LIC has recently launched a plan aimed to fund children’s higher education. LIC Amritbaal (Plan 874). Hence, here goes another review.

While I am usually biased against insurance-and-investment combo products, let us start this review on a positive note.

I must concede that there are a few things that only insurance products can do. And mutual funds cannot.

- Provide guaranteed returns (non-participating plans can do)

- Provide tax-free returns (subject to conditions)

- Provide cashflow structures that you can easily relate with your financial goals (kids’ education, retirement)

Let us consider a problem statement.

- You want to invest Rs 50,000 per annum in a product for your daughter’s education.

- You also want to ensure that this investment continues even if you are not around.

- And your daughter gets the money when she turns 18 (just when she is ready for higher education).

You just cannot do this through mutual funds. Can do this only through insurance products.

Mutual funds cannot provide tax-free or guaranteed returns. Yes, mutual funds are a good vehicle to accumulate funds but there is no way to ensure that your annual investment will continue even if you are not around. And you must plan withdrawals yourself.

Interestingly, insurance products always had this advantage over mutual funds. Still, I do not have a favourable opinion of many such products. Why?

Because there are still many issues that persist. Low returns and lack of flexibility are the prominent ones.

How does LIC Amritbaal fare? Let us find out.

LIC Amritbaal (Plan 874): Key features

- Non-linked, non-participating plan: This means the returns are guaranteed and you will know upfront what you will get from this plan.

- Specially designed to save for kids’ education.

- The child is the life insured (not you).

- Minimum Age at entry: 0 years (30 days completed)

- Maximum entry age: 13 years

- Minimum age at maturity: 18 years

- Maximum age at maturity: 25 years

- Single Premium Payment and Limited Premium Payment (5, 6, and 7 years)

- Minimum Policy Term: 5 years for Single Premium, 10 years for Limited Premium

- Maximum Policy Term: 25 years to both single and limited premium

- Sum Assured: Minimum: Rs 2 lacs, Maximum: No Limit

- Optional: Premium Waiver Benefit Rider

If you look at the entry age and exit age limits, it is easy to see that this product is designed to help you save for kids’ education or marriage.

LIC Amritbaal (Plan 874): Death Benefit

Am important caveat here.

Life insurance is on the life of the child. And not the parent.

Hence, the family gets nothing in the event of the demise of the parent. This is a problem, right? And LIC understand this too. And there is a workaround for this, albeit an expensive one. More on this later.

Death Benefit = Sum Assured on Death + Accrued Guaranteed Additions

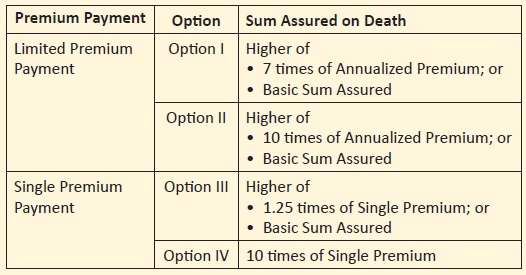

You have 4 options for Sum Assured on Death.

Single Premium

- Option 1: Sum Assured on death = Higher of (7X Annual Premium, Basic Sum Assured)

- Option 2: Sum Assured on death = Higher of (10X Annual Premium, Basic Sum Assured)

Limited Premium Payment

- Option 3: Sum Assured on death = Higher of (1.25X Annual Premium, Basic Sum Assured)

- Option 4: Sum Assured on death = 10X Annual Premium

As we have seen in many of the previous posts, higher life coverage implies lower returns. This happens because a bigger portion of your premium goes towards life cover.

Hence, everything else being the same, you will earn better returns in Option 1 than in Option 2. For Single premium plans.

Similarly, you will earn better returns in Option 3 than in Option 4 (for single premium plans).

Note: Option 1 and Option 3 will provide better returns, but the proceeds will be taxable. Option 2 and Option 4 will provide inferior returns, but the proceeds will be tax-free. More on this in the coming section.

“Basic Sum Assured” (BSA) is mostly used in calculating maturity benefit. And since the maturity benefit depends on the “Basic Sum Assured”, your annual premium also depends on your choice of BSA. As you increase the BSA, your annual premium will also go up.

LIC Amritbaal (Plan 874): Tax treatment

You can take tax benefit under Section 80C for investment in this plan, provided you are still under the old regime.

The death benefit is exempt from tax.

For the maturity proceeds to be exempt from tax under Section 10(10D), the Sum Assured must be at least 10 times the annual premium.

As we can see, this condition is met only in Option 2 and Option 4. Hence, the maturity proceeds from Options 2 and 4 will be tax-free.

For Option 1 and Option 3, the maturity proceeds (less the premiums paid) will be taxed at the slab rate.

An interesting point: Minimum age at maturity is 18 years. The maturity proceeds will go to the child after he/she turns major. Therefore, the clubbing provisions will not apply, and the maturity amount will be taxed in the hands of the child.

Now, at the time of maturity, the child (then a major) may not have much income. Hence, that may reduce effective tax liability for the family.

