NAHB and the Dodge Construction Network published research on the prevalence of green building in The Building Sustainably: Green & Resilient Single- Family Homes 2024 SmartMarket Brief. The research found that the overall share of home builders classifying more than half their projects as green* is at 34% for 2023 a one-percentage point increase from 2019. Similarly, for remodelers, this figure stands at 22%, a five-percentage point increase from 2019. This post will further examine these statistics, as well as delve into the drivers and obstacles for green building.

Level of Engagement

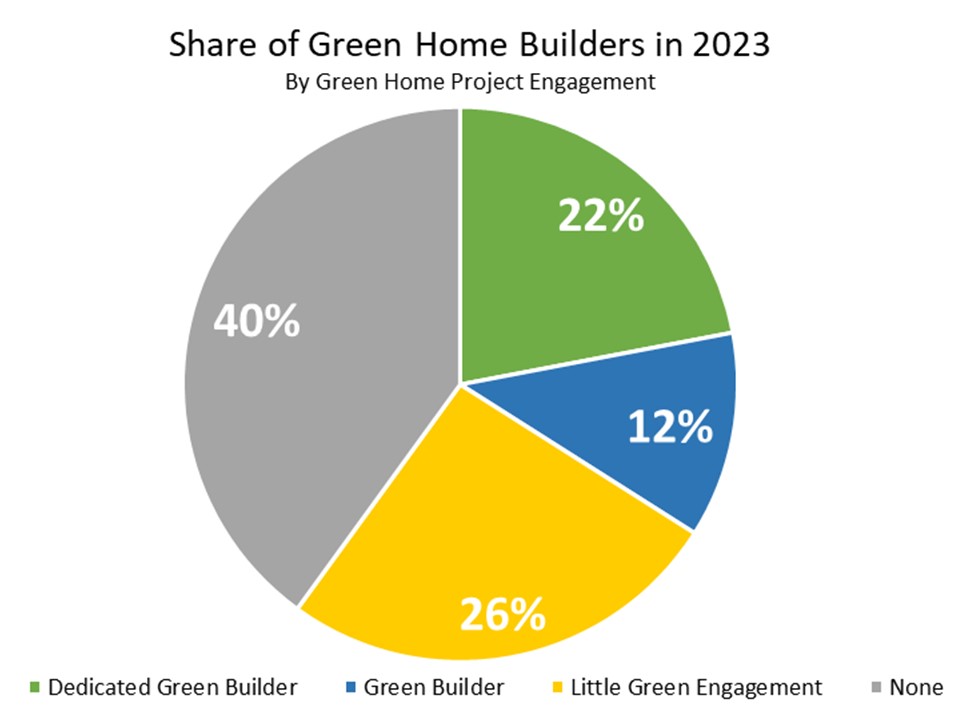

To further dissect the share of builders and remodelers involved with green projects, see the charts below. As shown, the largest proportion for both builders and remodelers are those with “no green engagement”. However, these numbers have diminished since the 2019 report, decreasing two percentage points for builders and seven percentage points for remodelers. Following those with no green engagement, are those with “little green engagement” (1-50% green projects). For builders, the next highest share is “dedicated green builders” (more than 90% green projects), and then “green builders” (51-90% green projects). The opposite is true for remodelers with the least prevalent share being dedicated green builders.

When looking at dedicated green builders, we see regional differences as well. Based on new home builder respondents, the region with the highest share is the Northeast at 45%. Followed by the West at 28%, the Midwest at 22%, with the South at 16%.

Motivations

Respondents who have done green projects were asked to pick the most important reasons for doing so. The top reason at 48% was “The Right Thing to Do”, followed by the closely aligned “Creating Healthier Homes” at 38%. This demonstrates many builders’ intent to create efficient, resilient and environmentally friendly housing, whether it is considered green or not. Other reasons listed include: “Code Requirements” (36%) “Reputation in Industry” (30%), “Differentiate Product in Local Market” (23%), “Market Demand” (18%), and “Tax Credits or Government Incentives” (16%).

Obstacles

Respondents were also asked the top obstacles for them to not undertake green projects. The top answer at 77% was “Lack of Customer Demand”. This is unsurprising with “Market Demand” being listed almost last for reasons to build green. “Too Expensive” was the second reason at 53%. All other reasons fell below 20% of respondents.

Costs

Delving into the expense of building green, respondents were asked about the cost premium to build green. Across the board, remodelers found green building to be more expensive. The highest percent of remodelers (36%) and builders (38%) were those that found green building to be between 11-20% more costly. The next highest for remodelers (28%) were those that found the cost premium to be more than 20%, while the second highest for builders were those the cost premium under 10%. The other categories are shown in the chart below.

more green engagement found the cost margin to be lower than those who did fewer green homes. Nearly half (45%) of dedicated green builders found that the added cost of building green is 10% or less. This is in contrast to only 25% of green builders, and 16% of low green engagement builders who listed the added cost as less than 10%. This may suggest that dedication to green building is needed to result in sufficient expertise and economies of scale to lower the cost of building green.

Looking forward, this post will be followed by a series of analyses that further examine the The Building Sustainably: Green & Resilient Single- Family Homes 2024 SmartMarket Brief.

*A green home incorporates strategies in design and construction that improve energy, water and resource efficiency, indoor environmental quality, and minimize environmental impacts on the site; and/or is certified by a third party to the National Green Building Standard, LEED for Homes, or any other green rating system or high-performance standard.