There’s been a lot of news coverage about what Budget benefits you can get, so I won’t go into detail here, but I wanted to focus on the changes in one’s personal finance strategies that this year’s Budget announcements has called for.

These include:

- New changes to CPF funds and RA caps, after age 55

- Why this may spell the death of the popular 1M65 movement

- Changes to cash top-ups for parents under the Matched Retirement Savings Scheme

- Potentially more tax reliefs for supporting your dependents

Let’s start first with the good news – the cash vouchers and goodies for every Singaporean.

1. More vouchers and rebates for individuals and households

This graphic by Today gives a great summary of what we can each expect to get:

Tip: Don’t get too excited and start spending this money as a “bonus”. The payouts are meant to help offset the rising cost of living and 1% GST increase this year, so use them for your essentials instead of justifying a splurge for your wants.

Even better, if you can, invest that instead! With compound interest, even an initial investment of $5k with a 6% annualised return over 20 years, could grow into $28k.

I share investment tips and quick takes on my Instagram almost daily – follow me here @sgbudgetbabe if you haven’t already!

2. The end of the CPF-SA Shielding Hack

When DPM Lawrence Wong announced the closure of the Special Account (SA) at age 55 when the Retirement Account (RA) is created, it riled up many in the personal finance community. That’s because the hack allowed Singaporeans to maintain a risk-free 4% p.a. account that they could withdraw cash from anytime after the age of 55.

That made it better than any other fixed deposit or endowment plans due to the 4% p.a. with no lock-in!

The CPF-SA Shielding Hack was a strategy that allowed folks to “stop” their SA funds from being transferred into the CPF-RA, where it would be locked into CPF Life for monthly payouts. By investing their SA funds right before they turn 55, the bulk of funds for RA would be taken from their Ordinary Account (OA) instead. Thereafter, these folks would sell off their SA investments for the money to go back into the SA, where it would continue earning 4.08% p.a. and available for withdrawal anytime.

With the closure of the CPF Special Account at age 55, our government has officially closed up this loophole.

The good news is, while they’ve taken this away from us, they have also raised the Enhanced Retirement Sum (ERS) to 4 times the Basic Retirement Sum (BRS).

Death of 1M65? No, but you’ll now have to invest, too.

CPF members wanting to get higher payouts in retirement were previously restricted to topping up their RA to no more than the Enhanced Retirement Sum (ERS), which was 3 times of the Basic Retirement Sum (BRS). The government has now raised the ERS to 4 times the BRS instead, which now allows one to commit more of their CPF savings into their CPF-RA to receive higher CPF payouts if they wish. A member turning 55 years old in 2025 can thus receive about $3,300 per month of CPF LIFE payouts at age 65 (if he chooses to top up to the new maximum ERS), which is up from about $2,500 today.

