Due to tightened monetary policy, the count of total job openings for the entire economy has trended lower in recent months. This is consistent with a cooling economy that is a positive sign for future inflation readings. The number of open jobs for the aggregate economy was relatively unchanged in January.

In January, the number of open jobs for the economy fell back to 8.86 million. This is notably lower than the 10.4 million reported a year ago. NAHB estimates indicate that this number must fall back below 8 million for the Federal Reserve to feel more comfortable about labor market conditions and their potential impacts on inflation.

While the Fed intends for higher interest rates to have an impact on the demand-side of the economy, the ultimate solution for the labor shortage will not be found by slowing worker demand, but by recruiting, training and retaining skilled workers. This is where the risk of a monetary policy mistake had some risk of arising. Good news for the labor market does not automatically imply bad news for inflation.

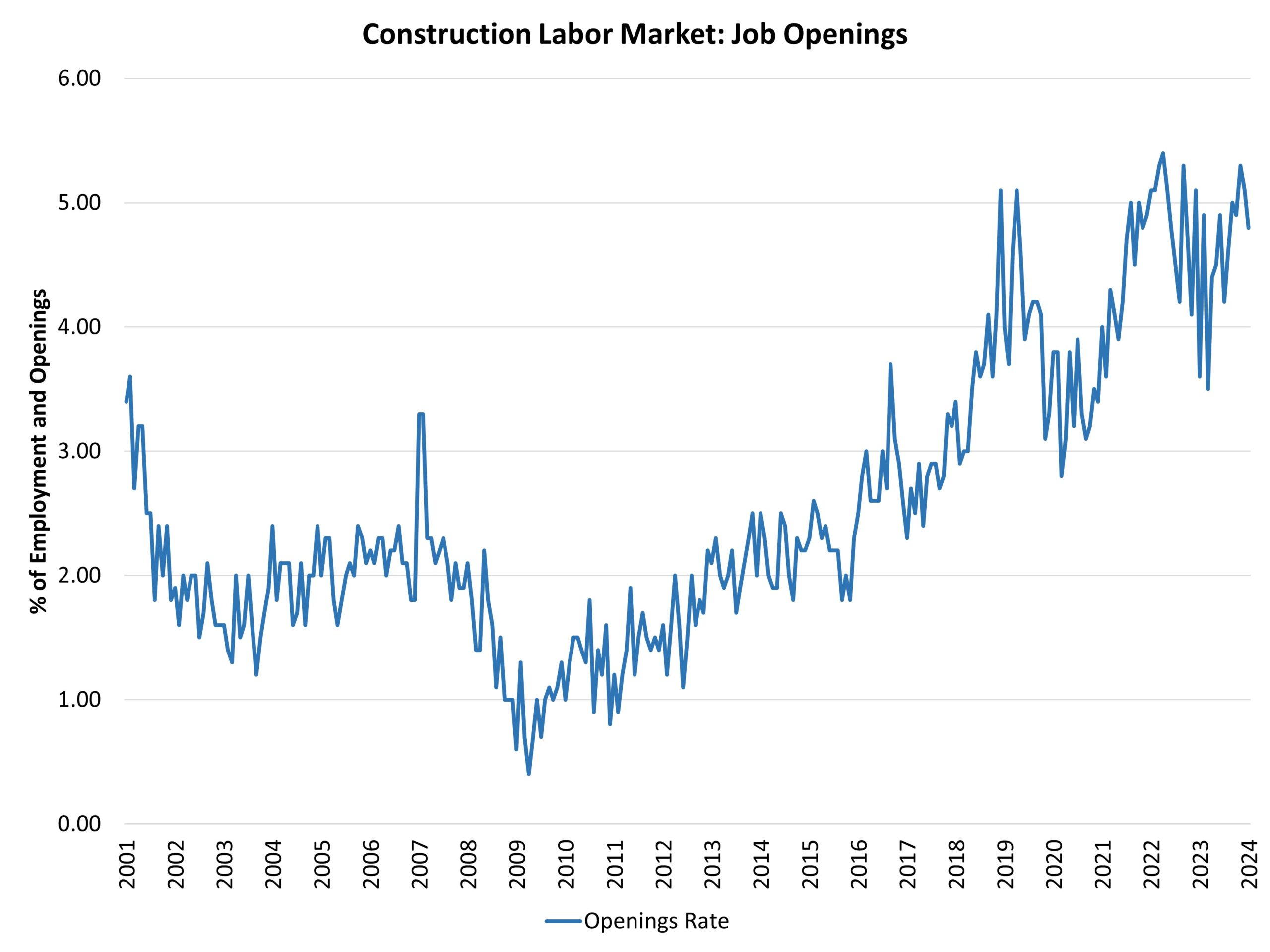

The number of open construction sector jobs was relatively unchanged in the most recent data, declining from 434,000 in December to 413,000 in January. The count was just 293,000 a year ago during a period of weaker home construction. The construction job openings rate decreased slightly to 4.8% in January. Nonetheless, a recent, increasing trend indicates an ongoing skilled labor shortage for the construction sector.