In the second quarter of 2024, the U.S. economy grew twice as fast as it did in the first quarter, supported by consumer spending and private inventory investment.

Furthermore, the data from the GDP report suggests that inflation is cooling. The GDP price index rose 2.3% for the second quarter, down from a 3.1% increase in the first quarter of 2024. The Personal Consumption Expenditures (PCE) Price Index, which measures inflation (or deflation) across various consumer expenses and reflects changes in consumer behavior, rose 2.6% in the second quarter. This is down from a 3.4% increase in the first quarter of 2024.

According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) expanded at a robust 2.8% annual pace in the second quarter of 2024. This is faster than the 1.4% gain in the first quarter of 2024. This quarter’s growth was close to NAHB’s forecast of a 2.7% increase.

This quarter’s increase in real GDP reflected increases in consumer spending, private inventory investment, and nonresidential fixed investment.

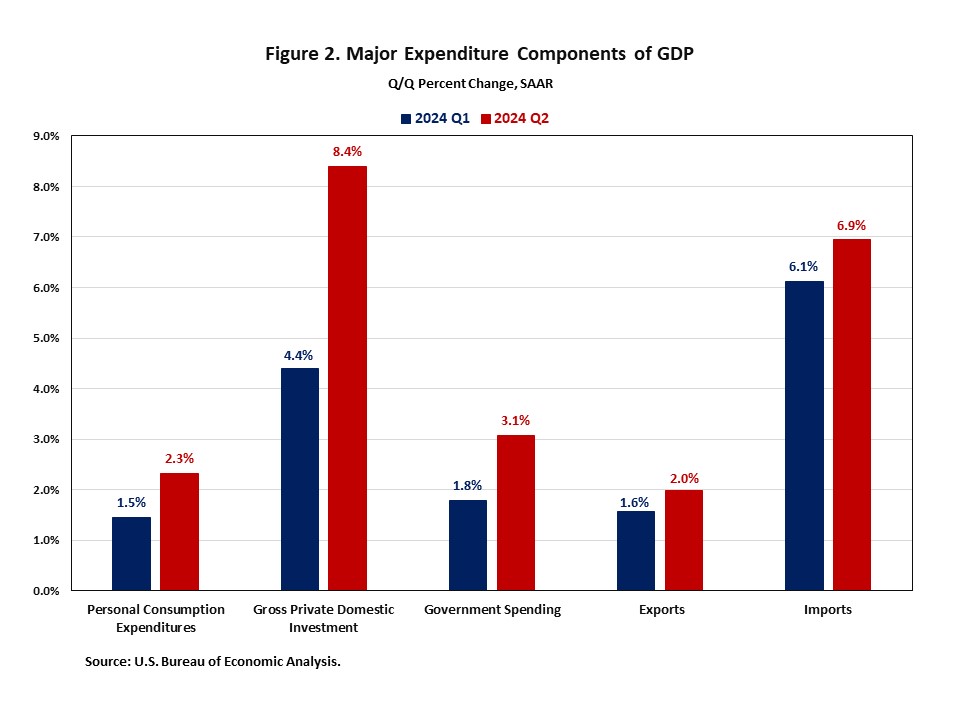

Consumer spending, the backbone of the U.S. economy, rose at an annual rate of 2.3% in the second quarter. The increase in consumer spending reflected increases in both services and goods. Expenditures for services increased 2.2% at an annual rate, while goods spending increased at a 2.5% annual rate.

The increase in private inventory investment primarily reflected increases in wholesale trade and retail trade industries that were partly offset by a decrease in mining, utilities, and construction industries.

Nonresidential fixed investment increased 5.2% in the second quarter. Increases in equipment and intellectual property products were partly offset by a decrease in structures. Meanwhile, residential fixed investment (RFI) decreased 1.4% in the second quarter and dragged down the contribution to real GDP by 0.05 percentage points. Within residential fixed investment, single-family structures declined 5.6% at an annual rate, multifamily structures decreased 3.2% and other structures (specifically brokers’ commissions) rose 5.9%.

The U.S. trade deficit increased in the second quarter, as imports increased more than exports. A wider trade deficit shaved 0.72 percentage points off GDP. Imports, which are a subtraction in the calculation of GDP, increased 6.9%, while exports rose 2.0%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.