Note: For maturity proceeds to be tax-free, there is an additional condition to be met. The aggregate annual premium for all traditional plans (non-linked plans) purchased after March 31, 2023, must not exceed Rs 5 lacs. For now, let us not consider this aspect.

LIC Amritbaal (Plan 874): Maturity Benefit

This is where the much “Basic Sum Assured” comes into play.

Maturity Benefit = Basic Sum Assured + Accrued Guaranteed Additions

The calculation for Guaranteed Additions is quite simple.

You are allotted Guaranteed Additions at the rate of Rs 80 per Rs 1000 of Sum Assured.

Hence, if your BSA for your policy is Rs 5 lacs, your policy will accrue Guaranteed Additions at the rate of Rs 5 lacs/1000 * 80 = 40,000 per annum.

Hence, if the policy term is 20 years with BSA of Rs 5 lacs, the total maturity benefit will be = Rs 5 lacs + 20 X 40,000 = Rs 13 lacs.

LIC Amritbaal (Plan 874): What are the returns like?

I will bank upon the 2 illustrations shared in the sales brochure. Please note any calculations that I share are only for these specific cases. Your returns may depend on entry age, choice of variant, and policy term.

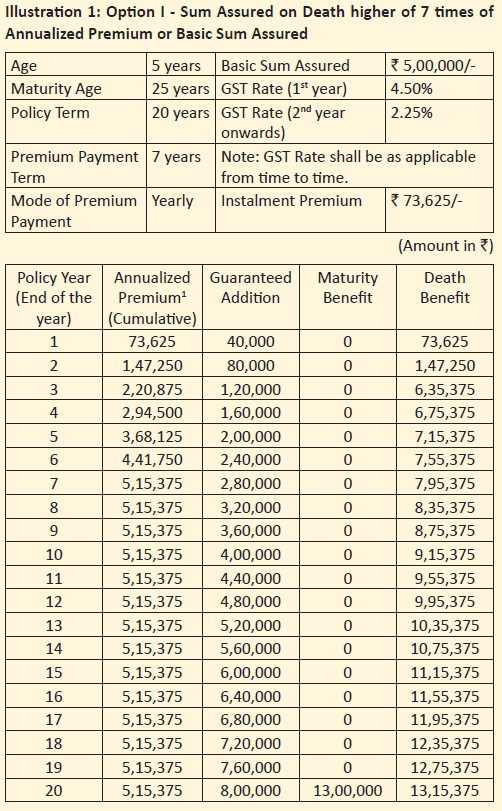

Illustration 1

Entry Age: 5 years

Policy Term: 20 years (Age at maturity: 25 years)

Premium Payment Term: Limited Premium (7 years)

Basic Sum Assured (BSA): Rs 5 lacs

Death Benefit: Option 1 => Sum Assured on Death = Higher of (7 X Annual Premium, BSA) = Rs 5.15 lacs

Annual Premium: Rs 73,625. This is before GST. GST of 4.5% in the first year. 2.25% in the subsequent years

Every year, Guaranteed additions worth Rs 5 lacs/1000 * 80 = Rs 40,000 will add to your policy. Note that Guaranteed additions are linked to Base Sum Assured. Rs 80 per Rs 1000 of BSA per annum.

Over 20 years, this adds up to 40,000 X 20 = Rs 8 lacs

Maturity Benefit = BSA + Accrued Guaranteed Additions = Rs 5 lacs + 8 lacs = 13 lacs.

XIRR (net returns) = 5.40% p.a.

Note that the life cover is less than 10X Annual Premium. Hence, the maturity proceeds (less single premium paid) will be taxable. This may reduce post-tax returns.

You can go for life cover of 10X Annual premium too (Option 2). In that case, the maturity proceeds will not be taxable. The maturity benefit will still be Rs 13 lacs (if BSA is Rs 5 lacs). However, the annual premium will go up. And this will reduce your net returns. There is no illustration in the brochure for 10X cover. Otherwise, it would have been easy to compare and demonstrate.

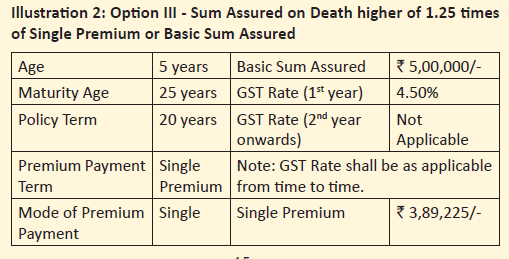

Illustration 2

Entry Age: 5 years

Policy Term: 20 years (Age at maturity: 25 years)

Premium Payment Term: Single Premium

Basic Sum Assured (BSA): Rs 5 lacs

Death Benefit: Option 3 => Sum Assured on Death = Higher of (1.25 X Single Premium, BSA) = Rs 5 lacs

Single Premium: Rs 3,89,225 (Premium to be paid just once). This is before GST. Including GST of 4.5%, the premium shall be Rs 4,06,740

Every year, Guaranteed additions worth Rs 5 lacs/1000 * 80 = Rs 40,000 will add to your policy.

Over 20 years, this adds up to 40,000 X 20 = Rs 8 lacs

Maturity Benefit = BSA + Accrued Guaranteed Additions = Rs 5 lacs + 8 lacs = 13 lacs.

