I have friends who use their credit cards abroad for their travel spending, with zero clue about the extra fees and charges they’re being made to pay. Instead, they’re happy about the “upsized” miles they’re earning – “my card gives me 2.2 mpd overseas, Dawn!”

If you’ve ever used your credit card to pay for your foreign currency transactions (this includes online payments with overseas merchants), did you know that there’s a whole list of fees that you might have unwittingly paid for?

Let’s talk about the fees

Fees and charges related to FCY transactions include:

- Dynamic Currency Conversions (DCC): 3%-4%

- FX conversion fees: 3% – 3.5%

- Cross-border SGD fees: 1%

PSA: all of your FCY transactions are subjected to a 3% – 3.5% fee by your bank or card network.

Your bank’s FCY conversion fees

| Issuer | Mastercard & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Dynamic Currency Conversion(s) fees

If you’ve ever paid any overseas merchant in SGD instead of the merchant’s local currency, guess what? You might be victim of the Dynamic Currency Conversions (DCC) fees too, which many label as a scam. This is a common way for merchants to earn additional money from unsuspecting customers, since it psychologically feels better for the customer to pay in their own currency rather than a foreign one. I’ve got my buddy Aaron from the Milelion to thank for shedding the light on sneaky DCC fees.

Did you know? Dynamic Currency Conversion (DCC) is a service offered by payment solution providers which allows consumers to pay in their local currency when using their credit cards overseas.The catch? Your currency conversion is done at a rate that is mostly unfavourable to you, and helps generate additional revenue spread which gets split between the merchant and the payment solution provider.

You can read Visa’s advisory on DCC here, and thanks to Aaron, I’ve learned that if anyone wants to try disputing the charge with their bank, you can quote the relevant chargeback codes:

- Visa: Reason Code 76 – Cardholder was not advised that Dynamic Currency Conversion (DCC) would occur. Cardholder was refused the choice of paying in the merchant’s local currency

- Mastercard: Reason Code 4846 – The cardholder states that he or she was not given the opportunity to choose the desired currency in which the transactions was completed or did not agree to the currency of the transaction

FYI, this happens more often than you think. You may have encountered it if a merchant bothered to ask you which currency you prefer to pay in, but a lot of them don’t – instead, most will automatically choose the DCC option for you, without your consent.

Even if you think you’ve been spared from DCC practices, don’t celebrate so soon. Even overseas merchants like iHerb, Google Play Store, Apple App Store and AirBnB can impose DCC on you when you book online with them, as they automatically convert foreign transactions into the currency of your credit card! Some folks have called out this as a scam, but guess what? You don’t have a say.

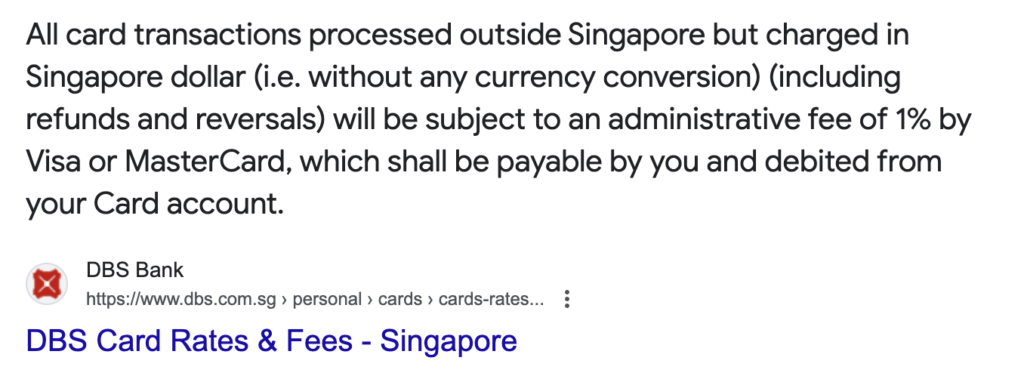

Cross-border administrative fee

While it may sound like a good idea to know how much you’re paying in SGD exactly, anecdotal observations have noted that the converted amount often comes with an average mark-up of at least 3%, if not more. What’s worse is that each time you pay in SGD abroad, most Singapore banks also levy a cross-border fee of about 1% of your transaction cost.

In total, you’ll easily be paying about 4 – 5% in charges in total just for that psychological comfort that comes with paying in SGD.

I’ve compiled a list of credit cards that give the highest earn rates on FCY spend and are popular among many travellers.

But there’s a catch. If you see the part I’ve highlighted in yellow, you’ll notice that all these miles (or 8% cashback) comes with hefty bank FCY fees.

