Do you want to invest in debt mutual funds but are confused by the term modified duration? If so, you are not alone. What is Modified Duration in Debt Mutual Funds?

Modified duration is one of the most important concepts to understand before you choose a debt fund for your portfolio. In this blog post, I will explain what modified duration is, how it affects the value and risk of debt funds, and how you can use it to select the best debt fund for your goals. I have been writing about the basics of Debt Mutual Funds for the past few months. You can find all those articles here “Debt Mutual Funds Basics“.

In this post, I dwell on the concept of Modified Duration. You may be aware of the interest rate risk of debt mutual funds. If you are unaware, then I suggest you to refer to my earlier post “Part 3 – Debt Mutual Funds Basics“.

What is Modified Duration in Debt Mutual Funds?

Modified duration of debt mutual funds is a measure of how sensitive the value of a fund is to changes in interest rates. It tells you how much the price of a fund will change if the interest rate changes by 1%. For example, if a fund has a modified duration of 2 years, it means that if the interest rate goes up by 1%, the fund’s price will go down by 2%. Conversely, if the interest rate goes down by 1%, the fund’s price will go up by 2%.

Do remember that Modified Duration in Mutual Funds is in no way connected to credit risk or default risk. Modified duration is completely connected to interest rate risk. Here’s a simple way to understand it:

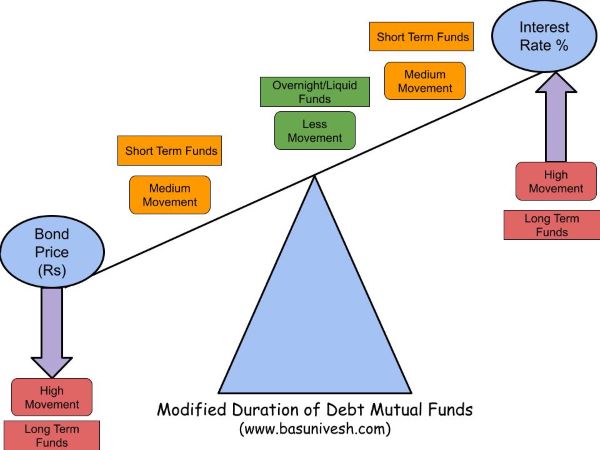

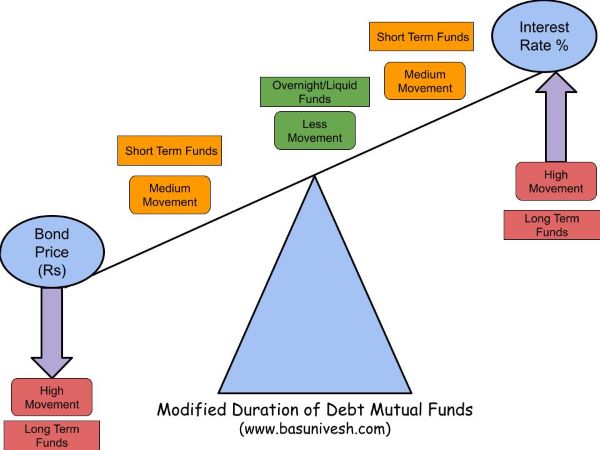

Imagine you’re on a seesaw. On one side is the price of the bond, and on the other side is the interest rate. When the interest rate goes up, the price of the bond goes down, and vice versa. This is because as interest rates increase, new bonds come into the market offering higher returns, making existing bonds less attractive unless their prices drop.

Now, the modified duration is like a measure of how far you are sitting from the center of the seesaw. If you’re sitting very close to the center (low modified duration), the seesaw won’t tilt much when interest rates change. But if you’re sitting far from the center (high modified duration), the seesaw will tilt a lot more.

In other words, bonds with a higher modified duration will see their prices change more significantly when interest rates change. So, if you’re an investor who wants to avoid risk, you might prefer bonds with a lower modified duration because their prices are less sensitive to interest rate changes. On the other hand, if you’re willing to take on more risk for the chance of higher returns, you might prefer bonds with a higher modified duration.

This concept is explained easily using the below image for your clarity.

This is the reason Overnight Funds, Liquid Funds, or Ultra Short Term Funds are less volatile to interest rate risk than medium to long-term mutual funds.

Understanding this much is enough for mutual fund investors. However, if you wish to know how it is calculated, then let me share that.

Modified Duration = (Macaulay Duration) / {1 + (YTM / Frequency)}

Regarding the Macaulay Duration, I will explain you in the next post. However, I am just sharing with you the formula of how one can calculate the Modified Duration.

Let us assume that Macaulay Duration of the bond is 8.7 years, the yield to maturity (Explained here “Part 4 – Debt Mutual Funds Basics“) is 10%, the frequency of interest payment is once a year, then the modified duration of the bond is 7.9 years (Modified Duration of Bond A = 8.7 / {1+ (10 / 1)} = 7.9 years).

It means if the interest rate increases by 1%, the price of a bond will fall by 7.9%. Similarly, a 1% fall in interest rates will lead to a 7.9% increase in the price of the bond.

Hence, when choosing a fund, looking for a modified duration is the most important aspect. Say you need money in few years, then never touch medium to long-term bond funds just by looking at fantastic returns (during interest rate fall). Instead, always you have to look for terms like YTM, Modified Duration, and Macaulay Duration concepts along with credit risk.

I hope I have cleared the concept of Modified Duration in Debt Mutual Funds.