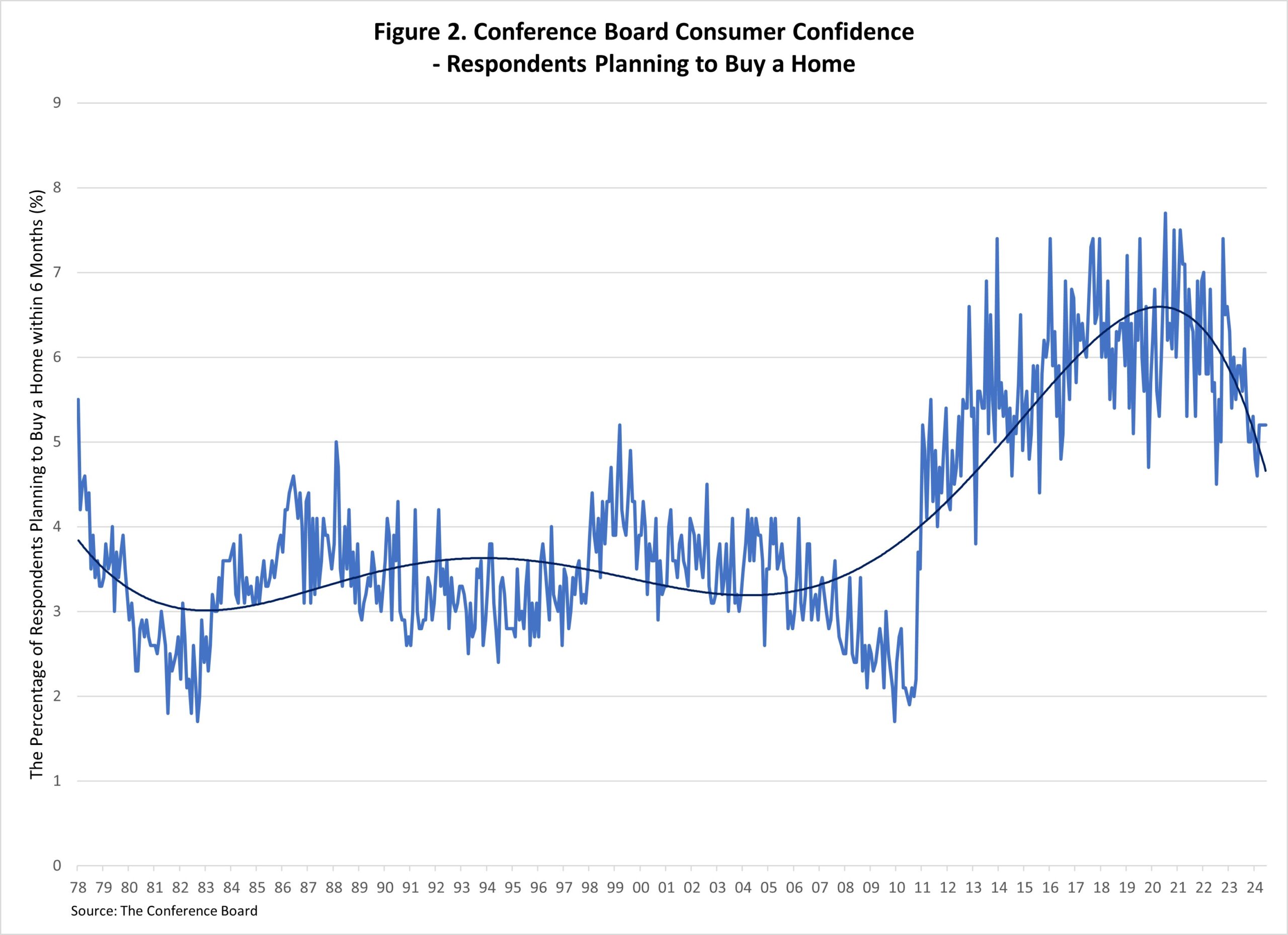

Consumer confidence weakened in June but remained within the range of the past two years, with optimism about current labor market conditions offsetting concerns about future economic outlook. However, higher interest rates and lingering inflation continue to discourage consumption. The Consumer Confidence Index, reported by the Conference Board, fell from 101.3 to 100.4 in June. The Present Situation Index rose 0.7 points from 140.8 to 141.5, while the Expectation Situation Index fell 1.9 points from 74.9 to 73. Historically, an Expectation Index reading below 80 often signals a recession within a year.

Consumers’ assessment of current business conditions fell slightly in June. The share of respondents rating business conditions “good” decreased by 1.2 percentage points to 19.6%, while those claiming business conditions as “bad” fell by 0.7 percentage points to 17.7%. Meanwhile, consumers’ assessments of the labor market were more positive. The share of respondents reporting that jobs were “plentiful” increased by 1.1 percentage points, while those who saw jobs as “hard to get” fell by 0.2 percentage points.

Consumers were less pessimistic about the short-term outlook. The share of respondents expecting business conditions to improve fell from 13.7% to 12.5%, while those expecting business conditions to deteriorate decreased from 16.9% to 16.7%. Similarly, expectations of employment over the next six months were less favorable. The share of respondents expecting “more jobs” decreased by 0.5 percentage points to 12.6%, and those anticipating “fewer jobs” declined by 1.5 percentage points to 17.3%.

