The budget deficit in 2024 is expected to total $1.9 trillion, according to the Congressional Budget Office’s most recent June estimates. This marks a $408 billion increase from the $1.5 trillion estimate published in February. This increase is the result of increased spending of $363 billion and decreased revenues of $45 billion for the year.

For the 2025-2034 period, the forecasted cumulative deficit was revised upwards by $2.1 trillion to $22.1 trillion over the period. This increase in the estimated deficit primarily comes from spending enacted this year that is expected to continue and rise with inflation.

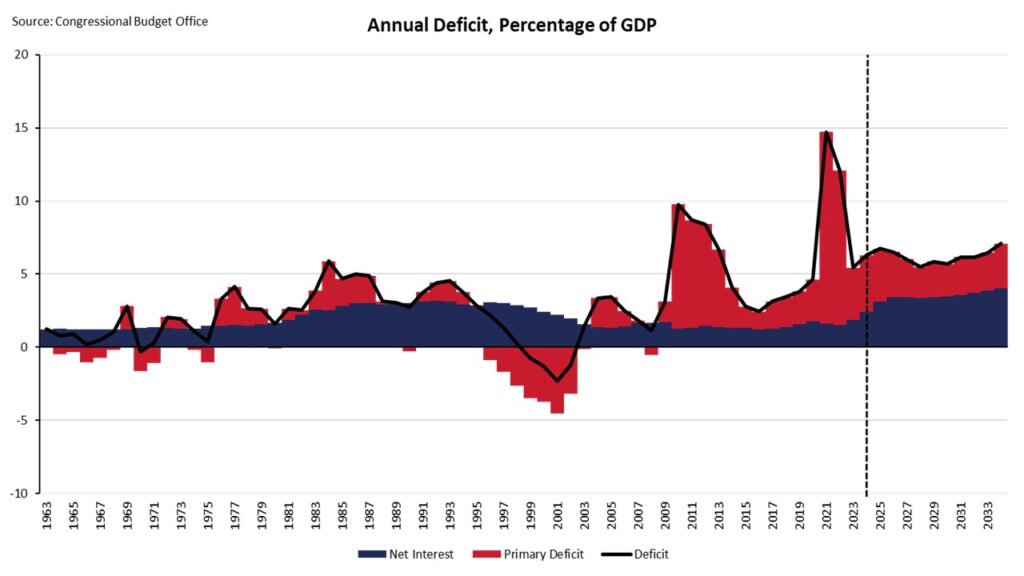

As a share of GDP, the annual deficit in 2024 is expected to be 6.7% and rise to 7.1% by 2034. Net interest cost is expected to increase from 3.1% of GDP this year to 4.1% by 2034. Net interest spending is expected to total $892.3 billion in 2024, surpassing discretionary defense spending.

By 2034, net interest spending is expected to be $1.7 trillion. Primary deficits (deficits excluding net interest spending) remain larger than historical levels, reaching 2.8% of GDP by 2034. Between 1947 – 2008, primary deficits have only exceeded 2.5% of GDP twice, while over the past 15 years they have exceeded 2.5% ten times.

When the Federal Reserve began raising the federal funds rate in 2022, interest rates increased significantly, including rates on U.S. Treasuries. These higher interest rates have a direct impact on higher net interest costs over the next ten years for federal spending. From the CBO:

“In CBO’s projections, about two-thirds of the growth in net interest costs from 2024 to 2034 stems from increases in the average interest rate on federal debt, and one-third reflects the larger amount of debt.”

