Nothing truly occurs in a vacuum.

All events have preceding factors, with many prior elements bubbling below the surface, most of which you didn’t even know existed. Unintended consequences of this action here will result in over there. If the flapping of a Butterfly’s wings can be felt halfway around the world, imagine the impact of the largest central bank intervention and emergency government fiscal program in the modern era.

People prefer definitive, clear answers about big issues, but the economy and markets are and will always be much more complex than that. We may prefer simple yes or no, black-and-white, binary analyses, but all that oversimplification does is confirm your priors. To get a deeper understanding of what is happening at any moment calls for nuance, allows for multiple causation of events, and accepts just how much uncertainty there is over what the future may bring.

I find it useful to engage in a thought experiment: List all of the factors that might be contributing to any particular event; I have done this with the dotcom implosion, 9/11, the great financial crisis, externalities, the pandemic economy, 2020s inflation, and other major dislocations, and find it to be helpful to my thought process.

The current state of events, so confusing to so many, has many sires. My top 10 of how we got to our current state looks something like this:

1. Great Financial Crisis: There were many results of the GFC, but a few stand out as especially important: A massive Monetary Policy response from the Federal Reserve, which itself was caused (in part) by the punk Fiscal Policy response from Congress. This led to a fairly typical post-credit crisis recovery: Weak GDP, subpar job creation, lagging wages, and soft consumer spending.

2. ZIRP/QE wasn’t all bad: Stocks had their best decade in a generation, bonds rallied as well, and everything priced in dollars and credit did well. The world was awash in capital, and if you had any to invest, you did great, but if all you had was your labor, you fell badly behind.

