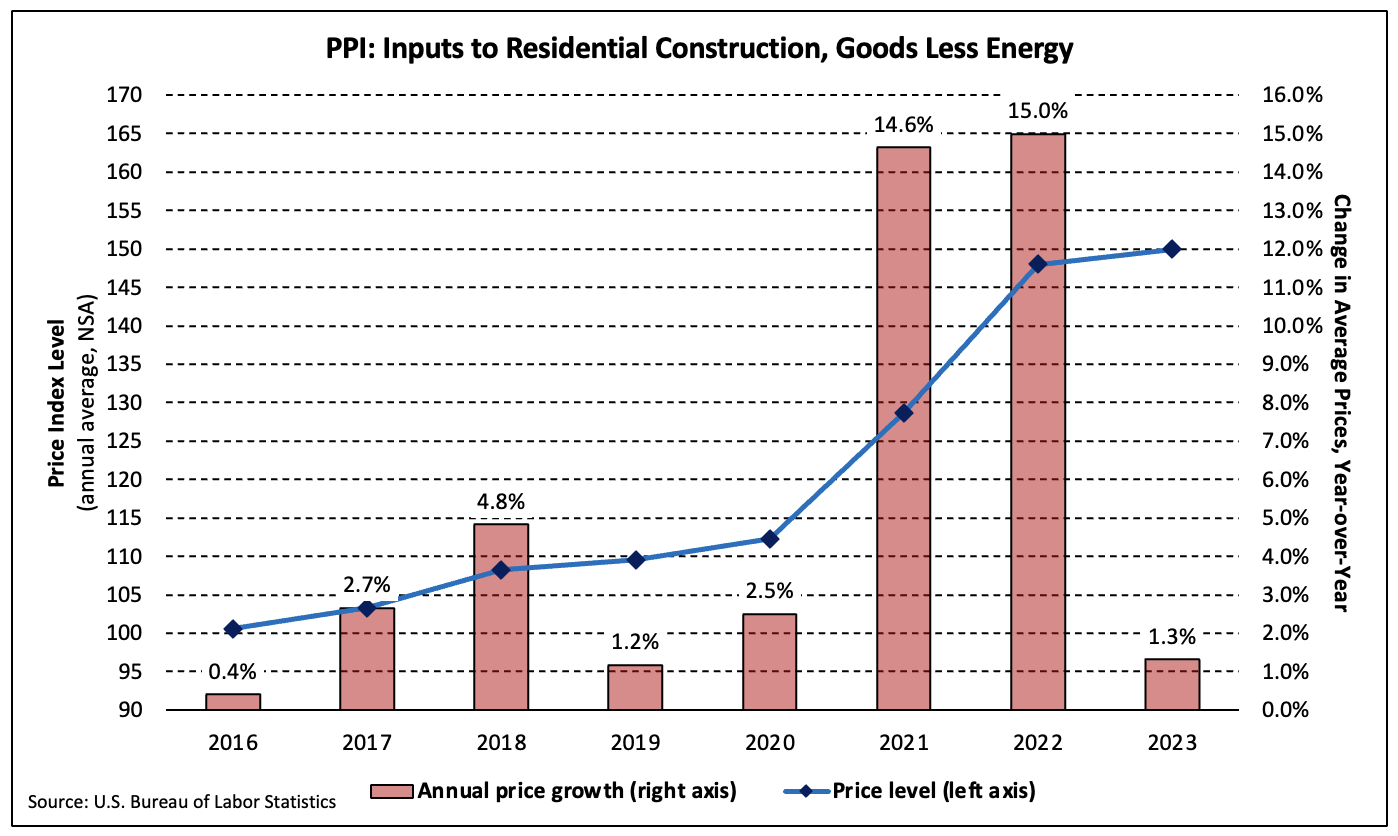

According to the latest Producer Price Index report, growth in the average price level of inputs to residential construction less energy (i.e., building materials) fell from 15.0% in 2022 to 1.3% in 2023 (not seasonally adjusted). On a monthly basis, building materials prices rose 0.1% in December after increasing 0.1% in November (revised). Monthly price increases averaged 0.2% in 2023, down from 1.5% in 2021 and 0.7% in 2022.

