After all these years of trying, the insights provided by Modern Monetary Theory (MMT) still haven’t cut through. One doesn’t even need to accept the complete box of MMT knowledge to know that, at least, some of it must be factual. For example, how much brainpower does a person need to realise that a government that issues its own currency surely doesn’t need to call on the users of that currency in order to spend that currency? Even if we could get that simple truth to be more widely understood it would change things. But every day, economists and journalists, that just give platforms to the economists write and say things that demonstrate even that simple understanding of the monetary system fails them. Are they stupid? Some. Are they venal? Some. What other reason is there for continuing to use major media platforms, which give the author a massive privilege in terms of influence and reach, to pump out fiction masquerading as informed economic commentary? And the gullibility and wilful indifference of the readerships just extends the licence of these liars. Some days I think I should just hang out down the beach and forget all of it.

A European friend (thanks RK) who regularly sends me material sent me this transcript yesterday (published May 28, 2024)- How the world got into $315 trillion of debt – which is so misleading that it is dangerous.

This US CNBC program segment was touted as ‘CNBC Explains’ except it didn’t really explain anything.

The pretext for the segment was the latest estimate from the Institute of International Finance that “the world is $315 trillion in debt.”

The IIF is a Washington DC based organisation allied to the financial sector, which provides advocacy and research services to banks, hedge funds, insurance companies, and the like.

One of its stated missions is to:

… promote a better understanding of international financial transactions generally

It appears to raise funds via subscription levies imposed on members and also from corporate sponsorships.

On May 7, 2024, it published its ‘Global Debt Monitor: Navigating the New Normal’, where it revealed that “Global debt rose by some $1.3 trillion to a new record high of $315 trillion in Q1 2024. Moreover, after three consecutive quarters of decline, the global debt-to-GDP resumed its upward trajectory in Q1 2024.”

The Report is for Members Only.

But it motivated the US media company CNBC to produce some headlines and attract some traffic to their news company.

They began their segment by wheeling out a character from the World Economic Forum who told the audience that the global debt level is around that seen during the Napoleonic wars – “close to 100% of Global GDP”.

Then we saw the number $315,000,000,000,000 pop up – all twelve zeros appeared on the screen to convince the viewer that it was a big number.

There seems to be some rules in these sorts of beat ups.

1. Say something over and over using the principle that if you repeat something enough eventually it becomes accepted.

2. Write huge numbers that most people have not clue about other than they look big.

And then the journalist demonstrated that she or her staff could use a pocket calculator with a wide screen and do a division as she offered “Another way to picture” the number with 12 zeros after it:

There are about 8.1 billion of us living in the world today. If we were to divide that debt up by person, each of us would owe about $39,000.

That is another rule:

3. Personalise the big number and induce people to extrapolate their own daily experience to try to understand government financial matters.

Many people owe nothing.

Children owe nothing.

These average figures that the debt phobes love to publish are meaningless in substance and just designed to invoke fear.

Then we get into a bit of detail:

1. “household debt, which includes things like mortgages, credit card and student debt. At the beginning of 2024, this amounted to $59.1 trillion” – so that is, 18.8 per cent of estimated total.

2. “Business debt, which corporations use to finance their operations and growth, sat at $164.5 trillion, with the financial sector alone making up $70.4 trillion of that amount” – 52.2 per cent of the total, of which 22 per cent of the total is in the form of ‘gambling’ debts held by speculators.

3. “Public debt stood at $91.4 trillion” – 29 per cent of the estimated total.

The CNBC segment wants us to believe that there is a major problem here.

But there are major problems with that inference.

First, adding the government debt to the non-government debt is invalid.

The non-government debt is held by currency users who face a financial constraint and any debt that they incur carries a credit risk – that is, a risk of default.

In most cases, government debt is credit risk free because the issuer is the also the currency issuer and can always meet outstanding liabilities denominated in that currency.

There are exceptions which I note below.

The real problem is the private debt although that conclusion also needs to be qualified.

For many households, the majority of their commitment is in the form of mortgage debt, and most people are able to meet the obligations and succeed in owning their own home, where that culture exists.

In Australia, around 37 per cent of houses are subject to mortgages.

The problem comes when families are pushed into large loans by banks etc, which rely on both adults (for example) working to meet the payments.

Often the second breadwinner combines casual work with home responsibilities and in a downturn they are the first to lose working hours as firms start adjusting to falling sales growth or even contraction.