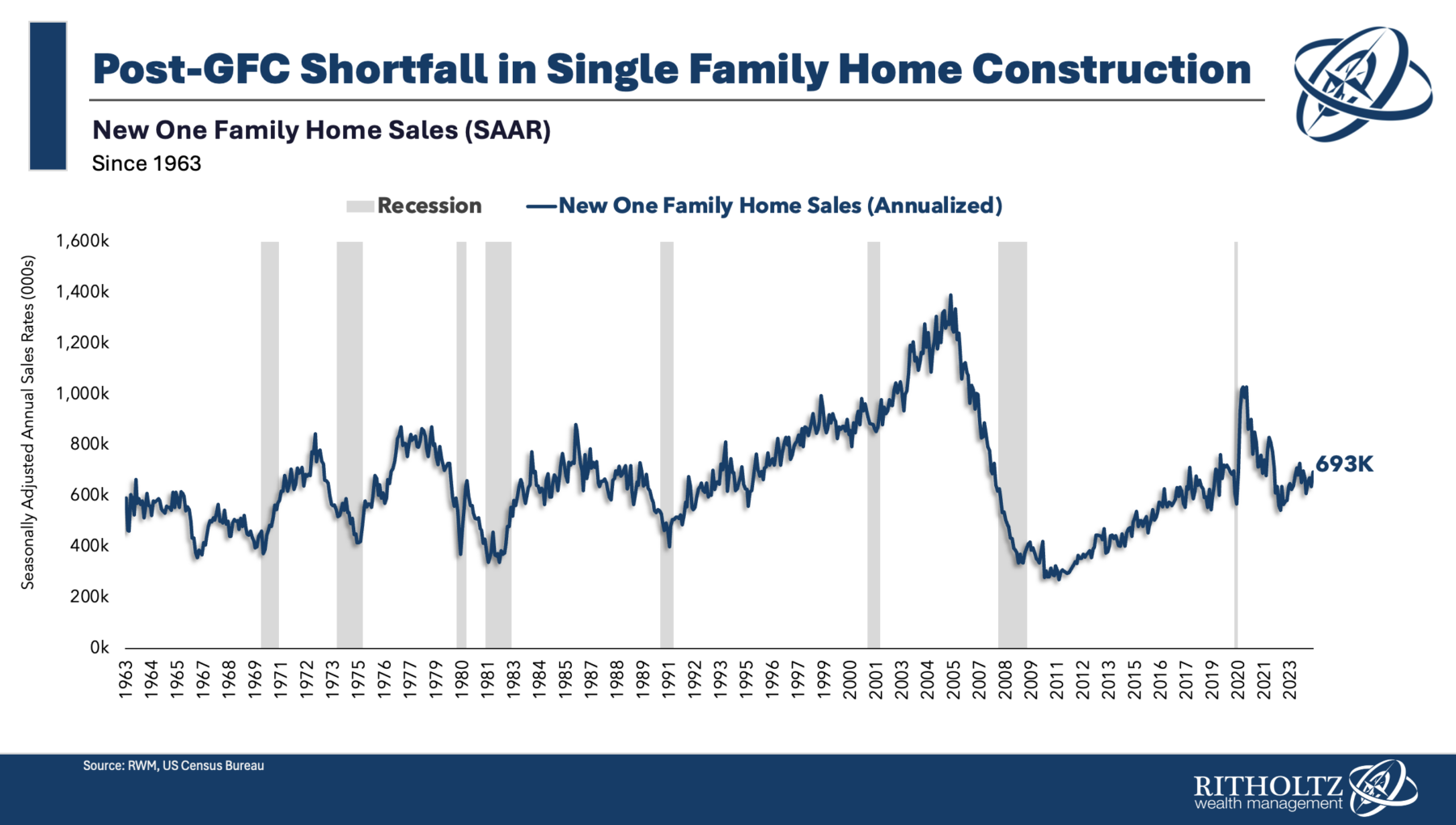

3. Home Builders pivot to multi-family: The GFC devastated the graduating classes in the late 2000s and even early 2010s. Jobs were harder to find, and they paid less. Household formation fell dramatically, and we heard endless tales of adult children living in their parent’s basements. Single-family home construction peaked in 2005-06 and then fell 80% to its nadir in 2010. It climbed slowly back to its prior average over the next decade. The result was a nation short of 2-4 million homes.

4. Wealth Inequality widened over the 2010s. When the main policy response to any crisis is Fed-driven, the focus is on capital, markets, and liquidity. (This has very specific beneficiaries). The rescue of banks but not the public and the widening of wealth/income inequality gave rise to political popularism, declining trust in institutions, and a drop off in optimism & sentiment.

5. Pandemic. Into this complex brew comes the pandemic. The infection and death count soared, and we were terrified into washing our groceries. In times of Emergencies, governments are often presented with two options: Bad or Worse. The right choice was made to throw lots of cash at the problem: Giant increase in unemployment payments and lots of money into Operation Warp Speed to create a vaccine.2

For the economy, the “Bad or Worse” choice was surging inflation (bad) or massive unemployment (worse).

6. Labor Shortage: Lots of factors contributed to the current shortfall of workers: Huge decreases in legal immigration, a spike in disability, and way too many Covid-related deaths. But overlooked is the impact of people who were locked up at home with nothing to do, but with cash in their bank accounts. A lot rose to the occasion to change careers, launch new businesses,(new business formation were near record-breaking pace) capitalize on their newfound skills, and pursue a better life for themselves.

