Welcome to the latest issue of ‘The Journal of Investing Wisdom’, where I delve into the thoughts, reflections, and readings that have recently captured my attention. This journal serves as a window into my contemplations and the resources that inspire and inform my journey as an investor. I hope you like what you read below. If you are new here, and wish to get insights and ideas like these straight into your inbox, please click here to become a member.

What I’m Reading

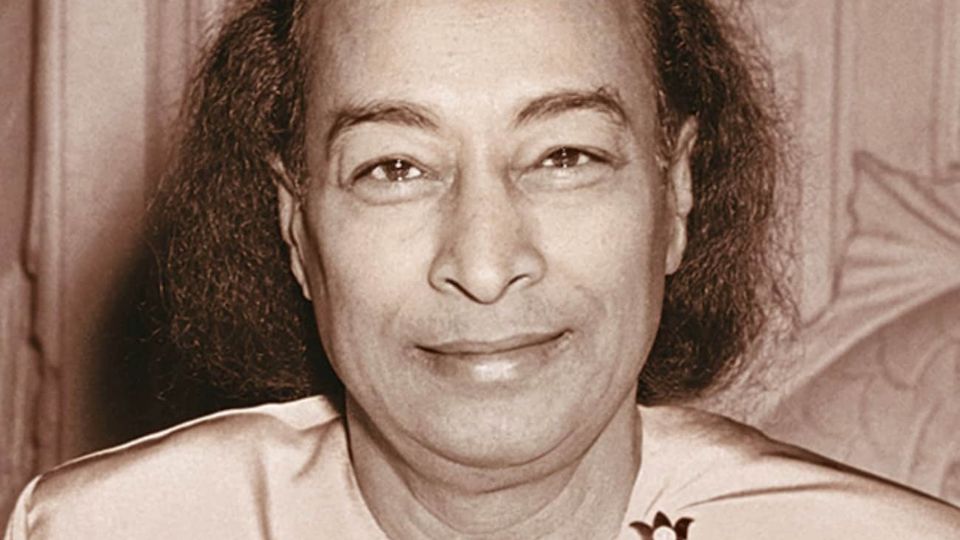

A Yogi’s Rules on Money and Happiness

I read an article recently written by Paramhansa Yogananda – of Autobiography of a Yogi fame – during the Great Depression in the US. It was titled Creating Your Happiness.

Not surprisingly, the principles laid out by Yogananda remain relevant even today, 90+ years after he wrote about them.

You see, the old rules of life or money never change and they only become tough on you when you ignore them. Like these golden rules laid out by Yogananda (the emphasis is mine), which if you continue to ignore, may make your life tough.

Over to Yogananda.

It is easier to spend than to earn.

Also, it is harder to save than to earn.

Most people spend thirty dollars a week when their income is only twenty. The extra ten dollars is acquired by borrowing, or by buying with promises to pay in the future, on installment plans, and such systems. You must not always feel that you have to “keep up with the Joneses.”

To try to own more than your purse will allow is to live in constant mental worry, and under such conditions happiness, like a will-o’-the-wisp, has to be chased foolishly all over the boggy surface of bottomless desires.

To spend more than you earn is to live in perpetual slavery. To spend more now in the hope of making more later on is the harbinger of all material suffering.

An expensive car, together with a good dress-suit, and a beautiful home are very pleasant to have, but the loss of your car because you cannot meet the so-soon-recurring installments due; foreclosure of the mortgage on your home, built and paid for by many years of labor and saving; the publicity, dishonor, and heavy heart that comes after such occurrences—all these are very unpleasant.

Is it not better to have an inexpensive car all paid for, a cozy cottage, a low-priced, clean suit, and a comfortable bank account than to have a big outward show with only borrowed money in your pocket?

Remember that along with the art of money-making it is well to learn the art of money-saving, for a large income is of no lasting good to you if it creates only habits of luxury and no reserve fund.

Think for a moment. If you should get sick suddenly, how would you continue your luxurious habits, without the usual income, if you have no savings put away?

It is a bad thing to cultivate luxurious habits if you have only a small income. Is it not better to live simply and frugally and grow rich in reality?

You should use one-fourth of your income on plain living, save three-fourths, and be at ease in your mind with a feeling of future security. Keep what you earn legitimately, and don’t gamble or lose it in trying to “get rich quick.”

The present depression has taught you to buy lower-priced things, to save for a “rainy day” and not to spend on mere material comforts more than you are earning.

Happiness can be had by the exercise of self-control, by cultivating habits of plain living and high thinking, by spending less even though earning more.

Make an effort to earn more so that you can be the means of helping others to help themselves, for one of the unwritten laws decrees that he who helps others to abundance and happiness, always will be helped in return by them, and he will become more and more prosperous and happy himself.

This is a law of happiness which cannot be broken.

The crux of Yogananda’s thoughts on money and happiness, which I got from his article, is that our pursuit of financial stability and true happiness requires a delicate balance between our desires and our means.

When we resist the urge to “keep up with the Joneses” and instead focus on sustainable financial practices, we can free ourselves from the burden of debt and the constant anxiety that accompanies living beyond our means.

True prosperity lies not in the accumulation of material possessions or the maintenance of an expensive lifestyle, but in the peace of mind that comes from financial stability and the ability to help others.

When we adopt a mindset of “plain living and high thinking,” we open ourselves to a more fulfilling and purposeful existence.

