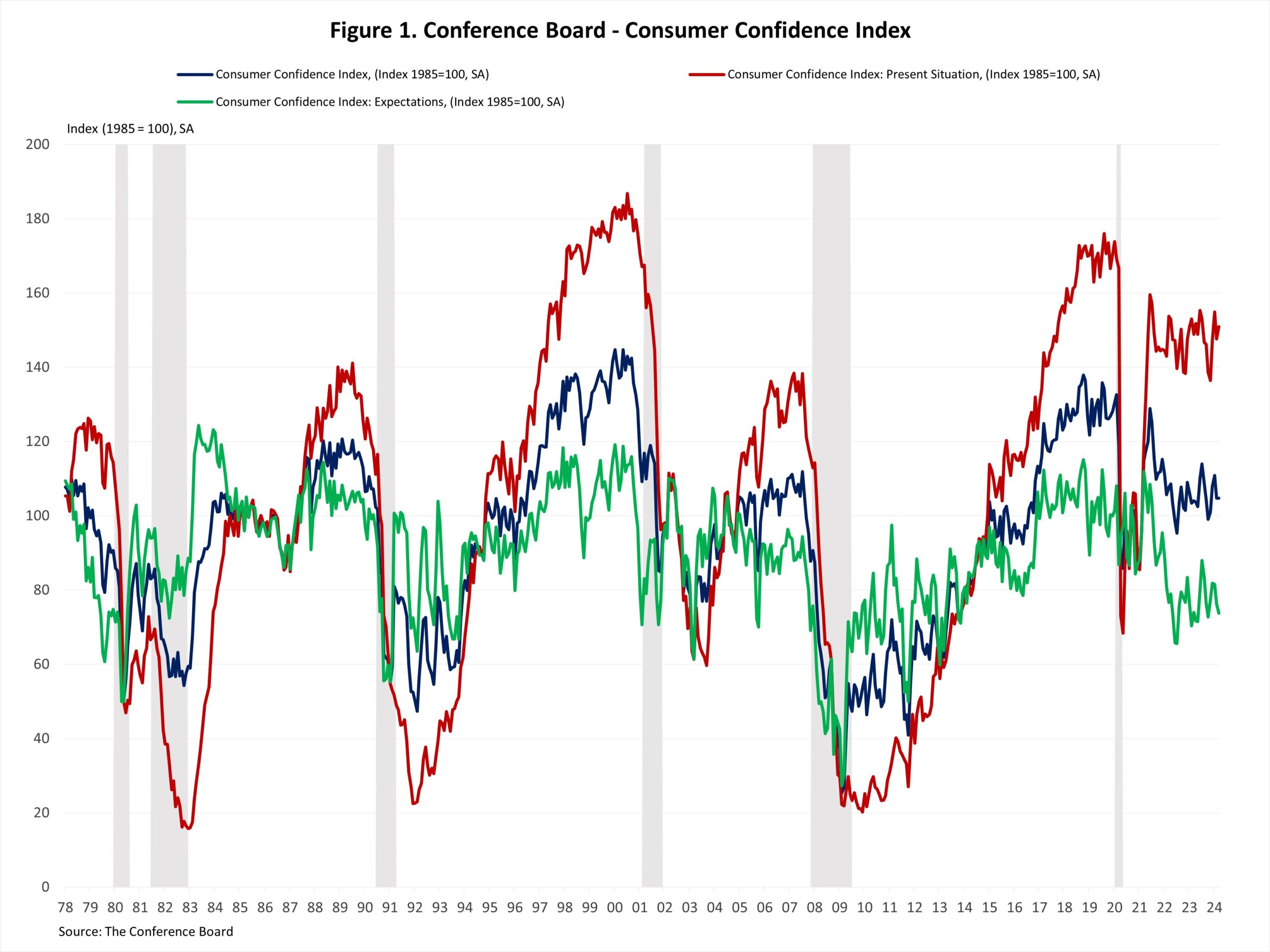

Consumer confidence held steady in March, with optimism about current conditions offset by concerns about the future economic outlook. This pessimism was primarily driven by persistent inflation, especially elevated food and gas prices.

The Consumer Confidence Index, reported by the Conference Board, stood virtually unchanged at 104.7 in March, the lowest level since November 2023. The Present Situation Index rose 3.4 points from 147.6 to 151.0, while the Expectation Situation Index fell 2.5 points from 76.3 to 73.8. Historically, an Expectation Index reading below 80 often signals a recession within a year.

Consumers’ assessment of current business conditions fell slightly in March. The share of respondents rating business conditions as “good” decreased by 0.9 percentage points to 19.5%, but those claiming business conditions as “bad” also fell by 0.5 percentage points to 17.2%. Meanwhile, consumers’ assessments of the labor market were more positive. The share of respondents reporting that jobs were “plentiful” increased by 0.3 percentage points, while those who saw jobs as “hard to get” fell by 1.8 percentage points.

