I am still catching up after being away in the UK last week. I will reflect on that trip in another blog post. So, today, we have a guest blogger in the guise of Professor Scott Baum from Griffith University who has been one of my regular research colleagues over a long period of time. He indicated that he would like to contribute occasionally and that provides some diversity of voice although the focus remains on advancing our understanding of Modern Monetary Theory (MMT) and its applications. Today he is going to talk about income tax cuts and cost of living relief. Over to Scott …

Cost-of-Living Tax Cuts: Who Really Benefits?

The Australian Federal Government has been making a big deal about the recently implemented income tax cuts.

The Treasurer together with the Prime Minister and an assortment of other MPs have been out spruiking how the tax cuts, which came into effect this month, are part of the government’s plan to help those most in need with increasing cost of living pressures.

The UK Guardian article – Families set to pocket more than $60 a week from stage-three tax cuts (June 22, 2024) – captured the government ‘sales pitch’ about the tax cuts:

… fighting inflation and easing the cost of living is our priority, with a real focus on families and middle Australia … (June 22, 2024)

News Limited gave the the government’s spin a platform in this article – ‘Billions of dollars’: Treasurer Jim Chalmers outlines changes to help Aussies with cost of living (July 1, 2024):

No matter who you are, where you live, what you do for a living or how much you earn, we’re doing what we can to help you with the cost of living…

Blah, blah, blah. Just the usual political rhetoric.

The tax cuts were first introduced by the conservative Liberal National Party in 2018 and were legislated to take place over three stages.

Their plan gave the top income earners the bulk of the benefits from the tax cuts, which is unsurprising given they represent the top-end-of-town.

The current Federal Labor government tweaked the third and final stage to make the cuts (little) fairer.

At the time there was much handwringing about broken election promises — the Labor party ‘promised’ to implement the tax cuts as originally slated by the previous government.

And then there was the outcry about how the reworked tax cuts would simply fuel inflation as all those low-income households and individuals all ran out and spent up big on flat-screen TVs and other frivolous discretionary items.

Worse of all, economic commentary from think tanks like the Grattan Institute (February 5, 2024) – The budget is the biggest loser from these tax cuts – demonstrated how ill-informed the mainstream debate about matters macroeconomic are in Australia:

… the biggest loser from the new tax plan may end up being the federal budget.

They want us to believe that the tax cuts will reduce the government’s ability to pay for things.

They argued:

The government’s tax plan will make it harder for this and future governments to meet community demands for more spending in areas such as healthcare, aged care, disability care, and defence.

Rubbish.

As if the Federal Government needs taxes to fund anything!

As usual, the handwringers missed the point.

What they should have really been up-in-arms about is how the tax cuts were not going to help those most in need!

Do those most in need benefit from the tax cuts?

There is no doubt that tax cuts result in increased disposable income for some individuals and households.

It is simply the way the basic accounting works.

A reduction in tax imposed by the government, results in more money in the non-government sector.

And they were certainly an improvement on the cuts originally legislated by the conservative coalition government when they were in power.

But the question is, do the tax cuts live up to the cost-of-living relief hype?

Regular readers may recall the Financial Resilience Barometer (FRB) – which Bill and I developed as part of a large-scale research project currently being funded by the Australian Research Council (ARC).

The FRB places communities along a continuum ranging from poor or low financial resilience to high financial resilience.

I first introduced the FRB in this post – The growing incidence of financial insecurity and inequality (August 21, 2023).

We followed it up with the release of our report and accompanying interactive website based on the index we developed – Launching the CofFEE Financial Resilience Barometer – Version 1.0 (October 18, 2023).

The FRB has proven to be an interesting measure and we have used it in our analysis of the 2023 Voice to Parliament Referendum to argue that voters were more concerned with everyday cost of living issues than the important issues dealt with via the referendum.

A pre-print version of our paper – Unravelling the Referendum: An analysis of the 2023 Australian Voice to Parliament Referendum outcomes across capital cities – is freely available.

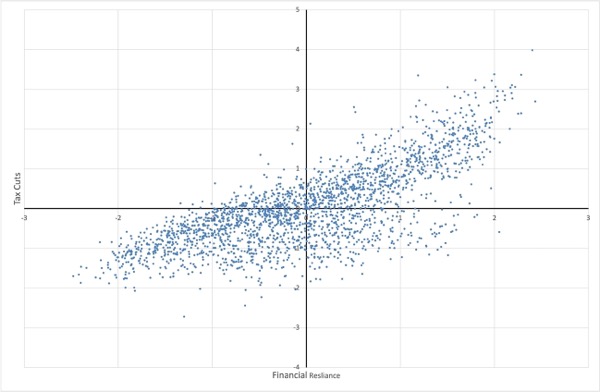

As a data visualisation exercise, we can consider the distribution of communities at the – Australian Bureau of Statistics SA2s – level, across Australia in terms of their score on the financial resilience index compared with the average level of tax cuts for the same communities.