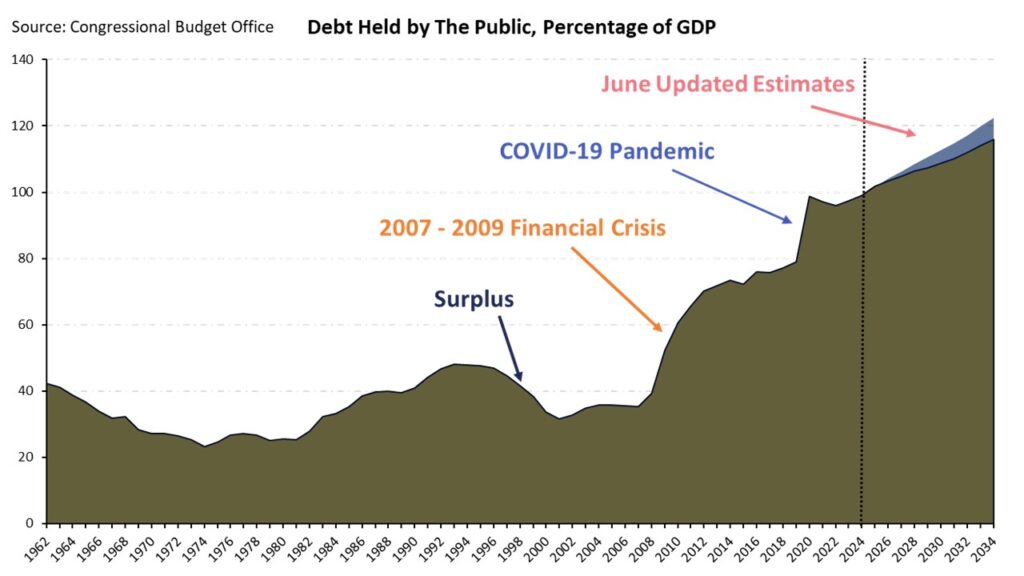

Federal Debt

Total debt held by the public is expected to be $28.2 trillion at the end of 2024 and rise to $50.7 trillion by 2034. As a share of GDP, debt held by the public is 99.0% in 2024 and rises to 122.4% by 2034. This marks a 6.4 percentage point increase from the February estimate of the debt-to-GDP ratio. Shown below in blue, June estimates are projected higher than the February estimates except for 2025.

Economic changes to the CBO’s estimates, which are changes to the macroeconomic forecasts that the CBO uses in its budget projections, resulted in decreasing the cumulative deficit between 2025-2034 by a relatively small $0.6 trillion. Recent legislative changes increased the cumulative deficit by $1.6 trillion, while technical changes (changes that are neither economic nor legislative) increased the cumulative deficit by $1.1 trillion.

Updates to Housing

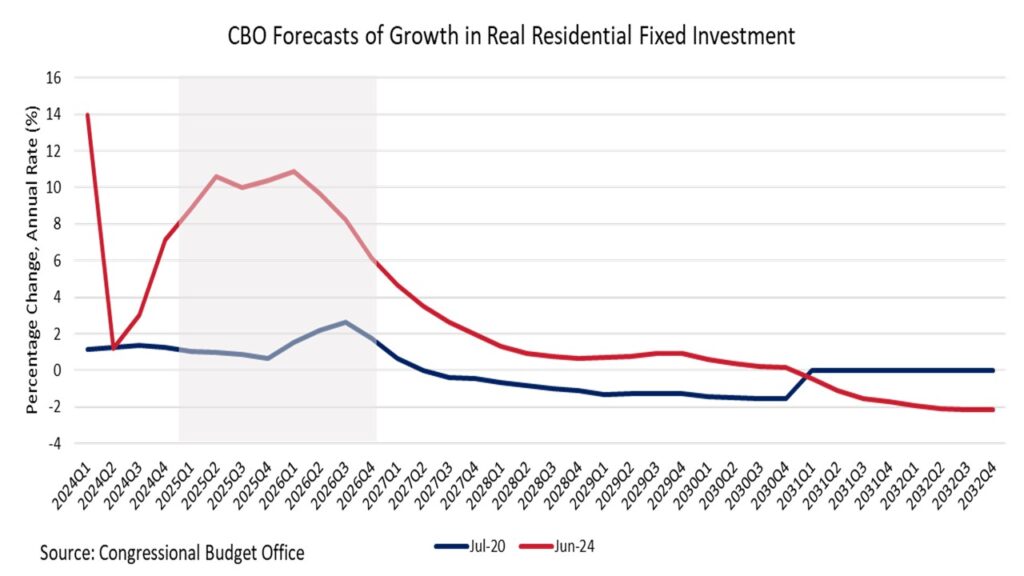

Among the economic changes, there are two major takeaways related to housing. The first being increases to growth in real residential investment. The CBO’s forecast of real residential fixed investment growth has been updated significantly higher. Real residential fixed investment consists of new residential construction, remodeling expenditures, brokers’ commission, and residential equipment such as furniture or household appliances. Looking at the July 2020 CBO release, real residential fixed investment was forecasted at under 3% annualized growth for every quarter in 2025 and 2026. This estimate has been increased to over 6% for each quarter of 2025-2026, peaking at 10.9% in the first quarter of 2026 (see chart below). This increase in projected residential fixed investment is due to increases in immigration and projected declines in mortgage rates in both 2025 and 2026, which will both increase demand for housing during those years. The revised CBO outlook reflects the ongoing housing deficit in the U.S.