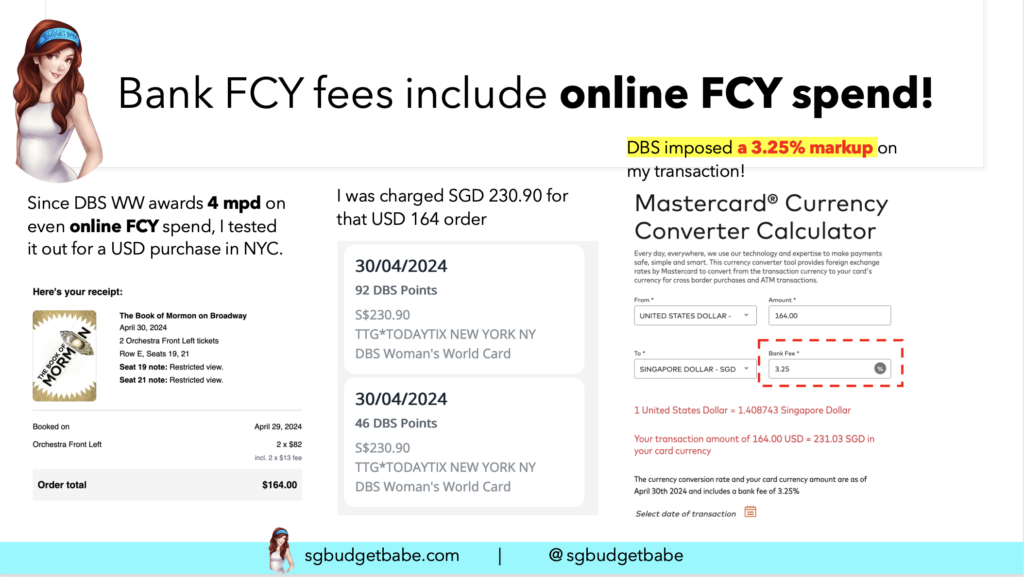

To gather the evidence for this, I deliberately tested this with my best online miles card – DBS Woman’s World, 4 mpd – to check when I was in New York last month catching a Broadway Show.

You can see that DBS charged me SGD 230.90 for my USD 164 purchase, which confirms the ~3.25% bank FCY fee levied on top of my transaction.

Prior to this, I brought my DBS Vantage Card on all my overseas trips with me because I was attracted by the bank’s ads to earn 2.2 mpd on my FCY spend abroad. After I realised this, I took my DBS Vantage out of my overseas wallet for good.

This begs the question:

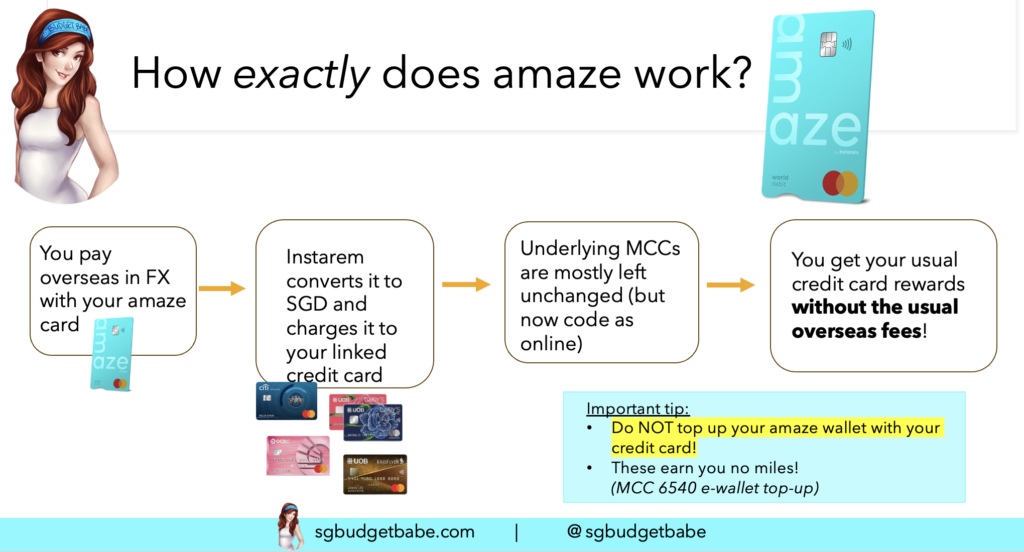

Why pay bank FCY fees to get miles when there’s amaze?

Knowing there’s a workaround for me to get 4 mpd and bypass the high(er) bank fees, why should I settle for 2.2 mpd AND pay DCC or lousy FX fees by swiping my actual credit card at all?

