Regular readers will know that I am not enamoured with the British Labour Party leadership and its obsession with its so-called fiscal rule, which is really just a continuation of the rule that the Tory’s were supposedly running with. How can a self-styled progressive party (so-called) that is about to take over a nation that has been shattered by 14 years of the worst Tory rule that one can imagine, and which will require billions of pounds to be spent to even put a dent in the degradation in infrastructure, services, not to mention addressing the forward-looking challenges (health, climate, etc), claim that a fiscal rule that is biased towards austerity be appropriate? It beggars belief. By continuing with such rules, the Labour Party is ensuring that it will either fail to make much headway in redressing the damage and placing Britain in a better position to deal with the carbon challenges or will fail to meet the fiscal rules or both. It is recipe for not much. Pity the British people who have already endured the consequences of supporting, first Blair’s Labour, then the long hard years of the bumbling and incompetent Tories. In today’s post I want to highlight one aspect of the fiscal rule absurdity, and actually say that Nigel Farage is right about one thing, although not for the right reasons. Read on – a story of corporate welfare and fiscal fictions unfolds.

I will do more detailed analyses of the fiscal rule dynamics in the weeks to come.

But with the – Labour Manifesto – now launched there are some obvious things one can say at a superficial level.

First, while politicians are always talking themselves up – and the Labour narrative about ‘my plan for change’ sounds aspirational – the reality is that the new government (if Labour) will do very little on either side of the fiscal ledger.

Labour’s fiscal plan – suggests it will aim to take out of the economy £7,350 million by 2028-29 and inject for providing “Labour’s additional public services” some £4,835 over the same period.

It also claims:

… that the current budget must move into balance, so that day-to-day costs are met by revenues and debt must be falling as a share of the economy by the fifth year of the forecast.

So that looks like a net austerity impact over the period “of the most recent Office for Budget Responsibility forecast”.

On growth, the Labour Manifesto says it will “kickstart economic growth” by delivering “economic stability with tough spending rules and relying on private businesses to “boost growth everywhere”.

Excuse me if I take a moment to have a laugh.

The British Labour leadership has adopted such a defensive position structured around the fiscal rules that it is hard to imagine the vast void created by the Tories will be reversed in any significant way.

All they seem to be telling the British people is that that they won’t do this (tax increases) or that (debt increases over 5 years against GDP).

There are some exceptions to this.

First, the Party has promised to make some major changes to the NHS but it is hard to see them achieving their aims within the fiscal rules they want to play by.

Second, the most outlandish part of the plan (joking) is the £4.7 billion per annum promised to fund the ‘green prosperity plan’, which is fact a drop in the ocean to what will be required over the immediate period ahead if Britain is to do anything meaningful about climate change.

And remember the initial promise was for £28 billion.

The scaled down plan just reflected the leadership running scared of the City and the mainstream economists.

They have said they will have to borrow to fund this program over the amount they will receive from a new windfall tax on the oil and gas companies.

Rough calculations suggest that they might have to borrow over the forecast period, given the £4.7 billion per annum promise, around £16-18 billion.

I have done some preliminary calculations, which I will expand on in future posts once I have completed them to my satisfaction that tell me – and the conclusion will only harden with more detail.

But if they stick to their word on the relatively modest (read mostly inconsequential climate plan), then at that rate, to fit within the fiscal rules they will have very little scope for spending on anything else.

The real growth in expenditure, given the projected inflation rate, is a couple of points above what the current government has proposed.

So nothing much really and it is constrained by what they term to be ‘protected’ areas of expenditure.

All which means the ‘unprotected’ areas will suffer for sure, or the new government will fail to meet the limits set by the fiscal rules.

Some calculations suggest that real spending cuts of around 3 to 4 per cent in the unprotected areas would be required.

And that is assuming a fairly robust (read probably unattainable) GDP growth rate.

The Manifesto, of course, claims it will not impose austerity cuts on other essential areas of government.

My assessment is that it all fails to add up.

The whole plan rests of GDP growth so strong that Brtiain would have to jump out of its skin, relative to its performance over the last few decades.

Bank of England Payments on excess reserves – scrap them?

Which brings me to the debate on central bank support payments for excess reserves.

This is a classic example of how the public debate is so misled by the fiscal fictions propagated by mainstream economists.

The scenario is this.

The asset purchasing program (Asset Purchasing Facility) of the Bank of England – quantitative easing – which was scaled up during the pandemic significantly expanded the balance sheet of the Bank.

The aim was held out to provide reserves to the banks which they would loan out and stimulate the economy.

The reality is that this logic was deeply flawed – banks do not loan out reserves and do not need reserves in order to make loans to customers – loans create deposits.

You might reflect on that point by reading this blog post – Quantitative easing 101 (March 13, 2009) – among many others that I have written.

The actual outcome of the QE was that interest rates in the maturity ranges of the debt that the Bank of England purchased were reduced and that might have been a stimulatory measure if borrowers were confident that they could prosper from increased debt exposure.

Given how flat the economy was at the time, that confidence was absent so the QE – which is just an asset swap – debt for reserves – was largely ineffective.

But it did mean that the Bank of England built up a large stock of government bonds on its balance sheet.

