After examining trends in single-family permits, we now turn our attention to multifamily permits to continue our exploration of correlations in housing permit data. Using multifamily permits from 2012-2022, five-year and ten-year correlations are used to create an association index for each Metropolitan Statistical Area (MSA) that describes how similar, or dissimilar, particular MSAs are when compared to the national trend.

NAHB’s purpose in developing this set of statistics, which will be updated annually, is to give local industry leaders a measure to describe whether their local market typically matches overall macroeconomic trends. As a set of statistics, the MAI provides forecasters with another variable to scale and distribute local market forecasts for home building.

The Market Association Index (MAI) is created by using the average of the five-year correlation and ten-year correlations between the U.S. multifamily permit level and the respective MSA’s level. With this method, the five-year trend is weighted more than the ten-year trend because the five years overlap within both variables. The MAI correlation coefficient that is calculated for both intervals can range from a negative one to a positive one and measures the strength of the linear relationship between the U.S. and the respective MSA. A correlation coefficient of -1 would mean there is a perfect inverse linear relationship between the two geographies, while +1 represents a perfect positive linear relationship. A 0 would indicate there is no linear relationship.

After taking the average of the five- and ten-year correlations, the MSA percentile rank of correlation is calculated amongst all MSA. This way, the MAI provides simple reading of which metro areas have multifamily home building trends that look the most like national dynamics in terms of growth and contraction.

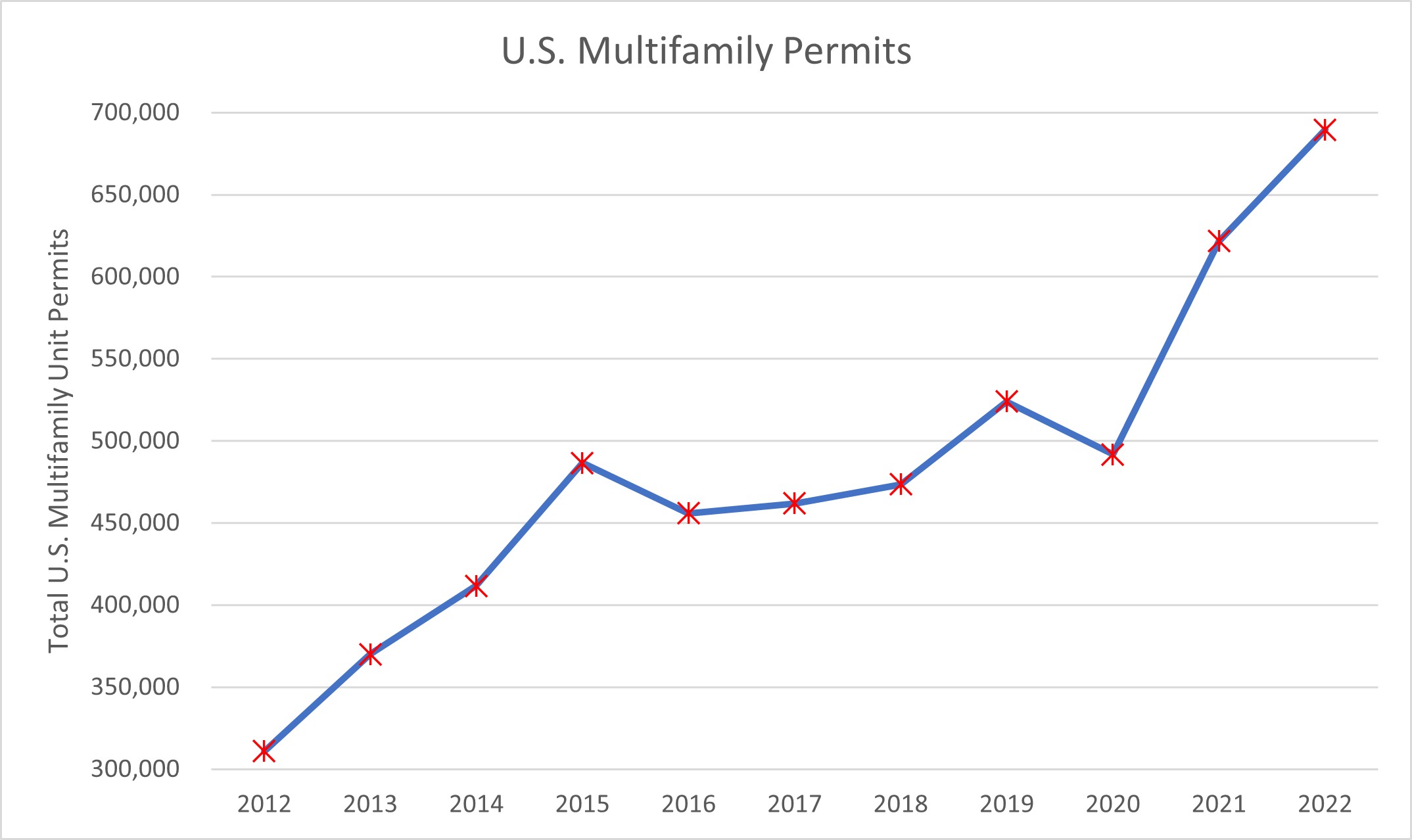

The national data above shows the total number of units permitted in multifamily structures since 2012. Prior to 2021, multifamily permit levels were well below 550,000 units but had been trending upwards since 2012 following the Great Recession. In 2012, the U.S. authorized 310,963 permits. Ten years later, the level increased to 689,504 units authorized, a 122% increase over the period. The compound annual growth rate in the number of multifamily permits for this ten-year span was 8.3% per year.