Consumers were more pessimistic about the short-term outlook. While the share of respondents expecting business conditions to improve rose from 14.0% to 14.3%, those expecting business conditions to deteriorate increased from 16.9% to 17.6%. Similarly, expectations of employment over the next six months were less favorable; The share of respondents expecting “more jobs” decreased by 0.2 percentage points to 13.9%, and those anticipating “fewer jobs” increased by 0.7 percentage points to 18.2%.

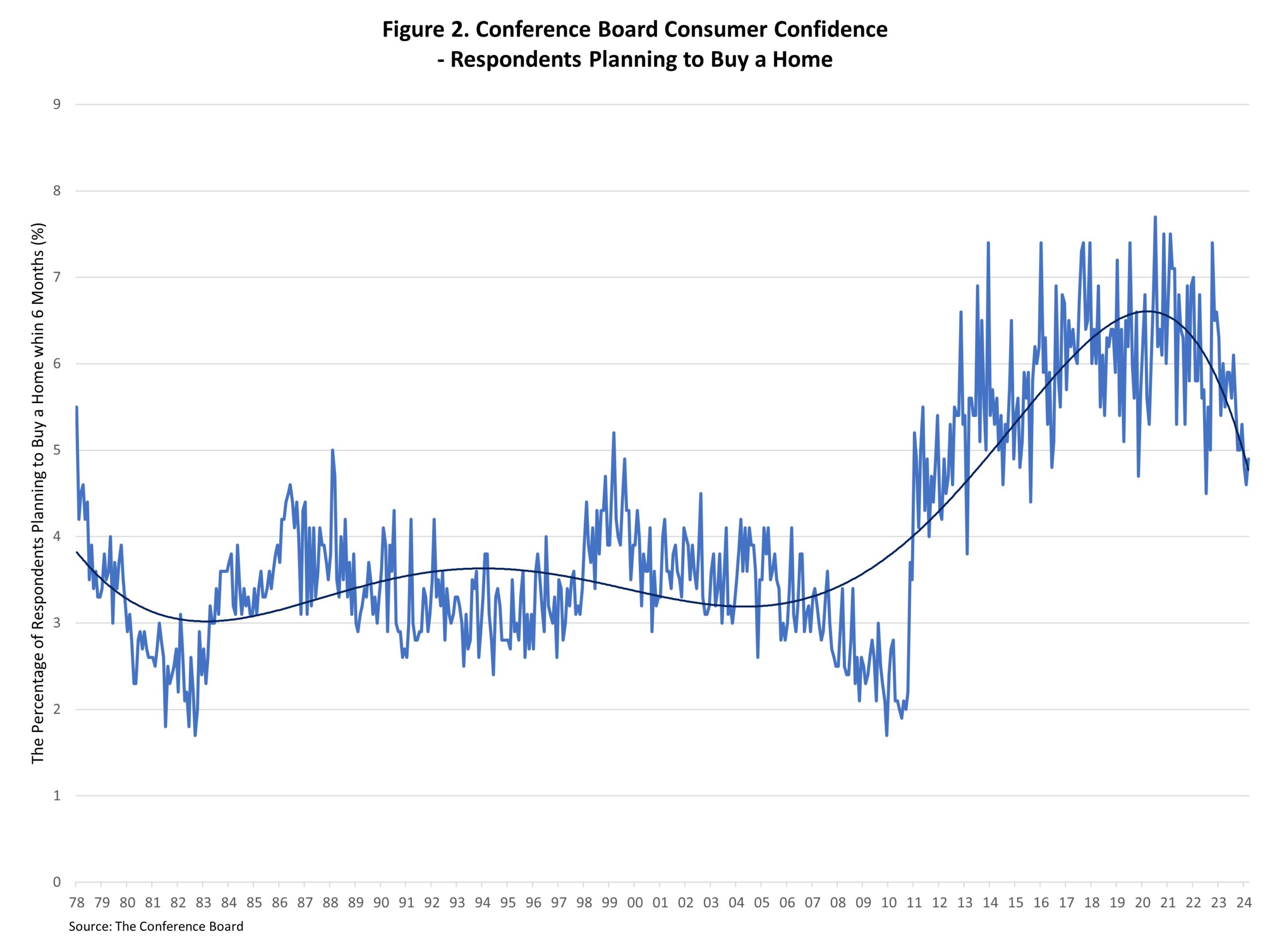

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home increased to 4.9% in March. Of those, respondents planning to buy a newly constructed home remained at 0.3%, and those planning to buy an existing home climbed to 2%.