Homeownership provides a wide range of benefits to households. In addition to providing households with a stable place to live, homeownership also offers an opportunity for households to accumulate assets and build wealth over time through equity. As of 2022, 66.1% of U.S. households owned their homes. For families that owned a home, the median net housing value (the value of a home minus home-secured debt) increased from $139,000 in 2019 to $201,000 in 2022, as home prices rose, and home mortgage debt was approximately flat1.

In this article, we use the 2022 data from the Survey of Consumer Finances (SCF) to examine household balance sheets, especially their primary residence, across age and education categories. The 2022 SCF is a detailed triennial cross-sectional survey of U.S. family finances, published by the Board of Governors of the Federal Reserve System. Compared to the quarterly Financial Accounts of the United States (previously known as the Flow of Funds Accounts), which provides aggregate information on household balance sheets, the SCF provides family-level data2 about U.S. household balance sheets every three years since 1989.

Homeownership plays an integral role in a household’s accumulation of wealth.

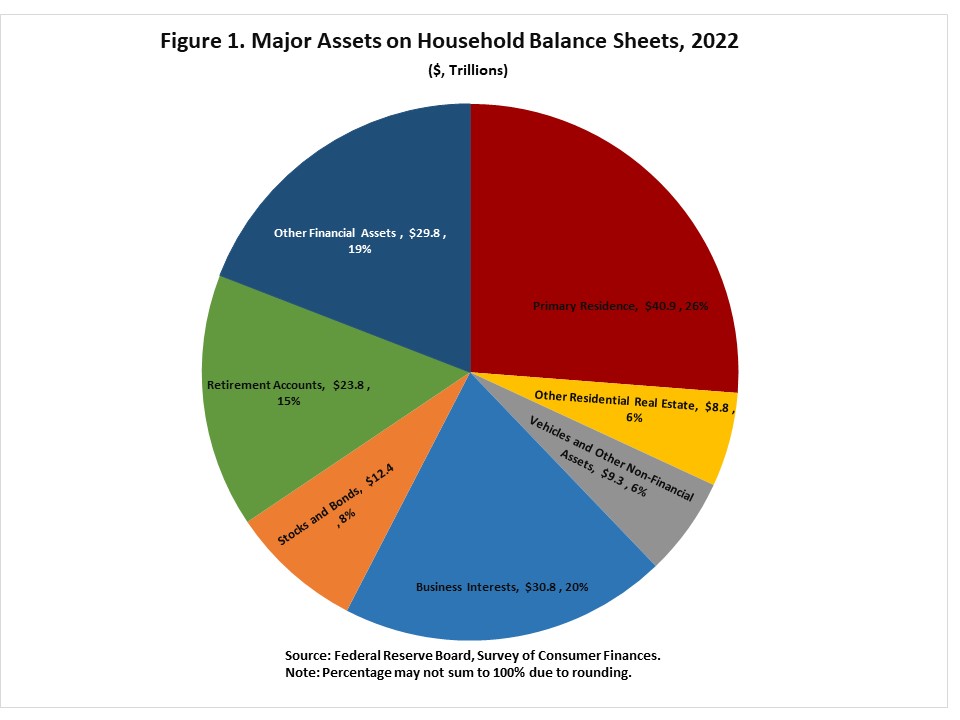

According to the analysis of the 2022 SCF, nationally, the primary residence remained the largest asset category on the balance sheets of households in 2022 (as shown in Figure 1 above). At $40.9 trillion, the primary residence accounted for more than one quarter of all assets held by households in 2022, surpassing business interests (20%, $30.8 trillion), other financial assets3 (19%, $29.8 trillion) and retirement accounts (15%, $23.8 trillion).

Playing an important role in household wealth accumulation, the primary residence not only represents the largest asset category on the household balance sheet, but also is a widely held category of nonfinancial assets by households. As mentioned earlier, about two out of every three households, 66%, owned a primary residence in 2022. Within the categories of financial assets, just over half of households, 54%, held retirement accounts, and 21% of households owned either stocks or bonds. Other financial assets, which were held by 99% of households, include items such as checking accounts, money market accounts, and prepaid debit cards, which are often held more to facilitate financial transactions than to build wealth.

