Motherson Sumi Wiring India Ltd. – Leading wiring harness player

Incorporated in 2020, Motherson Sumi Wiring India Ltd. (MSUMI) is a prominent full-system solutions provider in the wiring harness segment for Original Equipment Manufacturers (OEMs) in India. MSUMI is a joint venture between Samvardhana Motherson International Limited (SAMIL) and Japan’s Sumitomo Wiring Systems, Ltd. (SWS), a global leader in wiring harnesses and components. With 26 facilities across India, the company offers comprehensive solutions from product design to manufacturing, assembly, and integrated electrical systems.

Products and Services

MSUMI offers a wide variety of harnesses for different vehicles including passenger and commercial vehicles, two and three-wheelers, farm equipment and off-road vehicles. Its services also encompass 3D computer-aided design (CAD), printed circuit board (PCB) design and routing, 3D printing, prototyping, virtual and physical validation and technology implementation support.

Subsidiaries: As of FY23, the company does not have any subsidiary or associate companies.

Growth Strategies

- Market Leadership: Supplies to 10 out of 12 passenger vehicle models in India and expanded with three new facilities in FY23.

- Vertical Integration: Localizes production of components like cables and connectors.

- Strong Parentage: Benefits from SAMIL and SWS in terms of technology and R&D capabilities.

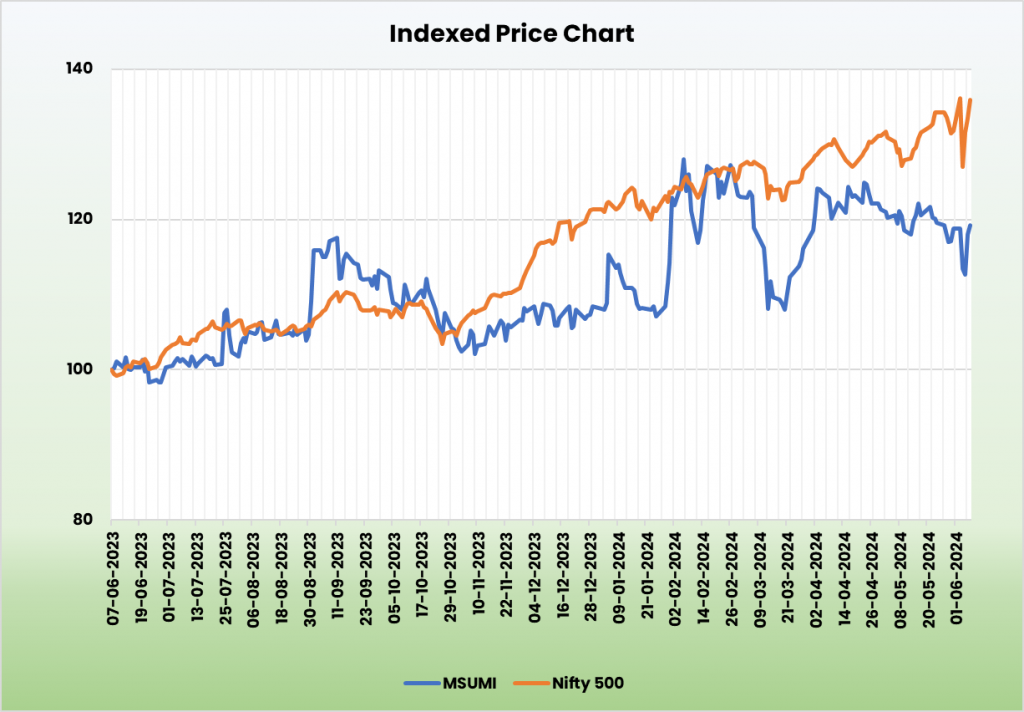

- Industry Outperformance: Surpassed industry growth by 11% in FY24 due to increased demand and trends in premiumization and SUVs.

Financial Highlights

Q4FY24

- Revenue: Rs. 2,233 crore, a 19% increase from Rs. 1,872 crore in Q4FY23.

- Operating Profit: Rs. 291 crore, a 32% increase from Rs. 221 crore in Q4FY23.

- Net Profit: Rs. 191 crore, a 38% increase from Rs. 138 crore in Q4FY23.

FY24

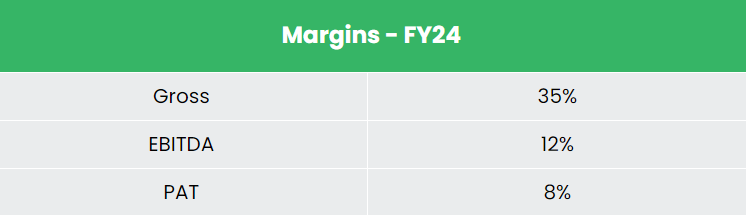

- Revenue: Rs. 8,328 crore, an 18% increase compared to FY23.

- Operating Profit: Rs. 1,013 crore, up 27% YoY.

- Net Profit: Rs.638 crore, a growth of 31% YoY.