That sort of debt is precarious and the consequences for the debt holder concerned can be devastating if they fail to meet the obligations.

The corporate debt which is used for investment purposes and working capital is also usually not an issue if the decision making is prudent.

Obviously, when bubbles start to occur and the borrowing frenzy is full-on, the prudential oversight declines and excessive and precarious debt obligations are taken on.

The unfolding insolvencies can spread via the expenditure multiplier and create a major disaster – cue the GFC.

But as I wrote during the GFC – There is no financial crisis so deep that cannot be dealt with by public spending – still! (October 11, 2010).

The statement – “There is no financial crisis so deep that cannot be dealt with by public spending” – was the title of a paper I published in 2008 – you can read the – Working Paper – version for free (fairly close to the final publication).

It reflects a basic insight that is derived from MMT once you fully understand that school of thought – its scope and its limitations.

Through sensible fiscal action, a situation can always be improved from where it is as a result of a crisis in the private financial markets.

Second, adding all public debt to get a grand total is invalid.

The debt issued by the Australian government is credit risk free.

The debt issued by any one of the 20 Member States of the Eurozone is not credit risk free because those governments use what is effectively a foreign currency.

If such a government wants to spend more than their tax revenue then they must gain the extra euros from the private bond markets, which may then demand higher yields as the risk increases.

In the situation where a Eurozone Member State is enduring mass unemployment and declining tax revenue, the situation becomes complex.

While there are no real resource constraints in this situation, the financial constraints persist.

As the automatic stabilisers increase the fiscal deficit (lower activity reduces tax revenue and increases welfare spending automatically), the nation must increasingly access funds from private investors.

Given the credit risk attached to such debt, the bond markets will require higher yields on newly issued debt as the governments capacity to raise taxes to repay the outstanding debt obligations becomes impaired when there is high unemployment.

And, perversely, the higher the yields the lower the ability to repay and the higher the default risk, as it soon spirals into default with no funding at any price.

So even though there is mass unemployment and chaos, the bond markets might refuse to fund such a government at sustainable yields because of fear of debt default.

This is the situation that occurred in 2010 and 2012 in the Eurozone crisis as yields skyrocketed on the debt of various nations (for example, Italy and Greece).

It was only the intervention of the ECB (the currency issuer) guaranteeing that all national government debts would be repaid at maturity that saved all of the Euro nations from insolvency.

Most governments that issue their own currency can never get into this type of dilemma.

Which means the $91.4 trillion debt estimate is meaningless.

Third, adding all public debt from all currency denominations is invalid.

Most governments borrow only in their own currency, which means they can never encounter a situation where they cannot meet the outstanding liabilities when they come due.

How much of the $91.4 trillion is covered by this class of government is not known to me today but it would be a significant proportion (well over the majority).

Which means the $91.4 trillion debt estimate is meaningless.

So that leaves the $315,000,000,000,000 figure looking rather wan, doesn’t it?

The journalist also tells her audience:

Finally, there’s government debt, which is used to help fund public services and projects without raising taxes.

Countries can borrow from each other or from global institutions such as the World Bank and the International Monetary Fund.

But governments can also raise money by selling bonds … which is essentially an IOU from the state to investors. And like all loans, it includes interest.

So all you MMTers now know how to respond to that garbage.

Government debt doesn’t fund anything.

It is just an unnecessary operational convention that is a hangover from the fixed exchange rate era.

Moreover, the continuing issuance of public debt for most governments (those that issue their own currencies) is in one sense political – in that it allows the conservatives to scream about the burdens on their grand kids, which is a short hand way of constraining government spending on welfare other than that that accrues in the form of corporate welfare – and in another sense, it provides the kids in the financial markets with a play thing to pursue their speculative greed – corporate welfare again.

We have a chapter in our new book (see below) entitled – ‘MMT Barbarians Enter the Gates of Canberra’ – where we discuss that topic.

The journalist also characterises government “debt … [that has] … been piling up” as the result of government spending “beyond their means” – the classic ‘spending like a drunken sailor’ type metaphor designed to invoke our disdain for wasteful profligate governments.

The means available to government have nothing to do with finances.

The IMF and all those bodies like to define ‘fiscal space’ and ‘fiscal sustainability’ in terms of debt to GDP ratios, or deficit to GDP ratios.

For most governments those indicators are meaningless and have nothing to do with the available fiscal space, which can only be meaningfully defined in terms of available real productive resources that can be brought into productive use through expenditure.

