For all of you who feel overwhelmed or daunted, here’s my guide to Adulting 101: The Insurance Edition for you.

Dear Gen Zs and young working adults,

I almost fell out of my chair recently when I learned recently about how under-insured you are. No judgment though, because it wasn’t too long ago when I was like you.

You see, just a decade ago, I was in my 20s and at the peak of my health. Back then, I used to think that nothing bad would happen to me. And even if anything does, I can handle it! I can surely bounce back!

That’s why I can relate to how you feel when I see you guys make statements like these:

“Insurance can be an unnecessary expenditure. What if I never fall ill or get into an accident? Then I’ll be paying for nothing, right?” – Gen Z Leonard Tan, 28 (as told to Today)

“If something bad does happen, I’ll probably regret not taking (insurance) more seriously at this stage. I understand it’s the consequence of my actions, but I don’t plan on dying anytime soon.” – Gen Z Eliza Wong, 30.

At the same time, I’m smiling and shaking my head because I recognise these statements as a shadow of my younger self. That girl who’s no longer as ignorant, after going through life.

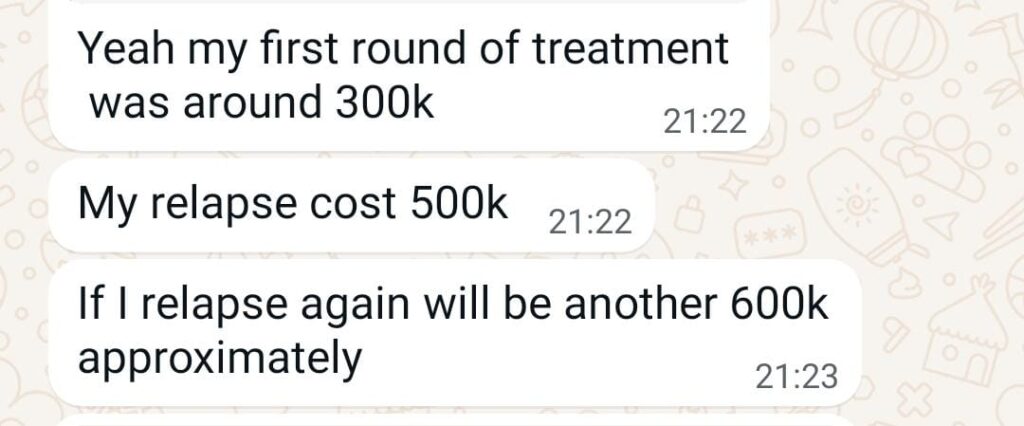

You see, life has its way of humbling you down no matter how strong or invincible you feel. As the years passed and my social circle grew, I started seeing more things happen to the people around me. Friends who ate clean and exercised regularly yet being diagnosed with cancer. Losing several of my JC and university friends to death. Acquaintances who got injured in road accidents even though it was no fault of their own. Folks in their 30s getting a stroke out of the blue. Peers who passed away before they even hit 45.

Witnessing their journeys made me realise the importance of insurance, because the ones who had it managed to beat the odds. Their families didn’t have to resort to loans or debts to pay for medical treatment and bills. During such hard times, money was the least of their concerns.