The Producer Price Index for all final demand goods fell 0.4% in December, the third consecutive decline (seasonally adjusted). Most of the decline can be attributed to a 1.2% decrease in the index for final demand energy (SA). For the 12 months ended in December, the PPI for final demand goods less foods and energy increased 1.8% (NSA). The annual average increased 2.8% in 2023, the smallest increase since 2020.

Price growth of goods inputs to residential construction, including energy, declined 0.6% in December and gained 1.0% over the past 12 months. The annual average decreased 0.3% in 2023 after surging 17.7% and 17.3% in 2021 and 2022, respectively.

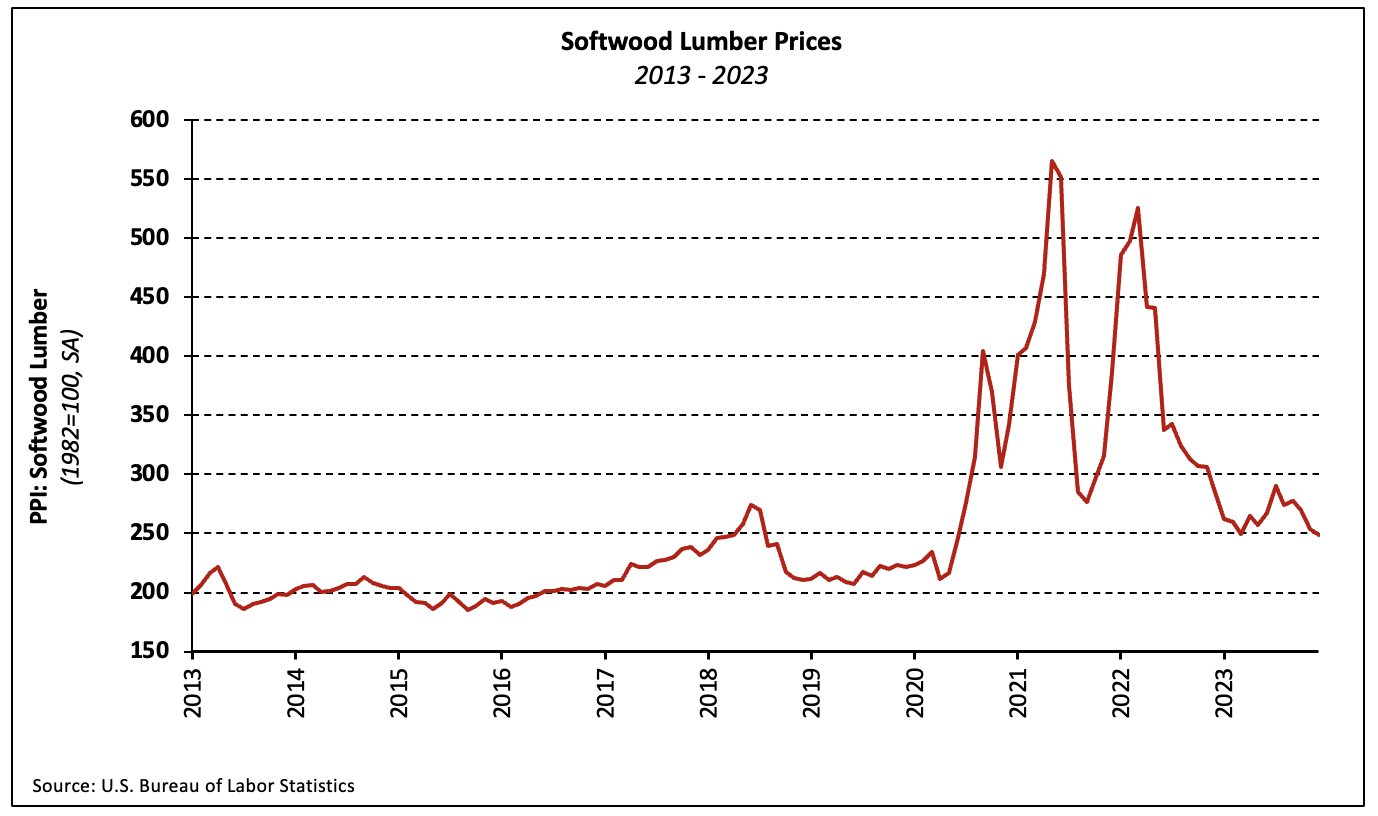

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) declined 2.3% in December, the third consecutive decrease and the fourth over the past five months. The index has fallen 14.5% since reaching its 2023 high in July.

