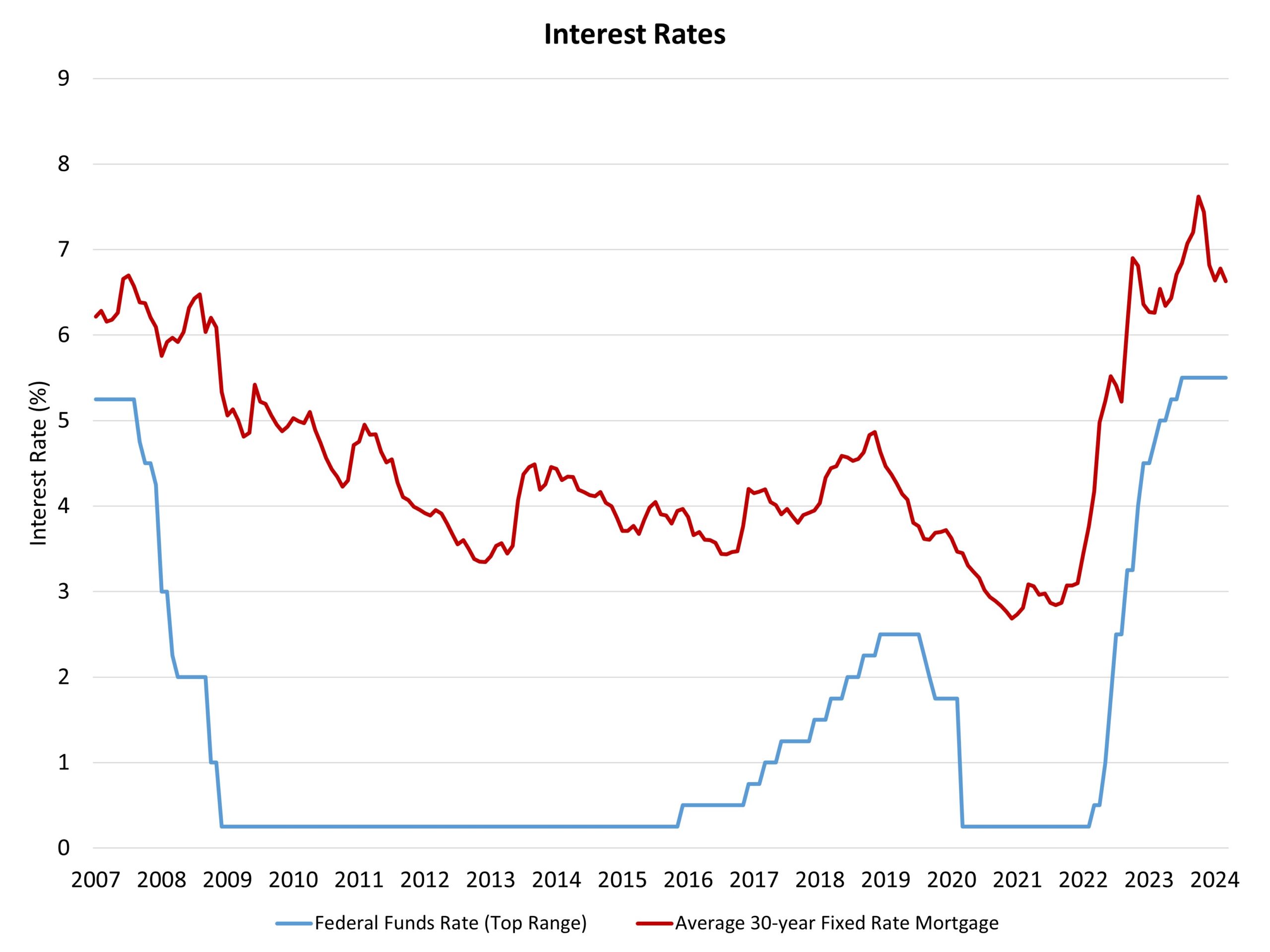

The Federal Reserve’s monetary policy committee held the federal funds rate constant at a top target of 5.5% at the conclusion of its March meeting. The Fed will continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities as part of quantitative tightening and balance sheet normalization. Marking a fifth consecutive meeting holding the federal funds rate constant, the Fed continues to set the ground for rate cuts later in 2024.

With inflation data moderating (albeit at a slower pace) and economic growth coming in better than forecast, the Fed’s future expectations for rate cuts stands at three (25 basis point cuts) in the central bank’s forecast for 2024. NAHB’s forecast continues to call for just two rate cuts during the second half of 2024 due to lingering inflation pressure and solid GDP growth conditions. Nonetheless, an ultimately lower federal funds rate will reduce the cost of builder and developer loans and help moderate mortgage rates headed into 2025.

The Fed made several upgrades to its economic outlook for the March report. The forecast for 2024 GDP growth increased from 1.4% to 2.1%. The Fed also increased its more theoretical long-run growth estimate for the economy from 2.5% to 2.6%. This suggests that the economy is more capable than previously estimated of handling higher interest rates in the years ahead (this is a measure of the so-called “neutral rate”).

All in, there was not a lot new for the March decision reporting. Markets and forecasters expected no change for Fed policy today. And equity and bond markets had already priced in expectations of stronger than expected growth via higher stock prices and a 10-year Treasury rate holding near 4.3%, a gain of more than 30 basis points since the start of the year despite forecasts for gradual declines by the end of 2024.

The NAHB Economics team’s focus continues to be on the interplay between Fed monetary policy and the shelter/housing inflation component of overall inflation. With more than half of the overall gains for consumer inflation due to shelter over the last year, increasing attainable housing supply is a key anti-inflationary strategy, one that is complicated by higher short-term rates, which increase builder financing costs and hinder home construction activity. For these reasons, policy action in other areas, such as zoning reform and streamlining permitting, can be important ways for other elements of the government to fight inflation.