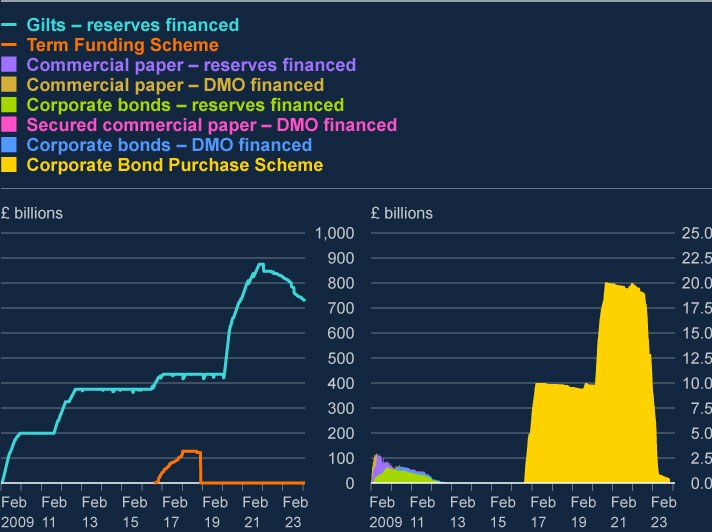

The most recent – Asset Purchase Facility Quarterly Report – 2024 Q1 (released April 30, 2024) – reports that the bank held (as at March 27, 2024) some £728,047 million worth of Gilts and £89 million worth of Corporate bonds.

This graph is provided by way of summary:

The Bank is busy running down the stocks it has built up so the current stocks of bonds held by the Bank of England are closer to £700,000 million now.

The analogue of these purchases is the that the commercial banks significantly increased the reserve balances held at the Bank of England.

These are the clearing balances and earn nothing unless the Bank of England pays a support rate.

And as I have explained many times previously, unless that support rate is paid, competitive pressure within the overnight (or interbank market) by banks with excess reserves to earn anything (by loaning them to other banks who are in reserve deficit) will drive the overnight rate to zero.

Which would then compromise any non-zero policy target rate and the Bank of England would effectively lose control over its monetary policy.

Okay.

So the Bank of England decided to pay a support rate, which has had to rise as its policy rate increased – in its forlorn effort to ‘fight inflation’.

Forlorn because the rate hikes were largely unnecessary given that the sources of the inflationary pressures were supply located and insensitive to domestic interest rate changes.

The current support rate on overnight funds (reserve balances) is 5.25 per cent yet the return on the government bonds delivers the Bank of England around 2 per cent per annum.

In other words, in an accounting sense, the Bank of England is now making a ‘loss’ on its bond holdings.

And the government has promised the Bank of England to reimburse the bank (read pay itself) for the ‘loss’.

And such payments then show up as ‘government spending’.

So the pressure has been on the Labour leadership to scrap the support payments to ‘save money’.

And all sorts of economists, including some of those self-styled progressives who wrote a letter to the UK Guardian today supporting Labour’s economic credibility (Source) have then claimed there would be dreadful consequences if the Bank stopped paying the commercial banks this return.

Nigel Farage has recommended the Bank of England stop paying the rate (which I support) because it would “stem the flow of cash out of the Treasury” (Source), which proves he doesn’t have a clue about the way the monetary system actually operates.

There have been proposals to introduce a tiered system with respect to bank reserves – some get the support payment, other bits don’t.

The economists then scream that this is taxing the banks.

Poor banks – those poor corporations that have been gouging billions from their customers over the last decade and handsomely rewarding their owners and executives.

All of which is the stuff of nonsense.

And the Labour leadership has run scared and declared it will not change the current approach.

And her reasoning suggests she has no real understanding of what is going on.

The fact is that the Bank of England ,being part of the consolidated government sector (the currency-issuing sector), could simply type 0 against that £700 billion worth of bonds it holds and no-one would really be the wiser.

All the fictional posturing about central bank losses, and the need for the right pocket of government (H.M. Treasury) to compensation the left pocket of government (the Bank of England), and all the other weird proposals to ‘save’ the Bank and give the government more breathing space within its ridiculous fiscal rules are nonsensical and just show how far the debate has moved into the land of the pixies.

The ‘losses’ the Bank of England are accounting for at present are meaningless.

Please read my blog post – Central banks can operate with negative equity forever (September 22, 2022)- for more discussion on this point.

The Bank is not a private corporation that faces insolvency if it record negative equity.

Absolutely none of its operations would be compromised it it recorded on-going losses or took the better step and just wrote off all the debt held.

And all of this nonsense is because these characters think the fiscal rules are necessary for the government to avoid insolvency.

The British government can never become insolvent.

It can never go broke.

It could reduce the debt ratio immediately by just writing off the debt holdings it has of its own debt.

And then continue to reduce it by declining to turnover the maturing debt held in the non-government sector.

That is, just stop issuing gilts altogether.

And then it could just stop paying the ‘corporate welfare’ support payments to the commercial banks for their excess reserve holdings.

That would push the overnight rate down to zero – and the yield curve would recalibrate down accordingly.

Then the government could use its fiscal capacity within the limits of the real resources available to foster a better level of well-being.

Conclusion

The City would scream – but so what – who would care about that.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.