Hi guys. I’m Sarah Mueller from Early Bird Mom and today I’m going to be sharing with you the Top Sinking Funds Everyone Should Have.

One of the problems you may encounter when you start budgeting as a beginner is spending money in places you hadn’t anticipated. This is to be expected in budgeting – you’ll have to make adjustments along the way.

To help you out, take a look at these 23 budget categories or “sinking funds.”

Sinking Fund defined: A sinking fund (or reserve fund) is a budget category that you don’t necessarily need every month, but that you want to contribute to, in order to start building up a balance. You “sink” or save money into a budget category or “fund” and let it build up over time.

Using sinking funds is a less stressful way to budget and pay your bills than trying to deal with each one when it’s due.

A sinking fund is different than an emergency savings because in a sinking fund, you are telling your money where to go, instead of letting an emergency dictate where you spend it.

Top Sinking Funds Everyone Should Have

Here’s how it works for us.

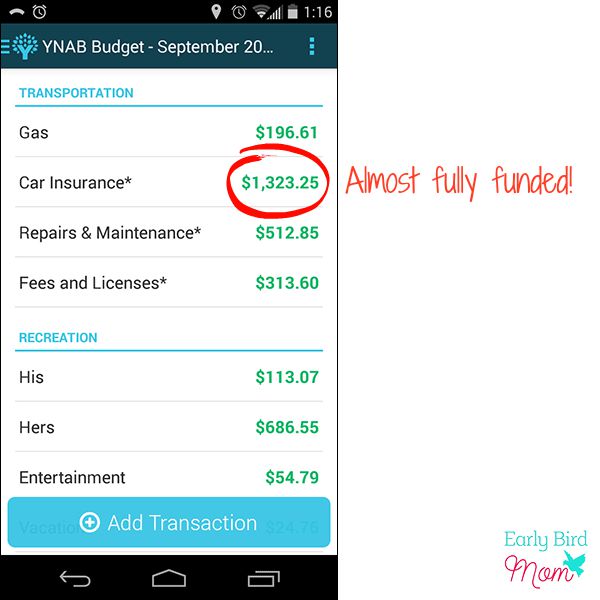

We pay our car insurance just once a year. But with 2 cars and living in a high cost state, our insurance bill is $1600. Yikes! I don’t want to have to face that bill without money in the bank.

So instead of scraping up the money when the bill is due, we put $130 every month into our car insurance sinking fund. By the time the insurance bill is due, we have the total amount saved up. I can write a check without having to worry that it won’t clear.

Another example of a helpful sinking fund is for variable utility bills.

If your winter heating bills are much higher than your spring and fall bills, you may experience a shock when you open that February bill! But if you’ve been putting a little extra into a utilities sinking fund all year, you can pay that February bill without having to take money out of say, the grocery budget.

Here is a list of 23 different sinking funds:

- Car repairs

- Car insurance

- New car savings

- Homeowners insurance

- Life insurance

- Taxes

- Doctor / dentist

- Medication

- Vacation

- Christmas / Holidays

- Gifts

- Fees and licenses (car registration, etc.)

- Dues and subscriptions (magazines, memberships)

- School and education fees

- School tuition

- Pets

- Utilities

- Home maintenance and repairs

- Kids sports and activities

- Miscellaneous

- Travel

- College savings

- Emergency fund

Where do you find the money to put into these sinking funds?

You start with the most critical ones. This means bills that are due soon and larger bills.

If you know your car insurance is due in 3 months, start adding to that fund first. You might not be able to fully fund it before it’s due, but even having some money set aside helps.

Find ways to save on your expenses (like electricity and groceries). Then put the money saved toward your sinking funds.

You can also contribute a little each month to some of the smaller funds.

If you put $5-$10 a month into the gifts fund, you’ll have enough to buy a present for a birthday party in just a month or two. Shop around at a few cashback sites before you order (here’s Sarah Titus’ favorite cashback site) and you’ll have a great present that wasn’t a burden to buy.

You might also spend some extra time working from home. Earn an extra couple hundred dollars a month to fund your sinking funds and ease the strain on your budget.

Related:

So what do you DO with the money you put into these funds?

You could put it into separate savings accounts, but this gets tricky if you have many different sinking funds. You could also have 1 account for monthly bills and 1 that you use to pay for these irregular expenses.

I manage the money in our sinking funds with the budgeting software tracker called You Need a Budget (YNAB). My husband and I both use their smartphone app and enter our purchases on the go.

Whatever system you use, make sure it’s easy to see how much money you’ve set aside for each fund. The simpler it is, the more likely you are to stick with your system.

How many funds are too many?

You could go crazy and set up a hundred funds or more. It really depends on your personality – are you the type that likes to see how you spend your money in great detail or would you rather keep it simple and have fewer categories? I find that 20-30 sinking funds is plenty for our budget.

How do you decide how much to put into each fund?

If you have an idea of how much you spent on a category in the past 12 months, ideally you would divide that amount by 12. Then contribute that amount each month. If you have a bill coming up and you know the amount, divide the amount of the bill by the number of months you have to save. Then save that amount each month.

Here’s example: Let’s say your daughter plays soccer.

Sports fees cost $50 per semester plus $50 for uniform and gear. Add in $10 for extra expenses and you’re expecting $110 per year for this sport. $110 divided by 12 is $9.16. So you should save $10 in the sports fund each month. As long as your first payment isn’t due for a few months, you’ll have enough money to cover your sports expenses.

What do you do if you have a bill and your sinking fund doesn’t have enough money yet?

You may have to borrow from another fund. We recently did this when we had some unexpected car repairs. Our car repair fund didn’t cover the bill. Since I’d already saved up our full Christmas budget, I took the money from there. I knew that I’d have time to bring the Christmas fund back up to it’s full amount before December.

What about things like retirement?

I don’t include long term savings goals like retirement because that money comes directly out of our paychecks and never hits our bank account or our monthly budget. I do include a college fund because that money does come out of our budget.

Use this list of sinking funds as a starting point and customize it to meet your own needs.

Tweak your funds each month as you budget. Make changes based on what bills are due and how much money you have to budget. After a few months, you’ll have a helpful list and larger bills should be easier to manage.