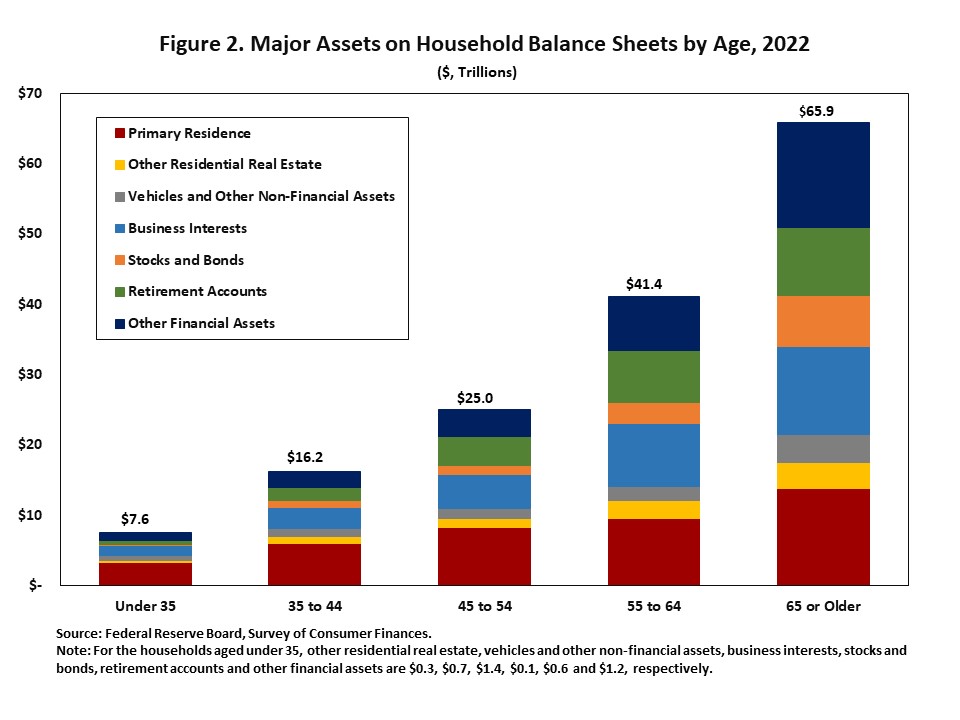

In Figure 2, the bars represent the distribution of major assets on household balance sheets by age categories in 2022.

The results shown in Figure 2 suggest that households generally accumulate more assets as they age. Total assets were $7.6 trillion for households under age 35, while they were $65.9 trillion for households aged 65 or older. The aggregate value of assets held by families where the head was aged 65 or older was approximately nine times larger than those held by families where the head was under age 35. The increases in the total assets among age groups indicate that the value of assets grows with age groups.

Moreover, the distribution of major assets on household balance sheets varies by age group. Across age groups where households were under the age of 65, the aggregate value of the primary residence was the largest asset category on these households’ balance sheets. For households aged 65 or older, the primary residence became the second largest asset category, less than other financial assets.

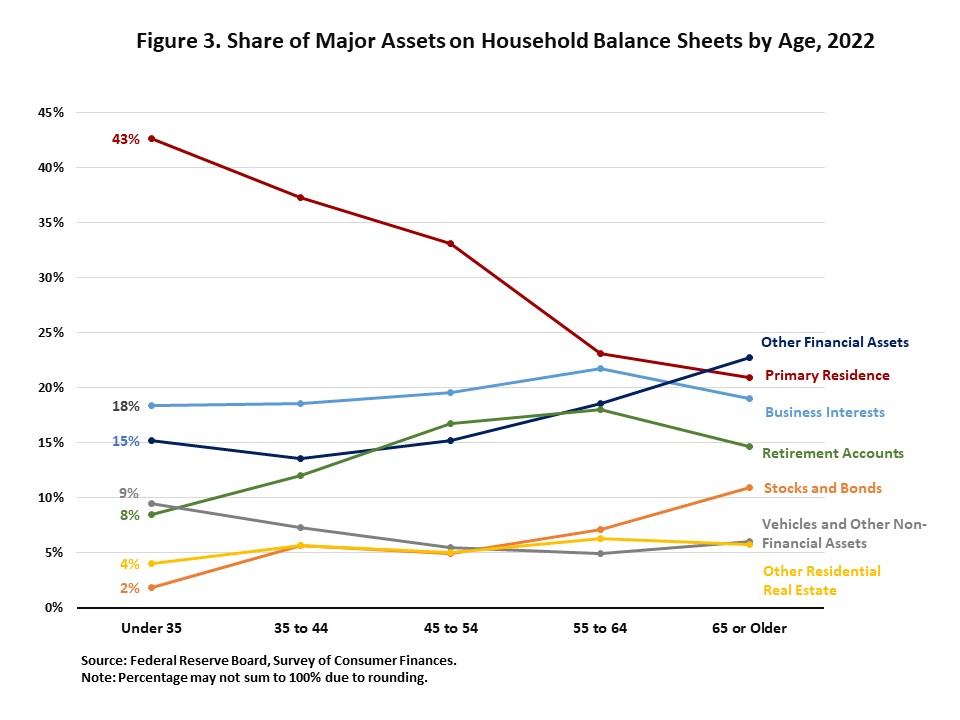

Although the aggregate value of the primary residence increases with age, partly reflecting higher homeownership rates across age categories, the aggregate value of the primary residence as a share of total assets declined with age, as shown in Figure 3. The decline in the share of total assets represented by the aggregate value of the primary residence was offset by growth in the share of other asset categories in aggregate, most notably stocks and bonds, other financial assets, and retirement accounts.

