The last year in general and the last few months, specifically, have been fantastic for the stock markets.

Let the data do the talking.

Below is the large cap – Bluechips – index represented by Nifty 50 and its growth over the last 1 year. It has delivered a 21.56% price return at the end of Jan 5, 2024.

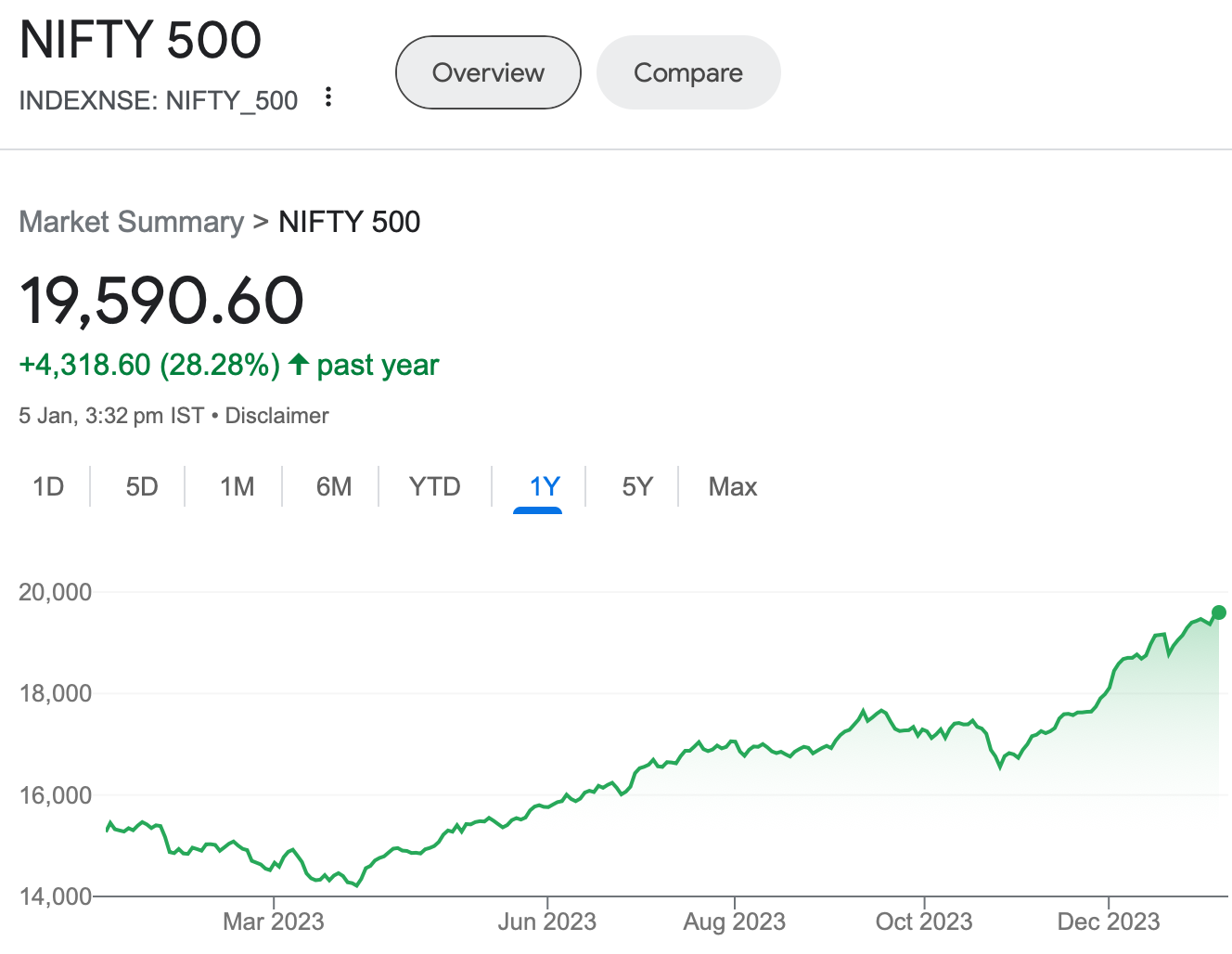

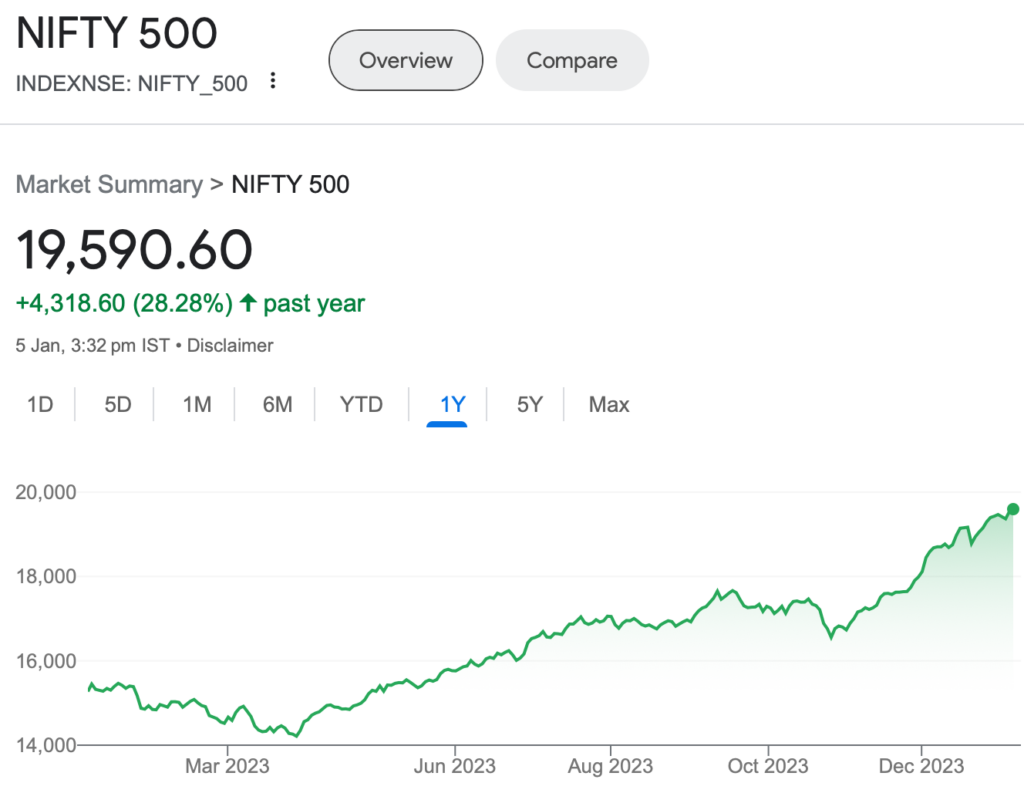

The broader market represented by Nifty 500 has a bigger run over the last year. Over the period, the Nifty 500 has delivered a price return of 28.28% return at the end of Jan 5, 2024.

See image below.

This indicates that the mid and small cap segments have gone up much more than the large cap one.

The Nifty Small Cap 250 Index has delivered over 50% return in last 1 year. Crazy!

Not just that. If you look at diversified portfolios with a healthy dose of fixed income/ bonds, they boast an annualised returns (since inception) closer to 20% – way more than expected of such a portfolio design.

All of this begs the question.

As an investor, what should you do now?

Should you invest more, hold or exit?

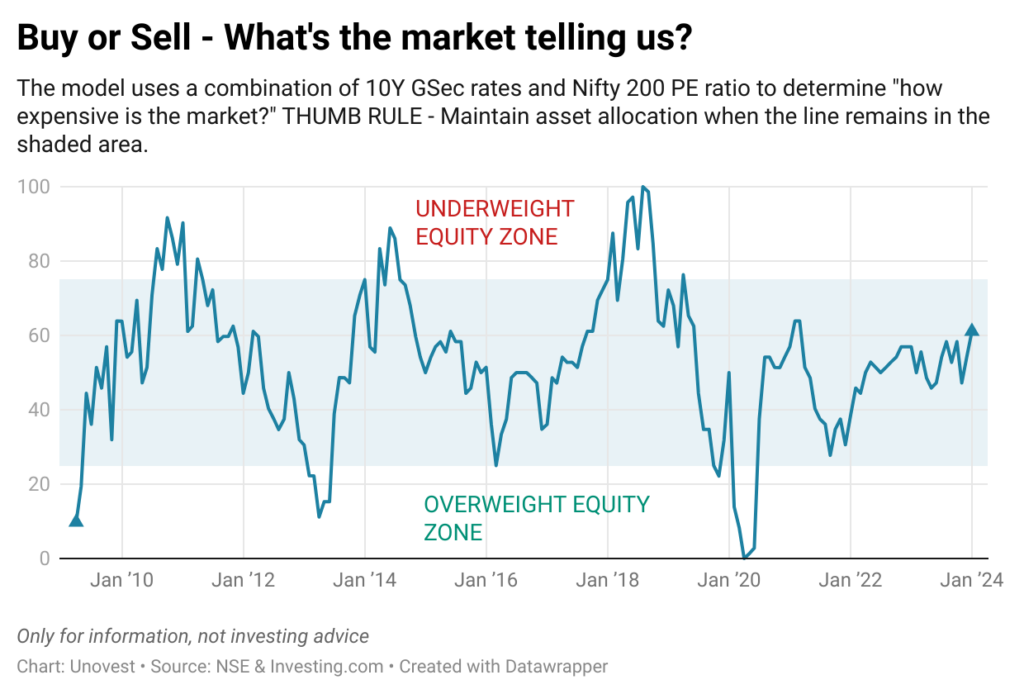

As always, we rely on our asset allocation model.

Some simple actions to consider:

#1 The indicator is still in the zone to keep your asset allocation going. Meaning, that if you are running a portfolio with a 50:50 in stocks and bonds, but the current market momentum has pushed the equity allocation to 70%, then it is time to take that extra 20% out and push it into bonds. Simple, right!

