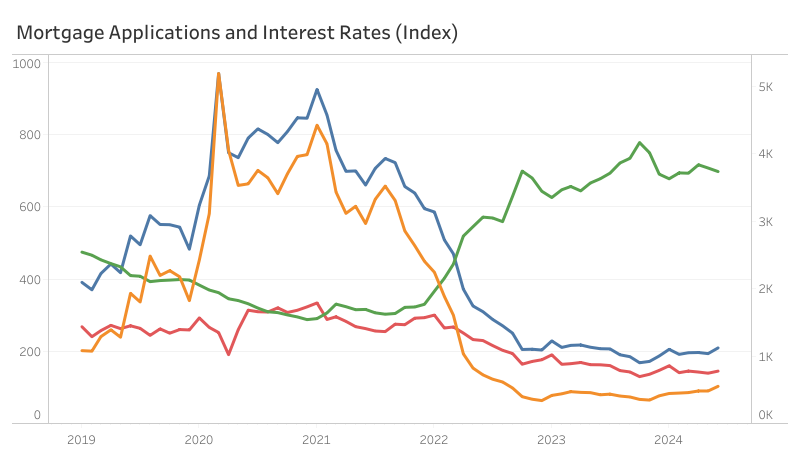

The Market Composite Index, a measure of mortgage loan application volume by the Mortgage Bankers Association’s (MBA) weekly survey, increased by 8.2% on a seasonally adjusted (SA) basis from May to June. In comparison to June 2023, the index is up by 1.0%. The Purchase and Refinance indices, over the month, are up by 4.1% and 14.3% (SA), respectively. On a yearly basis, the Purchase Index decreased by 10.8%; the Refinance Index, on the other hand, increased by 29.4%.

The increase in mortgage activities brought about by a 9.8 basis points (bps) decline in the 30-year fixed mortgage rate, from an average rate of 7.08% in May to an average of 6.98% in June. However, compared to the same month last year, the mortgage rate for June is higher by 19.8 bps.

The average loan size for the total market (including purchases and refinances) is down by 2.0% from May to $373,500 on a non-seasonally adjusted (NSA) basis in June. Similarly, the month-over-month change for purchase loans decreased 1.7% to an average size of $431,000 (NSA), while refinance loans increased by 4% to an average of $268,500 (NSA). The average loan size for an adjustable-rate mortgage (ARM) increased by 2.9% for the same period, from $1 million to $1.03 million.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.