For the time being I will continue my Wednesday format where I cover some things that crossed my mind in the last week but which I don’t provide detailed analysis. The items can be totally orthogonal. The latest inflation data for Australia continues to affirm the transitory narrative – dropping significantly over the last month. I will analyse that tomorrow in the context of a recent ECB paper that decomposes the different factors that drove the inflationary pressures across the globe. Today, I consider the basis of a claim by the Australian Treasurer that real wages are now growing. Like many things in statistics, the numbers can say almost anything that you want them to via different ways of measurement and combination. In one sense, the Treasurer is correct. But when we use a more careful method of calculating purchasing power loss, he is incorrect. If the Treasurer was wanting to be really honest with the Australian people he would admit that rather than try to score petty political points against an opposition that has no clue at all. I also consider the role of the US in the on-going massacre of innocent people in Gaza. The US could stop the conflict immediately and the fact that they don’t demonstrates the poverty of the capitalist system in terms of advancing humanity in general. And some old folk music to finish.

Spin from the Australian Treasurer to cover his tracks

Early yesterday, the Australian Treasurer Tweeted (or X’ed) this statement:

To assess the veracity of this statement, one has to decide on which frequency is most appropriate – do we concentrate on quarterly or annualised changes?

When the first suits, politicians emphasise that frequency, and vice versa.

If inflation is accelerating then the annual estimate of the real wage impact will lag behind the quarterly and vice versa.

So in a period of declining inflation, politicians will always seize on the quarterly result because it gives the best impression possible (which still might be poor).

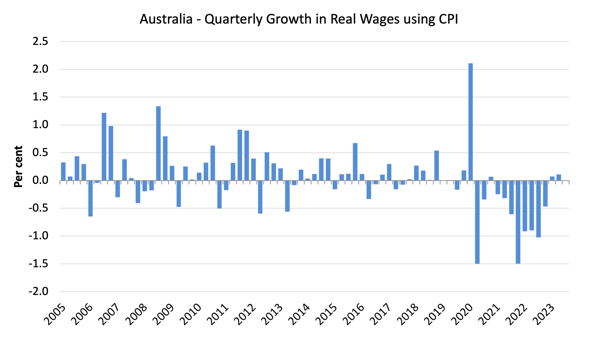

Here is the latest Wage Price Index data to the September-quarter 2023 combined with the CPI – with the bottom panel showing the annual percentage changes in the real WPI and the top panel showing the quarterly percentage changes in real wages.

Using this deflator (CPI), the last two quarters of published data did see positive real wages growth, albeit miniscule – 0.1 per cent.

Real wages are still 5.6 per cent lower than they were in March 2021 using the CPI deflator.

It also matters what deflator one uses as I explained in this blog post – Australia – real wages continue to decline and wage movements show RBA logic to be a ruse (August 16, 2023).

Basically, the ABS publishes the Consumer Price Index (CPI) and their Selected Cost of Living Indexes (SCLI), the latter which are derived from expenditure data and vary according to what category one falls in (pensioner, employee, etc), given that these different cohorts have different expenditure patterns anda re affected differentially by movements in prices.

In the September-quarter 2023 (latest data) we saw:

1. Quarterly CPI change 1 per cent.

2. Annual CPI change 5.3 per cent

3. Quarterly employee SCLI change 2 per cent.

4. Annual employee SCLI change 9 per cent.

Thus, when specific household expenditure patterns are more carefully modelled, the SLCI data reveals that the cost-of-living squeeze on ‘employee households’ is more intense than is depicted by using the generic CPI data.

So which index is the most appropriate for computing purchasing power loss arising from price rises?

The CPI is designed as ‘a macroeconomic measure of household sector (consumer) price change – inflation’, which is used to ‘inform monetary policy’, whereas the SCLIs are designed to capture cost-of-living changes more accurately for individuals.

The ABS recently published a methodology paper (August 3, 2023) – Selected Living Cost Indexes, Australia methodology – which concluded that:

A living cost index reflects changes over time in the purchasing power of the after-tax incomes of households. It measures the impact of changes in prices on the out-of-pocket expenses incurred by households to gain access to a fixed basket of consumer goods and services. The Australian Consumer Price Index (CPI), on the other hand, is designed to measure price inflation for the household sector as a whole and is not the conceptually ideal measure for assessing the changes in the purchasing power of the disposable incomes of households.

In other words, the SCLIs represent a more reliable indicator of “the extent to which the impact of price change varies across different groups of households in the Australian population”.

The ABS considers the ‘Employee households SCLI’ to be its preferred measure designed to capture cost-of-living changes more accurately for “households whose principal source of income is from wages and salaries”.

This puts the Treasurer’s comments in a wholly different light.

