The market value of household real estate assets rose from $44.90 trillion to $45.84 trillion in the first quarter of 2024 according to the most recent release of U.S. Federal Reserve Z.1 Financial Accounts. Over the year, household real estate assets were 7.75% higher.

After falling in the fourth quarter of 2023, the market value of real estate assets rose to a new high at the start of 2024. The value surpassed its previous peak of $45.27 trillion in the third quarter of 2023. The first quarter of 2024 percentage change of 2.08% was the highest increase since the second quarter of 2023 (5.21%). Additionally, the yearly percentage change of 7.75% was the largest increase since the fourth quarter of 2022 (9.48%). Year-over-year growth in real estate assets has returned after experiencing slight declines in both the first and second quarter of 2023 as shown by the red line in the chart below.

Real estate secured liabilities of households’ balance sheets, i.e. mortgages, home equity loans, and HELOCs, increased 0.29% over the first quarter to $13.08 trillion. Over the year, real estate liabilities have increased 2.69%. Year-over-year growth has slowed for liabilities after peaking at 9.84% in the first quarter of 2022 as home sales for both existing homes and new homes remain at low levels due to higher mortgage rates.

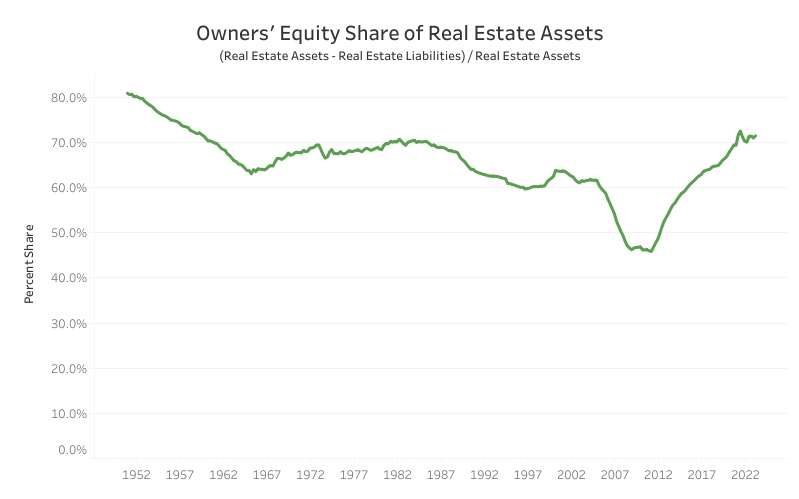

Owners’ equity share of real estate assets remained above 70% for the ninth straight quarter, continuing to mark the highest owners’ equity share since the late 1950s. The share in the first quarter of 2024 was 71.47%, up from the fourth quarter of 2023 (70.96%).

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.