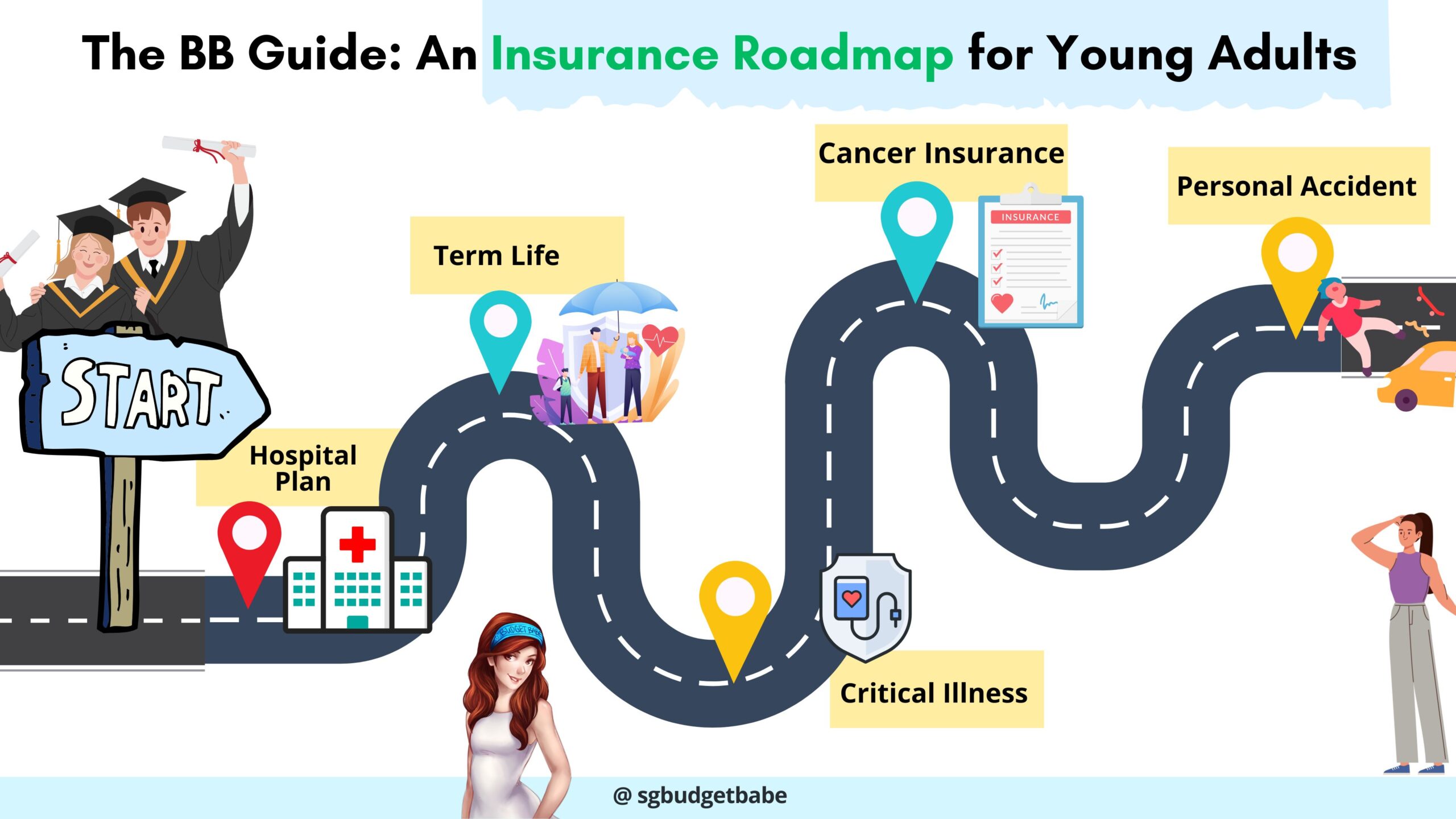

Gen Z Eliza Wong told Today newspaper that she would likely “benefit from a national roadmap guide outlining the recommended (insurance) plans for each age group or life stage”. In a recent livestream on personal finance that I did for Gen Zs, the most common question was “what insurance do you think is necessary for young adults?”

Since no such national roadmap exists, here’s my attempt at creating one for you guys.

Disclaimer: I’m neither an insurance agent nor someone who stands to earn any money if or when you buy insurance. I’m not incentivised to make you buy insurance, but I’m motivated enough to tell you that you should – because I’ve seen enough of life to know what happens to those who don’t.

Insurance 101: What to get as a young adult

First, you need to understand the role that insurance plays in our lives.

When we buy insurance, we outsource our financial risks (and bills) to a third party.

Therefore, start by thinking – what are some of the biggest financial risks that you might not be able to pay all by yourself with your cash savings?