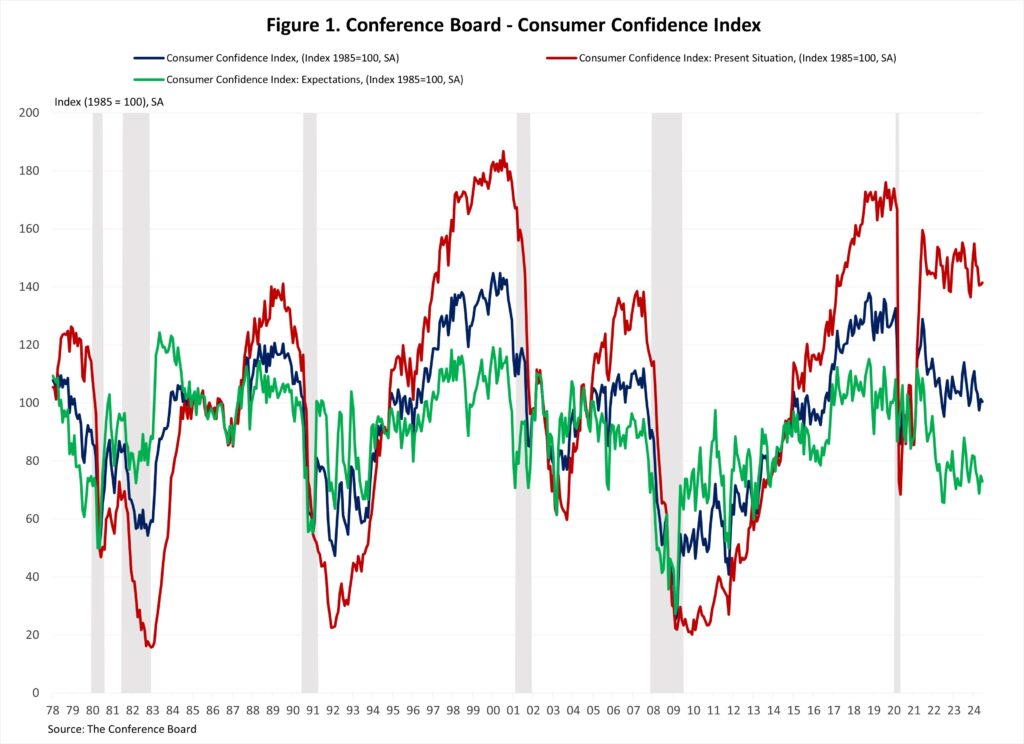

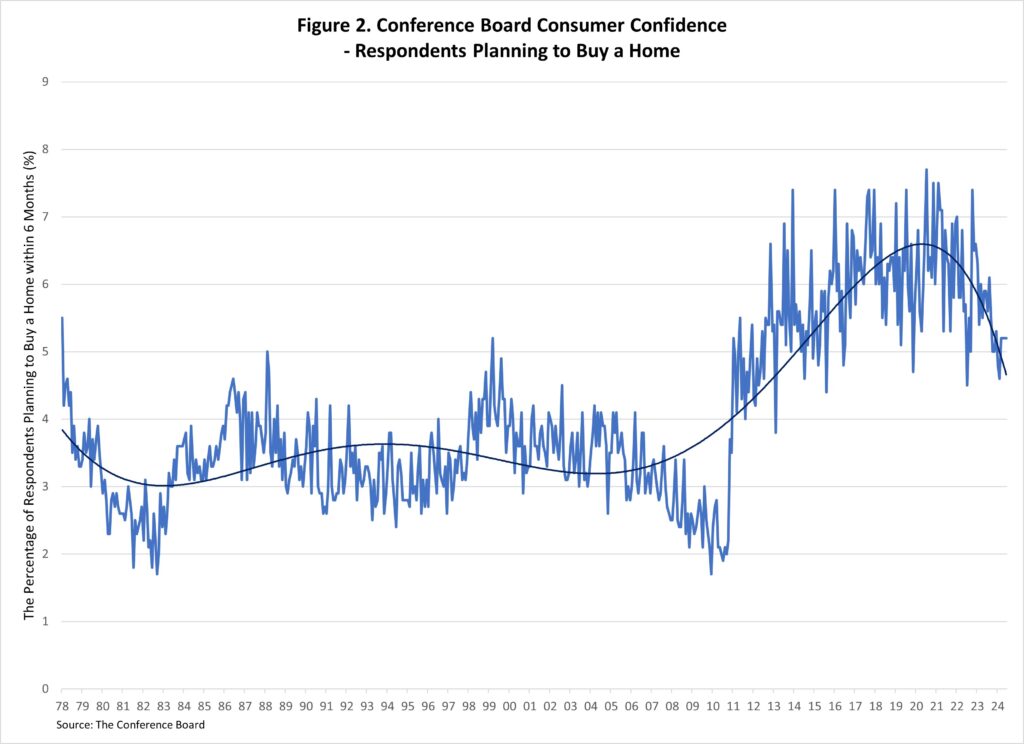

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home remained unchanged at 5.2% in June. Of those, respondents planning to buy a newly constructed home fell slightly to 0.4%, and those planning to buy an existing home decreased to 2%.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.