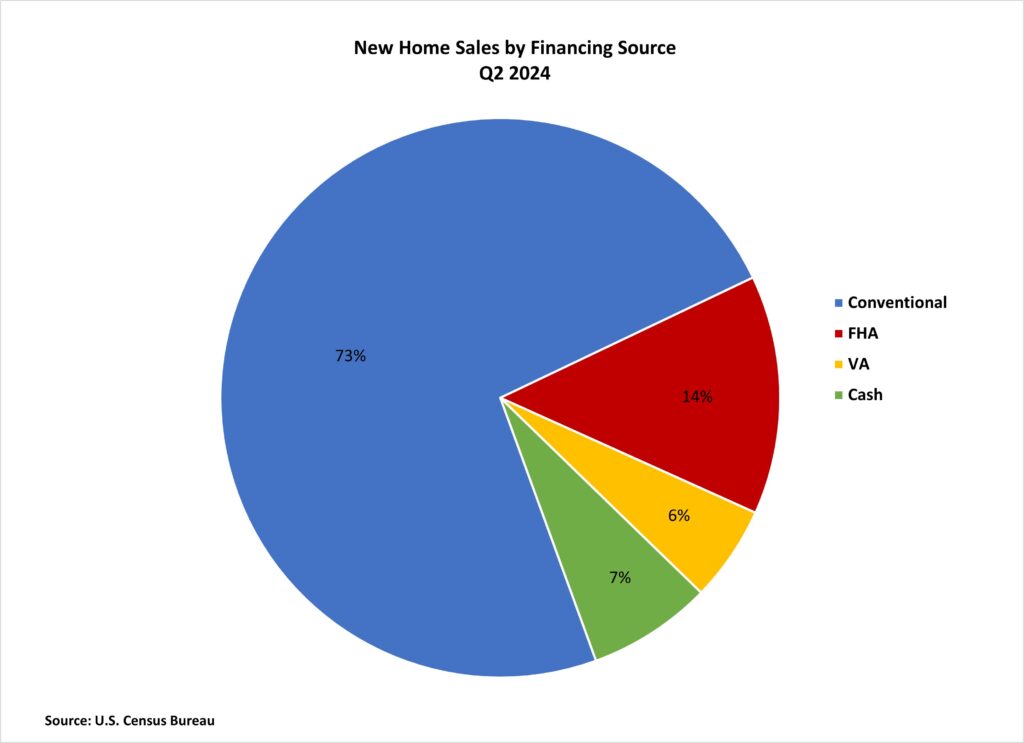

All-cash purchases accounted for 6.9% of new home sales in the second quarter of 2024, the lowest level since the fourth quarter of 2021, revealed by NAHB analysis of the most recent Census Quarterly Sales by Price and Financing report. Among mortgaged home sales, both FHA-backed and VA-backed sales fell while conventional sales remained unchanged. This is in line with the overall trend observed in mortgage activity, which has remained lower through the buying season due to higher mortgage rates and tighter lending standards. Despite the decline in sales, the median purchase price of new homes continued to decrease in the second quarter.