The other economic change of note was related to individual income taxes. Economic changes increased revenues for the federal government by $612 billion between 2025-2034. The CBO notes that lower mortgage interest payments are a factor as to why revenues increased over this period.

“Projected receipts from individual income taxes increased in the later years of the period because CBO lowered its estimates of the amount of interest paid on mortgages. Mortgage interest payments now average 2.3 percent of GDP over the 2025–2034 period, down from 2.8 percent in the February forecast. Mortgage interest is generally deductible for taxpayers who choose to itemize deductions.”

One point here worth considering regarding mortgage interest is the used term “generally deductible”. Taxpayers must itemize deductions to claim the mortgage interest deduction. According to IRS data, returns that itemize deductions have fallen from 31% in 2017 to just 9% in 2021. The Tax Cuts and Jobs Act (TCJA) passage in 2017 reduced the number of itemizing returns by raising the standard deduction, which in turn reduced the use of the mortgage interest deduction across all taxpayers. Additionally, the mortgage interest deduction can only be applied to the first $750,000 of mortgage debt for a joint return, which is down from the pre-TCJA level of $1,000,000 in mortgage debt. Given that this amount is not indexed for inflation, the deductions significance has eroded since 2017 given high levels of shelter inflation over the past few years.

Interest Rates

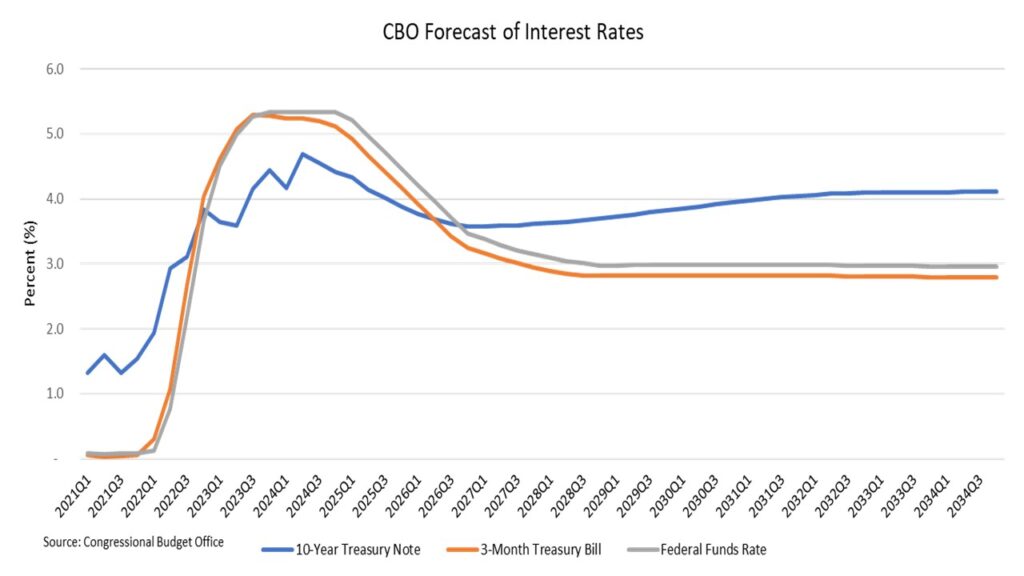

The CBO forecasts the Federal Reserve to cut the federal funds rates starting in the first quarter of 2025 as inflation continues to fall and unemployment rises. The CBO estimate shows the Federal Reserve then continuing to cut the fed funds rate to around 3% by 2028 and remains level through the following years. As the fed funds rate declines, 3-month treasury bill rates follow reaching just below 3% in 2028. The 10-year treasury note rate is expected to decline more slowly than short term rates, given they are typically higher. Between the first quarter of 2024 and 2028, the 10-year rate is forecasted by CBO to fall 0.5 percentage points, while the 3-month bill rate is expected to fall 2.3 percentage points. Over the long run and due to rising debt levels, the 10-year rate is forecasted to rise to 4.1% by 2034.

In the coming years, builders and home buyers need to monitor and be prepared to take part in government finances. Higher debt and continually large deficits will lead to higher nominal interest rates, which continue to negatively impact builder financing costs, mortgage rates, and overall housing affordability.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.