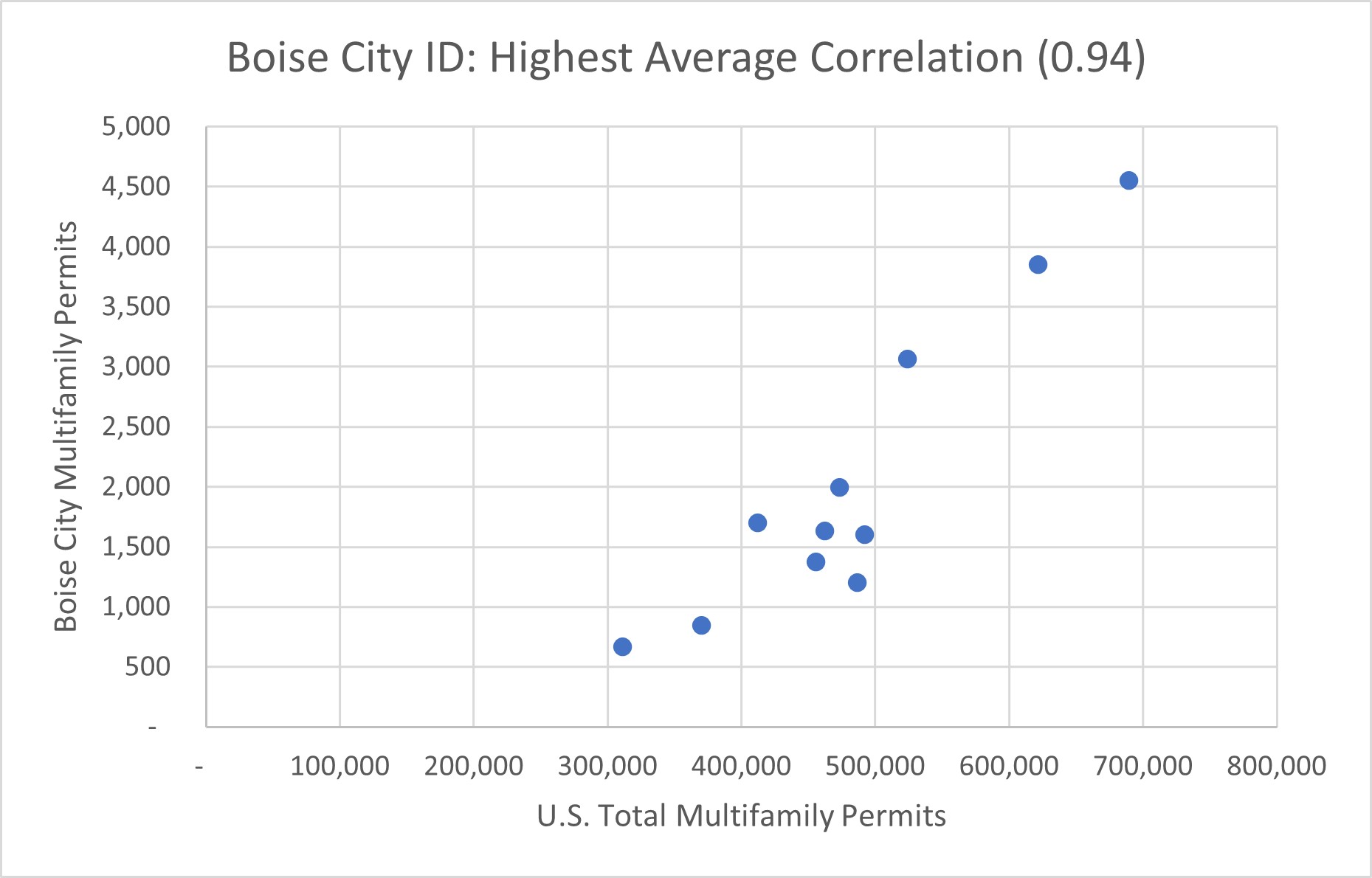

The scatter plots above illustrate MSAs on opposite ends of the distribution of correlations, where Boise City, Idaho has the highest degree of association with the national trend while Grand Forks, North Dakota-Minnesota had the most negative correlation with respect to the national trend . Whereas all MSAs reported single-family permits, not all MSAs registered multifamily permit activity between 2012 and 2022 . The MSAs that did not report any multifamily permits were: Columbus, Indiana; Gettysburg, Pennsylvania; Midland, Texas; Rocky Mount, North Carolina and Shreveport-Bossier City, Louisiana.

