If you’re balancing VTI vs. VOO, you’re probably looking at putting money into an index fund. That’s generally going to be a good decision. Index funds allow you to diversify your portfolio even if you don’t have much to invest, and even investment professionals often fail to pick stocks that beat the index performance.

But which of these funds should you choose? Let’s start with the basics.

VTI vs VOO: By the Numbers

| VTI | VOO | |

|---|---|---|

| Full Name | Vanguard Total Stock Market ETF | Vanguard S&P 500 ETF |

| Index Tracked | CRSP U.S. Total Market Index | S&P 500 Index |

| Assets Under Management* | $318.6 billion | $339.7 billion |

| Number of Holdings | 3839 | 507 |

| Expense Ratio | 0.03% | 0.03% |

| Dividend Yield* | 1.54% | 1.56% |

| Issuer | Vanguard | Vanguard |

* As of Sept. 2023

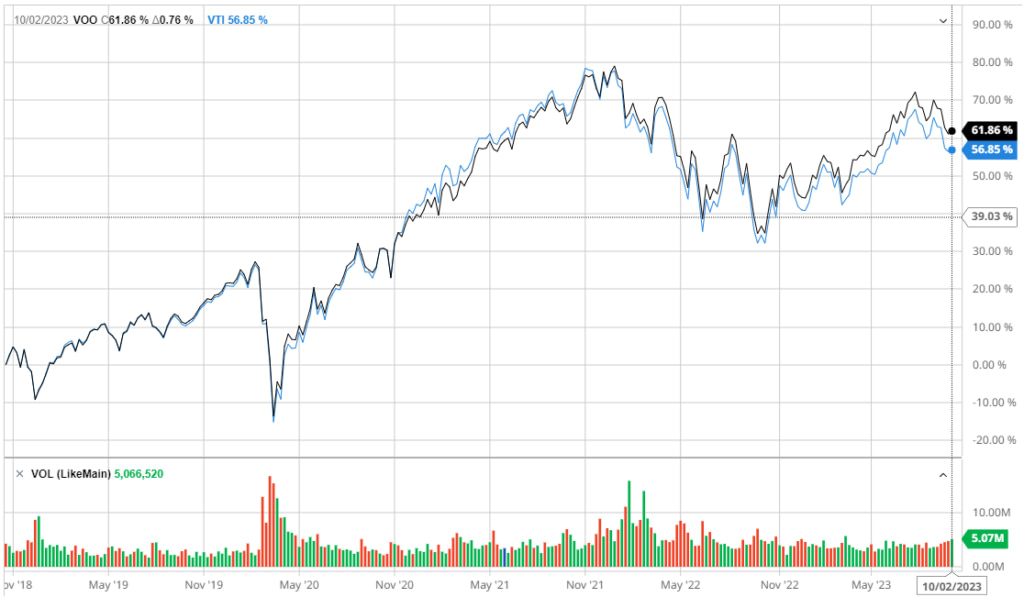

Five-Year Performance

Source: Barchat

VTI vs VOO: What’s the Difference?

The most important difference between VTI and VOO is that each fund tracks a different index:

- VTI tracks the CRSP U.S. Total Market index. The CRSP U.S. Total Market index is an index of almost 4000 companies headquartered in the US, from mega to micro capitalization. This makes the index a good representation of the entire US stock market, not just the largest companies.

- VOO tracks the S&P 500. The S&P 500 is an index of the 500 top largest companies in the US.

These indices and the ETFs that track them are market cap weighted. That means that they give larger companies a heavier weight.

VTI vs VOO: Sector Exposure

VTI and VOO use slightly different terms to break down their sector exposure.

