Fund families that get it right, over and over

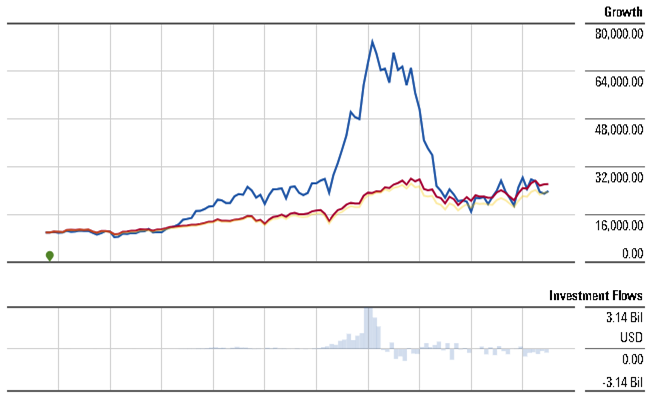

Briefly brilliant performance isn’t all the tough. It requires rather more luck the skill and it can be wildly profitable for the adviser, though deadly for the investors. ARK Innovation ETF is, of course, the current poster child for boom-then-bust. The fund posted triple-digit returns in 2020, saw its assets explode then promptly (and predictably) crashed. Anyone who bought five years ago and has devoutly held on has lost 1% annually and has trailed 99.9% of all similar investors. Those who bought at the peak three years ago have clocked annual losses of 30.3%.

In collaboration with the folks at Morningstar, MFO decided to identify the firms that were least likely to ever betray their investors by soaring and then smashing.

In collaboration with the folks at Morningstar, MFO decided to identify the firms that were least likely to ever betray their investors by soaring and then smashing.

The MFO Premium screener rates every fund family based on the performance of their existing funds. We assign every family of five or more funds into tiers based on the absolute performance of their funds against their peers. The families with the “top” rating are in the top 20% of all families for raw performance. We track that rating over a variety of periods, as a measure of consistent excellence. By our measure, only 10 families have excelled in every period we track.

The fly in the ointment is survivorship bias. We only analyze the records of funds that still exist; if an adviser had 15 funds a decade ago and was forced to liquidate 10 of them, they could still receive a Top ranking if the five survivors were excellent. In order to combat  survivorship bias, we enlisted the assistance of Dillon McConnell, an Associate Quantitative Analyst at Morningstar, who was able to query Morningstar’s survivorship-free database for us. He identified firms with a 100% 10-year success rate. That means that every fund that the firm had 10 years ago is still in operation and has beaten its peers over the past decade. There are 68 firms with a 100% 10-year success rate, although almost all of those are advisers with a single fund (e.g., Bretton Fund). Forty-one of those firms also have a perfect five-year record. (The complete list is here.)

survivorship bias, we enlisted the assistance of Dillon McConnell, an Associate Quantitative Analyst at Morningstar, who was able to query Morningstar’s survivorship-free database for us. He identified firms with a 100% 10-year success rate. That means that every fund that the firm had 10 years ago is still in operation and has beaten its peers over the past decade. There are 68 firms with a 100% 10-year success rate, although almost all of those are advisers with a single fund (e.g., Bretton Fund). Forty-one of those firms also have a perfect five-year record. (The complete list is here.)

We have melded those two lists to identify the fund families (five or more funds) that have consistently gotten in right by both MFO standards (top 20% batting average for the past 1-, 3-, 5- and lifetime periods) and Morningstar’s standards (above average performance while factoring in the effects of fund liquidations and mergers).

Top Tier Fund Families, data through 6/30/2024

| MFO Lifetime rating | One-year rating | Three-year rating | Five-year rating | Morningstar 10-year success rate | Morningstar 5-year success rate | Morningstar “parent” rating | |

| Dodge & Cox | Top | Top | Top | Top | 100 | 100 | High |

| Boston Partners | Top | Top | Top | Top | 86 | 70 | Above average |

| Marsico | Top | Top | Top | Top | 83 | 100 | Above average |

| FPA | Top | Top | Top | Top | 67 | 71 | Above average |

| Gotham | Top | Top | Top | Top | 67 | 38 | Average |

| Third Avenue | Top | Top | Top | Top | 67 | 100 | Below average |

| Hotchkis & Wiley | Top | Top | Top | Top | 63 | 80 | Above average |

| Driehaus | Top | Top | Top | Top | 50 | 75 | Above average |

| AQR | Top | Top | Top | Top | 37 | 40 | Average |

| Easterly | Top | Top | Top | Top | 25 | 50 | Average |

Source: MFO Premium (columns 2-5), Morningstar Direct (columns 6-7), Morningstar.com (column 8)

The unambiguous winner is Dodge & Cox. Dodge & Cox was founded in 1930 by Van Duyn Dodge and E. Morris Cox. They shared the belief that the investment firms of their day were undisciplined and self-serving; that is, the principals put their own interests ahead of their clients’. Dodge and Cox aimed to change that.