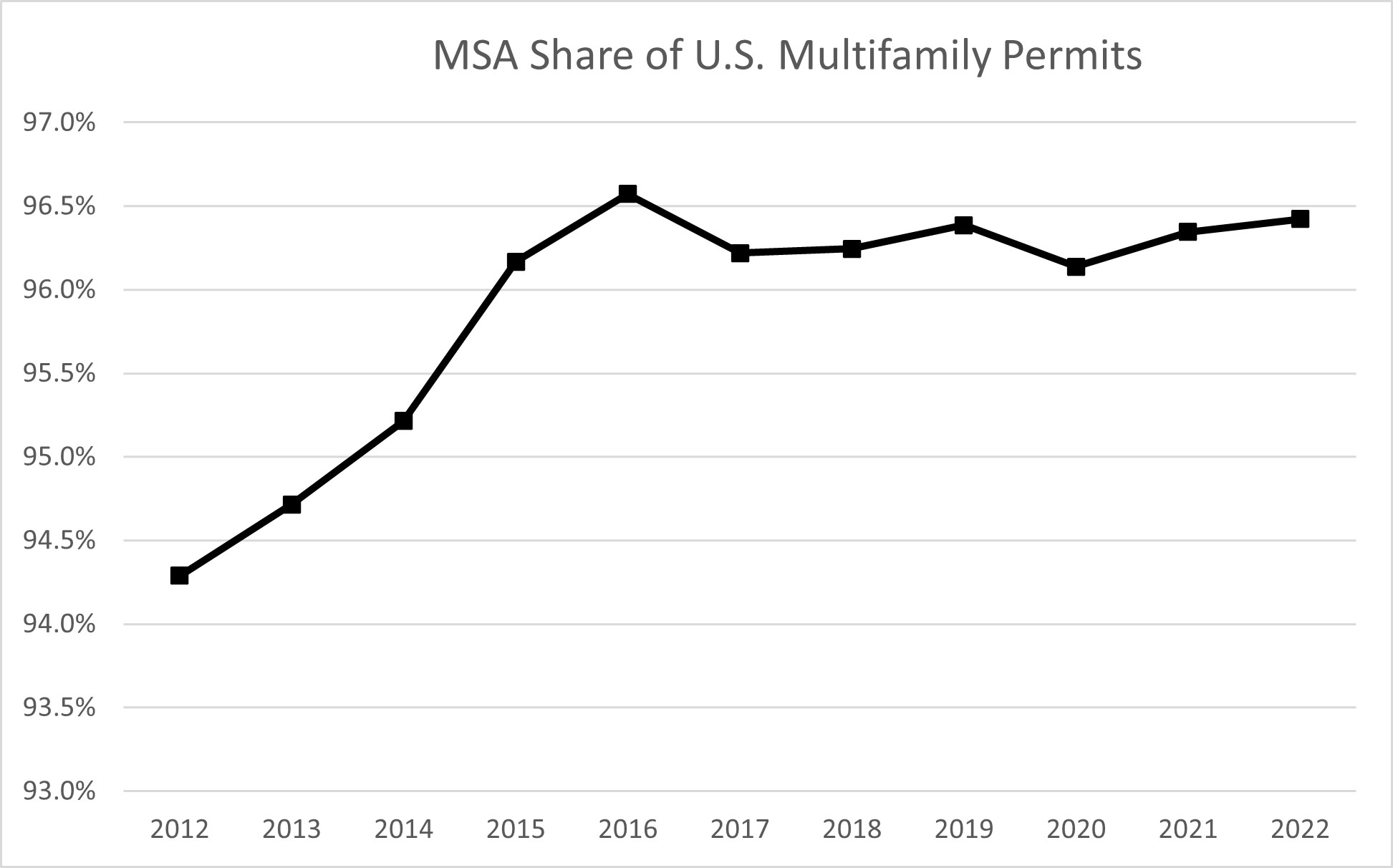

For additional comparison to the highest and lowest associated MSA, the average correlation for Charlottesville, Virginia was zero, with the graph above showing no linear relationship between the two variables. Of the 378 metro areas that reported multifamily permits, the average correlation was 0.25. In total, 262 MSAs had a positive correlation and 116 MSAs had negative correlation. MSA’s market share of total U.S. permits has risen since 2012 and hovered right between 96.0% and 96.5%. This in part explains why the average correlation is positive for the MSAs as they constitute an overwhelming majority of the multifamily permits in the U.S.

The map below displays the percentile rank of each MSA. Hovering over a particular MSA will display its percentile rank.

The ten highest ranked MSAs trending to the national level are below.

The ten lowest association index MSAs which are least likely to follow the national trend are below.

Find the full file of single-family and multifamily MAI scores here.