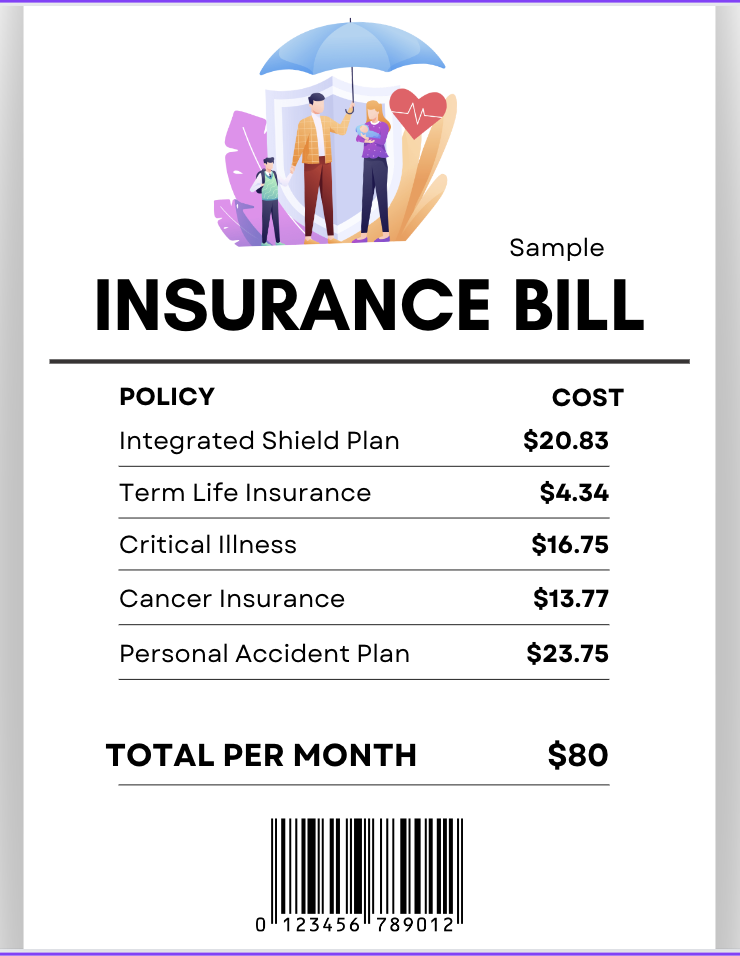

- Hospital bills: a minor surgery can easily cost 5-digits in Singapore.

- Disability or terminal illness: money is needed for long-term medications, caregiving and other support tools or services.

- Critical illness: medical treatments and drugs aren’t cheap, especially for cancer. You’ll most likely also have to stop working (or quit or get fired from your job for all the sick leave days you take) in order to focus on your recovery, due to your weakened immune system.

- Accidents: medical treatments or even physiotherapy, or 6-figure costs that you could be liable for if you accidentally caused any bodily injury or damaged someone else’s property.

No one goes through life planning to fall sick, get into an accident, or die before they’ve done what they want to do.

And certainly no one plans on getting cancer, a stroke, or even becoming paralysed while flying overseas on the world’s best airline.

Life can throw some curveballs. That’s exactly why we buy insurance – so we can throw these risks to the insurers and avoid paying large bills with our own savings.

I’m not a licensed insurance agent and thus, under MAS rules in Singapore, I cannot advise you on what plans you should or must buy.

But if you want to hear from a consumer’s point of view – especially from a budget-conscious someone who buys insurance and have seen how insurance helped protect the lives of her friends and relatives – then here are some basic insurance plans that I recommend you look into:

| Type of Insurance | What it does | How much? |

| Hospitalisation Insurance (Integrated Shield Plans) |

An Integrated Shield plan can significantly reduce how much cash you’ll have to pay out of your own pocket when you’re hospitalised, as it has higher limits on what you’re allowed to claim vs. on MediShield Life alone.

Also gives you the option to skip the long waiting lines via the public healthcare route (several months long) and seek treatment via private hospitals sooner. |

Ranges from $250 to $1,000+ per year |

| Term Life Insurance | Safeguard your loans, mortgage, yourself and your loved ones. Pays you (or your loved ones) a sum of money if you become permanently disabled, get diagnosed with a late-stage terminal illness, or pass away unexpectedly. The money can be used to help support your elderly parents in their retirement or pay for your children’s living expenses (school fees, etc) in your absence. |

As low as $0.09 per day to a few (low) hundred dollars yearly (depends on the coverage amount you seek) |

| Critical Illness (Top 3 Most Claimed Conditions) | Covers the 3 most claimed conditions in Singapore – heart attack, stroke and all stages of cancer. | From $4.86 per month to a few (low) hundred dollars yearly |

| Cancer Insurance | Covers all stages of cancer, including early-stage diagnosis. Pays you a sum of money for your cancer treatments and living expenses (despite your loss of income) while you take time off work to overcome cancer. | From $7.94 per month to a few (low) hundred dollars yearly |

| Personal Accident | Covers for unexpected medical expenses, injuries due to violence or fall in transportation, dengue fever, food poisoning, physiotherapy expenses, unexpected falls, Hand Foot & Mouth Disease (HFMD). | From $14.61 per month to a few (low) hundred dollars yearly |

You might also want to check out this article for global statistics on how cancer rates are rising the fastest among the 25 – 29 year olds than any other age group.

