Artificial Intelligence (AI) is a game-changer in financial services, particularly in detecting and preventing fraud. It is proving its efficacy in identifying bank statement fraud, by leveraging the concept of fraud knowledge graphs.

Fraud manifests in various ways. A common pattern is the replication of identical content across multiple bank statements. And, there are more sophisticated fraud methods where it’s less about replicating specific transactions ie ATM deposits, and more on using technology to generate a synthetic bank statement with unique content, appearing as a valid bank statement.

To tackle this, experts model bank statement data in a network graph format, making it easier to identify shared entities across distinct consumers and subsequently catch more fraud. Here, the application of AI, specifically the use of fraud knowledge graphs, emerges as a powerful tool.

Imagine four bank statements, seemingly unrelated at first glance. However, upon closer inspection, the AI identifies a pattern of identical deposits across all four. This raises a red flag, prompting further investigation. Then, a subgraph of connected elements emerges, a clearly abnormal pattern compared to the overall financial transaction graph.

A crucial aspect of this AI-driven approach is the ability to not only identify a single instance of fraud but to recognize patterns across multiple examples. Instead of relying on human eyes to review bank statements and detect anomalies, AI algorithms analyze vast amounts of data quickly and accurately. This efficiency is critical in the context of fraud detection, where timely intervention mitigates financial losses.

The heart of the AI solution lies in creating a deep subgraph for known instances of fraud. As the system encounters new data, it compares and contrasts patterns against this subgraph, enhancing its ability to identify subtle deviations that may indicate fraud. This dynamic learning process ensures that the AI model evolves and adapts to emerging patterns, staying one step ahead of potential threats.

Image 1 — An example of a standard graph for non-fraud. Each applicant (red nodes) can have 1-N bank statements (purple nodes), which in turn can have 1-N deposits (green nodes). Sometimes, deposits can even be similar across bank statements (as in the top right; extremely similar direct deposits from an employer appear across 4 different bank statements).

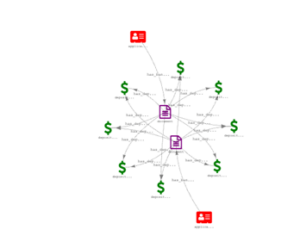

Image 2 – Dense subgraphs of shared extractions across Bank Statements attached to different applicants. Note the high number of shared deposit nodes (green) across bank statements (purple) linked to different people (red).

Image 3 example — zoomed in example of a single fraud cohort. This shows two different applicants with bank statements having completely different NPPI information, but identical deposit transaction patterns.

The advantage of employing AI for bank statement fraud detection is its consistency and reliability. While human reviewers may inadvertently overlook patterns or tire after prolonged scrutiny, AI algorithms examine data with unwavering attention to detail. This enhances the accuracy of fraud detection and frees up people to focus on tasks requiring intuition and strategic thinking.

To illustrate the potential impact of AI-driven fraud detection, consider the scenario where eyes can’t easily discern a fraudulent pattern across multiple bank statements. The AI model not only automates this process but does so with a level of precision surpassing human capabilities. It can analyze intricate connections within the data, unveiling relationships that might escape even the most trained eyes.

Performing shared-element detection via an algorithm is a much more feasible approach than having a human attempt to assess all the aforementioned elements manually, while increasing accuracy, decreasing fraud and time to close.

In thinking about the full universe of potential elements shared on JUST bank statements – deposits, withdrawals, account numbers, beginning and ending balances, fees, NPPI – it becomes clear that performing shared-element detection via an algorithm is much better than having a human attempt to manually assess all those elements.

Implementing AI-powered fraud knowledge graphs is not just about catching fraudulent activities in real-time. It also adds a layer of protection for financial institutions. By continuously learning and adapting, AI models become increasingly adept at identifying fraud trends, safeguarding financial institutions and their customers.

In conclusion, the use of AI, particularly through fraud knowledge graphs, is revolutionizing detection of bank statement fraud. The ability to create subgraphs for each set of bank statements, identify patterns, and build a deep subgraph for known fraud shows the power of AI in financial security. As the technology advances, collaboration between human expertise and AI solutions promise a future where financial transactions are seamless and secure.

If you’d like to learn more about how Informed used knowledge graphs to fight fraud, contact us.