It’s the Wednesday pot-pourri – British politics, self promotion, events, sport and music. Politicians invariably claim that the situation they inherit when they take office following an election is untenable and that the ‘public finances’ are worse than they had initially thought. Of course, the idea that ‘public finances’ can be good or bad or somewhere in between is a misnomer and just reflects the ignorance of the fiscal capacity that governments have (that is, currency-issuing governments). There is no such things as a deteriorating public finance situation. So when Rachel Reeves got up after being elected the new Chancellor of the UK she was just posturing and telling the British people that they should not expect much better than wha the Tories delivered. What can be good or bad or somewhere in between is the state of public infrastructure and public services. And after 14 years of devastating Tory rule, one can safely conclude that the there is a huge deficit in the UK in that context. The question then is what can be done about it. My reading of the situation is that if Labour want to actually improve things significantly in terms of public service provision and the viability of Britain’s infrastructure then it will have to abandon its mindless fiscal rule. And it would be better that they do that quicksmart while they enjoy such a large domination of the Parliament.

As an aside, I read in the UK Guardian article today – Labour suspends seven rebels who voted to scrap two-child benefit cap – that the Starmer purge squad continues to punish progressive elements in the Party.

The rebels voted for a SNP proposal “to scrap the two-child benefit limit” – “which prevents parents from claiming child tax credit or universal credit for more than two children, was introduced by the Conservative Government in 2017” (Source).

The Local Government Association – has long called on the Government to scrap the cap saying that:

Data provided by the End Child Poverty Coalition shows that removing the cap would lift 250,000 children across the UK out of poverty.

On April 6, 2023, the Child Poverty Action Group released a report – Six years in: the two-child limit – that:

… the policy will affect 1.5 million children including 1.1 million children growing up in poverty. Their families are missing out on up to £3,235 a year.

As the policy continues to roll-out, more and more children will be affected.

The policy is pushing families into deep poverty …

Abolishing the two-child limit is the most cost-effective way of reducing child poverty – it would lift 250,000 children out of poverty, and a further 850,000 children would be in less deep poverty at a cost of just £1.3 billion.

One would have thought that should be one of the first things the new British Labour government tackles given that children are the future of the nation and growing up in poverty is a sure-fire way to stifle that future.

The Labour leadership which is obsessed with the fiscal rules has declared that eliminating this Tory disaster would be ‘unaffordable’.

The only ‘cost’ of such a policy shift would be the extra food and other resources that families with more than 2 children who are currently living in abject poverty would be able to consume.

And the new government is claiming it wants to promote economic growth.

Then what better way to do it than providing extra £s to families who will consume every penny of the increment to their family incomes on making their children’s lives a bit better.

I don’t sense that there is not enough food etc in Britain at present, which means scrapping the shocking policy would not be ‘unaffordable’.

Anyway, as to quality of services, the Institute for Government in the UK released a report – Fixing public services: Priorities for the new Labour government (July 22, 2024) – which concluded that:

The government’s public services inheritance make its spending plans untenable …

The public is tired of poorly performing services and want a government that can deliver improvement. But that will be difficult to achieve if Labour sticks to the spending plans laid out in its manifesto, which would see day-to-day departmental spending increasing by 1.2% per year in real terms between 2025/26 and 2028/29. Taking account of commitments on the NHS, schools, defence, aid and childcare, other services – including police, criminal courts, prisons, probation, adult and children’s social care – will face average annual real-terms funding cuts of 2.4% over that period.

The conclusions are clear:

1. “Most services are performing worse now than they were in 2010 or before the pandemic.”

2. “The government’s status quo spending plans from April 2025 onwards will likely mean that all services other than general practice, hospitals and schools could be performing worse in 2027/28 than in 2019.”

3. “Pay freezes, below-inflation pay rises and declining working conditions have resulted in endemic problems with recruitment and retention, with staff leaving in their droves.”

And most damaging of all:

Labour is right to point out how dire its inheritance on public services is. At the same time, the spending plans laid out in its manifesto are the tightest since 2015 and imply real-terms cuts to some of the already worst-performing services. The hard truth for Labour is that sticking to the status quo means most services are likely to be performing worse at the next election in 2028/29 than at the last election in 2019.

The Report lists specific failings in the system in terms of the NHS, Local Government, Schools, Criminal Justice, which demonstrate the massive ‘deficit’ in service scope and quality that has arisen after 14 years of Tory rule (not to mention what went before them under Blair and Co).

Across all the main policy departments, the Report demonstrates staffing deficiencies are chronic, capital investment is dramatically deficient, and preventative strategies in health, welfare, housing etc are being sacrificed to deal with ‘acute’ demand emergencies.

So the choice is obvious – abandon the fiscal rule austerity or continue to see public services and infrastructure deteriorate and quality of life in Britain sour.

And on top of that is the issue of increasing pay for public employees in the NHS and education sectors.

It all cannot be done within the current fiscal framework.

So my first prediction: the fiscal rules will have to be amended – or in political speak – fudged.

Recent MMT Conference at Leeds

I recently attended, albeit fleetingly, the – UK MMT Conference – held at Leeds University last week.

It was a gruelling journey for me as I couldn’t leave Melbourne until Monday afternoon and had to fly back early Friday.

So less than three days on the ground.

But I had personal reasons for ensuring I attended and they overruled any practical considerations.

The event was impeccably organised and I want to thank the women at – GIMMS – and Neil and Phil and others who spent so much of their time (voluntary) making the conference run smoothly.

It was great to catch up with some of the early MMT economists in person (Randy Wray, Pavlina Tcherneva) and Warren Mosler and I did a double act launching our new book – Modern Monetary Theory: Bill and Warren’s Excellent Adventure.

