The Tax Cuts and Jobs Act (TCJA), passed in 2017, was one of the most extensive pieces of tax legislation to be passed in the last 30 years, touching many aspects of individual, corporate, and estate tax. However, most of TCJA’s provisions are set to ‘sunset’ at the end of 2025 – an event that would have at least as much impact as TCJA’s initial passage.

From an advisor’s perspective, TCJA’s impending expiration raises the importance of planning for clients who will potentially be impacted, which, given the law’s broad scope, could be nearly every client. And yet, the timing of the sunset provision at the end of 2025 means that the actual fate of TCJA will largely hinge on the uncertain outcome of the 2024 U.S. elections. In reality, any law that extends or replaces TCJA would likely not pass until well into 2025, creating a very limited window (potentially only days long) in which to implement any planning strategies. And so even though there’s uncertainty today about whether or not TCJA will sunset as scheduled, it’s still not too early to start making plans for either contingency so they can be triggered quickly once there is more certainty.

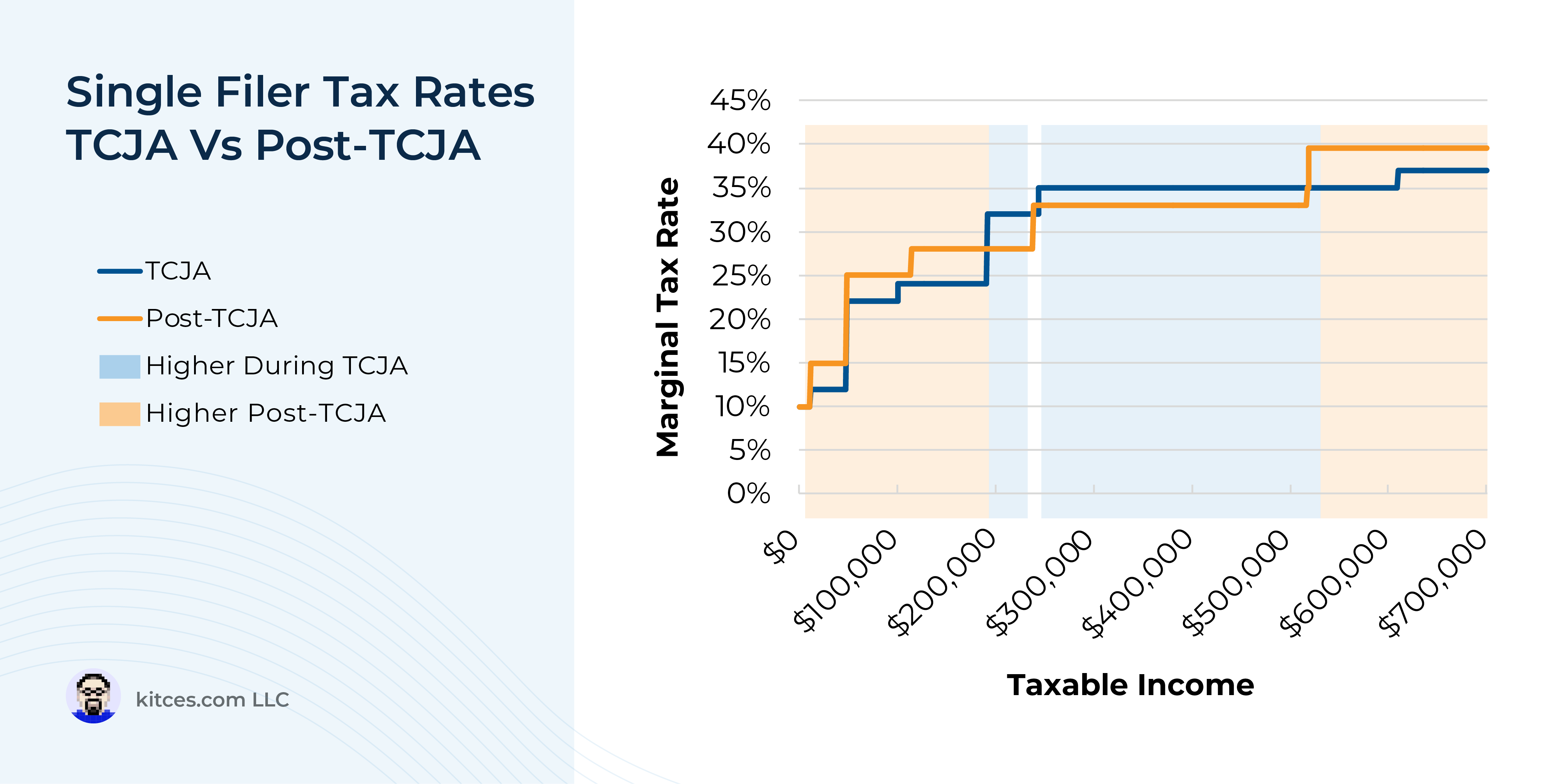

For many clients, one of the biggest questions is whether they’ll have a higher or lower marginal income tax rate after TCJA expires than they do today, and whether it is therefore reasonable to accelerate income – i.e., to recognize it before the end of 2025, such as by converting pre-tax retirement funds to Roth – or to defer income to be recognized in 2026 or beyond. And although TCJA’s reputation as a broad tax cut might give the impression that everyone’s tax rates would increase after its expiration, comparing the current Federal tax brackets with their estimated post-TCJA equivalents shows that a fair number of households will actually see their tax rates decrease.

Beyond the tax brackets themselves, however, households will also see significant changes to how their taxable income is calculated post-TCJA. First, the combination of a lower standard deduction and the elimination of the $10,000 cap on deductible state and local tax payments means that many more people will be taking itemized deductions instead of using the standard deduction. Second, the reinstatement of personal exemptions means that households will be able to take an estimated $5,010 exemption per taxpayer or dependent, meaning that larger households could see a large reduction in their taxable income. With the caveat that the expiration of TCJA will also bring back the Personal Exemption Phaseout (PEP) and “Pease limitation” on itemized deductions above a specific income threshold, both of which effectively create a surtax on income within the threshold range, increasing the household’s marginal tax rate above their nominal tax rate based on the tax brackets alone.

For owners of pass-through businesses like partnerships, S corporations, and sole proprietorships, the biggest concern around TCJA’s sunset is the elimination of the Section 199A deduction on Qualified Business Income (QBI), which allowed for a deduction equal to 20% of the lesser of the taxpayer’s QBI or their taxable income. For most pass-through business owners, the end of the QBI deduction will result in much higher marginal tax rates in 2026 or later, with one exception: Owners of Specified Service Trades or Businesses (SSTBs) like lawyers, consultants, and financial advisors, whose QBI deduction phases out above certain income thresholds, will have a much higher marginal tax rate on any income earned within the threshold range – meaning that while it might make sense for most business owners to accelerate income in 2024 and 2025 while the QBI deduction is still in effect, SSTB owners within the phaseout threshold range would be better off doing the opposite and deferring income until after TCJA expires.

The key point is that different households will experience the end of TCJA in a wide variety of ways, with income level, filing status, number of dependents, and QBI all factoring heavily into the impact that the TCJA sunset will have. And although TCJA’s ultimate fate may still be undecided, for at least some clients the potential benefit of taking action today (e.g., to recognize income at a lower marginal tax rate today versus after TCJA expires) may be worth taking the risk that TCJA is ultimately extended – since in that case the client would have simply recognized income at the same marginal rate that they would have later on, merely ‘costing’ them the value of a few years of tax deferral. So by understanding how each client stands to be affected, advisors can narrow their focus on the planning strategies that will have the biggest benefit for their clients.Read More…