On an annual basis, prices declined 31.3% in 2023 after falling 3.2% in 2022. Although the 33.5% two-year decrease is massive in historical terms, prices remain 22.7% above the 2019 level as the index skyrocketed 84.6% between 2019 and 2021.

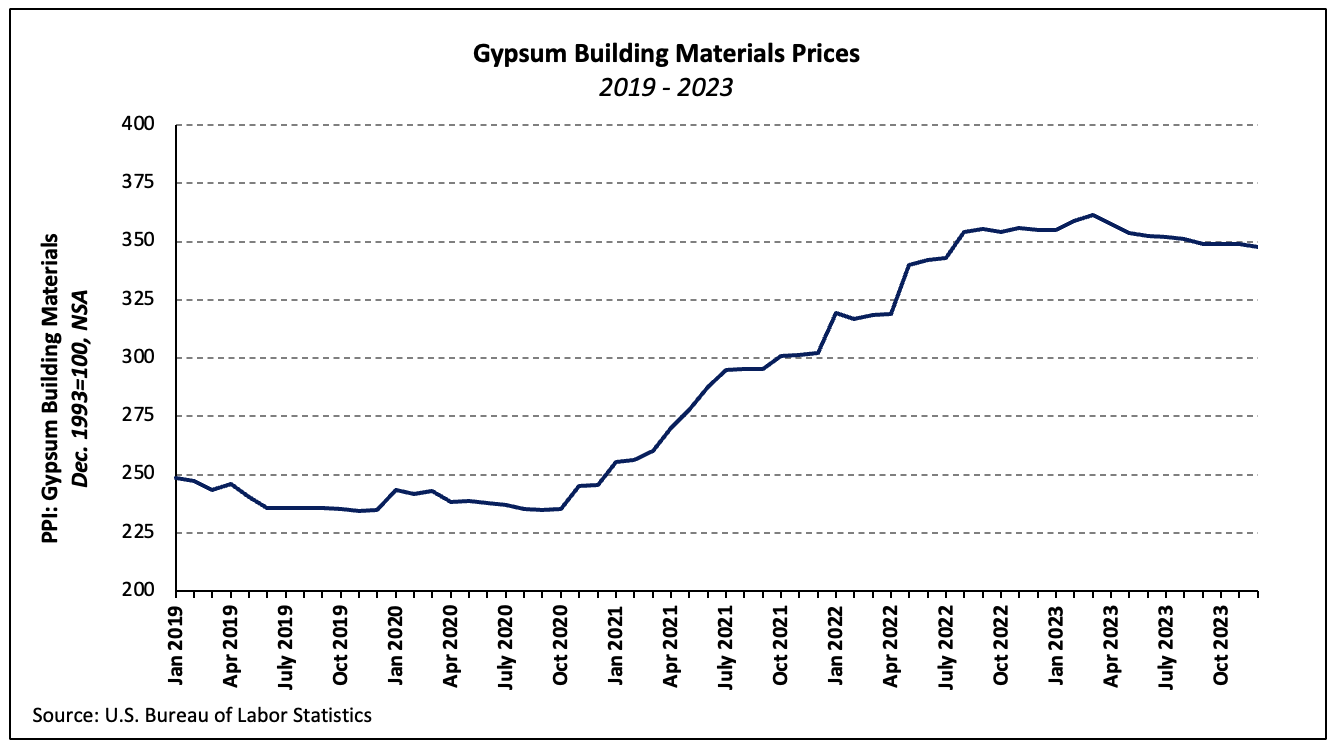

Gypsum Building Materials

The PPI for gypsum building materials declined 0.3% in December and have not increased since March 2023. The index decreased 2.0% over the past 12 months, a welcome change after the 44.6% increase seen over the two years ending December 2022.

