Bank FD Vs Debt Mutual Funds – Which is SAFE and BEST? When the returns and taxation of Debt mutual Funds are almost the same as FD, then why Debt Mutual Funds?

This is the typical inquiry I am likely to encounter following recent alterations in the taxation of Debt Mutual Funds. It is widely known that debt mutual funds are now taxed similarly to fixed deposits. However, the key distinction lies in the absence of TDS in Mutual Funds (excluding NRIs). In mutual funds, taxation will come into the picture when you are selling.

This article does not delve into the features of Bank FD Vs Debt Mutual Funds. Instead, it focuses on examining the risk and volatility present in both products.

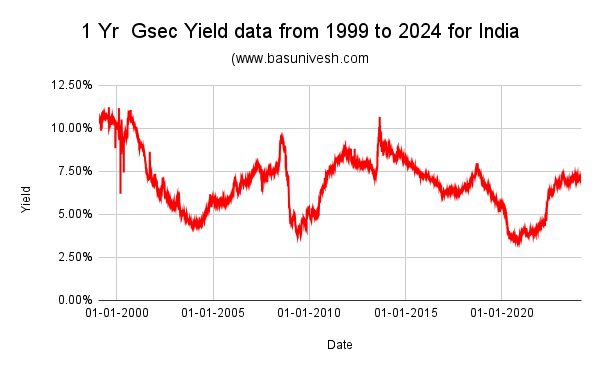

I am analyzing the 1-year Gsec data spanning the past 25 years, as well as the HDFC Money Market Fund data from the last 18 years (2006 to present) for this evaluation.

The reason for having such a limited amount of data is due to the availability of only 25 years of Gsec data (obtained from Investing.com) and the NAV data of HDFC Money Market Fund starting from 2006.

Note – To know more about basics of debt mutual funds, refer to our all earliest posts at “Debt Mutual Funds Basics“.

Bank FD Vs Debt Mutual Funds – Which is SAFE and BEST?

Let us try to look into the risk and volatility involved in both products.

Bank FD as an investment for your long-term goals

Assuming you are interested in investing in a Bank FD for a duration of one year, it is important to be aware of the potential risk associated with reinvestment after the maturity of the FD. Although long-term FDs are an option, for the purpose of demonstrating volatility, I will focus on the one year FD.

For this purpose, I have considered the 1 year Gsec data of last 25 years (from 1999 to 2024. You can notice the volatility easily from the below graph.

The fluctuating trajectory of the 1-year Gsec yield over the past 25 years is worth noting. This volatility can be attributed to the ever-changing cycles of inflation and interest rates. It is important to recognize that fixed deposit rates are directly influenced by inflation, which consequently amplifies the risk associated with reinvestment.

Opting for long-term FDs increases the reinvestment risk due to the uncertainty surrounding future inflation and interest rate cycles.

FDs are designed to meet short-term needs. It is not advisable to use FDs for long-term financial goals due to the annual TDS implications and the reinvestment risk after maturity.

Debt Mutual Funds as an investment for your long-term goals

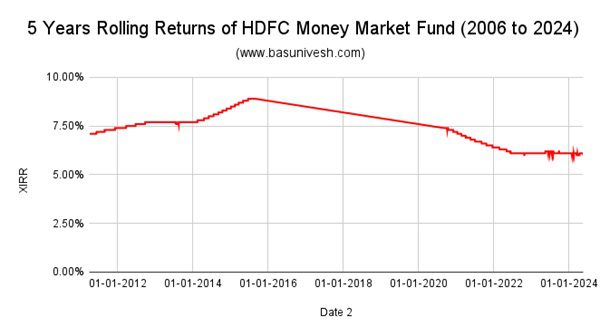

Let’s now examine the volatility of debt mutual funds. As previously stated, I have chosen the HDFC Money Market Fund for analysis due to its long history and substantial AUM. Despite being in existence for 24 years, I only have access to NAV data from 2006 onwards. Therefore, my analysis will be based on data from 2006 onwards.

The selection of the Money Market Fund aims to demonstrate the instability that can occur even with short-term funds. This is because Money Market Funds typically invest in money market instruments that will reach maturity within a year.

Notice the rolling coaster ride of 1-year rolling returns of HDFC Money Market Fund. Let us now compare by considering the 5 years of rolling returns.

Despite the decrease in volatility, it is important to observe that there are periods of upward and downward returns. These fluctuations can be attributed to the inflation and interest rate cycles that occurred during those specific periods.

Conclusion – When deciding between Bank FDs and Debt Mutual Funds, the choice of which is safer and better depends on your specific investment goals and risk tolerance. While FDs are generally seen as stable and low-risk investments, it’s important to remember the impact of TDS taxation and reinvestment risks. On the other hand, with debt mutual funds, it’s easy to overlook interest rate risks and assume they are completely secure. However, it’s crucial to be cautious, especially considering the different categories of debt funds available. For the sake of simplicity, let’s focus on money market funds, but it’s essential to recognize that other fund categories may pose different levels of risk.

Nothing is safe on this earth. The only way is to manage the risk. Also, risk is too personal. Because the risk I assume significant may be negligible for you and vice versa.