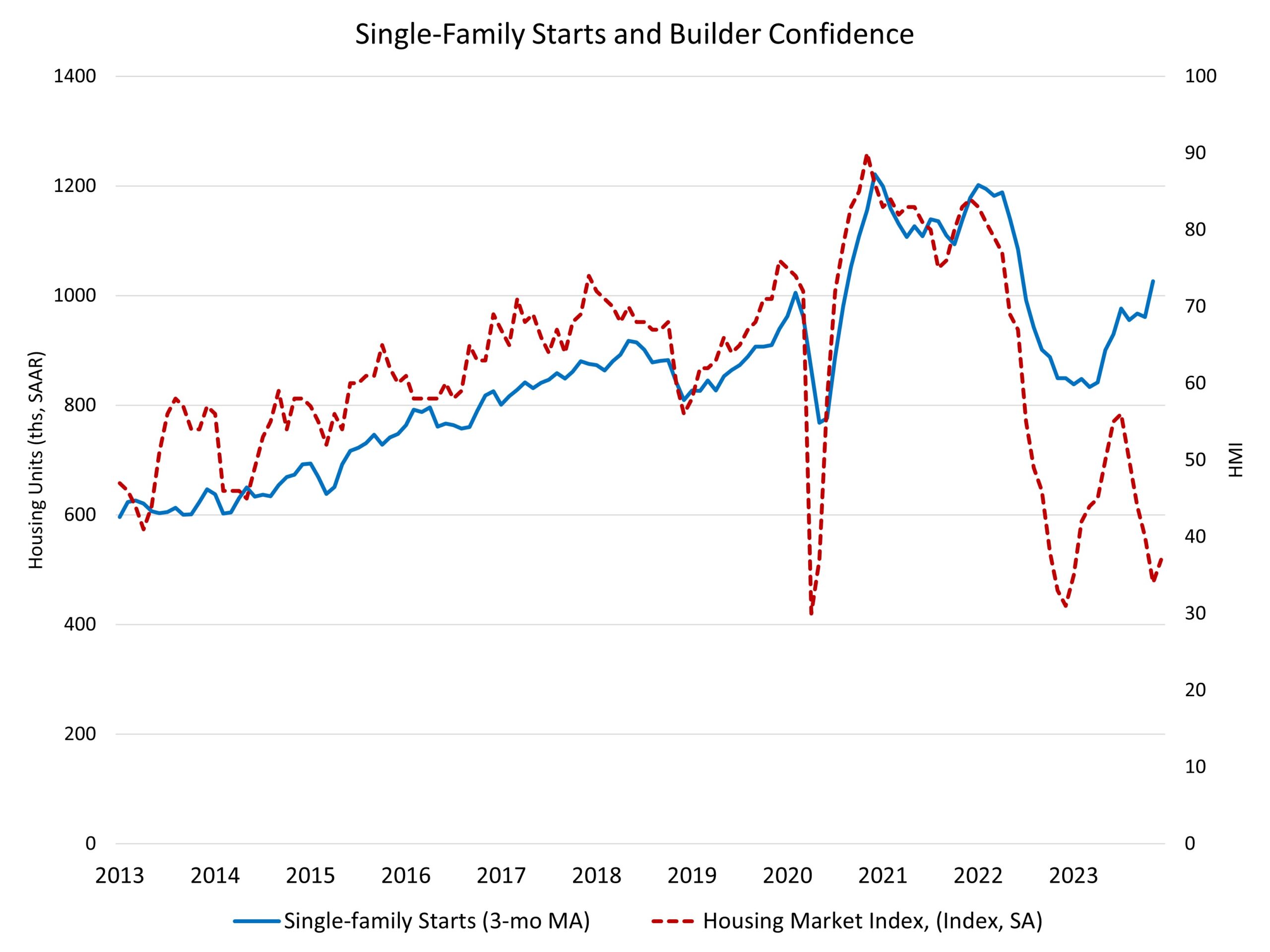

Single-family construction surged in November as lower mortgage rates helped to assuage affordability concerns and unleash pent-up demand for housing.

Overall housing starts increased 14.8% in November to a seasonally adjusted annual rate of 1.56 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The November reading of 1.56 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 18% to a 1.14 million seasonally adjusted annual rate. However, single-family starts are down 7.2% year-to-date. The multifamily sector, which includes apartment buildings and condos, increased 6.9% to an annualized 417,000 pace.

Lower interest rates and a lack of resale inventory helped to provide a strong boost for new home construction in November. And while these higher starts numbers are consistent with the turning of momentum in the latest NAHB/Wells Fargo builder survey, which shows a rise in builder sentiment and future sales expectations, home builders continue to contend with elevated construction and regulatory costs.

However, some skepticism should be adopted with the November data. It is possible that the strong reading, the best on a seasonally adjusted basis in more than a year, will be revised lower. It is also possible some acceleration of construction activity occurred in November, perhaps resulting in a lower reading for December. Nonetheless, NAHB is forecasting approximately a 4% gain for single-family starts in 2024.