The few slides we used are available – HERE

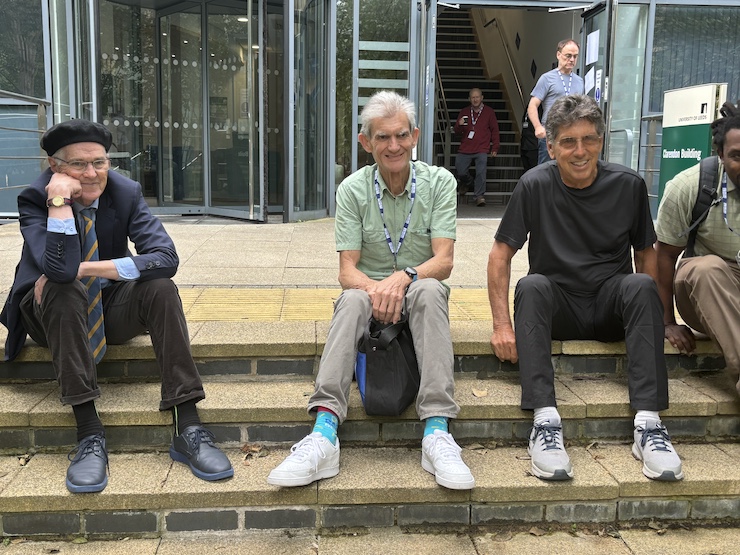

Here are some photos that Sara Holland (GIMMS) took (thanks for sending them to me).

Here I am with Phil Armstrong, who wrote the Preface to our Book.

With Pavlina Tcherneva:

The three amigos – after some sandwiches sitting on the steps outside (reduced Covid risk) – Bill, Martin Watts and Warren Mosler.

Episode 2 of our Manga, the Smith Family and their Adventures with Money comes out this Friday

Yes, recession has struck and the Smith Family are about to enter very uncertain times as the kids go back to school.

You can follow the – Smith Family and their Adventures with Money – throughout Season 2, with new episodes appearing fortnightly.

Book Event – Melbourne – September 12, 2024

I can confirm that there will be a really nice evening at Readings Bookshop, which is at 687 Glenferrie Road, Hawthorn – an inner suburb of Melbourne.

The details for the evening – Bill Mitchell with Alan Kohler – are available at that link.

The event is free but you must book as space is limited.

It will be Bill and Alan’s Excellent Evening discussing Bill and Warren’s Excellent Adventure.

I hope to see a lot of people at the event.

Readings are by the far the best bookshop in Australia and have demonstrated a commitment to local authors (and authors in general) for decades.

Please note that currently, Readings have the event listed as occurring on August 12. But the actual date is September 12 and their WWW site will be updated soon.

My alternative Olympic Medal Tally is coming

Since the 2000 Olympic Games I have been compiling – Bill Mitchell’s Alternative Olympic Games Medal Tally – which attempts to modify the official tally to take into account national wealth and population size as an antidote to the strutting nationalism deployed by the likes of China, the US and other big nations that have lots of investment in Olympic sports.

The alternative tally will begin over the weekend and proceed until the Games are over.

Music – Two legends die this week

It was a toss up as to who I might listen to this morning.

There were two notable deaths this week.

First, the last surviving member of the original Four Tops – Abdul “Duke” Fakir – died on July 22, 2024 at the age of 88.

Second, British blues legend – John Mayall – died on July 23, 2023 at the age of 90.

Both very influential in my musical awareness and education.

So I thought, let’s play both.

First, up the mighty Four Tops singing their classic – Reach Out I’ll Be There – which was first released on their 1967 album (Motown) – Reach Out.

This UK Guardian article – The Four Tops: how we made Reach Out (I’ll Be There) (April 7, 2014) – interviewed Duke Fakir and he explained the way in which the band recorded the song.

Some very interesting historical insights are in that article.

Here is a UK Guardian obituary – Abdul ‘Duke’ Fakir, last surviving member of Four Tops, dies aged 88 (July 22, 2024).

Then, John Mayall.

Here is an obituary from the ABC news service – John Mayall, blues legend who fostered the careers of Eric Clapton and members of Fleetwood Mac, dies at 90 (July 24, 2024).

This short song – Broken Wings – was Track 5, side B on the – The Blues Alone – album, which John Mayall released in November 1967 on the Ace of Clubs Records label.

This was the first full album I ever bought in my early teenage years with my paper round money. The Ace of Clubs label was great because they were (from memory) $1.99 instead of the usual price for a long playing disk of $4.95.

The album followed pretty well straight after he released – Crusade – his third studio effort which marked the appearance of Mick Taylor (just before he took up with the Rolling Stones).

Mayall had a habit of falling out with his guitar players or bassists – Eric Clapton left the Bluesbreakers, then his replacement, the mighty Peter Green left, bass player John McVie left, and then Mick Taylor. Quite a lineup. Fortunately the dissidents (Green and McVie) formed the first version of Fleetwood Mac and we know what that produced before the band turned to pop.

On this album, John Mayall played all the instruments barring the drums, which were provided by – Keef Hartley – whose own recording career is worth getting acquainted with.

Not only did John Mayall play most of the instruments, he also designed the sleeve notes and cover art for the album, which featured himself playing what I believe was a home made guitar.

So on The Blues Alone he could only really argue with himself.

I loved this track (still do) and fell in love with Hammond B3 organs and always wanted one except I never had a place big enough to store it and guitars took my attention away.

Anyway, mellow out and enjoy the artistry.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.