Those are the ‘means’ that a government has to play with as it seeks to provision itself in order to meet is electoral promises.

So if there is full employment (of all resources) and the government keeps ramping up nominal spending growth then it will impart inflationary pressures and at that point we can say it is ‘living beyond its means’.

But that has nothing to do with the size of the fiscal balance or how much outstanding public debt there is.

The CNBC segment also asks the related question: “how much debt is too much debt? When does it become unsustainable?”.

Her answer:

Put simply, it’s when you can no longer afford it.

So, for example, when a government is forced to make cuts in areas that hurt its people, such as education or healthcare, just to keep up with payments.

As long as there are real resources available the currency-issuing government ‘can afford’ to keep spending in order to bring them back into productive use.

There is never a justification for cutting spending when there is excess capacity in the economy. NEVER.

Some relevant extra reading:

1. Anything we can actually do, we can afford (February 15, 2024).

2. Look after the unemployment, and the budget will look after itself (March 5, 2012).

The titles of those blog posts came from John Maynard Keynes of course.

In the middle of the Second World War, British economist John Maynard Keynes made a series of radio speeches on the BBC about post War planning. As an allied victory was becoming more likely, Keynes outlined a substantial investment program for the British government to upgrade its housing stock, build educational and performing arts capacity and other infrastructure.

His ideas received significant push back from the elites in the financial and economics establishment who claimed that Britain would not have enough financial capacity to achieve his aims.

On April 2, 1942, the topic he addressed was ‘How Much Does Finance Matter?’.

The speech went like this (Keynes, 1978: 264-265):

For some weeks at this hour you have enjoyed the day-dreams of planning. But what about the nightmare of finance? I am sure there have been many listeners who have been muttering:

‘That’s all very well, but how is it to be paid for?’

Let me begin by telling you how I tried to answer an eminent architect who pushed on one side all the grandiose plans to rebuild London with the phrase: ‘Where’s the money to come from?’ ‘The money?’ I said. ‘But surely, Sir John, you don’t build houses with money? Do you mean that there won’t be enough bricks and mortar and steel and cement?’ ‘Oh no’, he replied, ‘of course there will be plenty of all that’. ‘Do you mean’, I went on, ‘that there won’t be enough labour? For what will the builders be doing if they are not building houses?’ ‘Oh no, that’s all right’, he agreed. ‘Then there is only one conclusion. You must be meaning, Sir John, that there won’t be enough architects’. But there I was trespassing on the boundaries of politeness. So I hurried to add: ‘Well, if there are bricks and mortar and steel and concrete and labour and architects, why not assemble all this good material into houses?’ But he was, I fear, quite unconvinced. ‘What I want to know’, he repeated, ‘is where the money is coming from’.

Keynes continued to articulate what he considered to be the mistake in the reasoning confronting him and then said (Keynes, 1978: 270):

Where we are using up resources, do not let us submit to the vile doctrine of the nineteenth century that every enterprise must justify itself in pounds, shillings and pence of cash income, with no other denominator of values but this. I should like to see that war memorials of this tragic struggle take the shape of an enrichment of the civic life of every great centre of population.

Why should we not set aside, let us say, £50 millions a year for the next twenty years to add in every substantial city of the realm the dignity of an ancient university or a European capital to our local schools and their surroundings, to our local government and its offices, and above all perhaps, to provide a local centre of refreshment and entertainment with an ample theatre, a concert hall, a dance hall, a gallery, a British restaurant, canteens, cafes and so forth.

Assuredly we can afford this and much more. Anything we can actually do we can afford. Once done, it is there. Nothing can take it from us. We are immeasurably richer than our predecessors. Is it not evident that some sophistry, some fallacy, governs our collective action if we are forced to be so much meaner than they in the embellishments of life?

Yet these must be only the trimmings on the more solid, urgent and necessary outgoings on housing the people, on reconstructing industry and transport and on replanning the environment of our daily life. Not only shall we come to possess these excellent things. With a big programme carried out at a regulated pace we can hope to keep employment good for many years to come. We shall, in fact, have built our New Jerusalem out of the labour which in our former vain folly we were keeping unused and unhappy in enforced idleness.

So when someone says to you “How are we going to pay for it?” you can simply reply as Keynes did ‘Anything we can actually do we can afford’.

The ‘How to pay for it’ question arises out of ignorance concerning the way government spending enters the economy.