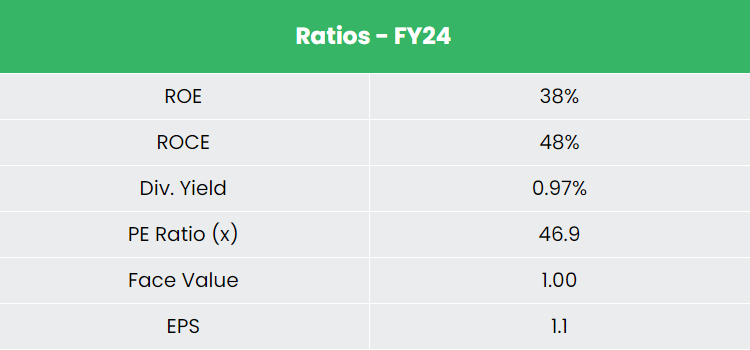

- Return on Capital Employed (ROCE): 48%, compared to 44% in FY23.

Financial Performance (FY21-24)

- Revenue and PAT CAGR: 28% and 17%, respectively, over three years.

- Average ROE & ROCE: 48% and 60%, respectively, over the FY21-24 period.

- Capital Structure: Debt-to-equity ratio of 0.15.

Industry Outlook

Market Expansion: India’s auto components industry is growing due to increasing automobile demand and rising incomes.

Localization Efforts: The growing presence of global automobile OEMs has increased the localization of components.

Economic Contribution: By 2026, the sector is expected to be worth US$ 200 billion, contributing 5-7% of India’s GDP.

Investment Plans: By FY28, the industry aims to invest US$ 7 billion to boost the localization of advanced components.

Manufacturing Incentives: Increased incentives are driving the expansion and advancement of the sector.

Growth Drivers

- FDI Policy: 100% FDI is allowed under the automatic route for the auto components sector.

- BNCAP Initiative: The Bharat New Car Assessment Program (BNCAP) is expected to strengthen the auto component value chain.

- FDI Inflow: The Indian automotive industry attracted $35.65 billion in FDI from April 2000 to December 2023.

Competitive Advantage

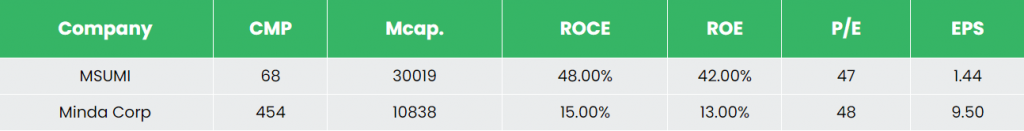

Compared to competitors like Minda Corporation Ltd., MSUMI generates better returns on invested capital. MSUMI’s dominance in the wiring harness business is bolstered by minimal competition, giving it a monopoly in the segment.

Outlook

Market Leadership: MSUMI leads the wiring harness industry with high entry barriers and significant operational scale.

Growth Opportunities: The growing SUV and connected vehicles market presents significant growth potential.

Strategic Locations: The company’s facilities are strategically located near major automobile hubs.

Expansion Plans: Two new facilities are in the pipeline to cater to the expanding automobile market.

Capex Guidance: FY25 capex guidance is Rs. 200 crore for growth, expansion, productivity, quality improvement, and asset maintenance.

Resilience: The company’s diversified locations and premium operations position it well for sustained growth.

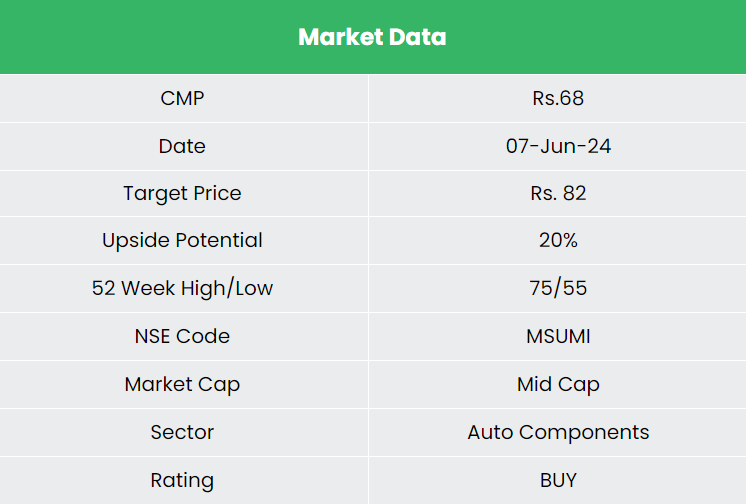

Valuation

MSUMI dominates the domestic wiring harness industry, supported by strong parentage from SAMIL and advanced technologies from SWS. We recommend a BUY rating with a target price of Rs. 82, based on a 50x FY26E EPS.

Risks

Technological Adaptation: Failure to adapt to rapidly evolving automotive industry technologies could affect market share.

Customer Retention: Inability to maintain wallet share with existing key customers could impact revenue.

Disclaimer: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

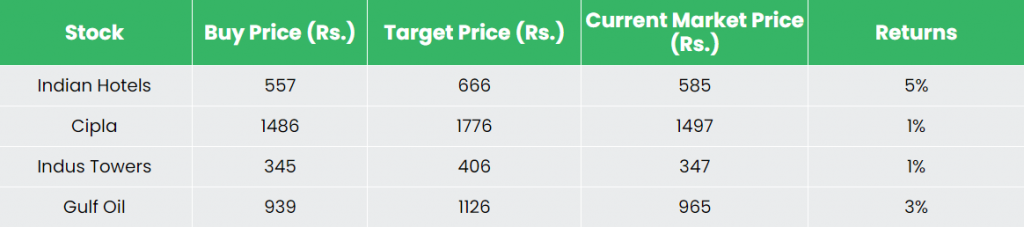

Recap of our previous recommendations (As on 07 June 2024)

Other articles you may like