I’ve raved about the amaze card since 2019 and till date, it remains my top choice for an overseas card. Each time I fly or even drive into JB, I tap my amaze card everywhere I go.

And because I was sharing about this amaze hack on my Instagram during my recent Korea trip, I had some skeptics who didn’t believe that amaze was really better…so I went to get evidence again.

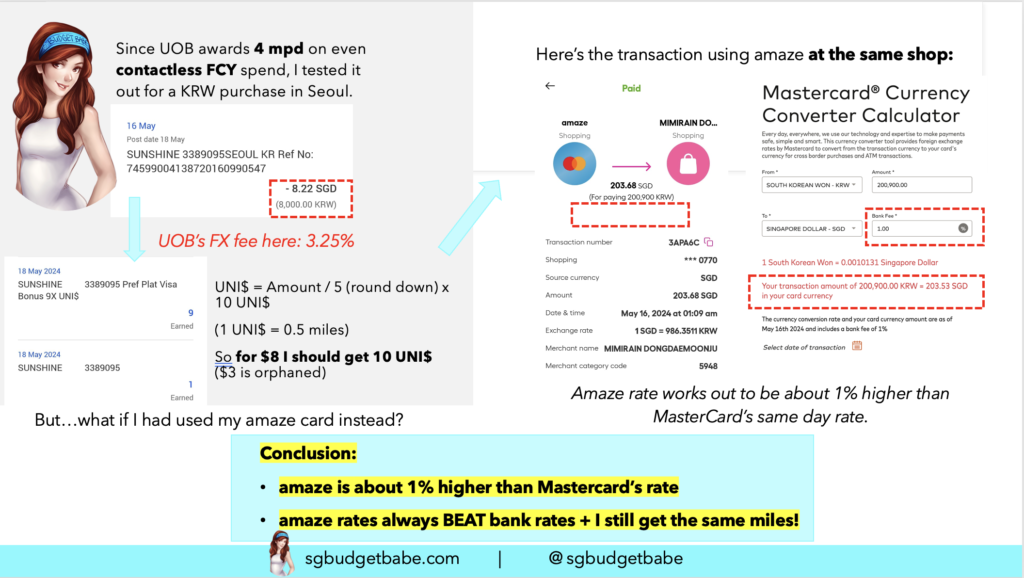

Below you’ll see 2 transactions at the same shop in Korea, where the fees work out to be:

- Paying direct with my UOB card = 3.25% bank FCY fees

- Paying via amaze = 1% above Mastercard’s rate

I don’t know about you, but I’d much rather pay 1% than 3.25% to get the same reward of 4 mpd.

Budget Babe

How does amaze compare to YouTrip?

I’ve lost count of how many people DM-ed to ask me whether amaze is better than YouTrip. If you’re wondering that too, you’re comparing it wrong because both cards are good for serving different purposes

With multi-currency wallet cards like YouTrip or Revolut, their fundamental purpose is to reduce the cost of your FCY transaction as much as possible. The mechanics therefore involve you converting currencies as you go, which also means many travellers deal with leftover foreign currencies at the end of their trip that they have to convert back – at a different day’s rate. You don’t earn any miles for a single dollar of your spend on YouTrip, Revolut or even Wise.

With amaze, the idea is to let you earn rewards while paying less than a traditional credit card. And since no credit card offers the Google / XE / mid-market rates, your correct basis of comparison needs to be the Mastercard rates instead. My experience with amaze shows that the amaze’s rate is roughly about 1+% higher.

But Dawn, I want to pay the lowest rates AND get my miles!

Sure, I hear you. Unfortunately there’s no such solution in the market today, but what’s stopping you from inventing one? Let me know once you do, so I can shoutout on this blog about it too.

Hence, your choice boils down to choosing one of the following options. Would you rather

- Pay the bank’s 3.25 – 3.5% FCY fees and get their FCY miles earn rate (usually 2+ mpd)? or

- Pay via amaze (1+% higher than Mastercard) and get local SGD miles earn rate? or

- Pay via YouTrip / Revolut / Wise and get zero miles (for both topping up the wallet and for spending)?

Personally, I use amaze as my primary mode of payment overseas, but also keep a multi-currency wallet option like YouTrip / Revolut / Wise handy as backup – that’s for all the times when I may need to withdraw cash abroad because certain places (e.g. street vendors) don’t accept card payments.