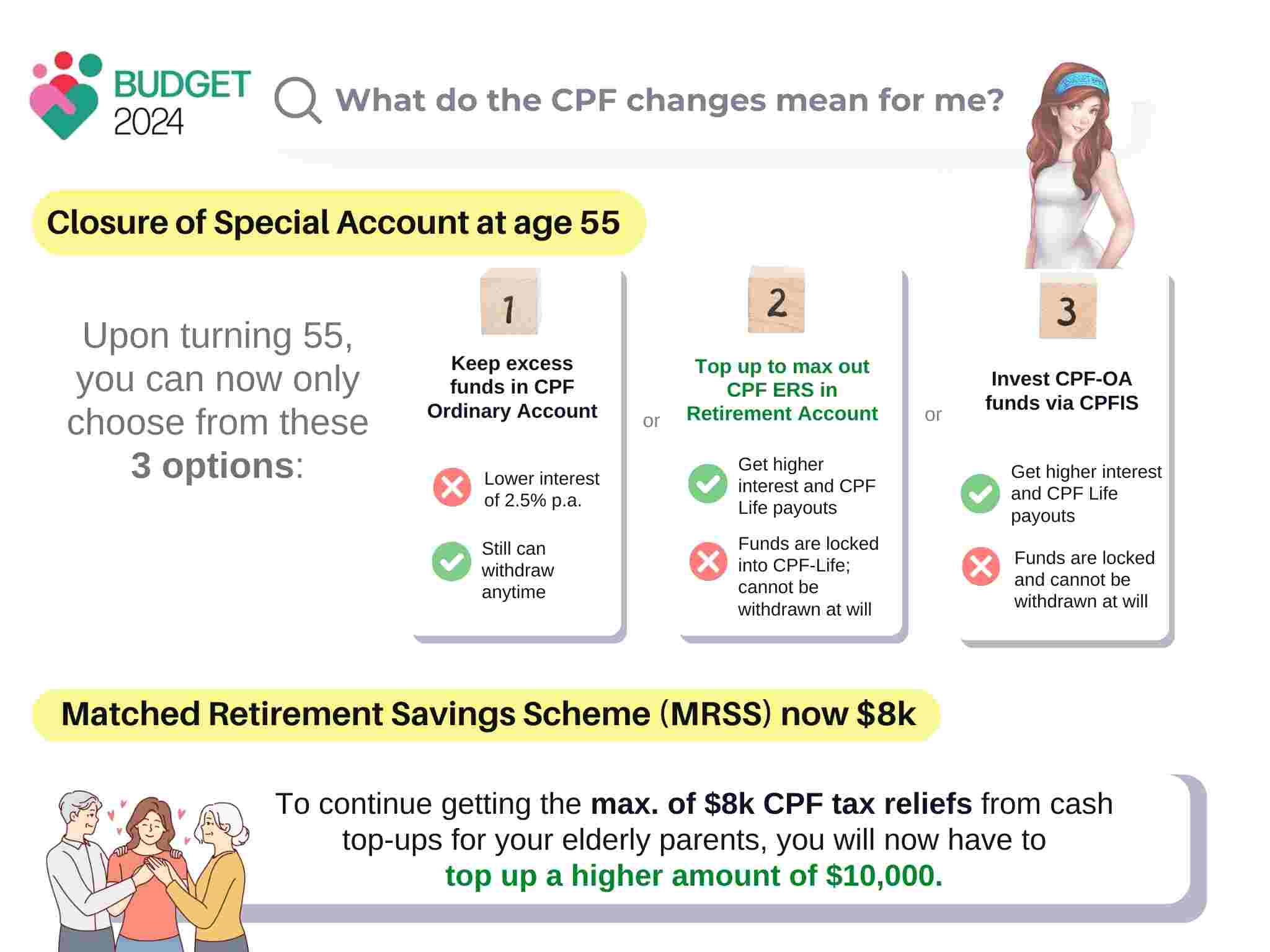

The changes mean that you can now only choose from the following options instead:

- Keep your excess funds in your CPF-OA: you’ll earn a lower interest rate of 2.5% p.a. but can withdraw anytime you wish.

- Top up your CPF-RA to max out the ERS: commit your funds to CPF Life to get higher payouts. Funds in the Retirement Account cannot be withdrawn at will.

- Invest your excess CPF-OA funds: you can get a higher return than 2.5% p.a. but take on investment risk. Risk-adverse folks can opt for capital-guaranteed investments such as T-bills, whereas folks willing to take on more risk can explore other CPFIS-approved products or funds for higher potential returns.

If you’ve been voluntarily topping up your CPF every year and moving funds into your Special Account with the original intention to execute the CPF Shielding Hack when you turn 55, you will now have to rethink your strategy in light of the above changes.