On a regional and year-to-date basis, combined single-family and multifamily starts are 16.7% lower in the Northeast, 12.3% lower in the Midwest, 6.2% lower in the South and 14.3% lower in the West.

Overall permits decreased 2.5% to a 1.46 million unit annualized rate in November. Single-family permits increased 0.7% to a 976,000 unit rate. However, single-family permits are down 8.4% year-to-date. Multifamily permits decreased 8.5% to an annualized 484,000 pace.

Looking at regional permit data on a year-to-date basis, permits are 19.9% lower in the Northeast, 15.3% lower in the Midwest, 10.3% lower in the South and 12.8% lower in the West.

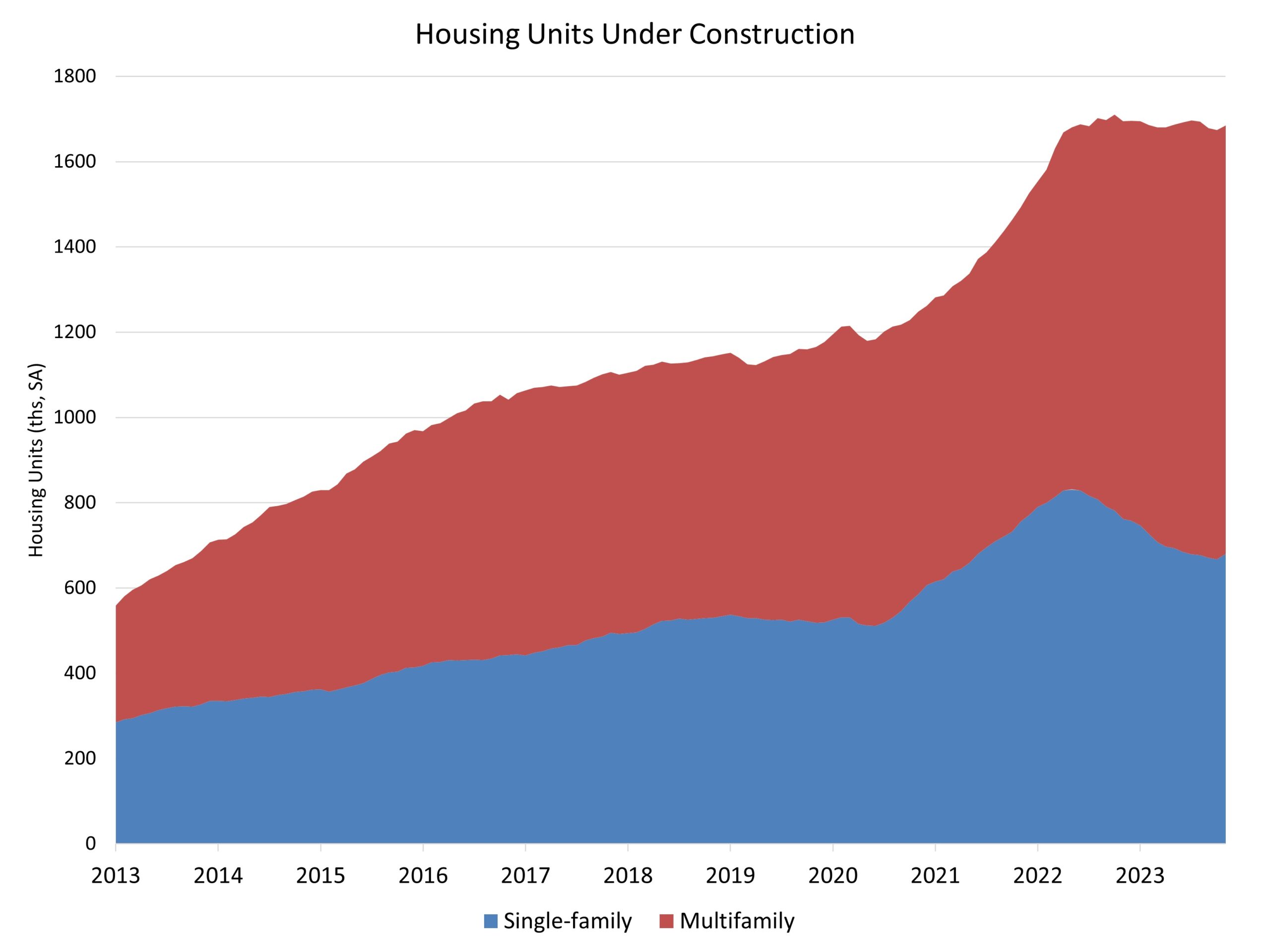

The number of single-family homes actively under construction is rising again. There are now 680,000 single-family homes under construction, the highest count since June 2023. The number of apartments under construction is falling slowly. There are now 1.005 million apartments under construction, with November being fourth consecutive month of decline. However, the current reading is still near the highest total since 1973.