That, I think, should be the way to financial nirvana.

The Sketchbook of Wisdom: A Hand-Crafted Manual on the Pursuit of Wealth and Good Life

This is a masterpiece.

Morgan Housel, Author, The Psychology of Money

Template on how to lead a happier and fuller life.

Ramesh Damani, Member, BSE

Behaviour beats intelligence in investing

I recently started a series on the psychology of investing, where I will write on the biggest psychological flaws we suffer from that causes us to make dumb mistakes in investing. You can read the first post here.

Anyways, in a recent podcast, Barry Ritholtz spoke with Morgan Housel on why behaviour beats intelligence in investing.

While discussing how financial decisions in the real world are not just mathematical calculations but are influenced by our personal history, world views, ego, pride, etc., Morgan said –

…think about health and medicine. You can have a medical degree from Harvard and know everything about biology and have all that insight in that intelligence. But if you smoke, And you don’t eat a good diet and you’re not getting enough sleep.

None of it matters. None of the intelligence matters unless the behavior actually clicks and is working and finance is the exact same. You can know everything about math and data and markets, but if you don’t control your sense of greed and fear and you’re managing uncertainty in your behavior, none of it matters.

So this is why finance is one of the few fields where people who do not have a lot of education and financial sophistication, but if they have the right behaviors, can do very well over time.

While Morgan’s message cautions those with extensive financial knowledge not to over-rely on their expertise at the expense of developing sound financial habits, it is encouraging because it suggests that with the right mindset and behaviours, financial well-being is within reach.

***

Investing and eternity

The Heilbrunn Center for Graham and Dodd Investing created a wonderful video in 2013 titled ‘Legacy of Ben Graham,’ which contains bytes from some of his students on how Graham’s teachings changed their lives.

Marshall Weinberg, one of those students from Graham’s class said that the biggest lesson he drew out of that class was on long-term thinking –

One sentence changed my life…Ben Graham opened the course by saying: ‘If you want to make money in Wall Street you must have the proper psychological attitude. No one expresses it better than Spinoza the philosopher.’

When he said that, I nearly jumped out of my course. What? I suddenly look up, and he said, and I remember exactly what he said: ‘Spinoza said you must look at things in the aspect of eternity.’ And that’s what suddenly hooked me on Ben Graham.

Here was the father of value investing teaching his students about the value of long-term thinking, and that too in terms of eternity. Now, almost eight decades later, we would be paying true homage to Graham if we could view investing through a wide-angle lens, zooming out, taking a long-term perspective, and striving for a long, sustained upward trend in our stocks instead of getting worried about the short-term volatility in their prices.

This may not help us eliminate all mistakes we may make as investors, but it can give us the tool to treat our investments and portfolios just a little bit better.

***

Lego at 75 – A beautiful journey of the iconic plastic brick

For three-quarters of a century, Lego has been more than just a toy company. It’s been a catalyst for creativity, a bridge between generations, and a living proof of the enduring power of simple ideas. In fact, when I teach my Mental Models class, Lego is my go to idea on how combining the simple, right models (pieces in Lego’s case) can lead us to wonderful decisions and creations.

The company was born in the workshop of a Danish carpenter in 1932 and introducing its iconic plastic brick in 1949, Lego has grown from humble beginnings to become a global phenomenon. Its core product – the interlocking brick – is a marvel of design simplicity. Yet from this basic unit, infinite possibilities emerge.

What could be a better metaphor for creativity, where simple elements combine to form complex structures, limited only by imagination?

This article nicely captures the fairytale story of Lego, and how it remains a place where even the most hardcore fans would say, ‘Wow!’”

Download “30 Big Ideas from Seth Klarman’s Margin of Safety” (E-Book)

*Also unlock access to free chapters of my upcoming books, multiple e-books, stock analysis excel, and membership to my newsletter – The Journal of Investing Wisdom.

(If you’re already a subscriber of my newsletter, you will receive a direct download link in your inbox soon)

What I’m Thinking

The best stock isn’t always the flashiest. Look for businesses solving real, enduring human needs – they’re the ones still standing when the hype fades.

***

Time and again it has been proved that majority of stock price changes are nothing more than random jitters in the system for which no explanation is ever required. Yet we investors obsess over every small movement and explain them like kids spotting animal shapes in the clouds.

***

Remember the “personal” in finance.

Quotes I am Reflecting On

If you owe nothing, you are rich.

– Ruskin Bond, Book of Simple Living

***

Nothing tells in the long run like good judgment, and no sound judgment can remain with the man whose mind is disturbed by the mercurial changes of the Stock Exchange. It places him under an influence akin to intoxication. What is not, he sees, and what he sees, is not. He cannot judge of relative values or get the true perspective of things. The molehill seems to him a mountain and the mountain a molehill, and he jumps at conclusions which he should arrive at by reason. His mind is upon the stock quotations and not upon the points that require calm thought. Speculation is a parasite feeding upon values, creating none.

– Andrew Carnegie

That’s all from me for today.

If you know someone who may benefit from today’s post, please share it with them.

If you are new here, please join my free newsletter – The Journal of Investing Wisdom – where I share the best ideas on money and investing, behavioral finance, and business analysis to help you secure your financial independence so you can live the life you deserve.

Also check out –

Thank you for your time and attention.

~ Vishal