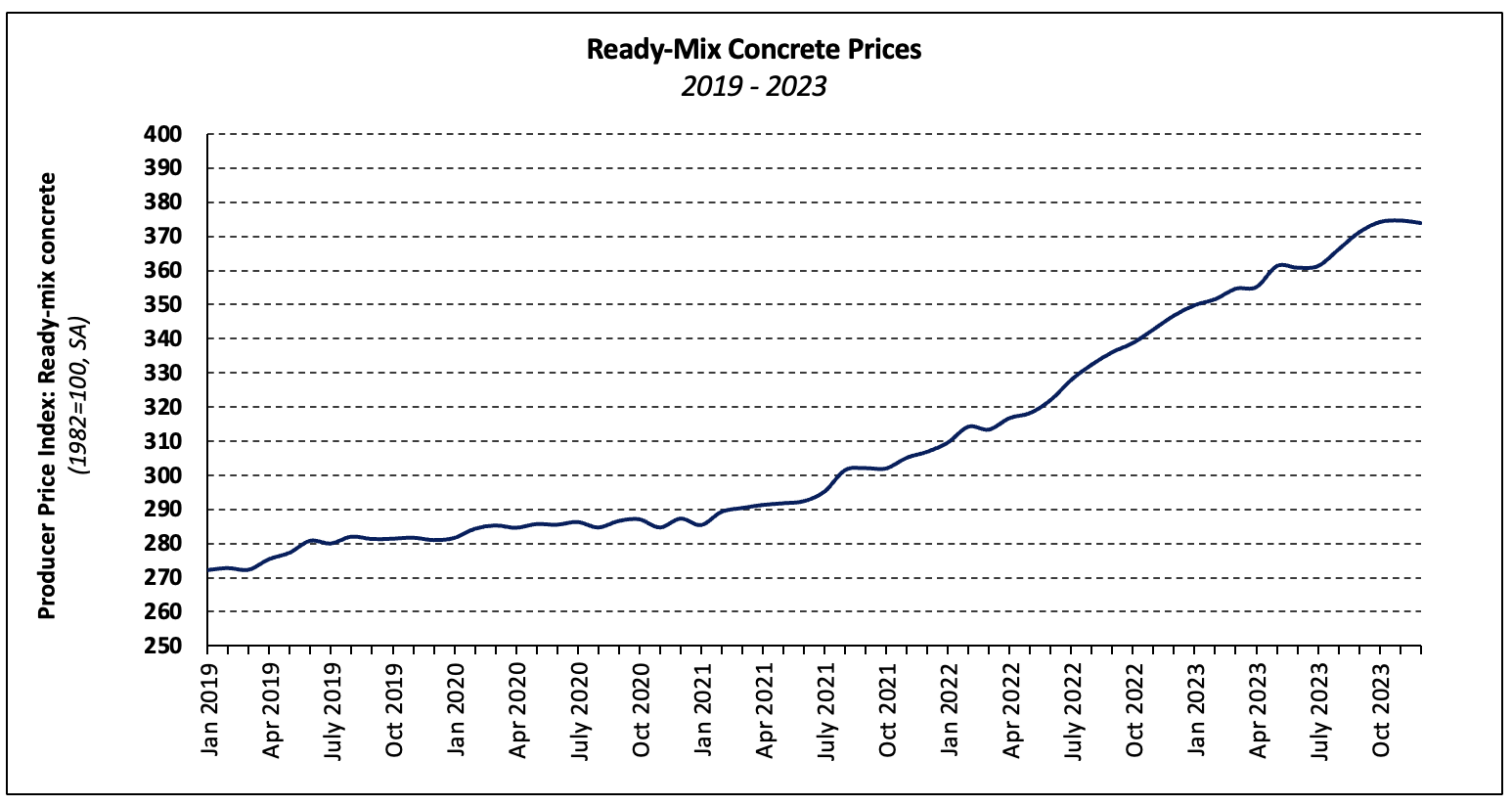

Ready-Mix Concrete

Ready-mix concrete (RMC) prices decreased 0.2% in November (SA), just the fourth decline over the last 36 months. Year-over-year price growth decelerated for the second consecutive month, falling from 9.3% in November to 7.8% in December. The average price of RMC increased 11.2% in 2023 and 10.3% in 2022 (NSA), combining for the second-largest two-year increase since 2000.

