I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to me that the post-pandemic era saw sentiment levels far below major dislocations such as the ‘87 crash, the 9/11 terrorist attacks, the Dotcom implosion, or the 08-09 great financial crisis.

We have tried to identify the causal factors by considering social media, increases in partisanship, ignorance, even trolling of pollsters. These explain some of the odd trends, but not enough to fully rationalize the disconnect between data and sentiment.

Today I want to step back and consider an overlooked psychological factor. I discussed this last week with Ben and Duncan on Ask the Compound, but I wanted to flesh out my thinking further:

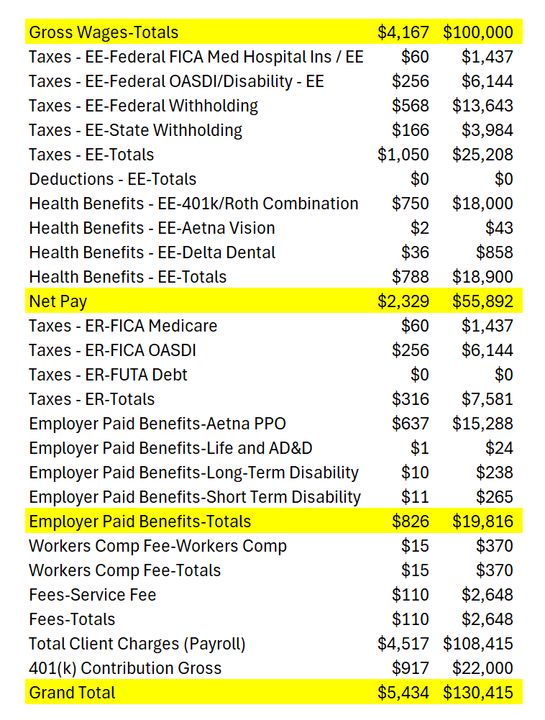

Inflation is obvious and everywhere. We all know what we pay for items in supermarkets; what it costs to go out to a nice dinner for two. Perhaps most obvious is when we tank up our cars with gas. Prices per gallon are displayed in six-foot tall letters sitting atop 30-foot high poles.

We see the costs of home prices (at least asking prices on Zillow).1

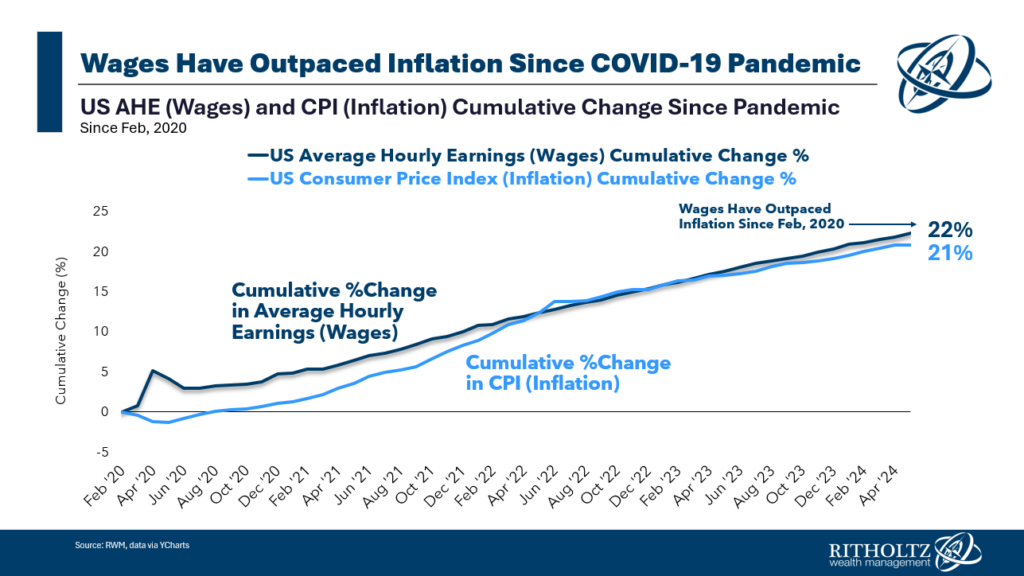

Your wage gains, on the other hand, are almost invisible. Most of us get paid by a direct deposit into our bank account. These aren’t posted online, or on giant signs in our front yard. Someone making $100,000 a year receives a twice-a-month paycheck of $2,328.82. If they get a 7% increase in wages, they see a modest increase in their direct deposit of after FICA, federal and state withholding taxes, 401K, etc. After that 7% bump, their comp goes up $163 to about $2491.84.

Your wage gains, on the other hand, are almost invisible. Most of us get paid by a direct deposit into our bank account. These aren’t posted online, or on giant signs in our front yard. Someone making $100,000 a year receives a twice-a-month paycheck of $2,328.82. If they get a 7% increase in wages, they see a modest increase in their direct deposit of after FICA, federal and state withholding taxes, 401K, etc. After that 7% bump, their comp goes up $163 to about $2491.84.

It’s not that this isn’t significant, it’s simply not in your face daily. It’s mostly invisible. Maybe you have a little more cash left over at the end of the month; perhaps you are paying down your debt a little faster. But earlier in my career whenever I got a significant salary bump, it was hardly felt.2

Now consider gas prices, a widespread complaint. It’s about $3.50. That is essentially flat over the past 10-20 years. FLAT. It’s been a little bit higher and somewhat lower over that period, but gasoline prices have been rangebound for 2 decades.