Your Insurance Starter Pack

(as curated by Budget Babe)

“A good way of thinking about insurance is to focus on buying policies where the financial risk is too much for you to shoulder.”

Budget Babe

For those of you who think insurance is expensive, think again. With the rise of direct insurers and digital offerings in recent years, premium costs have in fact been coming down. For the same type and level of coverage across hospital costs, critical illness (including early-stage conditions), term life and accident plans – it is cheaper today than it was a decade ago during my time when I first bought mine.

Back then, early critical illness (CI) policies were extremely expensive, there were hardly any standalone cancer policies, and direct term life insurance only had a few insurers offering it at a lower coverage amount. Today, you Gen Zs have more options including cheaper early CI plans, cancer-only policies, digital insurers with no commissioned agents and more…these have really changed the landscape of insurance.

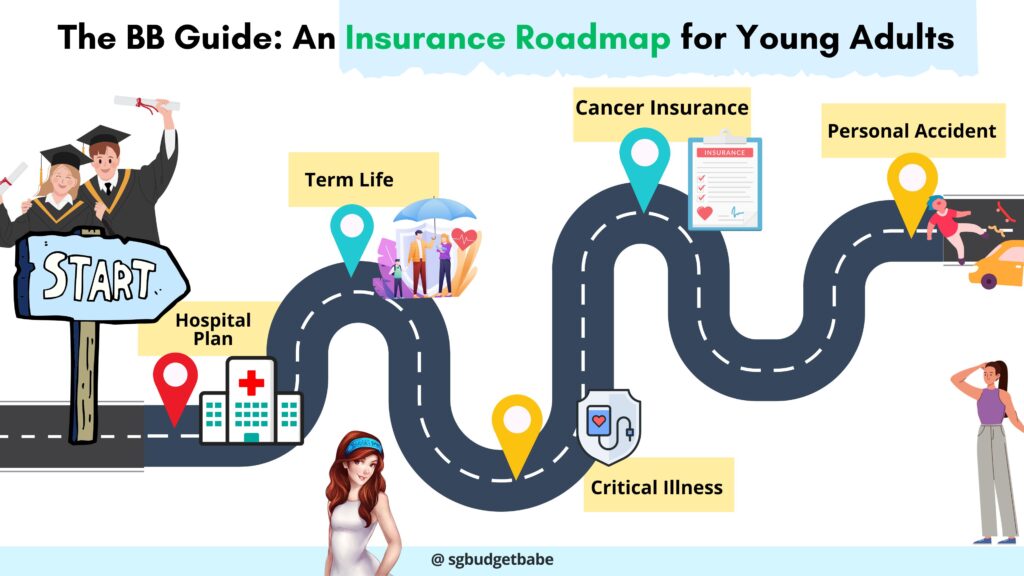

So here’s an example of a bare-basics, starter insurance pack I’d put together for the 25-year-old me today:

Note that I extracted the premiums above based from online quotes with automatic promotion codes applied for me based on the insurer’s prevailing offers at the time of my search (I didn’t manually key in any promo code). Due to some of the discounts being applied only on the first-year premium, this also means that your premiums vary upon renewal / changes by the insurer for the next age. Hence, please note that my prices above should only be used as a reference (!!); your exact insurance costs will vary depending on your personal circumstances and time of purchase.

Important: All quotes referenced in this article to calculate premiums are based on the scenario of a 25-year-old age next birthday, female and non-smoker. The per month premium calculated is also based on me opting for the annual insurance payment option (vs monthly), which then derives the per month premium based on yearly premium divided by 12.

The above would cost my 25-year-old self only ~$80 per month to get such a level of basic protection.

If you compare this against how much Gen Zs are already paying for a meal outside, or their Netflix / Spotify subscriptions, the cost is definitely affordable for most young adults.