#2 The other point is the sub allocations. If you had decided to have 10% in small caps and that stands at 20%, then it maybe time to stop putting any further money or take out that extra and reallocate to where the ratios have gone down.

These actions help us manage our risks and ensure that market ups and downs don’t make us feel the same way. You also book partial profits and keep the gains safe.

Yes, there will be taxes and transaction costs but they are worth the peace of mind.

What about investing more? Aren’t the markets too high?

First things first. A market index at 20,000 or 40,000 doesn’t really mean much. As companies grow their revenues and profits, the index numbers are bound to grow.

What you do need to be careful about is if the companies, the constituents of the index, are overvalued or not. When I say overvalue, I mean their market price is far more than what they are actually worth.

If you can determine that yourself, fair. Else, you take help of a professional through a fund manager or an investment adviser.

A relatively simple way is to keep doing your regular investments over time in simple products and ensure that you manage your risk right. Markets will go up and down and regular investments will help you capture the different prices.

If you feel uncomfortable with equity, bonds are a great option in the current scenario. Why? Because interest rates are close to peak now. You have Bank FDs close to 8% for a years deposit and some NBFCs going to 9%+ for a 3 to 5 year lock in.

What ever you do, don’t get too greedy now. That may not play out well.

The current markets are the perfect time for the appearance of snake oil salespeople.

Happy investing in 2024.