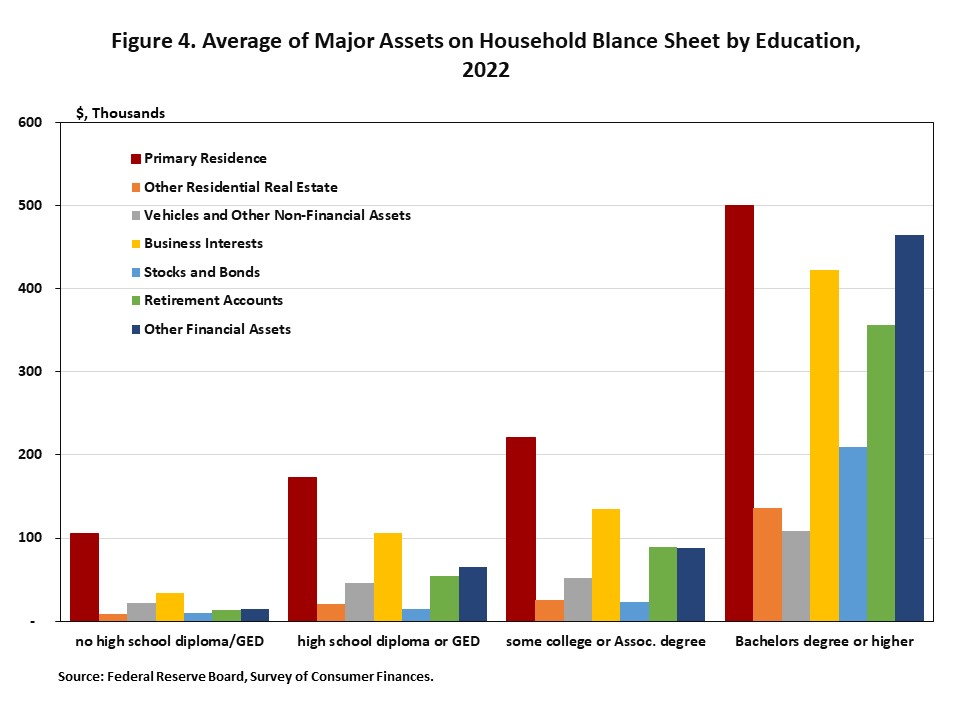

An analysis of the SCF reveals that higher educational attainment is associated with higher value of asset holdings. The aggregate value of assets held by households with a bachelor’s degree or higher was five times higher than the aggregate value of assets held by those with some college or associate degrees.

Notably, the primary residence remains the largest asset category for each educational attainment category. However, the aggregate value of the primary residence as a share of total assets varies by educational attainment categories. For households with a bachelor’s degree or higher, the aggregate value of the primary residence as a share of total assets was 23%, as these households held a greater amount of other assets, such as business interests, other financial assets, and retirement accounts. Meanwhile, for households with no high school diploma or GED, the primary residence accounted for half of their total assets.

Note:

1 For details on changes in U.S. Family Finances from 2019 to 2022, see Aladangady, Aditya, Jesse Bricker, Andrew C. Chang, Sarena Goodman, Jacob Krimmel, Kevin B. Moore, Sarah Reber, Alice Henriques Volz, and Richard A. Windle (2023). Changes in U.S. Family Finances from 2019 to 2022: Evidence from the Survey of Consumer Finances. Washington: Board of Governors of the Federal Reserve System, October, https://www.federalreserve.gov/publications/files/scf23.pdf.

2 According to the SCF, the term “families”, used in the SCF, is more comparable with the U.S. Census Bureau definition of “households” than with its use of “families”. More information can be found here: https://www.federalreserve.gov/publications/files/scf23.pdf.

3 Other financial assets include loans from the household to someone else, future proceeds, royalties, futures, non-public stock, deferred compensation, oil/gas/mineral investments, and cash, not elsewhere classified.

4 Other residential real estate includes land contracts/notes household has made, properties other than the principal residence that are coded as 1-4 family residences, time shares, and vacation homes.

5 Other nonfinancial assets defined as total value of miscellaneous assets minus other financial assets.