The sequence is as follows:

- The parliamentary system authorises government to make the relevant payments.

- The Treasury or Finance department instructs the nation’s central bank to credit (change to a higher number) the recipient’s bank account balance (called a reserve account) at the central bank.

- The bank of the recipient then records a deposit in the account of the supplier of the goods and services to the government.

That’s it.

There are no taxpayers or grand kids are in sight!

The final point to consider is the absurdity of the notion that under current institutional arrangements, where governments match their fiscal deficits with debt issuance, that both the non-government and government sectors can reduce their overall debt levels simultaneously.

If you are perplexed by that statement then read this blog post – Not everybody can de-lever at the same time (May 23, 2012).

That discussed the situation during the GFC when everyone was talking about government debt being too high and that the combination of high levels (whatever that is) of public debt and private debt were a dangerous cocktail.

There were calls for policies to reduce government debt while also reducing non-government debt, which had become excessive and driven the financial crisis.

The simple fact is that when private spending is subdued the government sector has to run commensurate deficits to support the process of private de-leveraging by sustaining growth.

Those advocating fiscal austerity or those who claim that the amount of outstanding private debt is simply too large for the Government to replace with public debt fail to understand the basic tyranny of the sectoral balance arithmetic.

Put simply, not everybody can de-lever at the same time.

Even progressives like Steve Keen got caught up in this flawed and inconsistent way of thinking.

Conclusion

That’s it.

Pretty depressing.

I am now going back to the final edits for our new book which will be available for delivery on July 15, but you can become part of the first print run by following details below.

Warren and I think readers will like what we have come up with.

Advance orders for my new book are now available

The manuscript for my new book, co-authored by Warren Mosler, goes to the publisher tomorrow.

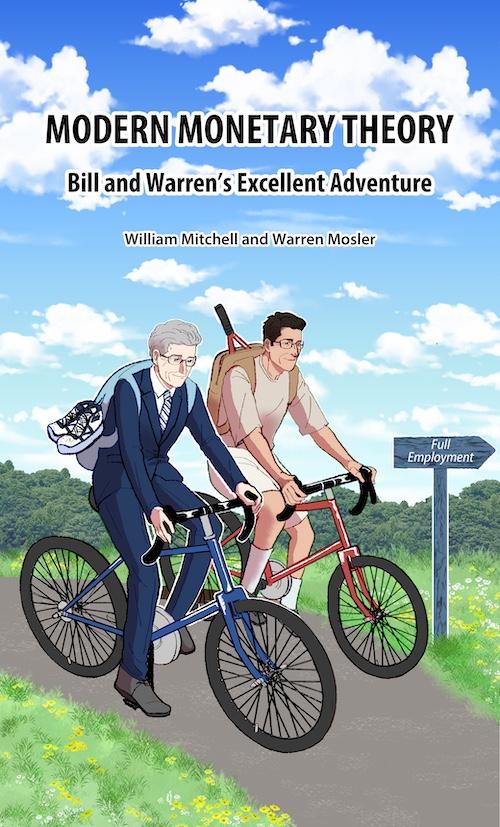

The book will be titled: Modern Monetary Theory: Bill and Warren’s Excellent Adventure.

Here is the final cover that was drawn for us by my friend in Tokyo – Mihana – the manga artist who works with me on the – The Smith Family and their Adventures with Money.

The description of the contents is:

In this book, William Mitchell and Warren Mosler, original proponents of what’s come to be known as Modern Monetary Theory (MMT), discuss their perspectives about how MMT has evolved over the last 30 years,

In a delightful, entertaining, and informative way, Bill and Warren reminisce about how, from vastly different backgrounds, they came together to develop MMT. They consider the history and personalities of the MMT community, including anecdotal discussions of various academics who took up MMT and who have gone off in their own directions that depart from MMT’s core logic.

A very much needed book that provides the reader with a fundamental understanding of the original logic behind ‘The MMT Money Story’ including the role of coercive taxation, the source of unemployment, the source of the price level, and the imperative of the Job Guarantee as the essence of a progressive society – the essence of Bill and Warren’s excellent adventure.

The introduction is written by British academic Phil Armstrong.

You can find more information about the book from the publishers page – HERE.

It will be published on July 15, 2024 but you can pre-order a copy to make sure you are part of the first print run by E-mailing: info@lolabooks.eu

The special pre-order price will be a cheap €14.00 (VAT included).

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.