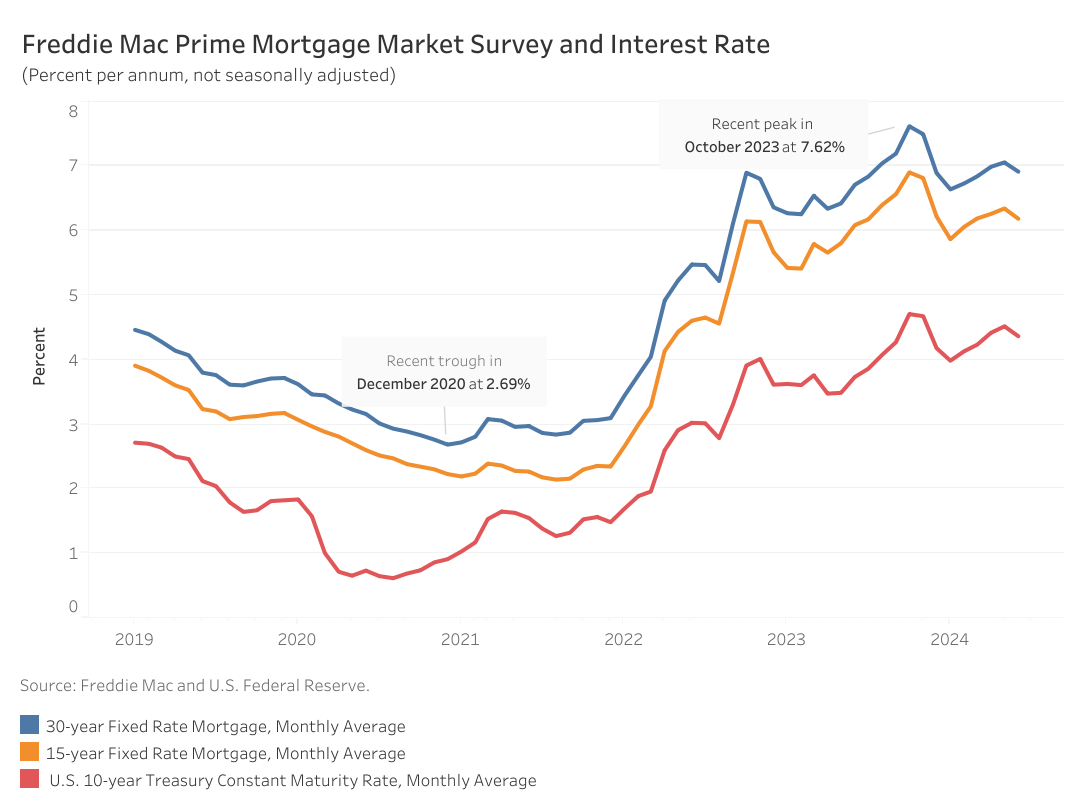

According to Freddie Mac, the average 30-year fixed-rate mortgage decreased by 14 basis points (bps) from 7.06% in the previous month to 6.92% in June 2024. This decline comes after increases from 6.64% in January to a peak above 7.2% in May.

Nonetheless, the current rate is still higher from one year ago by 21 bps, sidelining potential home buyers who are waiting for mortgage rates to decrease. Similarly, the 15-year fixed-rate mortgage also decreased by 16 bps from last month to 6.19% but remains 10 bps higher compared to last year. Mortgage rates declined as inflation data moderated and the 10-year Treasury rate fell back 15 bps from 4.52% in May to 4.37% in June.

Per the NAHB forecast, we expect 30-year mortgage rates to decline slightly to around 6.66% at the end of 2024 and eventually to decline to just under 6% by the end of 2025. The NAHB outlook anticipates the federal funds rate to be cut by 25 bps at the December Federal Reserve meeting and six more rate cuts in 2025 as inflation approaches the Fed’s target.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.