Don’t forget, amaze also awards InstaPoints (IP) each time you transact with them, which work almost as cashback:

- As of June 2024, users earn 0.5 IP for every S$1 (in FX equivalent)

- Max cap of 500 IP earned per month

- 2000 IP = $20 wallet credit

I can easily spend my InstaPoints wallet credits like cash, by simply changing the payment source for my amaze card to deducting it from the wallet instead of my linked credit card.

This is a bonus, although none of us who use amaze have typically counted in the cashback as a feature anyway. It is more of a bonus than anything else (ooh yay I have some extra money for free!).

With the max cap, this means you can only earn amaze cashback on a maximum of S$1,000 of your FCY expenses. There’s an easy workaround though – get 2 amaze cards if you’re travelling with a partner, and front-date your transactions for car rentals or activities, or essentially anything else you can pre-book ahead of going on your trip.

So if you’re spending huge dollars contributing to a foreign country’s economy while you’re away from home and spend anything north of those limits, then too bad, but hey, at least you’re still earning your credit card miles via amaze!

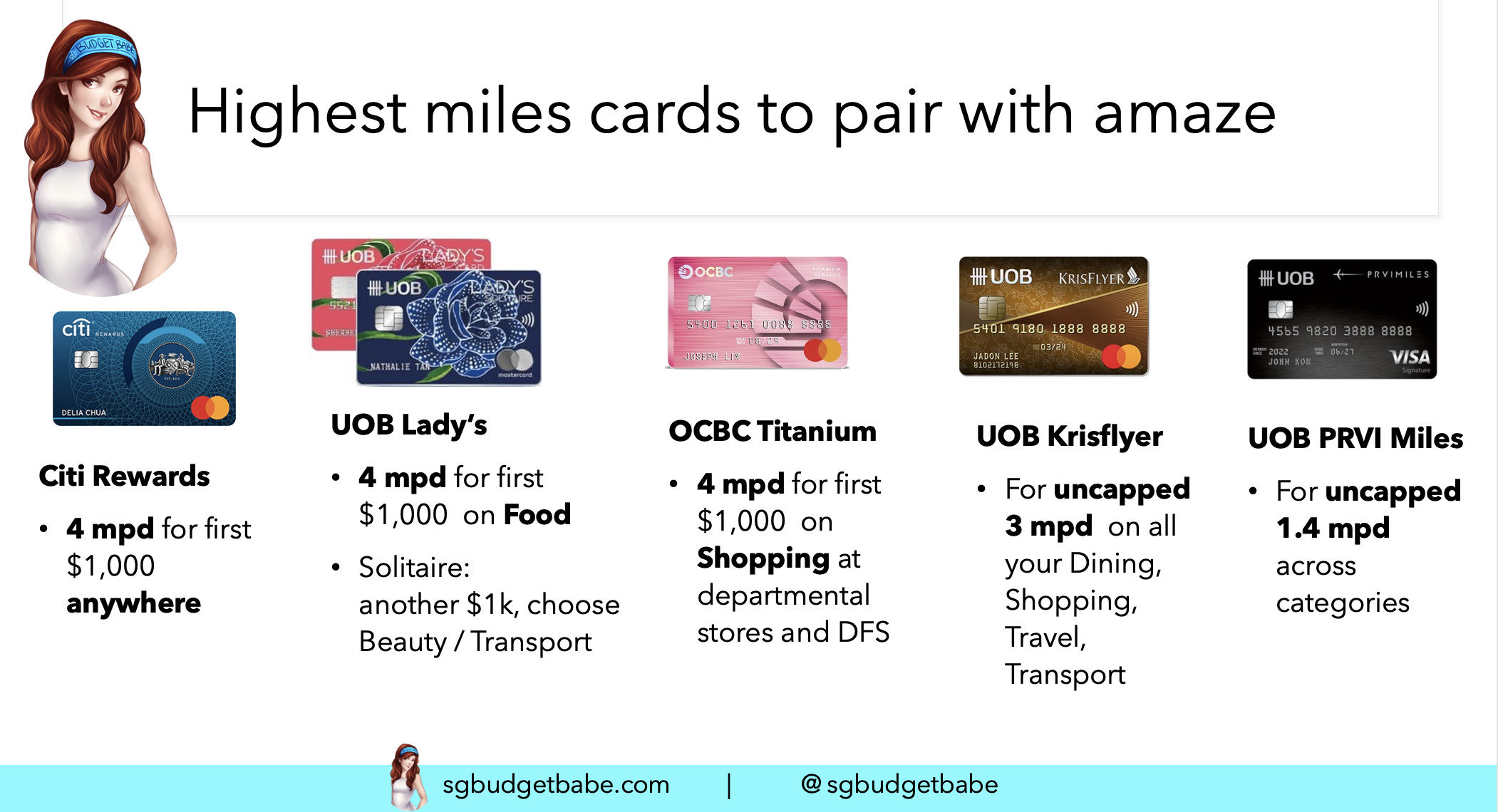

What cards can you use with Amaze?