VTI Sector Breakdown

| Sector | Weight |

|---|---|

| Information Technology | 30.20% |

| Consumer Discretionary | 14.40% |

| Industrials | 13.00% |

| Health Care | 12.60% |

| Financials | 10.30% |

| Consumer Staples | 5.10% |

| Energy | 4.60% |

| Real Estate | 2.90% |

| Utilities | 2.70% |

| Telecommunication | 2.20% |

| Basic Materials | 2.00% |

VOO Sector Breakdown

| Sector | Weight |

|---|---|

| Technology | 28.20% |

| Health Care | 13.20% |

| Financials | 12.40% |

| Consumer Discretionary | 10.60% |

| Communication Services | 8.80% |

| Industrials | 8.40% |

| Consumer Staples | 6.60% |

| Energy | 4.40% |

| Real Estate | 2.50% |

| Basic Materials | 2.50% |

| Utilities | 2.40% |

One thing that immediately stands out in these breakdowns is that both VTI and VOO are heavily weighted toward IT (tech & communication) especially VOO, reflecting the current large market capitalization of these sectors in the US stock market.

- VTI tracks a larger number of companies from a wider range of corporate sizes. It is weighted more heavily toward the consumer and industrial sectors, which contain more medium and small-size companies. The larger number of holdings and higher variation in the companies’ profiles make it more diversified.

- VOO tracks a smaller number of companies with a slightly greater concentration in tech. It gives a higher part to healthcare and financials, which tend to be dominated by large companies (sometimes referred to as Big Banks and Big Pharma).

Neither of these options is fundamentally better or worse. They provide exposure to slightly different sectors of the market, and that can lead to different performance characteristics.

VTI vs VOO: The Similarities

VTI and VOO have a lot in common. They are both extremely large ETFs. Both funds are managed by Vanguard, which has a reputation for providing low-cost funds.

If you’re looking for large, highly liquid funds with credible management, both of these ETFs will pass your screen.

There are also less obvious similarities, explaining the very similar performance charts stemming from three basic facts.

- As market cap-weighted indexes, they both give a predominant space to mega-caps worth trillions of dollars, most of them tech companies.

- A lot of the performance of the CRSP U.S. Total Market Index is driven by the top largest holdings, which are all part of the S&P 500.

- The stock market value of mid and small-cap stocks tends to move in unison with larger-cap stocks.

What does that mean in practice? Let’s look at the ten largest holdings of VTI and VOO.

Top Holdings: VTI vs VOO

The top holdings of both indexes are identical for the first 9th largest holdings, only in a slightly different order. It includes:

- Apple Inc.

- Microsoft Corp.

- Amazon.com Inc.

- NVIDIA Corp.

- Alphabet Inc. Class A

- Alphabet Inc. Class C

- Tesla

- Facebook Inc. Class A

- Berkshire Hathaway Inc. Class B

So the only difference among the top 10 holdings is that VTI contains insurance and healthcare stock UnitedHealth Group while VOO contains oil & gas Exxon Mobil Corp.

The same can be true even if looking at the next 10 holdings for each fund. The list is identical for 9th of them, with a very similar order:

- Exxon Mobil Corp or UnitedHealth Group

- Eli Lilly & Co.

- JPMorgan Chase & Co.

- Visa Inc. Class A

- Johnson & Johnson

- Broadcom Inc.

- Procter & Gamble Co.

- MasterCard Inc Class A

- Home Depot

The difference is in the 20th largest holdings: pharmaceutical company Merck & Co Inc. for VTI and energy company Chevron Corp. for VOO.

The only real difference is for the top holdings of VTI to be slightly less of the whole ETF, making space for the smaller holdings of smaller companies.

Which Is Best for You?

Both VTI and VOO are good choices for an investor who is looking for a quality diversified index fund. Both are among the largest and most prominent ETFs in the country, both are highly liquid, and they have very similar track records. They also have the same low fee of 0.03%.

Your choice will be based on what you are looking for in an investment.

- VTI is giving some exposure to companies with a smaller market capitalization. This gives a slightly different profile when looking at the sector basis, giving more importance to the industrial and consumer sectors.

- VOO is a more aggressive, less diversified fund focused on major tech companies. This gives it greater potential for gains in bull market periods but also opens up the possibility of significant losses in a bear market.

How you see the markets makes a difference: if you think markets are going to keep favoring large caps, then you will prefer an index focused solely on them. If you believe that smaller companies might be able to outperform, you will prefer an index able to rebalance toward them and increase their weight into the index while their market capitalization grows.

If you are weighing VTI vs VOO and you’re having trouble making up your mind, consider allocating a portion of your portfolio to each fund. Keeping several ETFs in your portfolio can provide the best of both worlds.