Welcome to the March 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that advisor lead generation platform Datalign Advisory reached nearly $15B in referred client assets (and almost $3B in actually-converted assets) in just its 2nd year of business, as advisor demand for paid leads continues to rise (especially with Datalign’s flat-fee one-advisor-per-lead model)… though arguably the greater significance is simply that new advisor lead gen platforms have still been able to find new channels to market to in order to create an ongoing flow of leads (while raising the question of how much further the category can grow before the competing platforms start to saturate the consumer marketplace?).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Salesforce Financial Services Cloud highlights a new pre-built multi-custodial data feeds solution in its AppExchange, dubbed Attune and powered by BridgeFT, as the CRM provider seems to come ‘downmarket’ into mid-sized independent advisory firms that want Salesforce’s depth but don’t have the internal resources to fully customize it from scratch.

- SEI invests $10M into TIFIN to support its development of new AI tools for wealth management, in a model that could both help SEI navigate the infamous “Innovator’s Dilemma” of being a large incumbent trying to innovate, and could represent a model that helps to fund more early- and mid-stage AdvisorTech startups (especially as the VC/PE funding environment continues to slow)

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- Nebo Wealth partners with Advyzon’s Investment Management (AIM) platform to ‘TAMPify’ its software, which models, illustrates, and optimizes a Liability-Driven-Investing style of portfolio design, customized for each individual retiree client… but until now left advisors on their own to figure out how to scalably implement when each client’s portfolio was different.

- Fabric Risk is acquired by MSCI as adoption continues to be sluggish for advisors building truly personalized-to-each-client portfolios, given both the operational difficulties of implementing, and the simple reality that pursuing such an approach can mean a material change to the advisor’s existing investment story with clients (which is often a disruption that advisors would just prefer not to deal with!)

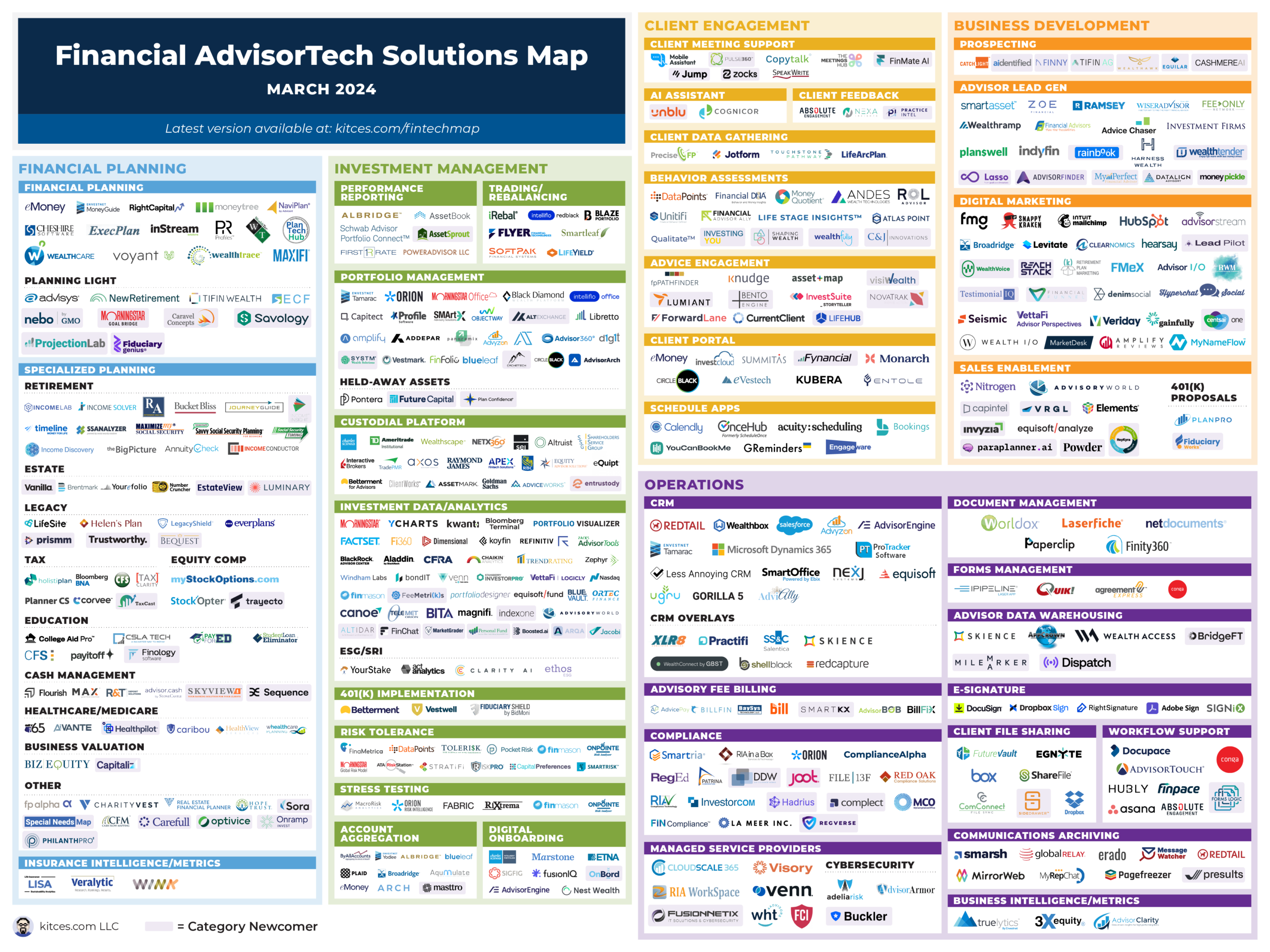

- A new AdvisorTech category for “Prospecting” appears on the AdvisorTech Map, as a slew of new startups including Catchlight, AIdentified, FINNY, Wealthawk, and Equilar bring AI (or at least, advanced analytics) to help scrub advisors’ lists of leads and figure out which ones are really Qualified prospects that advisors will get the best ROI on their time by pursuing.

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!