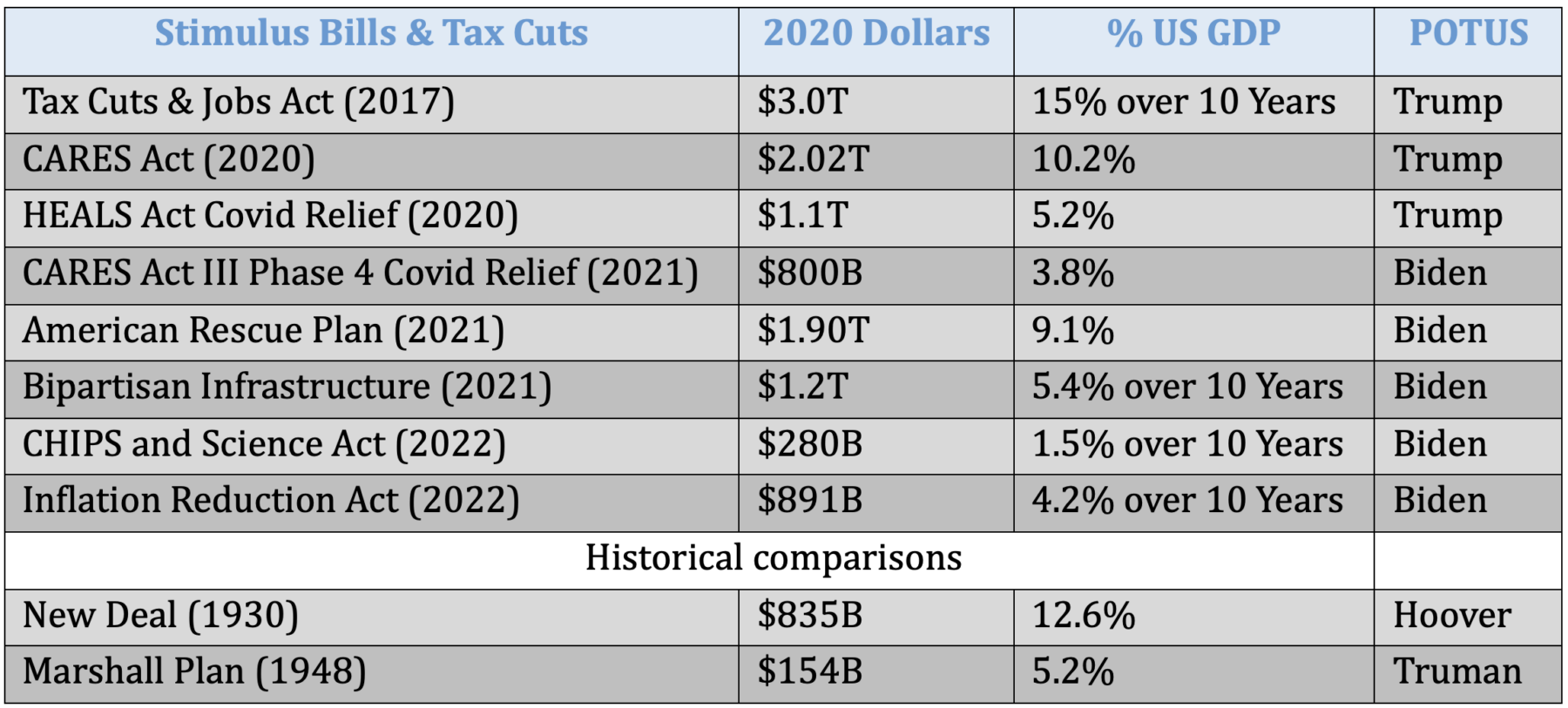

7. Regime Change: CARES Act 1 (2020) at $2T and 10% of GDP was the largest fiscal stimulus since WW2. It was followed by CARES Act 2 ($800B), and then (Under President Biden) CARES Act 3 ($1.7T) ). The nearly $5 trillion in fiscal stimulus and the rise from 0 to 5.25% in Fed funds rate signaled that the era of monetary stimulus was over, replaced by a new regime of fiscal stimulus.

7. Regime Change: CARES Act 1 (2020) at $2T and 10% of GDP was the largest fiscal stimulus since WW2. It was followed by CARES Act 2 ($800B), and then (Under President Biden) CARES Act 3 ($1.7T) ). The nearly $5 trillion in fiscal stimulus and the rise from 0 to 5.25% in Fed funds rate signaled that the era of monetary stimulus was over, replaced by a new regime of fiscal stimulus.

8. Inflation Surges: A few people (notably Wharton’s Jeremy Siegel and Ed Yardeni) warned that the fiscal stimulus would lead to a giant (albeit transitory) surge in inflation. The Fed was late to recognize this, late to raise rates, late to see the peak in inflation, and late to begin lowering rate. (This is normal).

Wages and inflation both run up; CPI rises 20% since the pandemic; Wages add 22%. The consumer continues to spend.

9. Inflation Peaks and Falls (but the Fed is late to recognize this). PCE falls to 3ish percent year over year, as does CPI. Target cuts prices on 5,000 items; McDonald’s brings back the $5 meal deal.

10. Lagging Housing Data: Shelter is artificially keeps CPI in the 3s; its 40% of the inflation measure, but the BLS model is badly behind current measures.

This is how we got here; there are lots more nuances and issues, but its hard to understand today if you do not have a firm grasp of history…

Previously:

Who is to Blame, 1-25 ( June 29, 2009)

End of the Secular Bull? Not So Fast (April 3, 2020)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Elvis (Your Waiter) Has Left the Building (July 9, 2021)

How Everybody Miscalculated Housing Demand (July 29, 2021)

Revisiting Peak Inflation (June 29, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Which is Worse: Inflation or Unemployment? (November 21, 2022)

Why Aren’t There Enough Workers? (December 9, 2022)

The Least Bad Choice (September 28, 2023)

Understanding Investing Regime Change (October 25, 2023)

Wages & Inflation Since COVID-19 (April 29, 2024)

Why the FED Should Be Already Cutting (May 2, 2024)

__________

1. We can go further back to the dotcom implosion or LTCM or the 1987 crash, but to keep the length of our discussion modest, I will only go back 15 or so years to the GFC.

2. Operation Warp Sped was the most successful program of the Trump administration. THey mostly bungled the rest of the pandemic, at first not taking it seriously and by the time they did, we were deeply behind, short of essential products. I have yet to see any good explanation as to why the Emergency Defense Act was not used for PPE and other essentials.