Considering how most Gen Zs I know are earning $3,000 – $5,000 these days, so there’s really no excuse as to why you can’t afford to purchase basic financial protection for yourself.

Of course, the alternative would be to save up so that you self-insure, but how much and how fast can you save? Imagine saving $500 a month and having to deplete several months of savings just to pay for an unexpected hospitalisation or chiropractor fees to fix your bones from an accident. Would you really want your hard-earned savings to be depleted like that, or would you rather pay a small fee to let your insurer take care of that if it happens?

Take it from this Millennial finance mama nagging you: get insurance while you can. Insurance is something that you buy while you’re in the pink of health, and you really don’t want to wait until something changes in your health status later on which will cause you to get excluded from insurance (or get slapped with hefty loading fees by the underwriters due to your condition).

That’s when people regret not having gotten protection while they still had the chance.

I learnt from the wisdom of folks older than me, and am passing this down to you today so you can learn from their experience, instead of having to go through the ordeal by yourself.

How much will insurance cost me if I want more coverage?

Of course, the basic “starter pack” above is just my personal suggestion on what you should start looking at. I’ve focused on what I see as “essential” protection plans, but since I don’t know you personally – my dear reader – your own needs might vary from mine.

As a general rule, you pay more for higher or more comprehensive benefits.

How much you’ll end up paying therefore all boils down to what benefits YOU want and prioritise.

There will always be a suitable insurance plan for every budget. If your budget is tight, you can focus on lower coverage plans first and upgrade your coverage later as you get older, or when you have more cash.

The good news is, if you are in your 20s, your insurance can be as affordable as a few hundred dollars a year, or $1,000+ to cover multiple areas of financial protection. If you add on more plans such as endowment savings, or sign up for a whole life policy, then your cost will go up – but it still shouldn’t cross a few thousand dollars at maximum for most people in their 20s.

There’s a general guideline that you shouldn’t be spending more than 10% of your yearly salary on insurance protection, so if you use $3,000 x 12 as a base, that roughly translates to a $3,600 budget.

The options I’ve provided above are more conservative – and thus cost even lesser – than that 10% guidance.

Of course, you must understand that there are many factors that will affect your insurance premiums, such as:

- Your age (younger = cheaper)

- Sum assured i.e. how much you want to be covered for / how much the insurer has to pay you if you claim

- Your gender – females generally pay more due to their longer lifespans

- Non-smokers pay cheaper premiums

There is thus no point in asking – “what’s the BEST insurance policy to get?” – because there is no such thing. Some people prioritise highest coverage, others want the longest period of protection, while some are even willing to give up certain benefits and take their odds in exchange for cheaper premiums.

What’s more, history has shown that the “best” (or cheapest) insurance plan today may no longer remain so tomorrow.

Hence, you’d be better off finding something that fits (i) your needs and (ii) your budget.

Ideally, if you have an insurance agent whom you can trust for advice and work with for claims, then that’ll be even more convenient and reassuring – but you shouldn’t count on it, since even your buddy can choose to quit as an agent anytime. It’s their career choice after all, and you have no say – even if you bought your policy through them before.

For those who can DIY and don’t care about having agents service you, the rise of digital insurers in the last few years have also shaken up the traditional insurance landscape with their lower cost premiums. Etiqa is one such insurer that has emerged to offer affordable insurance premiums. In fact, their term life policy is one of the cheapest on compareFIRST (a comparison portal which is a collaborative effort by the Monetary Authority of Singapore, Consumers Association of Singapore, the Life Insurance Association, Singapore and MoneySENSE) especially if you’re in your 20s (or even 30s like me).

Other Insurance Plans for Gen Zs

If you have more budget to spare, or feel that the starter pack I curated above is not enough for your needs, here are two other basic plans that most young adults also tend to consider.

Whole Life Policy

There’s a lot of debate between whole life vs. term life policies, but both plans have its functions for different consumers.

For Gen Zs who share Leonard Tan’s perspective of not wanting to “pay for nothing” if you don’t make any claims, a whole life insurance plan gives you the option to “cash out” on your policy later on.

For instance, Etiqa’s whole life policy allows you to purchase $200k sum assured that will cover you even after age 65, which is when most term life plans end. In the event that you wish to stop your financial protection and take back some cash to fund your living expenses, you can surrender your plan then.