XIRR (net returns) = 5.98% p.a.

Note that the life cover is less than 10X Single Premium. Hence, the maturity proceeds (less single premium paid) will be taxable. This may reduce post-tax returns.

You can go for a life cover of 10X Single premium too. In that case, the maturity proceeds will not be taxable. The maturity benefit will still be Rs 13 lacs (if BSA is Rs 5 lacs). However, the single premium will go up. And this will reduce your net returns. There is no illustration in the brochure for single premium (10X cover). Hence, cannot share the exact returns.

LIC Amritbaal (Plan 874): What are the good points?

It is from LIC, one of the most trusted Indian brands.

It is a simple product. Easy to understand and relate to. Guaranteed returns.

You want to invest for your kids’ education. You know upfront that if you invest Rs X every year for a fixed number of years, you (your kid) will get Rs Y on product maturity.

If something happens to you, all the premiums get waived off (if you buy a rider) and your kid still gets Rs Y on maturity.

Could there be anything simpler?

LIC Amritbaal: What are the bad points?

#1 Insurance is on child’s life

In the event the parent (earning member) passes away, the family gets nothing. Beats the entire purpose of buying life insurance.

Yes, you can purchase Premium Waiver Benefit rider. If you purchase the rider, in the event of demise of the proposer (parent), any subsequent premium will be waived off (deemed to be received) and the plan would continue.

However, there are 2 problems with this approach.

Firstly, if you are calling a product a child plan, such a feature should be part of the default offering. Not to be purchased as a rider.

What if the parent does not know about the rider or chooses not to buy (despite knowledge)? If the family cannot pay the premium after demise of parents, what happens to the child’s education fund then?

Note: LIC Amritbaal is an utterly useless plan if you do not buy the Premium waiver benefit rider as an add-on. The only excuse for not buying “Premium Waiver Benefit Rider” is that you already have an adequate life cover. In that case though, you might want to revisit why you are buying this product in the first place.

Secondly, the premium waiver benefit rider will come at an additional cost. The premium will increase, which will adversely affect your net returns.

Point to Note: In the product brochure, the insurer has chosen to share illustrations for low life covers (Option 1 and Option 3). Everything else being the same, Options 1 and 3 will offer better returns than Option 2 and respectively. Moreover, the illustrations do not consider the purchase of Premium waiver benefit rider, which I think is quite important for plans such as these.

#2 Attempt to deceive?

Sometimes, with traditional plans, I see a deliberate attempt to confuse (or even deceive) prospective investors. For instance, in the illustration given in the brochure, the last row mentions “Guaranteed Additions” at 8 lacs. And Maturity benefit at 13 lacs.

If you are taking a quick glance, you would expect to receive Rs 13 lacs + Rs 8 lacs = Rs 21 lacs on maturity.

No, you get only Rs 13 lacs.

Rs 8 lacs is just for cosmetics. You will not get it.

Now, this is not technically incorrect. But this is irresponsible. It is difficult to believe that brochure writers did not know what they were insinuating.

LIC Amritbaal: Should you invest?

I leave it to your judgement whether 5-6% p.a. return is good enough for you for a long-term investment product.

For me, it is not good enough.

Moreover, the illustration showed the variants where the returns were higher. And without “Premium Waiver Benefit” rider. If you choose other variants and include the premium waiver benefit rider, your premium will go up, but the maturity amount will remain the same. This will bring down net returns.

However, you do not have to think like me or share my preferences in an investment product. You may value the safety of capital, guaranteed returns, and easy-to-see cashflows more.

Hence, you may find merit in this product if:

- You have a use-case where this product fits perfectly. AND

- You like such products with returns guarantee and simple cashflows. Even in this case, compare with similar child insurance products in this space. AND

- You already have exposure to products with higher risk-and-reward in the child education portfolio and are looking to add a stable product (with tax-free returns) to complement the portfolio. In other words, your asset allocation allows you to include this product in the portfolio.

If you must invest in LIC Amritbaal, select the variant wisely. Options 1 and 3 will NOT offer tax-free maturity proceeds. Only Option 2 and 4 will offer tax-free but lower returns.

Consider adding Premium Waiver Benefit rider in the plan (unless you have a strong reason to do so). Without this rider, buying this product is an unwise decision.

Additional Links/Source

LIC Amritbaal: Product brochure and Policy Wordings

Featured Image Credit: Unsplash

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investment in securities market is subject to market risks. Read all the related documents carefully before investing.

This post is for education purpose alone and is NOT investment advice. This is not a recommendation to invest or NOT invest in any product. The securities, instruments, or indices quoted are for illustration only and are not recommendatory. My views may be biased, and I may choose not to focus on aspects that you consider important. Your financial goals may be different. You may have a different risk profile. You may be in a different life stage than I am in. Hence, you must NOT base your investment decisions based on my writings. There is no one-size-fits-all solution in investments. What may be a good investment for certain investors may NOT be good for others. And vice versa. Therefore, read and understand the product terms and conditions and consider your risk profile, requirements, and suitability before investing in any investment product or following an investment approach.