The monthly decrease in the national data was entirely due to a 0.9% price decline in the South as prices in the Northeast, Midwest, and West regions were unchanged.

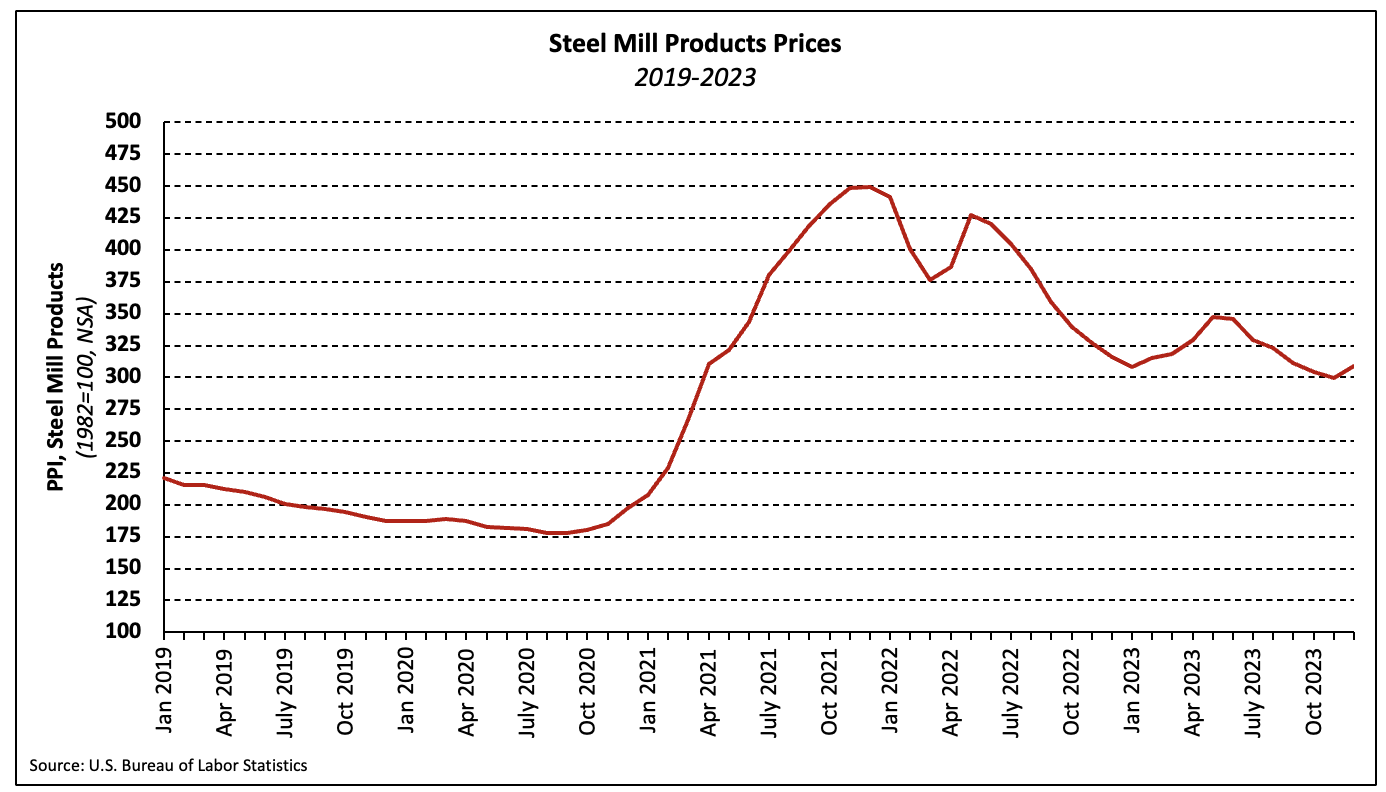

Steel Mill Products

Steel mill products prices climbed 3.3% in December, the first increase since May. Steel mill products annual average prices declined 16.1% in 2023 after increasing 8.7% in 2022 and the historic 90.3% increase of 2021. Prices are 31.2% lower than their 2021 peak but remain 65.1% higher than they were in January 2020.