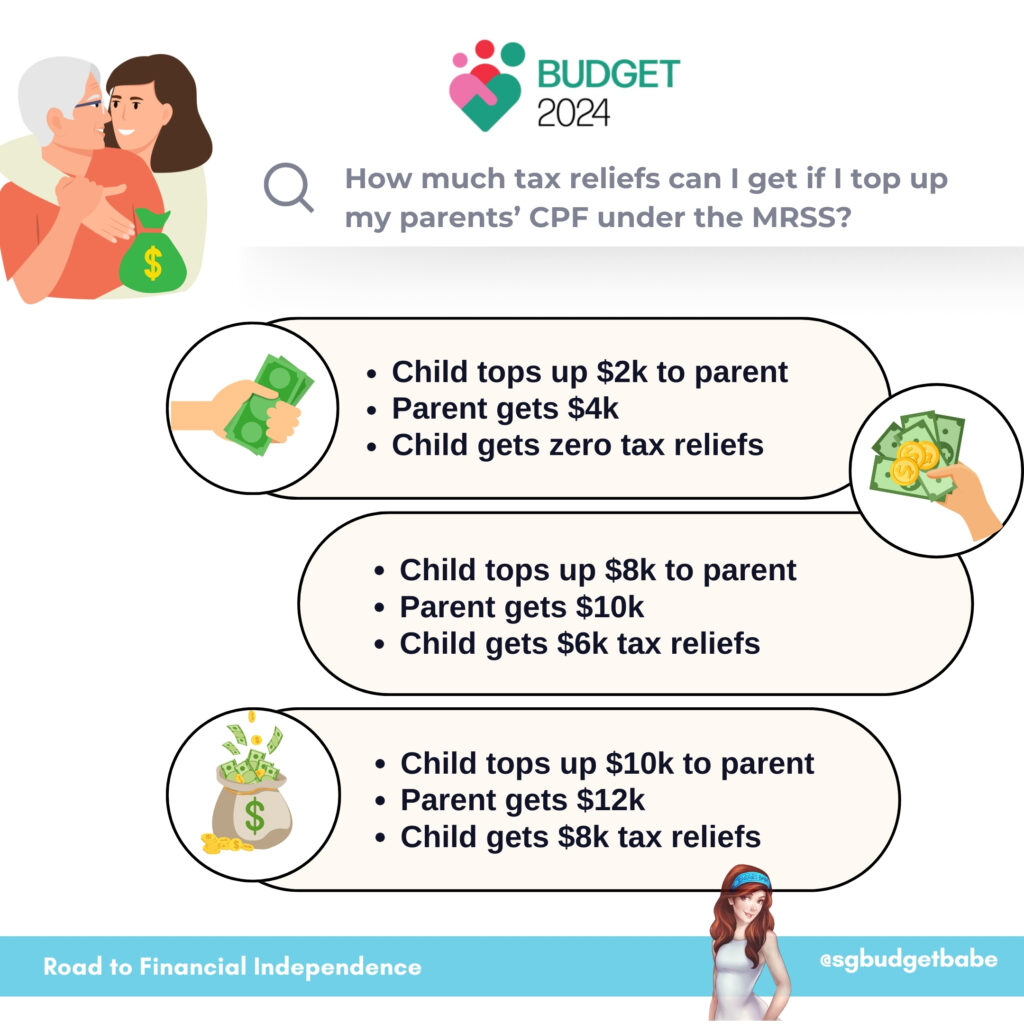

3. Higher co-matching for topping up parents’ CPF

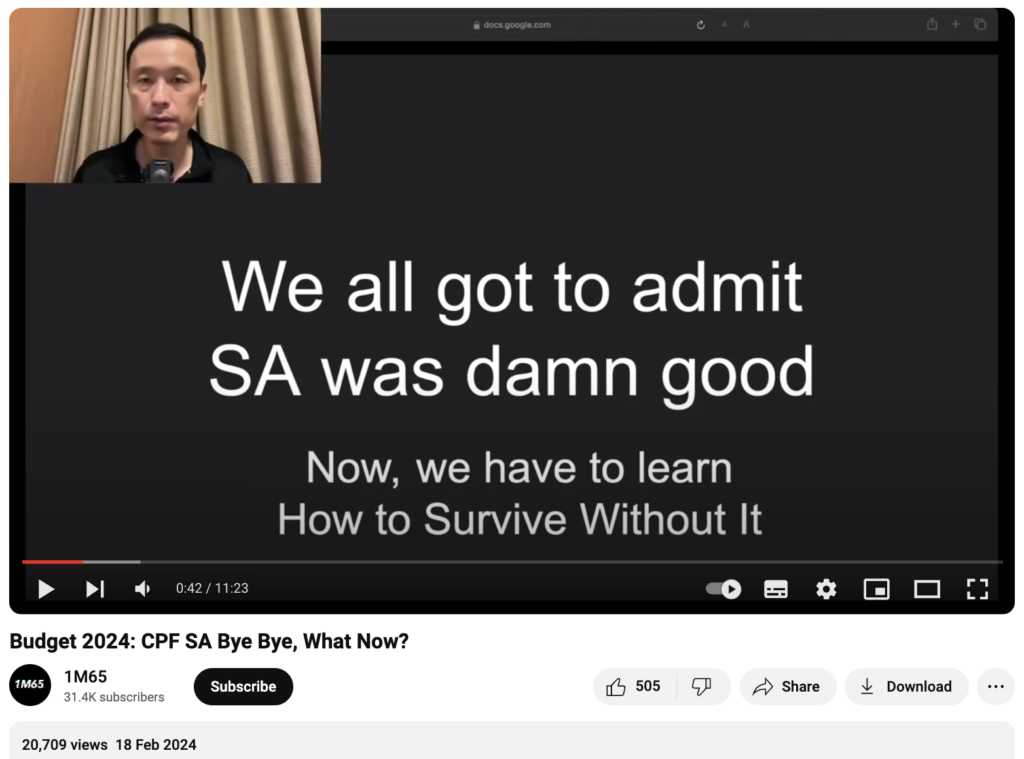

In 2021, the government announced the launch of the Matched Retirement Savings Scheme (MRSS) to run for five years between 2021 – 2025 during which, the Government will match every dollar of cash top-ups made to the CPF Retirement Accounts of eligible members up to $600 per year. This would amount to a maximum of $3,000 over five years.

I’d shared about how I’ve leveraged it to get more money for our parents. However, my dad and father-in-law crossed 70 during this period, which meant they could no longer benefit from the scheme.

With the increase in matching grant cap and removal of age limits, this spells good news for us who wish to get more money from the government via the MRSS.

However, with the tax relief for cash top-ups that attract the MRSS matching grant now being removed, it also means that we need to top up more to continue getting the maximum for CPF tax reliefs. In other words:

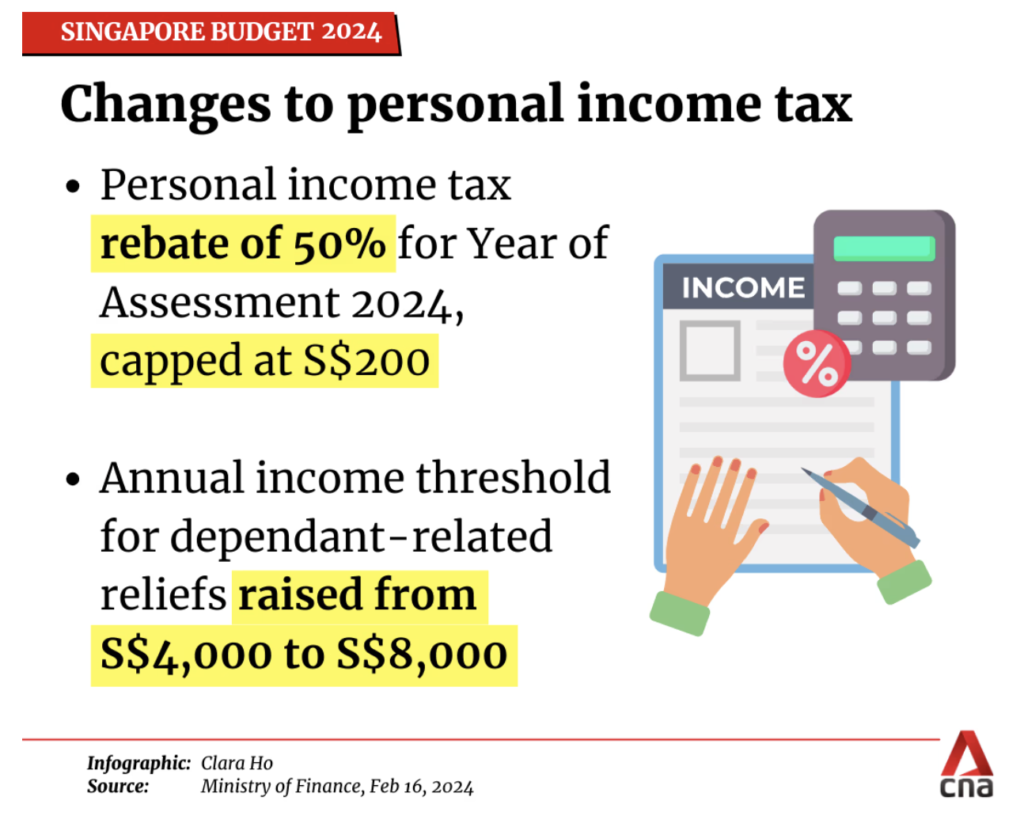

Remember how I shared in previous years that I could never get tax reliefs for supporting my parents financially, because their part-time jobs or short employment stints meant that they easily crossed the $4k annual income threshold and thus did not qualify for the relief?

Well, the government has (finally!) increased the annual income cap to $8k now, to reflect the rising costs of living and wage growth. If you have any dependents (parents, children, siblings or spouse) who earn under $8,000 a year, you can now claim tax reliefs on them.

This is great news for many of my friends, especially for cases where one spouse is temporarily unemployed or has taken a career break (usually to care for their kids or sickly parents).