The trade-off here is that you’ll be paying higher premiums upfront for that benefit:

(Both quotes above are for a 25-year-old female on a $200k sum assured life plan, using Etiqa’s insurance plans as a sample reference).

Endowment Savings Policy

Another policy that some working adults consider would be a capital-guaranteed^ endowment plan, which can help to enforce a habit of saving towards your future goals – be it paying for your wedding, honeymoon, new home, or even your kids’ future university fees.

^capital guaranteed upon maturity.

One such instance would be for you to start saving as a 25-year-old in your first job towards your wedding or first property. But if you don’t trust yourself to not touch your savings in your bank between now till then, an endowment plan can help you enforce that discipline.

Committing to pay ~$1,100 monthly for an endowment savings plan – such as Tiq CashSaver – for 2 years and save for 7 years could see you:

- pay ~$26,400 in premiums

- but get e.g. $28,743* to $30,817* your policy finishes 7 years later.

*Based on an illustrated investment rate of return of 3% vs. 4.25% per year respectively. Yearly premium frequency was selected, and this calculation assumes that the policyholder accumulates the yearly cash benefit for compounding, rather than withdrawing it each time.

That way, you can rest in the knowledge that you will have your sum of money for your future purchase…since your endowment policy ensures that you’re kept on track even if you use up all the savings in your bank on other FOMO expenses (or worse, if you unwittingly lost it to a scam, such as this couple in their 20s).

TLDR: Your Gen Z Insurance Starter Pack

You Gen Zs wanted a “insurance roadmap”, so I’ve created exactly that for you.

Remember, under local MAS laws, only a licensed insurance agent can give you advice on what insurance policies to buy. I’m just a finance blogger sharing my own learnings and opinions on this website, which is my personal blog – albeit one that has survived and built quite a reputation for itself over the last decade and has been featured by the government, our local news media, and even by various insurers themselves as an unaffiliated expert speaker at their events.

I don’t earn a single cent whether or not you buy insurance to get yourself protected, but I care that people do not put themselves at unnecessary risk of financial ruin. I’m also old enough to have seen cases where people chose not to buy insurance because they felt they were strong and healthy enough with no (known) family health risks, only to forever lose their chance of getting protection coverage later on when they got diagnosed with a condition.

Unexpected events and sudden medical bills can be one of the quickest way to wipe out your cash savings, and force you to restart your financial journey all over again from scratch as you go back to ground zero. As a finance writer, my objectives include teaching you how to prevent that from happening to you.

The easiest way to avoid that would be to pay insurers a small fee (within your budget) to outsource that risk.

So if you have very little money but still care about being financially protected, I suggest that you look at the following protection plans for a start:

- Hospitalisation insurance

- Term life

- Critical illness (or at least for the top 3 most claimed conditions)

- Cancer insurance

- Personal accident

You can easily get these for less than $100 in cash premiums per month, so there’s really no reason to say you can’t afford it.

And then, as your needs evolve through your different life stages, you can always afford to add on more protection coverage later on.

Sponsored Message:

Looking for affordable insurance coverage without busting your budget? Check out the full range of Tiq by Etiqa’s offerings here!

Disclosure: This article is brought to you in conjunction with the digital insurer Etiqa, whom I approached to feature their insurance offerings as an affordable option for the budget-conscious young adults in Singapore to consider. Etiqa’s term insurance is the cheapest on compareFIRST (a comparison portal by the authorities MAS, LIA, CASE and MoneySENSE) especially if you're in your 20s (or even 30s like me). All opinions in this article are that on my own, and Etiqa had no say in which plans I chose to feature and recommend in my roadmap.

DISCLAIMERS:All products except for shield plan mentioned in this article are underwritten by Etiqa Insurance Pte. Ltd (Company Reg. No. 201331905K).This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This comparison does not include information on all similar products. Etiqa Insurance Pte. Ltd. does not guarantee that all aspects of the products have been illustrated. You may wish to conduct your own comparison for products that are listed in www.comparefirst.sg.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

As term plans has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

It is usually detrimental to replace an existing personal accident plan with a new one. A penalty may be imposed for early termination and the new plan may cost more or have less benefit at the same cost. Benefits of Tiq Personal Accident will only be payable upon an accident occurring.

Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Etiqa or visit the General Insurance Association (GIA) or Life Insurance Association (LIA) or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is correct as of 15 July 2024.