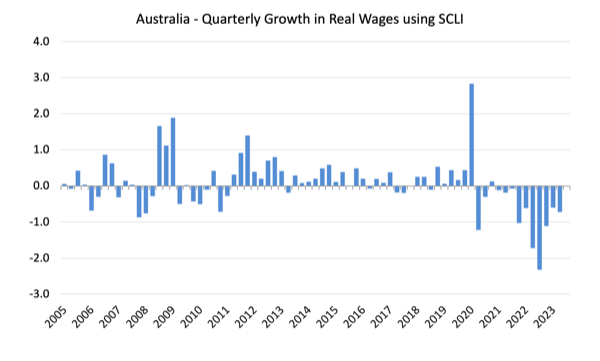

The relevant cost-of-living measure for workers has risen by 9.0 per cent over the last year while wages growth was just 4.02 per cent – a massive real wage cut of 5 per cent.

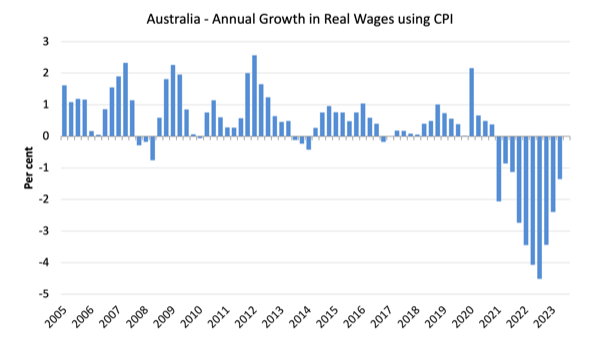

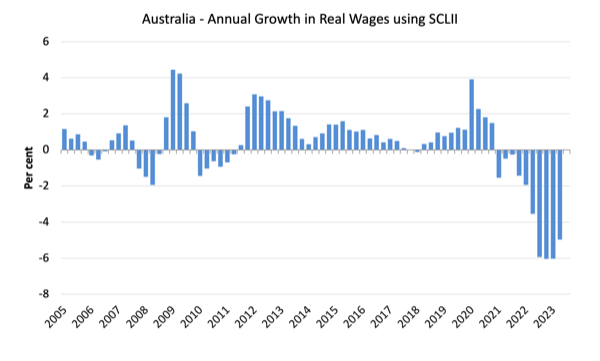

The following graphs show the quarterly real wage change using the SCLI (top panel) and the annual real wage change using the SCLI – (bottom panel).

There has been no real wages growth – quarterly or annual using this approach since the inflationary pressures emerged.

Real wages are 8 per cent lower than they were in March 2021 using the SCLI deflator.

I consider this to be the better indicator of what is happening to workers’ purchasing power and if the Treasurer was wanting to be really honest with the Australian people he would admit that rather than try to score petty political points against an opposition that has no clue at all.

Climate change and Gaza

The mainstream (‘progressive’) press cannot quite bring itself to demand that the advanced governments bring the Gaza massacre to an end, they skirt around the edges with articles that will appeal to their readerships – like the UK Guardian’s article yesterday (January 9, 2023) – Emissions from Israel’s war in Gaza have ‘immense’ effect on climate catastrophe.

The article reports on recent research (yet to be ‘peer reviewed’) that:

The planet-warming emissions generated during the first two months of the war in Gaza were greater than the annual carbon footprint of more than 20 of the world’s most climate-vulnerable nations ,,, the climate cost of the first 60 days of Israel’s military response was equivalent to burning at least 150,000 tonnes of coal.

The article notes that only a small number of factors (out of many) are considered in the calculation, which means that the results of the research will significantly “underestimate” the actual impact.

A graphic provided a “breakdown of carbon emissions generated by the first 60 days of the war” which shows that:

Almost half the total CO2 emissions were down to US cargo planes flying military supplies to Israel.

That figure alone encapsulates the problem – the US government could stop the massacre once and for all if it stopped being an active partner in the murderous behaviour of the IDF.

But of course the US economy is a major beneficiary of the slaughter of innocent Palestinians.

Meanwhile around 23,000 Palestinians – “mostly women and children – have been killed, with thousands more buried under the rubble presumed dead”.

And “85 per cent of the population have been forcibly displaced and faces life-threatening food and water shortages life-threatening food and water shortages”.

And US profiteering is at the centre of this.

Our current period of history reveals that our civilisation based on a Capitalist system that prioritises private profit over anything else has collapsed.

Music – Four Strong Winds

Over the break, I played a ukulele a lot while sitting outside in the sun.

Ukuleles a somewhat limited I think but you can play some really nice songs on them.

This is one of them.

I first heard this version of the song – Four Strong Winds – in the early 1970s as a youngster.

It was written by the Canadian folk singer Ian Tyson and recorded with his then wife Sylvia and released in 1963.

They formed the folk duo – Ian & Sylvia – who were popular in the 1960s and ended in the mid-1970s when their marriage fell apart.

By the time I heard the song, the folk period was losing momentum as electric guitars were dominant.

Bob Dylan had switched to a Fender stratocaster with the Butterfield Blues Band as backing at Newport in 1965, which caused a – controversy – among the diehards.

I liked Neil Young’s 1978 version, but always return to the original on a regular basis.

The song has a really lovely chord sequence – G Am D G, G Am D, G Am D G, C Am D.

Summer days in South Gippsland after the beach!

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.