The unambiguous winner is Dodge & Cox. Dodge & Cox was founded in 1930 by Van Duyn Dodge and E. Morris Cox. They shared the belief that the investment firms of their day were undisciplined and self-serving; that is, the principals put their own interests ahead of their clients’. Dodge and Cox aimed to change that.

The firm describes its core this way:

“A rather chaotic investment world” describe the Roaring Twenties—when high-priced investment products flooded the marketplace—and our founders believed clients deserved a new kind of investment firm. Dodge & Cox was founded with the goal of putting clients’ interests first through a focused set of investment strategies designed to preserve and enhance their investment capital over the long term and offered at reasonable and transparent fees. These principles still guide our firm more than 90 years later.

We have built our firm to withstand periods of turbulence on the bedrock of independent ownership, financial strength, a commitment to active, value-oriented investing, and a deep belief in the power of fundamental research, diverse perspectives, and teamwork. Our culture emphasizes our fiduciary responsibility to our clients and Fund shareholders above all else.”

The firm’s seven strategies are all team-managed. They launch a new strategy about once a generation and handle manager succession exceptionally well. While there was some concern in 2023 that CIO David Hoeft might be front-running his firm’s funds by buying stock for his personal account ahead of a firm’s purchase of the same stock, D&C’s internal review concluded otherwise and Morningstar continues to affirm their high opinion of the company.

From both Morningstar’s metrics and ours, three firms stand out as advisers who get it right with startling consistency. Here is one fund you should learn more about from each family.

Dodge & Cox Global Bond just passed its 1o-year anniversary. At $2.8 billion, it’s small and nimble by D&C standards. The fund

…seeks to generate attractive risk-adjusted total returns by investing across global credit, currency, and interest rate markets. We evaluate each investment with a three- to five-year investment horizon in mind, but regularly adjust our positioning in response to changes in fundamentals and market pricing.

Over the past decade, it’s had the fifth-highest returns of a fund in Lipper’s global income peer group.

Comparison of Lifetime Performance (06/2014-06/2024)

| Annual return | Maximum drawdown | Ulcer Index |

Sharpe Ratio |

|

| Dodge & Cox Global Bond | 2.8 | -14.7 | 4.9 | 0.20 |

| Lipper Global Income Category | 0.8 | -20.2 | 7.7 | -0.12 |

Each of the seven managers has invested more than $1 million of their own money in the fund.

WPG Partners Select Small Cap Value is one of Boston Partner’s two newest launches; the other is the newly launched Select Hedged Fund, which is a long/short small-cap fund. The firm launched it at the behest of current investors. The fund attempts to “identify out of cycle companies with clear catalyst and event paths through bottom-up fundamental research, executive suite engagement, and broad industry knowledge.”

The Select Small Cap Value fund is a public manifestation of a longer-running strategy. The Select Small Value strategy was launched in December 2018. Since inception, the strategy has returned 18.97% annually which crushes the Russell 2000 Value’s 6.7%. The fund launched in December 2021 and maintains a huge performance gap over the benchmark.

Comparison of Lifetime Performance (01/2022-06/2024)

| Annual return | Maximum drawdown | Ulcer Index |

Sharpe Ratio |

|

| Boston Partners WPG Partners Select Small Cap Value | 11.4 | -18.8 | 6.9 | 0.37 |

| Lipper Small Core Category | -0.1 | -22.9 | 11.8 | -0.18 |

The fund’s sole manager is Eric Gandhi. He joined the WPG Group in 2012 as an analyst and is now manager, or co-manager, of four WPG micro- to small-cap strategies. He has invested between $100,000 – 500,000 in the fund.

Marsico International Opportunities, the smallest of the Marsico funds, launched in June 2000. Founder Tom Marsico took over the reins in 2017 and added his sons Peter and James as co-managers in 2023. They joined the firm as analysts in 2008 and 2009, respectively, and now co-manage a range of funds with their father.

The fund attempts to “capitalize on various secular trends fueling growth across the globe through a portfolio of high quality, growth-oriented international companies.” The fund is concentrated, a Marsico hallmark, with use 27 stocks, an unusually high investment in US-domiciled companies (38% of the portfolio) and an active share of 90.

Comparison of Marsico-led Performance (07/2017-06/2024)

| Annual return | Maximum drawdown | Ulcer Index |

Sharpe Ratio |

|

| Marsico International Opportunities | 8.9 | -36.8 | 14.0 | 0.37 |

| Lipper Int’l Large Growth Category | 6.4 | -34.3 | 12.9 | 0.25 |

Mr. Marsico the Elder has invested between $500,000 – $1 million in the fund while his co-managers have chosen not to commit their own funds to it.

Bottom Line

There are no guarantees in life or in investing. At best, an investor can seek an edge: an enduring advantage they possess over their peers. One edge you possess is time arbitrage; if you are a long-term investor in a world of short-term traders, you mostly need to make a handful of sensible commitments and then walk away from the madding crowd and their howling handlers. The other edge you possess is the ability to identify investment partners who keep getting it right: they rarely launch funds, they rarely abandon funds, and they outperform over reasonable time frames.

We’ve identified just 10, out of hundreds, of investment firms that meet that threshold. We commend them to you.