What are the Latest Income Tax Slab Rates for FY 2024-25 after Budget 2024? Is there any change in tax rates during the Budget 2024?

During her budget speech, the Finance Minister mentioned that she is not revising the income tax slab rates applicable for individuals. In this post, let us look into the tax slab rates.

Do remember that the Loksabha election is around the corner, it is an interim budget. Hence, let us try to understand the difference between the interim budget and vs union budget. We have to wait for the full fledge Budget in July 2024.

Difference between Interim Budget vs. Union Budget

The timing, scope, and duration distinguish an interim budget from a union budget. An interim budget serves as a temporary financial plan that the government presents before the general elections, while a union budget is a comprehensive budget that the ruling government presents annually for the entire fiscal year.

Here are some of the key distinctions:

- An interim budget typically refrains from making major policy announcements or introducing new schemes, focusing instead on essential expenses. In contrast, a union budget includes new policy initiatives, announcements, and changes in taxation and expenditure.

- An interim budget receives parliamentary approval for a limited period, usually a few months or until the new government presents the full budget. On the other hand, a union budget requires parliamentary approval for the entire fiscal year.

- An interim budget is based on estimates for the upcoming financial year, while a union budget covers the entire financial year, spanning from April 1 to March 31.

- The outgoing government presents an interim budget, whereas a union budget is presented by the ruling government of the day.

The difference between Gross Income and Total Income or Taxable Income?

Before jumping into what are the Latest Income Tax Slab Rates for FY 2024-25 / AY 2025-26 after Budget 2024? Are there any changes to applicable tax rates for individuals? Let us see the details., first, understand the difference between Gross Income and Total Income.

Many of us have the confusion of understanding what is Gross Income and what is Total Income or Taxable Income. Also, we calculate the income tax on Gross Income. This is completely wrong. The income tax will be chargeable on Total Income. Hence, it is very much important to understand the difference.

Gross Total Income means total income under the heads of Salaries, Income from house property, Profits and gains of business or profession, Capital Gains or income from other sources before making any deductions under Sections 80C to 80U.

Total Income or Taxable Income means Gross Total Income reduced by the amount permissible as deductions under Sec.80C to 80U.

Therefore your Total Income or Taxable Income will always be less than the Gross Total Income.

Latest Income Tax Slab Rates FY 2024-25

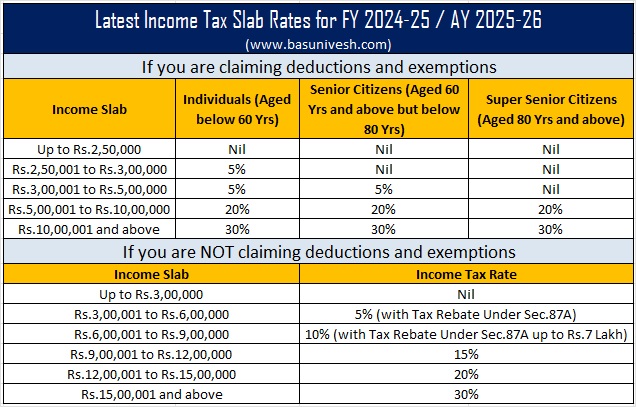

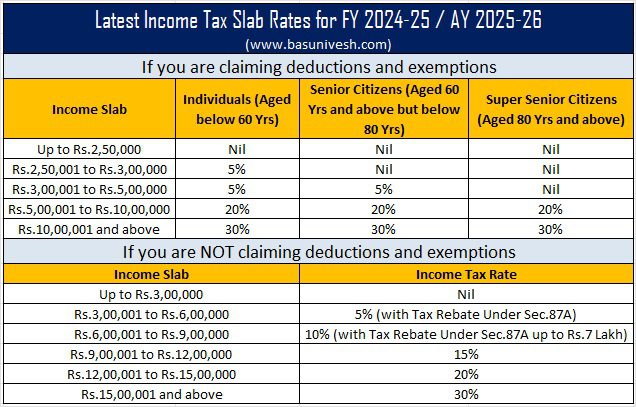

There will be two types of tax slabs.

- For those who wish to claim IT Deductions and Exemptions.

- For those who DO NOT wish to claim IT Deductions and Exemptions.

Earlier, under the new tax regime, there were six income tax slab rates used to be there. But last year, it was reduced to five income tax slab rates. Do remember that the changes in income tax slab rates done last year apply only to the new tax regimes.

Also, earlier the standard deduction available for the salaried class and the pensioners including family pensioners is available only for the old tax regime. Last year, it was made to be available under the new tax regime.

Let me now share with you the revised Latest Income Tax Slab Rates FY 2024-25

Let us wait for the full-fledged budget post-Loksabha election.