Cars are much more efficient – we tank up the hybrid every other month! – and energy as a percentage of your household budget is less than it ever was. This is despite a raging hot war in the Middle East (a very large source of oil) and an ongoing war that began with Russia (another giant oil producer) invading Ukraine.

That you can tank up in 2024 for $50-75 is an economic miracle, but people still love to complain about gas prices.

Houses are another legitimate and big complaint. We have discussed in the past how this is primarily a supply issue. (And that’s before we get to the Lock-In effect). As of January 1 2024, about 70% of all mortgage holders had rates three full percentage points below market prices. Said differently, 88.5% have a mortgage rate below 6%. I don’t want to minimize the very real stress young families feel unable to buy a starter home. But for the rest of us, it seems like we are all glass half-empty mortgage holders.

All of this reminds me of an old Steven Wright bit: “Last night somebody broke into my apartment and replaced everything with exact duplicates… When I pointed it out to my roommate, he said, “Do I know you?”

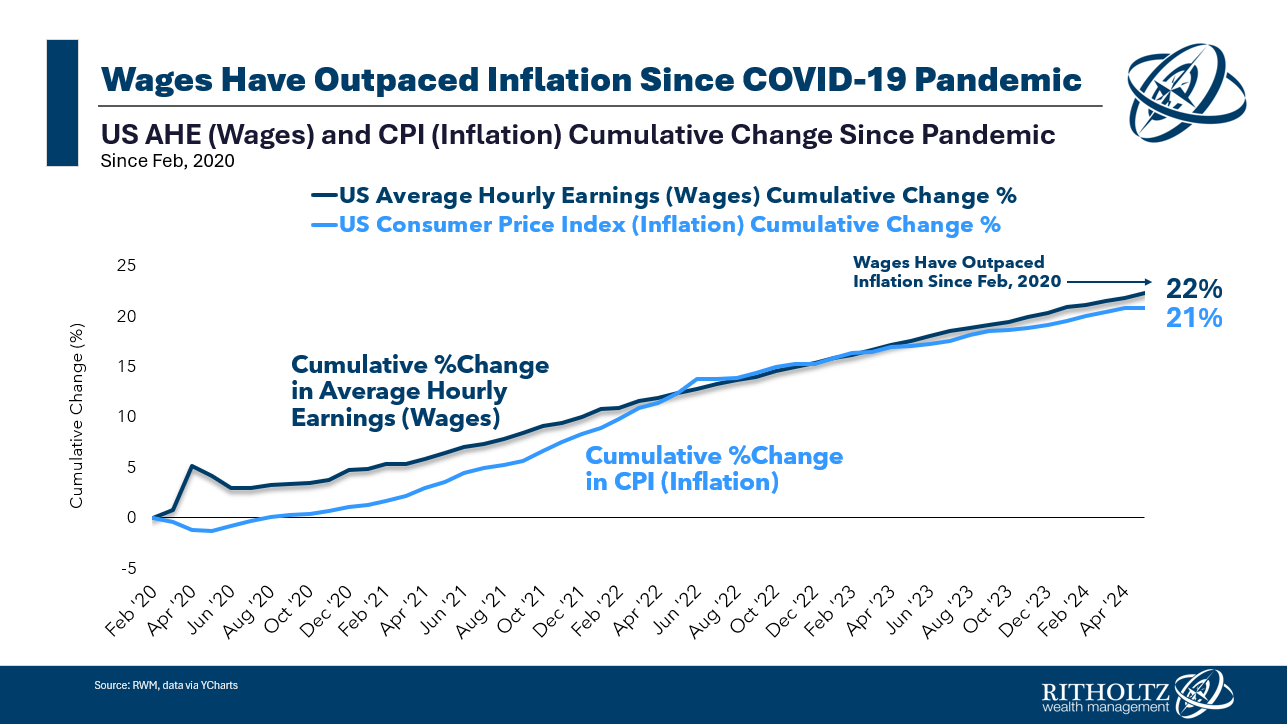

Prices have risen dramatically following the biggest fiscal stimulus as a percentage of GDP since WW2. But so too have wages. For most of us who are not regularly crunching the numbers in spreadsheets, it may not feel that way.

Some changes are obvious and upsetting. Others are positive but invisible. I don’t know if this explains all of the mismatch between actual economic conditions and sentiment, but perhaps it explains some…

Previously:

What Is the Consumer Doing…? (May 20, 2024)

Wages & Inflation Since COVID-19 (April 29, 2024)

What Else Might be Driving Sentiment? (October 19, 2023)

Is Partisanship Driving Consumer Sentiment? (August 9, 2022)

The Trouble with Consumer Sentiment (July 8, 2022)

Sentiment LOL (May 17, 2022)

How Everybody Miscalculated Housing Demand (July 29, 2021)

__________

1. The first thing I do when I look at any listed home for sale is to click more information and see how long the house has been listed. Any homeowner unable to sell a house within a few weeks or a month in what has been the hottest market of our lifetime has mispriced the house.

When you do a Zillow search organize the results by newest first then Scroll down to the bottom of the list to see the houses that have been unsold for 200, 300, 400 days. These houses aren’t really for sale.

2. I vividly remember the first year the combined salaries of my wife & I were over 6 figures; it meant we no longer looked closely at prices in the supermarket, and we could buy more fresh fruit and name-brand pasta sauces…