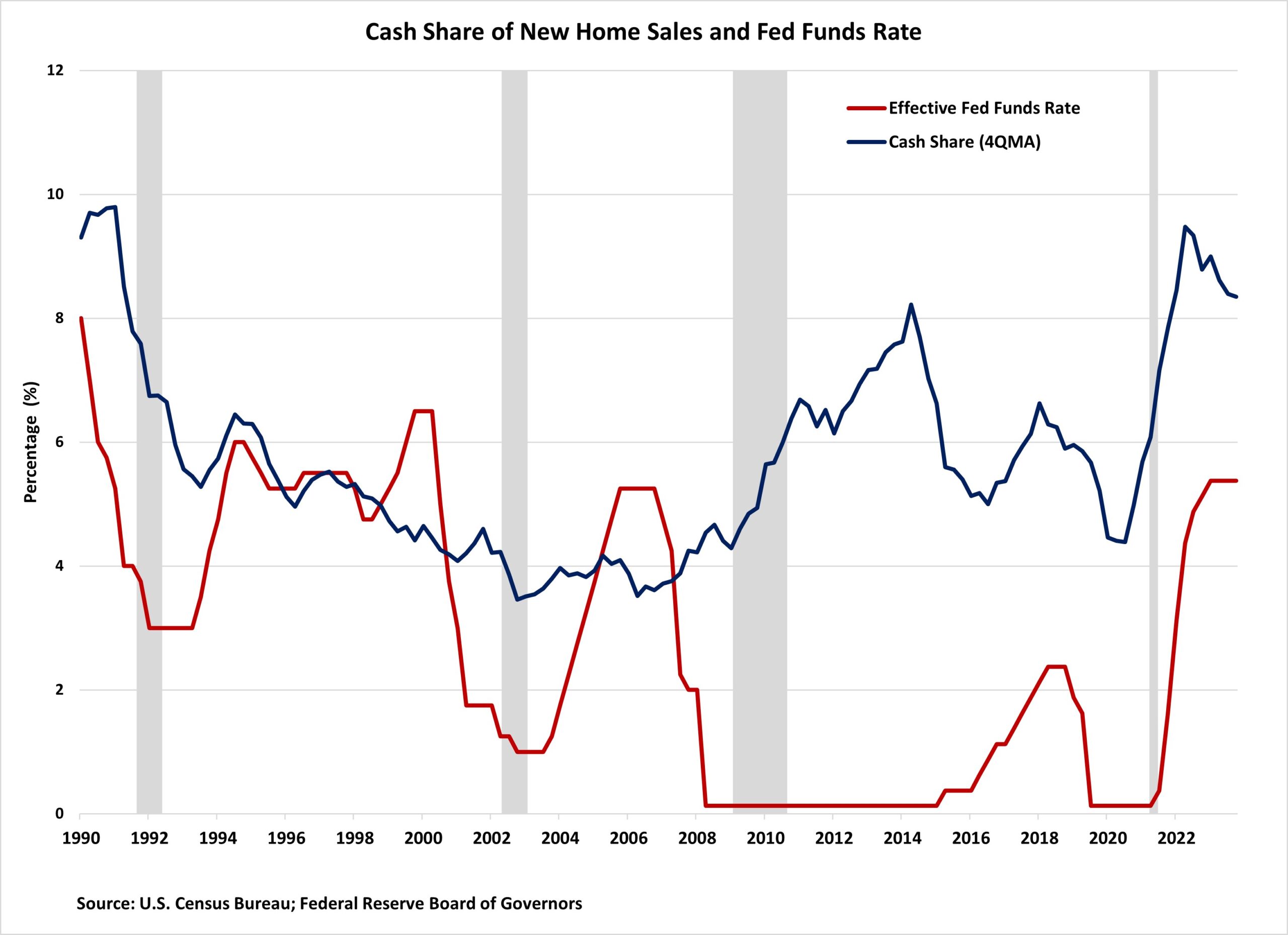

Since the Federal Reserve began raising interest rates in early 2022, the share of all-cash new home sales has increased significantly, with an average of 8.6% amid this tightening cycle. The interest rate hikes have caused the average mortgage rate to more than double, surging from 3.1% in the fourth quarter of 2021 to 7.0% by the end of second quarter of 2024. The chart below illustrates how much more sensitive the all-cash share has become to changes in the federal funds rate since 2017. However, after peaking at 10.7% in the fourth quarter of 2022, the all-cash share has recently trended lower.

It is worth noting that NAHB surveys found a different share for cash-based sales of new homes. A mid-2024 NAHB survey of builders reported a 22% cash share for builder sales during the first half of 2024. The NAHB survey was a survey based on builders, while the Census is based on homes sold. These different sampling methods may be responsible for these differing shares.

Although cash sales make up a relatively small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of Realtors, 28% of existing home transactions were all-cash sales in June 2024, unchanged from May but up from 26% in June 2023.

The share of FHA-backed sales fell from 13.8% to 12.0% in the second quarter of 2024, reaching the lowest level since the fourth quarter of 2022. This share remains below the post-Great Recession average of 17.0%. Meanwhile, the share of VA-backed sales also decreased, falling from 5.5% to 5.1%. Among declines in other types of new home financing, the share of conventional loans financed sales saw an increase in the first quarter of 2024, climbing from 73.5% to 76.0%, the highest level since the third quarter of 2022.

Price by Type of Financing

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the second quarter, the national median sales price of a new home was $412,300. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $433,900, $358,100, $376,000, and $400,300, respectively.

The purchase price of new homes financed with conventional and VA loans declined over the past year, while the price of homes financed with FHA loans and cash increased. The largest gain occurred in cash sales prices, which rose 3.0% over the year. This is in stark contrast to year-over-year price changes in the second quarter of 2023, where median sales price dropped 14.0% (see below).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.