As a reminder, Amaze can only be paired with credit cards on the Mastercard network and allows you to link up to 5 cards.

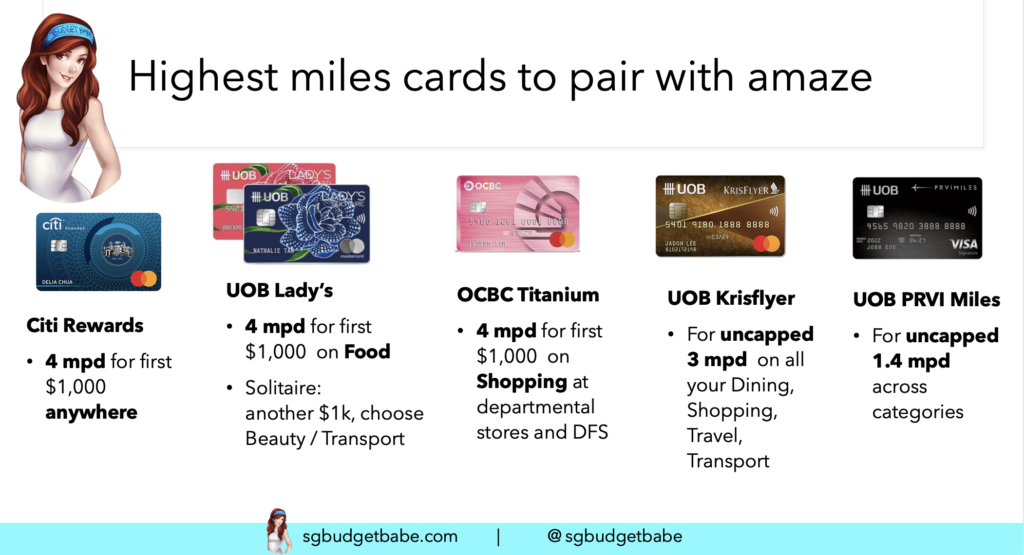

My recommendations are to:

- Use the Citi Rewards as your primary Amaze pairing, capped at S$1,000

- Use the UOB Lady’s Solitaire Card for dining and travel (the two categories we’re most likely to spend on when overseas) capped at S$2,000

- Use the OCBC Titanium Rewards for shopping, capped at S$1,100

- Once maxed out, switch to use UOB Krisflyer (uncapped) for dining, shopping, travel and transport

- Alternatively, switch to UOB PRVI Miles for 1.4 mpd (uncapped) and across more categories

Reminder: the UOB Krisflyer Card requires you to spend a minimum of S$800 on Singapore Airlines, Scoot, Kris+ or KrisShop within the year to be eligible for the upsized 3 mpd. If you fail to meet this requirement, you’ll only be getting 1.2 mpd.This requirement is fairly easy to get around – just charge your air tickets to the card, or taxes and surcharges on a KrisFlyer award redemption, or even paying for add-on services with Scoot like luggage, seat selection and meals. The accelerated Miles will be awarded on these transactions from the start of your membership year, not just from the time the minimum spend was met, so you can technically start spending on the card first before you clock your SIA Group $800 spend for the year.

But if you’re not a fan of waiting for UOB Krisflyer to post your accelerated miles (takes anywhere between 2 – 14 months), then the UOB PRVI Miles would be a better fit, albeit at a downsized 1.2 mpd.

These five cards should be more than enough to cover most of your overseas spending, though it definitely requires some switching back and forth on the amaze app to maximise it.

Conclusion: why I use my amaze card when I travel

I hope this article serves as a wake-up call for anyone who hasn’t been monitoring their card transactions and didn’t realise you’re actually being levied fees on all your FCY spend.

More importantly, I highly recommend that you get the amaze card for when you travel abroad – and I hope this post helps you understand the trade-offs you’re settling for when you choose any other option other than amaze.

If you prefer to convert at the lowest rates and earn no miles, or to pay your bank fees to earn the same (if not lesser) miles on your FCY spend, that’s cool.

I’m Budget Babe though, so I prefer to go for an option where I get to earn miles for the least fees.

Need a referral code for amaze? Use DAWNBB to get welcome InstaPoints that you can later convert into cash for spending on your amaze card.

If you found this guide useful, go ahead and share it with others!

With love,

Dawn