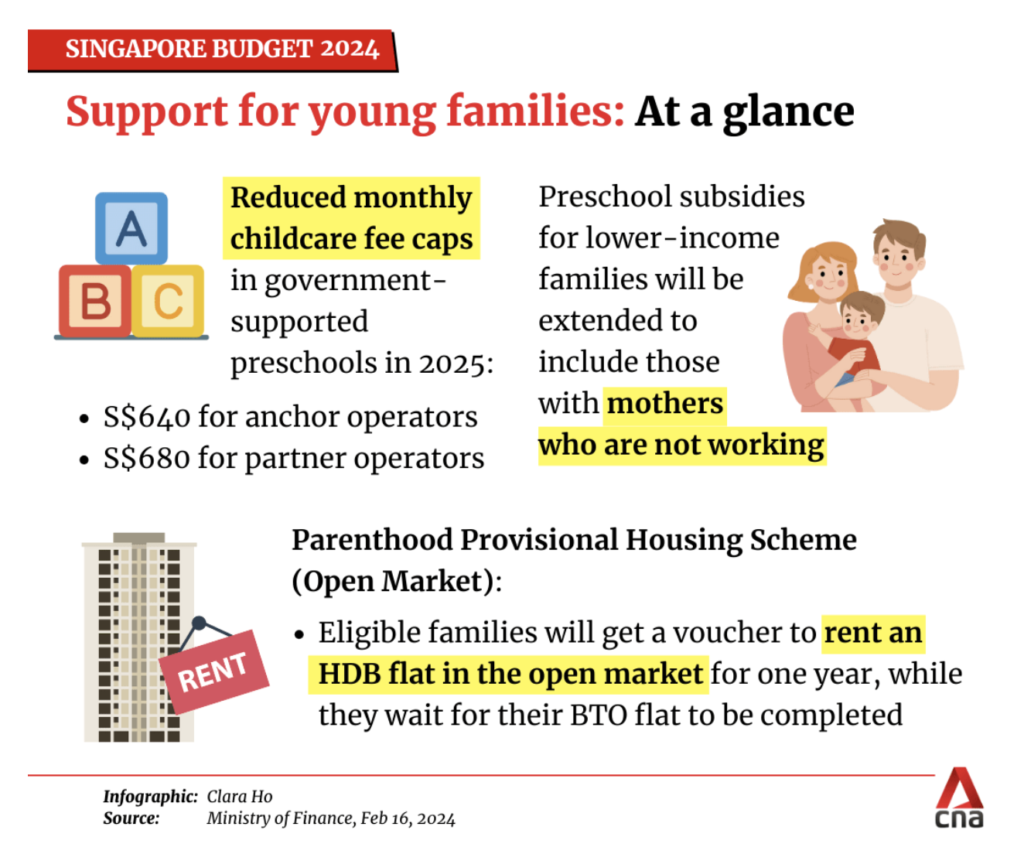

5. Preschool subsidies to be extended to non-working mothers

I’ve friends who had to stop working because their kids needed them, and it has always felt unfair that they were excluded from the preschool subsidies that working mothers could apply for.

Now that the government is (finally) extending the same preschool subsidies to all mothers – regardless of whether the mother is working or not, I feel happy for my friends who can now finally stand on the same footing.

Conclusion

This year’s Budget 2024 definitely has one of the more generous handouts in recent years, so it is no wonder that most Singaporeans are generally quite happy with the announcements.

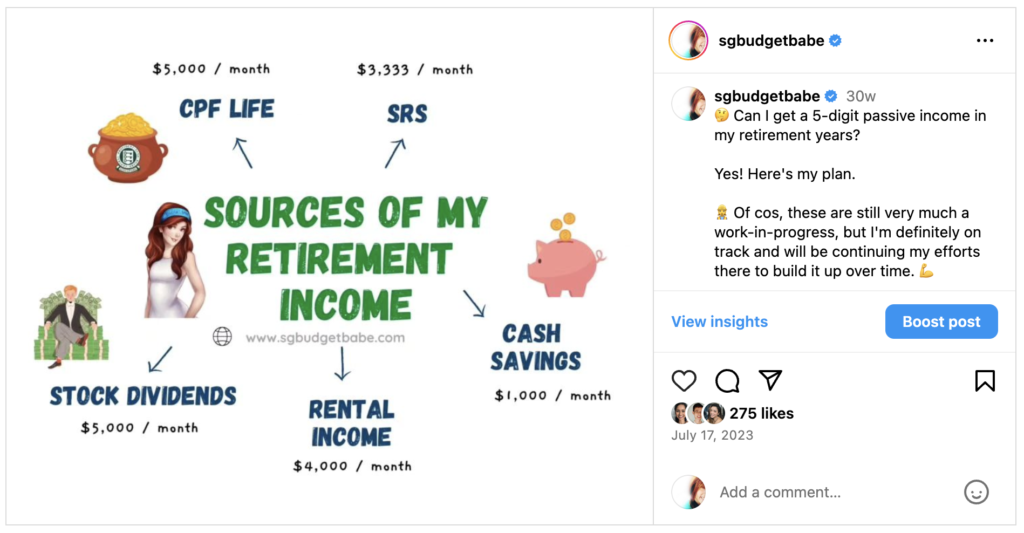

The CPF changes – while shocking to many – served as a good reminder once more that we cannot afford to ignore policy risk when it comes to planning for retirement with our CPF. Our government has shown that they can change the rules anytime they want, and there’s nothing you or I can do about it when that happens. Thus, CPF should only be one facet of our overall plan – see mine here:

I was personally bummed that they didn’t reverse the changes on the Working Mother Child Relief (WMCR) which was announced last year, much to the chagrin of many middle-class working mothers. Read about why I wasn’t a fan of the changes, and how this negatively impacted many of my friends’ consideration as to whether to have another child. Dear DPM Lawrence Wong or our dear policy-makers, if you’re reading this, wouldn’t you consider bringing that back, please?

With love,

Budget Babe