The data has been standardised to allow comparison, with both measures distributed around a mean of zero.

Each marker represents a community.

Eyeballing the data, we can see the general pattern is for communities with higher levels of financial resilience (upper right quadrant) to record higher average tax cuts, while those with poorer financial resilience (lower left quadrant) record lower average tax cuts.

This is not entirely surprising given that average income was one of the measures used to construct the original index.

Nevertheless, the outcome is stark.

While there are some obvious outliers, those most in need, communities with poor financial resilience, get the least help from the so-called cost-of-living tax cuts!

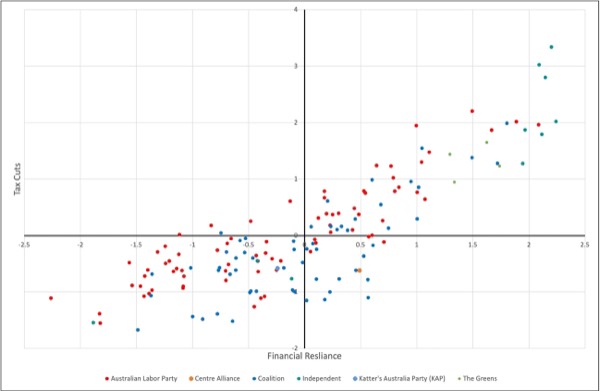

In our original financial resilience report we also considered the political implications of financial resilience by adjusting the index to account for the distribution across federal electorate divisions.

Again, we can compare these outcomes with the average tax cuts.

Here we have electorates, rather than communities, and it is those electorates with the poorest financial resilience that received the lowest benefit in terms of tax cuts.

Again, not surprising, but stark.

Despite running about telling everyone about their fabulous cost-of-living tax cuts, the current ruling Labor party is leaving many of its constituents behind.

Voters should be up in arms.

What is even more of an affront is that the federal Treasurer, whose own electorate is one of these left-behind places, is happy to tell the media that his policy is making a difference to struggling families.

The people who he purports to represent might beg to differ.

But it is not only the ruling Labor party that should be taking notice.

The opposition (conservative Liberal/National Party coalition) should also be doing more to help those most in need.

From this the take-home message is clear.

All political parties have work to do if they truly believe in helping struggling Australians.

The most vulnerable are being hoodwinked!

While it is true that tax cuts increase disposable income, what we see here is that those most in need of cost-of-living relief are being left behind.

Despite the government banging on about helping with cost-of-living pressures, for many of those who did receive a tax cut, the difference is paltry.

The cuts will unlikely make a significant difference for those facing increasing cost pressures.

Worst of all are those who were not even eligible for a tax cut.

In this article from Ben Phillips (January 29, 2024) – Stage 3 stacks up: the rejigged tax cuts help fight bracket creep and boost middle and upper-middle households – we read that that under the new tax cuts:

… there remain 31% who will be neither better off nor worse off, because they don’t pay personal income tax.

It is worse if you are among very low-income earners:

In the lowest earning fifth of households, far more are better off (13.5%) than worse off (0.2%) with the overwhelming bulk neither better nor worse off (86.3%).

We also read that the bottom income quintile of households receives, on average, a measly $67 extra a year due to the tax cuts.

It makes you wonder what people in some of the most disadvantaged communities think when government spin tries to convince them that their elected representatives really care.

We know that the government can do better to help those most in need.

In my blog post The Australian government ignores the cost-of-living crisis impoverishing vulnerable citizens (November 10, 2022) – I argued that:

In the long term, ensuring secure well-paid employment, adequate training opportunities and well-funded public services, the kinds of things that governments seem to have jettisoned in the past, will help those most vulnerable … A more immediate response must be the provision of financial support for our lowest-income earners.

These points still hold true, even after all the promises of cost-of-living relief.

If they choose to, governments can make a huge difference.

The extra payments made during the early period of COVID-19 prove that governments can step up to help the most vulnerable when they need to.

While there will be the usual fretting about being fiscally prudent and being responsible with ‘taxpayers’ money’, as most MMTers know from blog posts such as this – Taxpayers do not fund anything (April 19, 2010) – that these sorts of arguments are just smokescreens to legitimise what are nasty and unfair political and ideological decisions.

Conclusion

I am sure that the government believes its spin about relieving cost of living pressures, and I guess that for some people and communities, there has been some relief.

But that is not the point.

Despite all the talk, the government’s cost-of-living tax cuts have done little for society’s most vulnerable.

Those left behind continue to fall through the cracks.

Governments can and must do more.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.